Global CNG & LPG Vehicle Market Size, Share, and COVID-19 Impact Analysis, By Fuel Type ((CNG (Compressed Natural Gas), LPG (Liquefied Petroleum Gas)), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Kit Type (Venturi, Sequential, Retro Fitment), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Industry: Automotive & TransportationGlobal CNG & LPG Vehicle Market Insights Forecasts to 2033

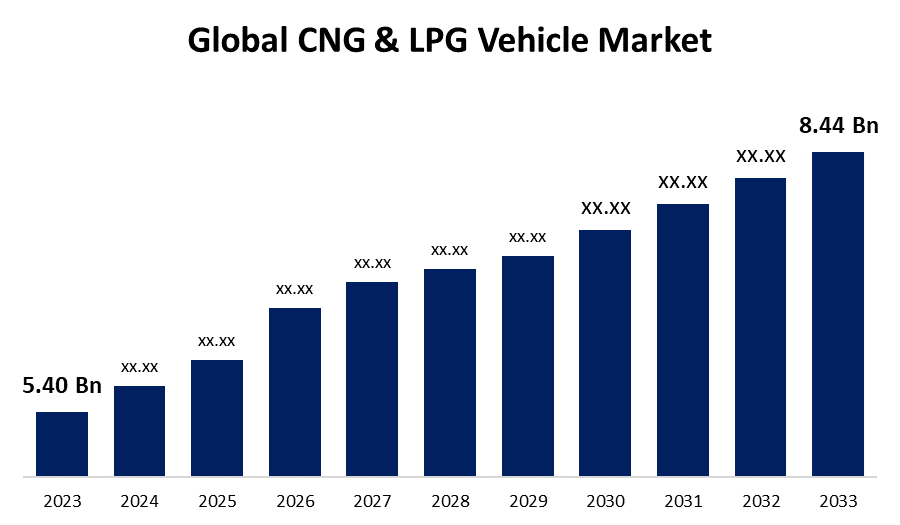

- The Global CNG & LPG Vehicle Market Size was Valued at USD 5.40 Billion in 2023

- The Market Size is Growing at a CAGR of 4.57% from 2023 to 2033

- The Worldwide CNG & LPG Vehicle Market Size is Expected to Reach USD 8.44 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global CNG & LPG Vehicle Market Size is Anticipated to Exceed USD 8.44 Billion by 2033, Growing at a CAGR of 4.57% from 2023 to 2033.

Market Overview

CNG and LPG vehicles are in high demand around the world due to their low cost and excellent efficiency when compared to traditional fuels like gasoline and diesel. Since the availability of a dual fuel option, these cars are appealing in terms of lower operating costs and elimination of range problems. Governments around the world have been vocal about the need to embrace cleaner automobiles to reduce the environmental impact of traffic. Many governments and towns have implemented restrictions to enhance fuel efficiency (and so reduce CO2) and limit air pollution. Fuel economy efforts were focused on smaller automobiles. However, similar concepts are rapidly being applied to commercial and heavy-duty vehicles, culminating in the use of LPG and CNG fuel. The increased demand for low-emission automobiles as individuals become more conscious of the adverse effects of air pollution is one of the primary drivers driving market expansion. Aside from that, governments in several nations are encouraging the use of CNG and LPG automobiles through subsidies and tax breaks. They are also working on establishing CNG and LPG infrastructure, which is driving market expansion.

Report Coverage

This research report categorizes the market for the global CNG & LPG vehicle market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global CNG & LPG vehicle market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global CNG & LPG vehicle market.

CNG & LPG Vehicle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.40 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.57% |

| 2033 Value Projection: | USD 8.44 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Fuel Type, By Vehicle Type, By Region |

| Companies covered:: | Suzuki Motor Corporation Honda Motor Company Hyundai Motor Group Volkswagen AG Ford Motor Company MAN SE IVECO SpA TATA Motors General Motors Co. Ford Motor Co. Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increased demand for original equipment manufacturer (OEM)-fitted automobiles is favorably influencing the industry due to a variety of perks, including vehicle customization and warranty coverage. Aside from that, CNG and LPG cars are increasingly being used as public transportation due to their low cost and fuel economy around the world. This, combined with the expanding vehicle industry, is driving market growth. The rising cost of diesel vehicles due to the integration of advanced exhaust gas recirculation and particle filter systems is also driving up demand for CNG and LPG vehicles. Furthermore, the increasing conversion rates of aging gasoline and diesel vehicles to CNG and LPG vehicles, together with the widespread availability of various CNG and LPG.

Restraining Factors

CNG & LPG automobiles are generally more expensive than ordinary gasoline automobiles. This is owing to the additional components included in these cars. As some sections of these vehicles are damaged faster compared to petrol vehicles due to the absence of lubrication in most of these vehicles, these vehicles require much more regular maintenance over the years and thus cost more in the long run.

Market Segmentation

The global CNG & LPG vehicle market share is classified into fuel type, vehicle type and kit type.

- The CNG (compressed natural gas) segment is expected to hold the largest share of the global CNG & LPG vehicle market during the forecast period.

Based on the fuel type, the global CNG & LPG vehicle market is categorized into CNG (compressed natural gas), and LPG (liquefied petroleum gas). Among these, the CNG (compressed natural gas) segment is expected to hold the largest share of the global CNG & LPG vehicle market during the forecast period. The marketplace is due to its lower cost and environmental friendliness compared to gasoline and diesel. CNG vehicles provide significant savings at the pump because natural gas is currently priced about 40-50% lower than equal amounts of gasoline. With fluctuating crude oil prices raising petrol and diesel prices, consumers are increasingly drawn to CNG as a reliable and economical fuelling choice. Eco-friendliness is another important factor. It produces 25-30% fewer emissions of greenhouse gases than diesel or petrol. CNG vehicles are being incentivized via subsidies and tax breaks as both the public and private sectors promote 'green' transportation to reduce environmental pollution in densely congested cities.

- The passenger cars segment is expected to grow at the fastest CAGR during the forecast period.

Based on the vehicle type, the global CNG & LPG vehicle market is categorized into passenger cars, and commercial vehicles. Among these, the passenger cars segment is expected to grow at the fastest CAGR during the forecast period. The changing consumer choices for family mobility highlight the importance of this market. Rapid urbanization and improving economic conditions have increased the demand for sedans and SUVs for commuting, school runs, and weekend vacations. Manufacturers catering to this growing passenger mobility have introduced broad CNG-powered model ranges.

- The retro fitment segment is expected to hold a significant share of the global CNG & LPG vehicle market during the forecast period.

Based on the kit type, the global CNG & LPG vehicle market is categorized into venturi, sequential, and retro fitment. Among these, the retro fitment segment is expected to hold a significant share of the global CNG & LPG vehicle market during the forecast period. Retro fitting kits are in higher demand than venturi kits because to their improved fuel economy and better control of vehicle emissions. The central government is anticipated to approve the retrofitting of BS-VI petrol automobiles with CNG kits, potentially lowering fuel usage by 40-50%. The road transport ministry has issued a draft notification outlining emission and other parameters for such retrofitting. This is a commendable move by the government because using CNG as fuel will significantly relieve the general public of the high expense of fuel.

Regional Segment Analysis of the Global CNG & LPG Vehicle Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is projected to hold the largest share of the global CNG & LPG vehicle market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global CNG & LPG vehicle market over the forecast period. While personal automobiles continue to run mostly on gasoline, the commercial transportation sector is increasingly migrating to CNG and LPG due to cheaper operating costs. This is evidenced by the growing number of CNG/LPG-powered buses, taxis, and delivery vans on major ASEAN city highways. Local automakers have realized this opportunity and are aggressively promoting environmentally friendly vehicles that are compatible with these alternative fuels. The governments of ASEAN countries are also encouraging this move by developing refueling infrastructure and providing purchasing incentives for CNG/LPG vehicles. This is likely to increase their regional market share in the forecast period.

North America is expected to grow at the fastest CAGR growth of the global CNG & LPG vehicle market during the forecast period. The Renewable Energy Perspective investigates the processes shaping the global energy transition. The regional growth in the global CNG & LPG vehicle industry, combined with better automobile fuel efficiency attributed to CNG, is expected to remain a key driving factor in the North America. Fast development in North America developing economies drives raise in energy demand by a third. Renewables are by far the fastest-growing fuel source, increasing fivefold and accounting for approximately 14% of primary energy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global CNG & LPG vehicle market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Suzuki Motor Corporation

- Honda Motor Company

- Hyundai Motor Group

- Volkswagen AG

- Ford Motor Company

- MAN SE

- IVECO SpA

- TATA Motors

- General Motors Co.

- Ford Motor Co.

- Others

Recent Developments

- In November 2022, Maruti Suzuki, India's largest passenger vehicle manufacturer, has announced that the New Brezza small SUV will be available in CNG starting in December 2022.

- In March 2022, Maruti Suzuki India (MSI) introduced the Dzire, a compact sedan with S-CNG technology. The Dzire S-CNG has a 1.2-liter petrol engine that generates 57kW of peak power and 31.12 km/kg of mileage. Intelligent injection is standard on S-CNG vehicles. Vehicles are tuned and calibrated to deliver peak performance and drivability over a variety of terrains.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global CNG & LPG vehicle market based on the below-mentioned segments:

Global CNG & LPG Vehicle Market, By Fuel Type

- CNG (Compressed Natural Gas)

- LPG (Liquefied Petroleum Gas)

Global CNG & LPG Vehicle Market, By Vehicle Type

- Passenger Cars

- Commercial Vehicles

Global CNG & LPG Vehicle Market, By Kit Type

- Venturi

- Sequential

- Retro Fitment

Global CNG & LPG Vehicle Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?