Global Coffee Roaster Market Size, Share, and COVID-19 Impact Analysis, By Type (Direct Fire, Half Hot Air, Hot Air, and Others), By Batch Size (Small, Medium, and Large), By Application (Industrial, Commercial, and Residential), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Consumer GoodsGlobal Coffee Roaster Market Insights Forecasts to 2032

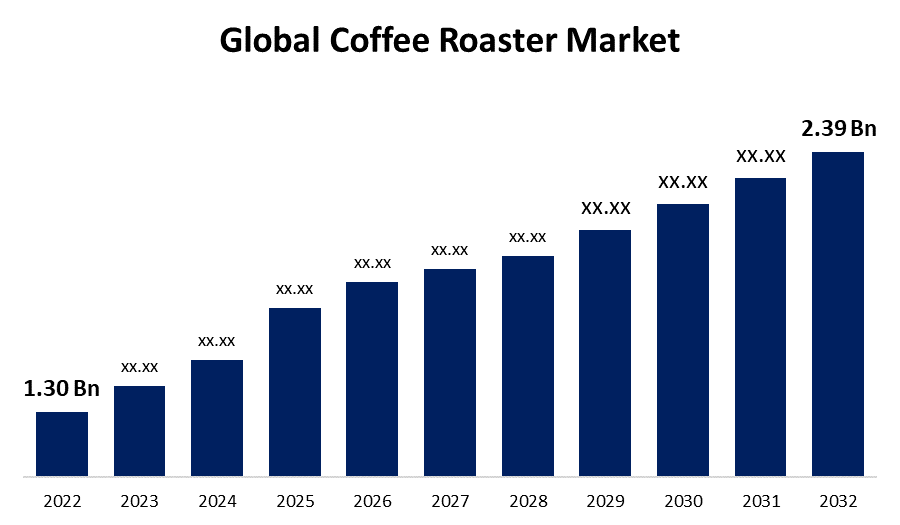

- The Global Coffee Roaster Market Size was valued at USD 1.30 Billion in 2022.

- The Market Size is Growing at a CAGR of 6.3% from 2022 to 2032

- The Worldwide Coffee Roaster Market Size is expected to reach USD 2.39 Billion by 2032

- Asia-Pacific is expected to grow fastest during the forecast period

Get more details on this report -

The Global Coffee Roaster Market Size is expected to reach USD 2.39 Billion by 2032, at a CAGR of 6.3% during the forecast period 2022 to 2032.

Market Overview

A coffee roaster is a specialized device or machine used to transform green coffee beans into aromatic and flavorful roasted coffee beans. It plays a crucial role in the coffee production process, as it determines the final taste, aroma, and quality of the brewed coffee. Coffee roasters use controlled heat and airflow to roast the beans evenly and develop their desired characteristics. Roasting brings out the natural oils and sugars in the beans, caramelizing them and giving coffee its distinct flavors and aromas. Coffee roasters can vary in size and complexity, ranging from small countertop units for home use to large industrial roasters used in commercial coffee production. Roasting coffee is both an art and a science, requiring skill and expertise to achieve the perfect roast for different coffee varieties.

Report Coverage

This research report categorizes the market for coffee roaster market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the coffee roaster market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the coffee roaster market.

Global Coffee Roaster Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 1.30 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.3% |

| 2032 Value Projection: | USD 2.39 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Batch Size, By Application, By Region |

| Companies covered:: | Nestle, Buhler Group, Probat AG, Scolari Engineering S.P.A., Genio Roasters, Cia. Lilla de Maquinas Ind. e Com, Coffee Holding, Diedrich Manufacturing Inc., Giesen Coffee Roasters B.V., Toper |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The coffee roaster market is driven by several factors that contribute to its growth and expansion, because of the rising global consumption of coffee is a significant driver. With coffee becoming an integral part of people's daily routines, the demand for roasted coffee beans has surged, leading to an increased need for coffee roasters. The growing trend of specialty and gourmet coffee has fueled the market. Consumers are increasingly seeking unique and high-quality coffee experiences, driving the demand for customized and artisanal roasts. Additionally, the proliferation of coffee shops, cafes, and specialty coffee retailers has created a robust market for commercial coffee roasters. Moreover, advancements in coffee roasting technology, such as computerized controls and precision roasting equipment, have enhanced the efficiency, consistency, and productivity of roasting processes, further driving the market. Overall, the growing popularity of home brewing and DIY coffee roasting has also contributed to the market growth, as enthusiasts seek to have more control over their coffee experience.

Restraining Factor

The coffee roaster market faces certain restraints that can impede its growth, due to the high cost associated with coffee roasting equipment and machinery poses a challenge, especially for small-scale roasters or startups. Additionally, the volatile and fluctuating prices of green coffee beans can impact the profitability of coffee roasters, as they need to manage price fluctuations to maintain their margins. Furthermore, the increasing concerns about environmental sustainability and carbon emissions have led to a demand for more energy-efficient and eco-friendly roasting methods, which may require investments in new technologies or modifications to existing equipment. Overall, the intense competition within the coffee industry and the presence of established players can create barriers for new entrants in the market.

Market Segmentation

- In 2022, the hot air segment accounted for around 40.5% market share

On the basis of the type, the global coffee roaster market is segmented into direct fire, half hot air, hot air, and others. The hot air segment has emerged as the dominant force in the coffee roaster market, capturing a significant share. There are several factors that contribute to the dominance of this segment. The hot air technology offers precise control over the roasting process, ensuring consistent and reproducible results. The use of hot air allows for even distribution of heat, minimizing the risk of under or over-roasting the coffee beans. This level of control is crucial in achieving the desired flavors, aromas, and profiles, making hot air roasters highly preferred among coffee roasters. The hot air roasters provide flexibility in terms of batch size and roasting capacity. They can accommodate a wide range of batch sizes, from small quantities for specialty and artisanal roasters to large-scale production for commercial roasters. This versatility makes hot air roasters suitable for various types of coffee roasting operations. Furthermore, hot air roasters are known for their energy efficiency. By utilizing heated air as the primary medium for roasting, these roasters minimize energy consumption compared to other types of roasting technologies. This aspect is not only environmentally friendly but also financially beneficial for coffee roasters, reducing operational costs and maximizing profitability. Additionally, hot air roasters are generally easier to clean and maintain compared to other roasting technologies. The absence of direct contact between the heating source and the coffee beans simplifies the cleaning process, allowing for better hygiene and minimizing the risk of flavor contamination. Overall, the precision control, flexibility, energy efficiency, and ease of maintenance associated with hot air roasters have made them the preferred choice for a wide range of coffee roasters, contributing to their dominant share in the coffee roaster market.

- In 2022, the industrial segment dominated with more than 46.7% market share

Based on the application, the global coffee roaster market is segmented into industrial, commercial, and residential. The industrial sector has emerged as the leader in the coffee roaster market, holding a significant share. Several factors contribute to the dominance of this sector in the market, such as the industrial sector caters to the high-volume production needs of commercial coffee manufacturers, large-scale coffee chains, and coffee retailers. These entities require coffee roasters with large roasting capacities to meet the demands of their customer base. Industrial coffee roasters are capable of processing large quantities of coffee beans in a single batch, ensuring efficient and timely production. The industrial sector benefits from economies of scale, allowing for cost-effective production and higher profit margins. Large-scale production enables these manufacturers to reduce per-unit costs, making their products more competitive in the market. Furthermore, industrial coffee roasters often incorporate advanced technology and automation features to enhance efficiency, consistency, and productivity. These roasters are designed for continuous operation, allowing for uninterrupted production and optimized throughput. Additionally, the industrial sector is well-equipped to comply with stringent quality and safety standards, including certifications and regulations required by global markets. Industrial coffee roasters implement quality control measures to ensure consistent roasting results and product excellence. Moreover, the industrial sector possesses robust distribution networks and marketing capabilities, enabling them to reach a wide customer base both domestically and internationally. Overall, the industrial sector's ability to meet high-volume production requirements, leverage economies of scale, implement advanced technology, and comply with quality standards has positioned it as a leader in the coffee roaster market, capturing a significant market share.

Regional Segment Analysis of the Coffee Roaster Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

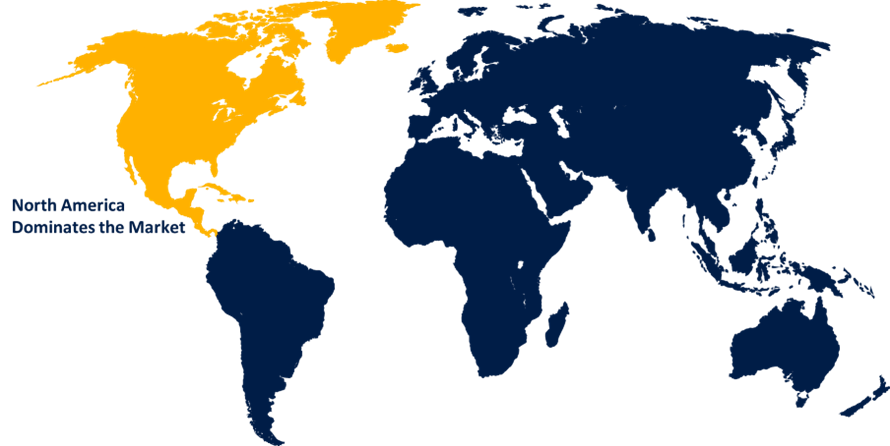

North America dominated the market with more than 32.6% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as the dominant player in the coffee roaster market, holding the largest share. Several factors contribute to this market dominance, because the region has a strong coffee culture with a high consumption rate, creating a significant demand for coffee roasters. The presence of a well-developed and mature coffee industry, including established coffee chains, specialty coffee shops, and artisanal roasters, has contributed to the growth of the market. Additionally, North America boasts advanced technology and infrastructure, facilitating the adoption of modern coffee roasting equipment. Moreover, consumer preferences for specialty and gourmet coffee have driven the demand for customized roasts, further fueling the market growth. Overall, a strong emphasis on quality and consistency in the coffee industry has propelled the demand for high-performance roasting machines, making North America a key market for coffee roasters.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global coffee roaster market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Nestle

- Buhler Group

- Probat AG

- Scolari Engineering S.P.A.

- Genio Roasters

- Cia. Lilla de Maquinas Ind. e Com

- Coffee Holding

- Diedrich Manufacturing Inc.

- Giesen Coffee Roasters B.V.

- Toper

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2022, Iron & Fire, a speciality coffee roaster, has created a new website for wholesale clients. Since its reopening, Iron & Fire has supplied coffee shops, bar chains, restaurants, garden centres, hotels, and other businesses, and it has achieved phenomenal development.

- In January 2023, PROBAT AG debuted the P12e electric coffee roaster as part of their P series, which employs electrical hot air technology. With a roasting capacity of 40kg/h, the P12e offers consistent and reproducible roasting results, satisfying the expectations of coffee roasters seeking efficiency and quality.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global coffee roaster market based on the below-mentioned segments:

Coffee Roaster Market, By Type

- Direct Fire

- Half Hot Air

- Hot Air

- Others

Coffee Roaster Market, By Batch Size

- Small

- Medium

- Large

Coffee Roaster Market, By Application

- Industrial

- Commercial

- Residential

Coffee Roaster Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?