Global Cold Chain Equipment Market Size, Share, and COVID-19 Impact Analysis, By Type (Storage Equipment, Transportation Equipment), By Application (Meat, Dairy & Frozen Desserts, Bakery & Confectionary, Processed Food, Pharmaceuticals, Vegetables & Fruits, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Industry: Machinery & EquipmentGlobal Cold Chain Equipment Market Insights Forecasts to 2033.

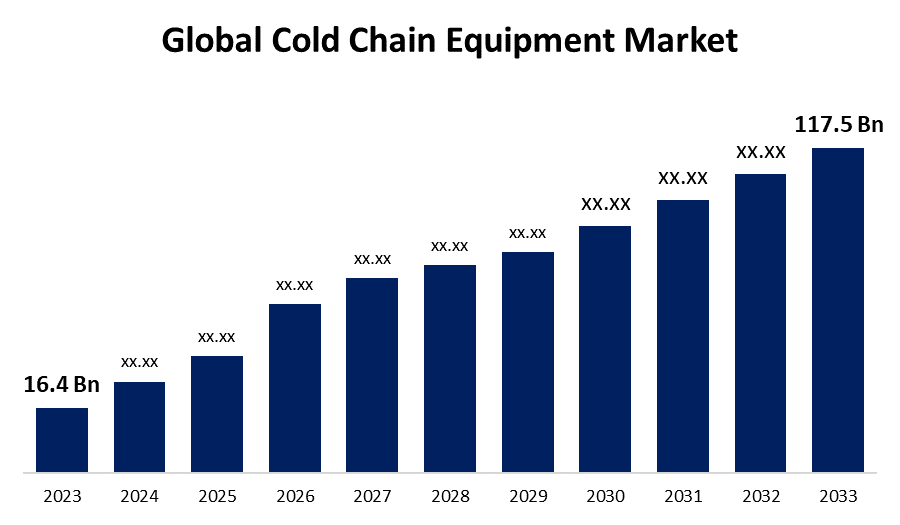

- The Global Cold Chain Equipment Market Size was Valued at USD 16.4 Billion in 2023.

- The Market Size is Growing at a CAGR of 21.76% from 2023 to 2033.

- The Worldwide Cold Chain Equipment Market Size is Expected to Reach USD 117.5 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Cold Chain Equipment Market Size is Anticipated to Exceed USD 117.5 Billion by 2033, Growing at a CAGR of 21.76% from 2023 to 2033.

Market Overview

Cold chain equipment is essential for keeping and moving temperature-sensitive products such as medications, vaccines, and perishable foods within the supply chain. Cold chain equipment also includes ice packs, refrigerators, vaccine carriers, foam pads, biotech products, insulin, and cold boxes. In recent years, the growing global demand for frozen diets has created a massive demand for cold chain equipment. Furthermore, cold chain equipment is an important component of the vaccination supply chain in the healthcare industry. According to reports, cold chain equipment such as freezers, cold rooms, vaccine carriers, cold boxes, and refrigerators are supposed to meet World Health Organization performance standards. Furthermore, businesses are utilizing IoT and cloud computing to monitor and manage temperature and humidity levels in real-time, allowing them to quickly resolve any issues. Data loggers and sensors are used in a variety of industries, including pharmaceuticals, to track the temperature and humidity of commodities as they travel. The growing demand for perishable foods necessitates the use of effective cold chain equipment. For instance, enterprises in the seafood industry must ensure that fish and other seafood items are transported safely and in excellent condition. Companies are investing in cutting-edge refrigeration and monitoring equipment, such as temperature sensors, data loggers, and monitoring systems, to satisfy demand.

Report Coverage

This research report categorizes the market for the global cold chain equipment market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global cold chain equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global cold chain equipment market.

Global Cold Chain Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 16.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 21.76% |

| 2033 Value Projection: | USD 117.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | LINEAGE LOGISTICS HOLDING, LLC, Fermod, Intertecnica, ebm-papst Group, Americold, Burris Logistics, NICHIREI CORPORATION, Schmitz Cargobull, Thermo King, Zanotti SpA, Viessmann, Carrier Transicold, Schmitz Cargobull, CAREL, Bitzer, Kelvion, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The fast growth of the pharmaceutical industry, as well as the increasing requirement for temperature-sensitive drug storage and transportation, are driving demand for sophisticated cold-chain solutions. Pharmaceutical businesses are spending extensively on reliable and efficient cold chain equipment to meet the growing demand for biopharmaceutical goods and vaccines that require strict temperature control throughout the supply chain. Governments, pharmaceutical makers, and logistics companies are working together to build strong cold chain networks that will ensure vaccine distribution is safe and effective. This driver is defined by the ongoing demand for technologically improved cold chain systems capable of maintaining precise temperature settings, complying with regulatory standards, and ensuring the integrity of pharmaceutical products. As the pharmaceutical sector continues to develop and expand, demand for sophisticated equipment is projected to be a major market driver for the foreseeable future.

Restraining Factors

The high initial investment and operational costs of developing and maintaining modern cold chain infrastructure harm cold chain equipment market growth. The purchase of cutting-edge refrigeration technology, monitoring systems, and energy-efficient equipment incurs high upfront costs, which can be a significant barrier for small and medium-Sized Enterprises (SMEs) or firms with low cash. Operational expenditures, such as energy usage and maintenance, add to the overall financial load. The requirement for continual monitoring, compliance with tight rules, and frequent maintenance to ensure the proper operation of cold chain equipment increases overall operational costs. This cost element might dissuade enterprises, particularly in emerging markets or industries with low-profit margins.

Market Segmentation

The global cold chain equipment market share is classified into type and application.

- The storage equipment segment is expected to hold the largest share of the global cold chain equipment market during the forecast period.

Based on the type, the global cold chain equipment market is divided into storage equipment and transportation equipment. Among these, the storage equipment segment is expected to hold the largest share of the global cold chain equipment market during the forecast period. The storage equipment is designed to maintain a specific temperature range appropriate for the product being stored. Some commodities, such as vaccinations, can be kept at temperatures ranging from below freezing to just above freezing, while other products, such as fruits and vegetables, can be kept above freezing. Throughout the cold chain process, it is critical to maintain product quality, safety, and efficacy, which necessitates the use of proper storage equipment and temperature control. Without the proper storage equipment, the items might decay, lose efficacy, or become unsafe to use or consume. Due to these serval factors the storage equipment segment is anticipated to hold a significant share in the global cold chain equipment market.

- The pharmaceuticals segment is expected to grow at the fastest pace in the global cold chain equipment market during the forecast period.

Based on the application, the global cold chain equipment market is divided into meat, dairy & frozen desserts, bakery & confectionary, processed food, pharmaceuticals, vegetables & fruits, and others. Among these, the pharmaceuticals segment is expected to grow at the fastest pace in the global cold chain equipment market during the forecast period. The demand for temperature-sensitive medicine storage and distribution is increasing, particularly in places where vaccination campaigns are being promoted. In the market, the pharmaceuticals segment is responsible for storing and shipping temperature-sensitive medications, vaccines, and biopharmaceuticals. This industry prioritizes precise temperature control throughout the supply chain to assure pharmaceutical product efficacy and safety.

Regional Segment Analysis of the Global Cold Chain Equipment Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global cold chain equipment market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global cold chain equipment market over the predicted timeframe. The cold chain equipment market in North America is mature and established, serving a diverse variety of industries such as food, pharmaceuticals, and chemicals. Several well-known companies offer cold chain equipment solutions in the region. One example is Lineage Logistics, the world's largest temperature-controlled warehousing and logistics provider. Lineage Logistics has approximately 300 sites in North America and offers a wide range of services, including blast freezing, cross-docking, and import/export. Another example is Carrier, a world leader in heating, air conditioning, and refrigeration solutions. Carrier supplies a wide range of cold chain equipment solutions, including refrigerated transport vehicles, storage choices, and refrigeration systems. In addition, Americold is a top provider of temperature-controlled warehousing and logistics services, with an emphasis on sustainability and efficiency.

Asia Pacific is expected to grow at the fastest pace in the global cold chain equipment market during the forecast period. Asia Pacific experienced the fastest growth rate over the predicted period, owing to rapid industrialization, expanded pharmaceutical manufacturing, and rising demand for high-quality food goods. The region's dynamic economies, notably China and India, are making large investments in cold chain infrastructure. The increasing e-commerce sector and an expanding middle class add to the growing demand for effective cold chain solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global cold chain equipment along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LINEAGE LOGISTICS HOLDING, LLC

- Fermod

- Intertecnica

- ebm-papst Group

- Americold

- Burris Logistics

- NICHIREI CORPORATION

- Schmitz Cargobull

- Thermo King

- Zanotti SpA

- Viessmann

- Carrier Transicold

- Schmitz Cargobull

- CAREL

- Bitzer

- Kelvion

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Americold Realty, a temperature-controlled storage and transportation company, announced plans to open its first site and co-locate Americold warehouse facilities on the CPKC network as part of a strategic relationship. By combining CPKC's extensive rail network with its cold storage capabilities, Americold would be able to provide a unique product to a larger number of clients in North America.

- In March 2023, Trane Technologies, a global pioneer in climate innovation, certified the use of fossil-free hydrotreated vegetable oil (HVO) fuel as a sustainable alternative to diesel fuel in Thermo King cold chain solutions. While maintaining optimal product performance, the use of HVO fuel results in a 90% reduction in greenhouse gas emissions and more than 30% in particulate matter. The certification comes after intensive testing, including a profitable pilot operation with a national food wholesaler.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global cold chain equipment market based on the below-mentioned segments:

Global Cold Chain Equipment Market, By Type

- Storage Equipment

- Transportation Equipment

Global Cold Chain Equipment Market, By Application

- Meat

- Dairy & Frozen Desserts

- Bakery & Confectionary

- Processed Food

- Pharmaceuticals

- Vegetables & Fruits

- Others

Global Cold Chain Equipment Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?LINEAGE LOGISTICS HOLDING, LLC, Fermod, Intertecnica, ebm-papst Group, Americold, Burris Logistics, NICHIREI CORPORATION, Schmitz Cargobull, Thermo King, Zanotti SpA, Viessmann, Carrier Transicold, Schmitz Cargobull, CAREL, Bitzer, Kelvion, and Others.

-

2. What is the size of the global cold chain equipment market?The global cold chain equipment market is expected to grow from USD 16.4 Billion in 2023 to USD 117.5 Billion by 2033, at a CAGR of 21.76% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global cold chain equipment market over the predicted timeframe.

Need help to buy this report?