Global Cold Storage Market Size, Share, and COVID-19 Impact Analysis, By Warehouse Type (Public, Private, Semi-Private), By Temperature (Chilled, Frozen), By Construction Type (Bulk Storage, Production Stores, Ports), By Application (Food & Beverage, Pharmaceuticals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Machinery & EquipmentGlobal Cold Storage Market Insights Forecasts to 2032

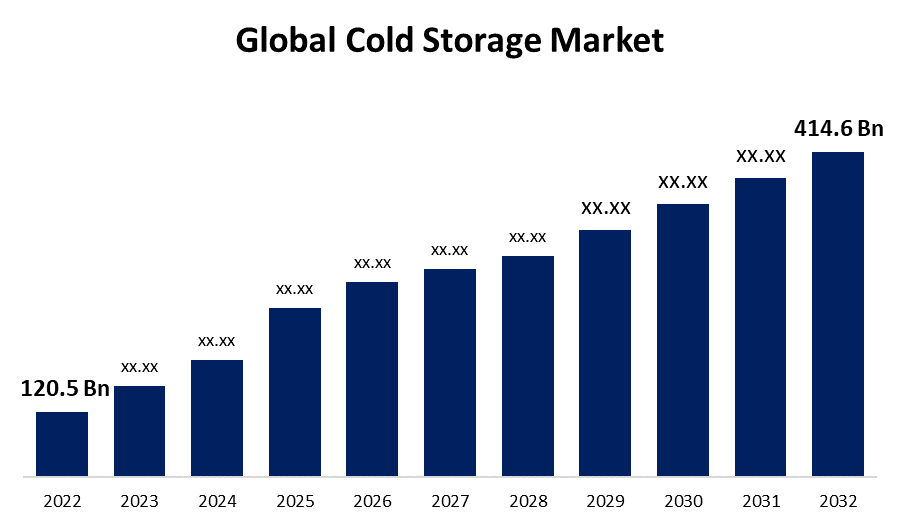

- The Global Cold Storage Market Size was valued at USD 120.5 Billion in 2022.

- The Market is Growing at a CAGR of 13.15% from 2022 to 2032

- The Worldwide Cold Storage Market Size is expected to reach USD 414.6 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Cold Storage Market Size is expected to reach USD 414.6 Billion by 2032, at a CAGR of 13.15% during the forecast period 2022 to 2032.

The purpose of cold storage is to preserve food or any other items in a refrigerator. It is the best location for handling large quantities of sensitive or fresh goods for production, particularly vegetables and fruits. It is also used to keep such goods fresh by controlling different gases and maintaining the proper humidity and temperature inside the storage solution. Cold storage has advantages for the food processing industry as well as for other industries like biotechnology, pharmaceuticals, and medicine.

When it comes to storing and transporting goods that must be kept at a particular temperature, cold storage is a crucial link in the supply chain. A manufacturer might have a personal cold storage facility where they are kept before being transferred to final customers. Furthermore, storing beauty products in low temperatures is necessary because they can also be ruined by heat, such as lipsticks, mascaras, nail paints, and other products. Fur, wool, and skin are common textile materials that need to be stored in cold storage because higher temperatures render them unusable. The microorganisms found in perishable foods are the primary cause of food poisoning. These bacteria have a substantially faster rate of multiplication, making the food items unsafe for eating. This risk can be fully avoided by keeping them in suitable solutions like cold storage.

Global Cold Storage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 120.5 Billion |

| Forecast Period: | 2032 |

| Forecast Period CAGR 2032 : | 13.15% |

| 032 Value Projection: | USD 414.6 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Warehouse Type, By Temperature, By Construction Type, By Application, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Agro Merchants Group,Americold Logistics LLC,Wabash National Corporation,Barloworld Limited,Versa Cold Logistics Services,Henningsen Cold Storage,Nordic Logistics,United States Cold Storage,FreezPak Logistics,Burris Logistics,New Cold,NICHIREI CORPORATION,Tippmann Group |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising demand for fresh food throughout the world, together with technical advancements in transportation and refrigeration or cold storage operations, are the main factors driving the worldwide cold storage industry. More novel storage solutions are needed as a consequence of expanding urbanization, which in turn contributes to the expansion of the worldwide market. The government is educating the public and agricultural workers about the loss of food waste and encouraging them to invest in cold storage building technologies that will support the world market. The use of cold storage buildings in blood banks, cemeteries, and transplant organ storage also aids in the expansion of the world market for this type of building. The global market is expanding as a result of the rising need for cost-effective and cutting-edge cold storage equipment.

Restraining Factors

The market growth is expected to be restricted by high energy, infrastructure, and maintenance costs as well as expanding government regulations placed on gases used in cold storage. Lack of infrastructure for temperature-sensitive shipping, especially in emerging countries, is another obstacle that is anticipated to provide difficulties for the establishment of cold storage facilities. Interest in cold storage providers is rising as a result of high energy costs. The corporation has significant obstacles when trying to grow in new areas due to a lack of the infrastructure required to operate cold storage. Furthermore, the absence of electrical connections for refrigerated trailers in ports and transportation hubs may limit market expansion in this sector. The size, cost, and materials required for the storage operations, as well as the size and expense of big cold storage equipment, restrict the expansion of the worldwide market.

Market Segmentation

By Warehouse Insights

The public segment dominates the market with the largest revenue share over the forecast period.

On the basis of warehouses, the global cold storage market is segmented into public, private, and semi-private. Among these, the public segment is dominating the market with the largest revenue share of 68.2% over the forecast period. Public warehouses, also known as duty-paid warehouses, are those that are owned by a company or a specific person. In comparison to private warehouses, public warehouses are more adaptable and cost-effective. Public storage gives a great deal of freedom. Utilizing greater public warehouse facilities might also make it simple to grow into a new region or geographic area.

By Temperature Insights

The frozen segment is witnessing significant CAGR growth over the forecast period.

On the basis of temperature, the global cold storage market is segmented into chilled and frozen. Among these, the frozen segment is witnessing significant CAGR growth over the forecast period. Factors related to rising frozen food consumption in developing countries such as India and China are particularly pushing the frozen food industry. The demand for this market segment has been prompted by changing customer tastes towards ready-to-cook meals as a result of increased awareness of convenience and hygiene, as well as customers' preference for frozen food due to its simplicity in terms of packing and support for microwave cooking.

By Construction Insights

The bulk storage segment is expected to hold the largest share of the global cold storage market during the forecast period.

Based on the construction, the global cold storage market is classified into bulk storage, production stores, and ports. Among these, the bulk storage segment is expected to hold the largest share of the cold storage market during the forecast period. In addition to extending the availability of other bulk items like flour, culinary ingredients, and canned products by preventing their deterioration by keeping them out of direct sunlight, this sort of warehouse is perfect for storing fruits and vegetables in bulk.

ports category is estimated to generate much more income throughout the projection period. As more and more cold storage facilities are constructed close to ports to accommodate the expanding import and export of perishable goods, the market for cold storage buildings is anticipated to rise. A cold storage warehouse's type of insights.

By Application Insights

The food & beverage segment accounted for the largest revenue share of more than 57.2% over the forecast period.

On the basis of application, the global cold storage market is segmented into food& beverage and pharmaceuticals. Among these, the food& beverage segment dominates the market with the largest revenue share of 83.2% over the forecast period. Food goods, such as milk and dairy products, must still be stored in a refrigerated environment to prevent deterioration. Therefore, when keeping dairy goods in refrigerated warehouses, it is important to follow the rules controlling the deterioration of food ingredients caused by bacterial development. The rise in the food and drinks market is being driven by the need to preserve food quality while also preventing degradation.

Regional Insights

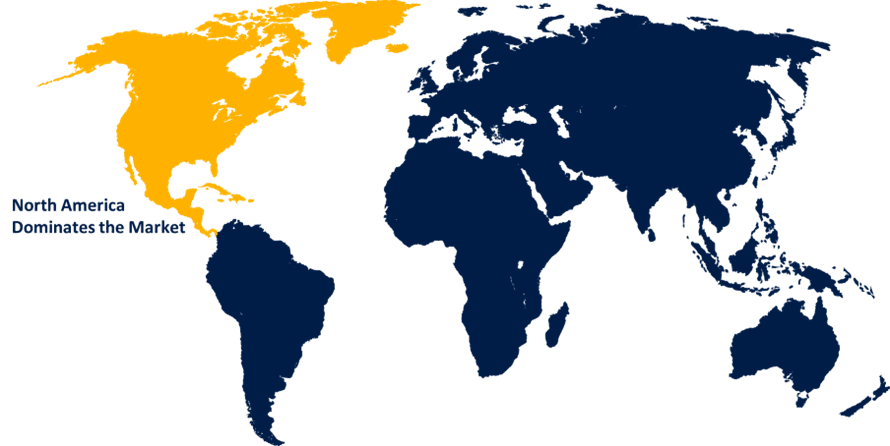

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 62.7% market share over the forecast. The addition of connected devices, along with a big customer base, is the primary driver of the region's growth. Particularly in US, Mexico is anticipated to experience exponential growth as a result of increased expenditures in the construction of the logistics infrastructure and a strengthened network of warehouses. Market expansion in this area will be aided by Mexico's expanding economy and revisions to government rules targeted at simplifying the country's current projects and immigration program.

Asia-Pacific, on the contrary, is expected to grow the fastest during the forecast period. Some countries, particularly China, are transitioning to a market-based economy. They are thus expected to increase considerably over the forecast year. Europe, market is expected to register a substantial CAGR growth rate during the forecast period.

List of Key Market Players

- Agro Merchants Group

- Americold Logistics LLC

- Wabash National Corporation

- Barloworld Limited

- Versa Cold Logistics Services

- Henningsen Cold Storage

- Nordic Logistics

- United States Cold Storage

- FreezPak Logistics

- Burris Logistics

- New Cold

- NICHIREI CORPORATION

- Tippmann Group

Key Market Developments

- On March 2023, Americold confirmed a strategic investment in RSA Cold Chain, a reputable regional cold storage business with operations starting in Dubai in 2017. The company's intentions to grow locally, explore strategic expansion opportunities in the Middle East and surrounding regions, and link RSA Cold Chain to its worldwide network will all be made possible by Americold's minority ownership.

- On February 2023, At the Fruit Logistica trade event in Berlin, Lineage Logistics debuted its "Lineage Fresh" service in Europe, which provides storage options for top supermarkets, fresh produce farmers, and importers. With Lineage's cold storage technology and robust logistics network, the service, which went live in the U.S. in November 2022, will make it easier for items with a limited shelf life to meet challenges and reduce the danger of deterioration.

- On January 2023, in order to empower sustainable food retail through digitalization and lower food waste and energy use in retail refrigeration, Danfoss worked with Microsoft.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the global cold storage Market based on the below-mentioned segments:

Cold Storage Market, Warehouse Analysis

- Public

- Private

- Semi-Private

Cold Storage Market, Temperature Analysis

- Chilled

- Frozen

Cold Storage Market, Construction Analysis

- Bulk Storage

- Production Stores

- Ports

Cold Storage Market, Application Analysis

- Food & Beverage

- Pharmaceuticals

Cold Storage Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?