Global Cocoa and Chocolate Market Size, Share, and COVID-19 Impact Analysis, By Type (Dark Chocolate, Milk Chocolate, Filled Chocolate, White Chocolate), By Application (Food & Beverage, Cosmetics, Pharmaceuticals, Others), By Cocoa Ingredients (Butter, Liquor, Powder), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Food & BeveragesGlobal Cocoa and Chocolate Market Insights Forecasts to 2030

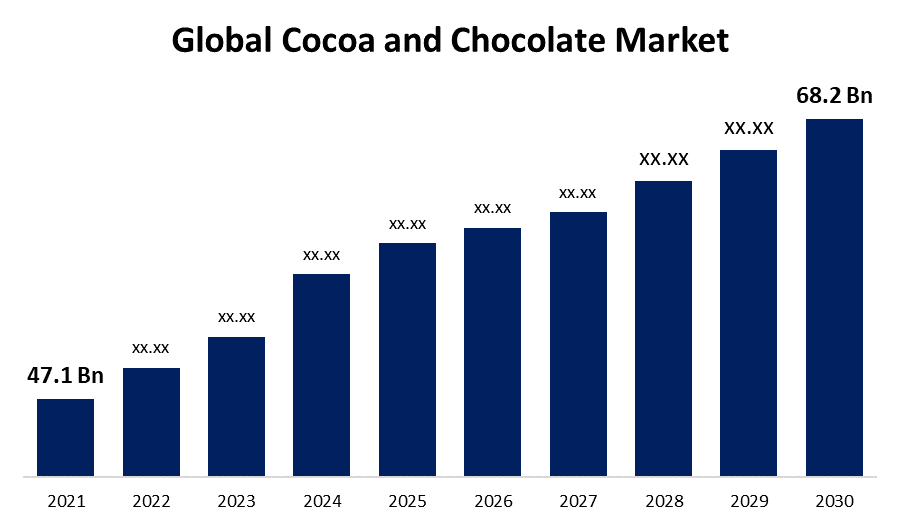

- The Global Cocoa and Chocolate Market Size was valued at USD 47.1 Billion in 2021.

- The Market is growing at a CAGR of 4.37% from 2022 to 2030

- The Worldwide Cocoa and Chocolate Market Size is expected to reach USD 68.2 Billion by 2030

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Cocoa and Chocolate Market Size is expected to reach USD 68.2 Billion by 2030, at a CAGR of 4.37% during the forecast period 2022 to 2030. Consumer’s growing preference for chocolate confectioneries for celebration activities, as well as rising demand for cocoa ingredients to develop premium-quality products, are expected to drive market growth. The cocoa and chocolate markets have been expanding in collaboration with increase demand for the health benefits of cocoa in chocolate products.

Market Overview

Cocoa powder is made from a chunk of roasted bean crumbs after the cocoa butter is extracted. Cocoa powder is mostly used in the manufacturing process of cocoa-based products such as drinks, cake fillings, ice creams, and others. Cocoa powder is generally available in retail stores to customers. Chocolate is a solid food prepared by combining cocoa butter, cocoa liquor, and sugar. The proportion of cocoa liquor in the final product determines how dark the chocolate is. Chocolate has a high caloric, fat, and sugar content due to the presence of cocoa butter. Chocolate comes in a variety of flavours, including raw, semi-sweet, sweet, dark, milk, white, and compound. Chocolate comes in many different forms, including small beads, bars, liquid, and powdered. Increased festive sales, increased use of chocolate as a functional food, and increased usage of dark and ruby chocolate are driving the growth of the Cocoa and Chocolate Market. Chocolate demand has increased due to the growing trend of gifting chocolates during the holiday season. People nowadays prefer chocolate celebrations as gift items because they are available in a variety of flavours and price ranges.

Chocolates developed to meet the needs of different target customers, such as mass-produced and craft-produced chocolates, are distinct products that meet different consumer needs. Mass-produced chocolates are made in larger quantities using a standardised process. Craft chocolates, on the other hand, are created using artisan techniques and are unique to each batch. During the study period, the emergence of new techniques and chocolate development, as well as rising demand for chocolate, are anticipated to drive forward of cocoa and chocolate products and support market growth.

Report Coverage

This research report categorizes the market for the global cocoa and chocolate market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cocoa and chocolate market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cocoa and chocolate market.

Global Cocoa and Chocolate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 47.1 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 4.37% |

| 2030 Value Projection: | USD 68.2 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Application, By Cocoa Ingredients, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Olam International, Fuji Oil Company Ltd., ECOM Agroindustrial Corporation Ltd., Niche Cocoa Industry Ltd., BD Associates Ghana Ltd., PLOT Enterprise Ghana Limited, Barry Callebaut, AG, Cargill, Inc., Cocoa Processing Co. Ltd., Touton S.A., Mars Wrigley, Nestlé,, Mondelez International. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Demand for chocolate confectioneries in emerging economies has increased, owing to rising consumer spending on indulgent confectionery products, particularly chocolate confectioneries. The addition of new different flavour chocolate types, such as dark chocolate and ruby chocolate, to the portfolios of key manufacturers, is expected to help cocoa and chocolate industry grow. During the projected period, the rising trend of gifting chocolates during festive seasons is also anticipated to be a major contributor to the development of the chocolate confectionery market. The growing popularity of clean-label and organic products for overall health and wellness has increased the demand for dark and sugar-free chocolates. In the coming years, the growing awareness of labour welfare is expected to fuel demand for fairly traded cocoa. Consumer preference for single-bean chocolates among key consumers, as well as significant market players commercializing these products to meet rising demand, are expected to drive market growth.

Restraining Factors

Changing consumer preferences and the availability of various substitute products can stymie market growth. Because cocoa ingredients are generally expensive due to their properties, people have begun to substitute cocoa ingredients, which may have an adverse effect on market growth. The use of cocoa butter alternatives improves the fat stability and fat composition profile of finished chocolate products, which drives their growth rate. Recognizing the high demand for cocoa ingredient substitutes as the price of cocoa ingredients rises, major market players such as Wilmar International, Cargill Inc., Danisco, and others are offering a diverse range of cocoa butter equivalent blends to meet market demand, which is also hampering the growth of the cocoa ingredients market.

Market Segmentation

The Global Cocoa and Chocolate Market share is segmented into type, application, and cocoa ingredients.

- The filled choclate segment is expected to grow the fastest during the forecast period.

Based on the type, the global cocoa and chocolate market is segmented into dark chocolate, milk chocolate, filled chocolate, and white chocolate. Among these, the filled chocolate segment is anticipated to be the fastest growing segment during the projected period. Because of the increased popularity of various filled chocolates such as truffles and bonbons, it is clear that consumers are looking for a new way to enjoy their favourite treat. The increasing indulgence of key demographics in multi-flavored chocolate consumption, as well as market players experimenting with developing novel types of filled chocolates such as truffles and bon-bon, are expected to cater to the surge in demand for filled chocolate and drive the segment's growth.

- The food & beverage sector is expected to hold the significant revenue share during the predicted period.

Based on the application, the global cocoa and chocolate market is segmented into food & beverage, cosmetics, pharmaceuticals, and others. Among these, the food and beverage industry is expected to have a significant revenue share during the forecast period. The food and beverage industry is booming globally, creating numerous opportunities for this industry. Chocolate has remained a popular flavour in new beverage, bakery, and confectionery product launches. This trend is expected to drive demand for cocoa butter and cocoa powder in the coming period. Rising consumer health consciousness, as well as increased consumption of bakery products such as chocolate-infused cookies, doughnuts, cupcakes, rolls, sweet rolls, cakes, pies, and coffee cakes, are expected to drive demand for cocoa and chocolate.

- In 2021, butter held the largest market share.

On the basis of cocoa ingredients, the global cocoa and chocolate market is differentiated into butter, liquor, and powder. Among these, the butter segment held the largest market share in 2021. The reason behind the growth is, the increasing usage of cocoa butter in the cosmetic industry for the development of skin care and food products, as well as the growing demand for natural cosmetics among key consumers are the factors to drive the market of cocoa butter. Palmer has introduced a new line of cocoa butter-based body care products, including lotions and other skin care items. Cocoa butter-based lotions provide significant benefits to consumers, such as superior skin moisturization and additional vitamin nourishment, which encourages consumer adoption.

Regional Segment Analysis of the Global Cocoa and Chocolate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe holds the largest market share over the forecast period.

Get more details on this report -

Europe held the largest market share and is expected to continue over the projected period. Most of the global’s major industrial chocolate producers are based in Belgium, the Netherlands, Germany, and Switzerland, making Europe a hub for industrial chocolate production. Europe is the world's largest importer of cocoa beans. The region is a significant producer and consumer of chocolate and chocolate-related products. The European cocoa market is extremely diverse, with European buyers sourcing cocoa beans of various qualities and origins to fulfill the demand of the cocoa and chocolate industries.

North America is anticipated to grow the fastest over the projected period owing to increasing demand for chocolate-based confectioneries and increasing acquisition of chocolate ingredients to infuse food products such as indulgent snacks, chocolate-flavored ice creams, and cocoa bars, others. Furthermore, rising awareness of the health benefits of cocoa and chocolate consumption is expected to drive the uptake of cocoa products and thus market growth. In North America, rising consumer awareness concerning health benefits of cocoa is expected to drive the demand of dark chocolate in the region’s chocolate confectionery market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global cocoa and chocolate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Olam International

- Fuji Oil Company Ltd.

- ECOM Agroindustrial Corporation Ltd.

- Niche Cocoa Industry Ltd.

- BD Associates Ghana Ltd.

- PLOT Enterprise Ghana Limited

- Barry Callebaut, AG

- Cargill, Inc.

- Cocoa Processing Co. Ltd.

- Touton S.A.

- Mars Wrigley

- Nestlé,

- Mondelez International.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On March 2022, Crunchy Cookie Chocolate Spread has been launched by Hershey India Pvt Ltd as an expansion to the existing Hershey's chocolate spread, which is available in flavours such as cocoa with almond and cocoa.

- On November 2022, Niche Cocoa Industry has announced the expansion of its manufacturing facility in Franklin, Wisconsin. The development will also improve the company's direct presence in the U.S. by strengthening its global market presence.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the global cocoa and chocolate market based on the below-mentioned segments:

Global Cocoa and Chocolate Market, By Type

- Dark Chocolate

- Milk Chocolate

- Filled Chocolate

- White Chocolate

Global Cocoa and Chocolate Market, By Application

- Food & Beverage

- Cosmetics

- Pharmaceuticals

- Others

Global Cocoa and Chocolate Market, By Cocoa Ingredients

- Butter

- Liquor

- Powder

Global Cocoa and Chocolate Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?