Global Coating Additives Market Size, Share, and COVID-19 Impact Analysis, By Type (Acrylics, Fluoropolymers, and Urethanes), By Formulation (Powder Coating, Radiation Curable Coating, Solvent Borne Coating, Solventless Coating, Water Borne Coating, and Others), By End Users (Architectural Coating, Automotive Coating, Industrial Coating, Marine Coating, Metal Packaging, Wood & Furniture Coating, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Coating Additives Market Insights Forecasts to 20233

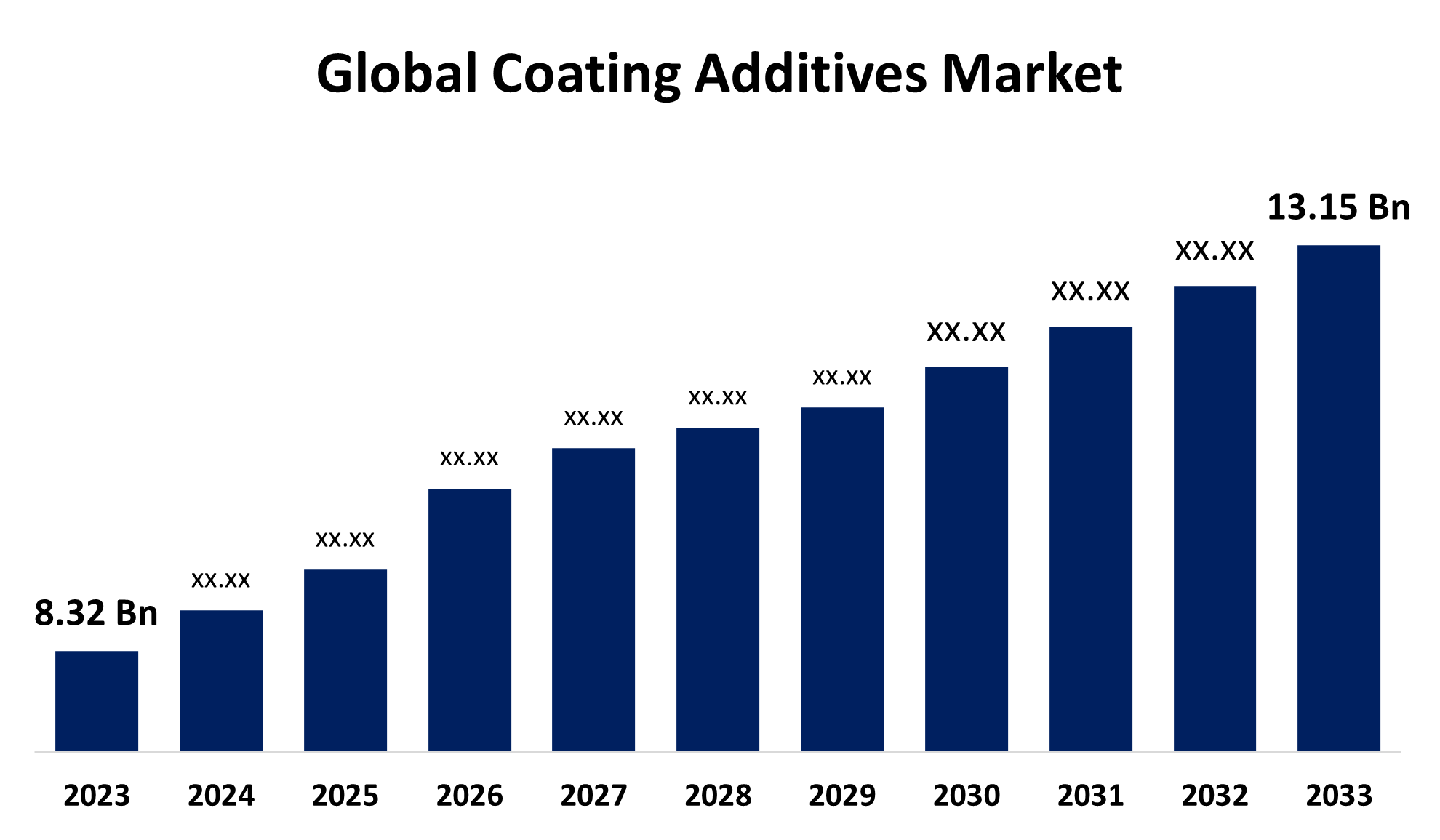

- The Global Coating Additives Market Size was Estimated at USD 8.32 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 4.68% from 2023 to 2033

- The Worldwide Coating Additives Market Size is Expected to Reach USD 13.15 Billion by 2033

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Coating Additives Market Size is anticipated to exceed USD 13.15 Billion by 2033, Growing at a CAGR of 4.68% from 2023 to 2033.

Market Overview

Coating additives market refers to the supply of substances for improving the performance of paints and coatings. A variety of industries such as automotive, construction, and architectural sectors are using these additives. A wide range of industries depend on coating additives, which are specialized materials added to coating formulations to enhance durability, adhesion, weather resistance, appearance, and functionality. Further, it is anticipated that the need for coating additives in a variety of applications would be driven by factors such as the requirement for corrosion protection as well as technological improvement and shifting customer demands. The food industry increasingly uses coating additives as an edible film to extend the shelf life of food products due to ongoing technological evolution and advancement. The use of bio-based coating additives made from renewable resources aids in the coating additive sector's transition to sustainability. The technological advancements in coating additives including coating formulation streamlining and silicone-modified polyesters are bolstering the market expansion. The increasing application of coating additives in the building and construction segment is providing lucrative market growth opportunities.

Report Coverage

This research report categorizes the coating additives market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the coating additives market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the coating additives market.

Global Coating Additives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.32 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.68% |

| 023 – 2033 Value Projection: | USD 13.15 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Type, By Formulation, By End Users and By Regional Analysis |

| Companies covered:: | Key Companies, BASF SE, ALTANA AG, Arkema, Nouryon, Allnex GmbH, Elementis Plc., Momentive, Eastman Chemical Company, Ashland, Solvay, Evonik Industries AG, CLARIANT, Dow Inc., LANXESS and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing application of sustainable and environment-friendly products is influencing the growth of bio-based coating additives, thereby propelling the market. The surge in infrastructure, the automobile sector, and the need for a sustainable coating additives market are significantly contributing to propelling the market demand. The growing consumer needs for sustainable coating material and evolving technologies with the increasing dynamic needs of various industries are bolstering market growth.

Restraining Factors

The environmental concerns and volatile organic compound (VOC) emissions are challenging the market. Further, the price fluctuations of volatile raw materials are also responsible for restraining the market growth.

Market Segmentation

The coating additives market share is classified into type, formulation, and end users.

- The acrylics segment is expected to dominate the market with the largest market share during the forecast period.

Based on the type, the coating additives market is classified into acrylics, fluoropolymers, and urethanes. Among these, the acrylics segment is expected to dominate the market with the largest market share during the forecast period. Acrylic coating additives aid coating surfaces in dealing with biocides, increased temperature, abrasion, moisture, and chemical resistance. The increasing building & construction and automotive industries are driving the market growth in the acrylics segment.

- The water borne coating segment is projected to grow at the fastest CAGR during the projected timeframe.

Based on the formulation, the coating additives market is classified into powder coating, radiation curable coating, solvent borne coating, solventless coating, water borne coating, and others. Among these, the water borne coating segment is projected to grow at the fastest CAGR during the projected timeframe. Water-based coating emits fewer volatile organic compounds (VOCs), which makes it an eco-friendly alternative and compliant with strict environmental regulations. The stringent regulatory restrictions and product demand in the architectural and industrial wood segments are driving the market demand.

- The automotive coating segment is expected to register the fastest CAGR growth during the forecast period.

Based on the end users, the coating additives market is classified into architectural coating, automotive coating, industrial coating, marine coating, metal packaging, wood & furniture coating, and others. Among these, the automotive coating segment is expected to register the fastest CAGR growth during the forecast period. Coating additives in the automotive segment enhance durability, resistance to UV radiation, and aesthetic appeal. The vital role of coating additives in automotive for protective and aesthetic purposes along with the growing automotive sector are driving the market demand.

Regional Segment Analysis of the coating additives market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the coating additives market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the coating additives market over the predicted timeframe. The growing demand for furniture coatings in China and growing construction activities in the region are driving the regional market demand for coating additives. Further, the rapid industrialization and urbanization creating vast opportunities in the construction and manufacturing industries are contributing to driving the market.

North America is expected to grow at the fastest CAGR growth of the coating additives market during the forecast period. The growing need for environmentally friendly products and rising infrastructure in the United States are significantly responsible for driving the market demand. Further, the growing automotive, building, and construction industries along with the adoption of environmental regulations to avoid environmental hazards are anticipated to propel the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the coating additives market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- ALTANA AG

- Arkema

- Nouryon

- Allnex GmbH

- Elementis Plc.

- Momentive

- Eastman Chemical Company

- Ashland

- Solvay

- Evonik Industries AG

- CLARIANT

- Dow Inc.

- LANXESS

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, Hexion Inc., a global leader in specialty chemicals, announced a strategic collaboration with Clariant, an intumescent additive supplier, to develop cutting-edge intumescent coatings.

- In May 2024, Axalta, a leading global coatings company, announced a partnership with Solera, a global leader in vehicle lifecycle management. Through this partnership, Axalta’s conventional and Fast Cure Low Energy (FCLE) refinish paint systems would be integrated into Solera’s Sustainable Estimatics platform, enabling Axalta customers to estimate their CO2 emissions per repair, while considering repair methods (repair versus replace), paint application process, and drying conditions.

- In April 2024, Swedish packaging solutions startup Saveggy raised SEK 20M (€1.76M) to scale up its plastic-free, plant-based coating for fruits and vegetables, starting with cucumbers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the coating additives market based on the below-mentioned segments:

Global Coating Additives Market, By Type

- Acrylics

- Fluoropolymers

- Urethanes

Global Coating Additives Market, By Formulation

- Powder Coating

- Radiation Curable Coating

- Solvent Borne Coating

- Solventless Coating

- Water Borne Coating

- Others

Global Coating Additives Market, By End Users

- Architectural Coating

- Automotive Coating

- Industrial Coating

- Marine Coating

- Metal Packaging

- Wood & Furniture Coating

- Others

Global Coating Additives Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?