Global Colonoscopes Market Size, Share, and COVID-19 Impact Analysis, By Type (Fiber Optic Colonoscopes and Video Colonoscopes), By Procedure Type (Therapeutic and Diagnostic), By Age Group (Pediatric and Adult), By Application (Crohn’s Disease, Colorectal Cancer, Ulcerative Colitis, Lynch Syndrome, Polyps, and Others), By End-User (Ambulatory Surgical Centers, Hospitals & Clinics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Colonoscopes Market Insights Forecasts to 2033

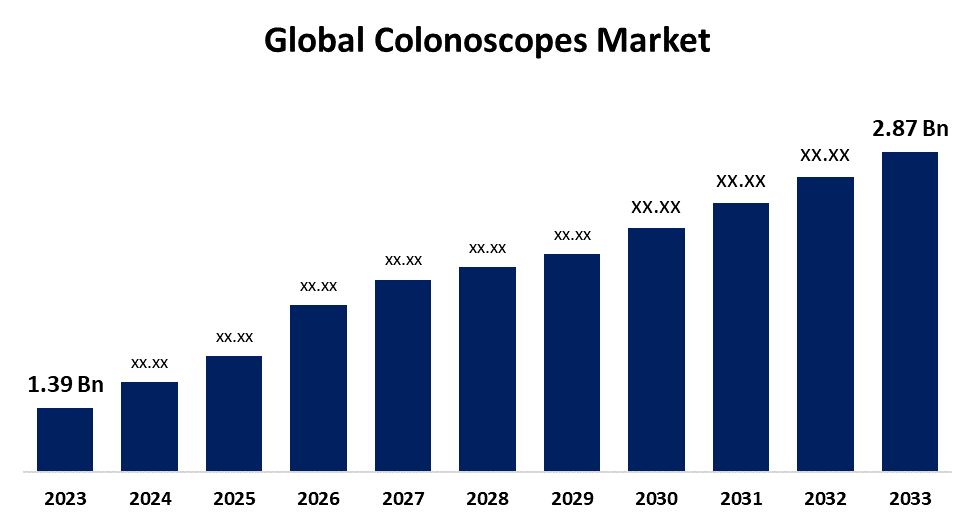

- The Global Colonoscopes Market Size was Estimated at USD 1.39 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 7.52% from 2023 to 2033

- The Worldwide Colonoscopes Market Size is Expected to reach USD 2.87 Billion by 2033

- Asia Pacific is predicted to Grow at the fastest CAGR throughout the projection period

Get more details on this report -

The Global Colonoscopes Market Size is anticipated to Exceed USD 2.87 Billion by 2033, Growing at a CAGR of 7.52% from 2023 to 2033. The market growth is facilitated by the increasing prevalence of colorectal cancer, a rising proportion of the geriatric population, rising cases of gastrointestinal diseases involving inflammatory bowel disease, and aesthetic living of the patients escalates the need for colonoscopes in the colonoscopy medical procedure.

Market Overview

The colonoscope market involves the manufacturing and commercialization of flexible tube-like structures called colonoscopes used for visualization of internal organ linings of the colon, rectum, and ileum and aids in the diagnosis and treatment of several diseases. Colonoscopy is an extensive method utilized for the diagnosis of colorectal cancer. The colonoscope is an integral part of the colonoscopy. The colonoscope is a medical instrument, a long flexible tube typically 1cm in diameter, equipped with an imaging system with a mini camera at the tip which transmits the images of the colon to an external monitor and is facilitated by the source of light. Colonoscopy differs from endoscopy as colonoscopy examines the lower part of the digestive tract and endoscopy examines the upper part of the digestive tract.

Several government initiatives and regulatory bodies provide funds for diagnostic services in India and offer free access to medicines and diagnostics tests for the population for the management of various diseases resulting in the increasing demand for medical instruments and devices including colonoscopes instruments leading to the expansion of the market. For instance, the Government of India launched the Medical Access and Assistance (MAA) scheme for the sake of a beneficial outcome for the Indian population. The scheme, which has been allocated rupees 3,500 crore, aims to bridge healthcare accessibility by increasing the number of free diagnostic tests available at government-run health centers[PV1] . In Delhi, the government has expanded free diagnostic tests in mohalla clinics to 450, benefiting around 2 crore residents annually.

Globally, colorectal cancer cases are rising in population, and screening activities for colorectal cancer drive the demand for colonoscopy procedures resulting in the growth of the colonoscopes market. For instance, the World Health Organization (WHO) reported that colorectal cancer is the third most common type of cancer worldwide, accounting for approximately 10% of [PV2] all cancer cases. In 2020, over 1.9 million new cases and over 930,000 deaths were estimated worldwide owing to colorectal cancer.

The Centre for Disease Control and Prevention (CDC) established the program as a Colorectal Cancer Control Program (CRCCP), primarily for the United States population. The CRCCP program provides grant funding to 23 state health departments and six universities, the third most common cancer in men and women and the second leading cause of cancer death in the U.S. In 2020[PV3] , an estimated 147,950 men and women were diagnosed with colorectal cancer, and 53,200 individuals died from the disease. The goal is to increase colorectal cancer screening rates among high-need groups, reducing the burden of colorectal cancer for thousands or millions of Americans. Therefore, rising screening activities for colorectal cancer among Americans accelerate the need for colonoscopes in government and private hospitals in the North America region which results in the expansion of the colonoscopes market.

The increasing prevalence of inflammatory bowel diseases leads to growing diagnostic test services such as colonoscopy which escalates the need for colonoscopes. A colonoscopy is a vital diagnostic test for detecting inflammation, ulcers, and other IBD abnormalities in the colon and terminal ileum, enabling real-time assessment to differentiate between Crohn's disease and ulcerative colitis due to their distinct visual characteristics. For example, in 2019[PV4] , IBD cases reached 4.9 million globally, with China and the USA having the highest number (911,405 and 762,890 cases per 100,000 people, respectively). Contemplating all the advantageous aspects of colonoscopes propels the market growth.

This research report categorizes the global colonoscopes market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global colonoscopes market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global colonoscopes market.

Colonoscopes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1.39 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.52% |

| 2033 Value Projection: | USD 2.87 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Procedure Type, By Age Group, By Application, By End-User |

| Companies covered:: | Pentax Medical, Smith Nephew plc, Cantel Medical Corp., Olympus Corporation, Boston Scientific Corporation, Stryker Corporation, Karl Storz GmbH Co. KG, Medtronic plc, Fujifilm Holdings Corporation, Teleflex Incorporated, Smith Nephew plc, Applied Medical Technologies, Inc., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors:

Innovations in the colonoscopy and colonoscope:

Technological advancements have significantly accelerated the colonoscope market, leading to the development of innovative products and techniques. High-definition imaging systems have improved visualization of the colon and other gastrointestinal tract areas, enabling the detection and diagnosis of abnormalities like polyps and tumors. Narrow-band imaging (NBI) technology enhances tissue contrast, making it easier to identify suspicious areas.

Virtual colonoscopy or CT colonography uses advanced imaging technology to create a 3D model of the colon, allowing detailed examination and diagnosis without invasive procedures. Advances in endoscope design and instrumentation have also contributed to the market, with new devices including disposable and balloon-assisted colonoscopes improving patient comfort and procedure accuracy. Artificial intelligence (AI) has become a major focus in the industry, analyzing large amounts of imaging data to identify abnormalities that are invisible to the naked eye. These innovations continue driving the colonoscope market.

Rising incidence of colorectal cancer:

Colonoscopy is crucial for early detection and prevention of colorectal cancer, allowing for the removal of polyps before they become cancerous. The increasing prevalence of colorectal cancer is driving demand for colonoscopy procedures, leading to the growth of the colonoscope market. For instance, the data provided by the National Cancer Institute, Surveillance, Epidemiology, and End Results Program states that in 2021, 1,392,445 people [PV1] were estimated to have colorectal cancer in the United States.

Restraining Factors

Colonoscopy is an invasive procedure with several complications such as continued bleeding after biopsy, rectal irritation, perforation in the intestinal wall, high cost of the devices, and lack of awareness in low-income countries may impede the growth of the market.

Market Segmentation

The global colonoscopes market share is classified into type, procedure type, age, application, and end-user.

- The video colonoscopes segment dominated the market with 75.01% of the share in 2023 and is anticipated to grow at a significant CAGR throughout the forecast period.

Based on the type, the global colonoscopes market is categorized into fiber optic colonoscopes and video colonoscopes. Among these, the video colonoscopes segment dominated the market with 75.01% of the share in 2023 and is anticipated to grow at a significant CAGR throughout the forecast period. The segmental expansion is attributed to low-dose computed tomography, less invasive than regular colonoscopes, has precise imaging, and greater magnification features, accurately identifies the large intestine pathologies, eliminates the usage of anesthetic agents for anesthesia of the patient, is easy to operate, features capturing real-time assessment of imaging of the lower digestive tract.

- The diagnostic segment accounted for the largest share in 2023 and is expected to grow at a substantial CAGR throughout the projected timeframe.

Based on the procedure type, the global colonoscopes market is categorized into therapeutic and diagnostic. Among these, the diagnostic segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe. The diagnostic segment accounted for the largest share in 2023 and is expected to grow at a substantial CAGR throughout the projected timeframe. The segment growth is facilitated by the increasing prevalence of colorectal cancer, rising cases of inflammatory bowel diseases such as Crohn’s disease and ulcerative colitis, growing use of colonoscopy as a diagnostic test for the early detection of cancer and inflammatory bowel disease, reliable outcomes, specificity, and sensitivity characteristics.

- The adult segment held the largest share in 2023 and is expected to grow at a substantial CAGR throughout the projected timeframe.

Based on age, the global colonoscopes market is categorized into pediatric and adult. Among these, the adult segment held the largest share in 2023 and is expected to grow at a substantial CAGR throughout the projected timeframe. The segment growth is facilitated by the rising occurrence of chronic diseases such as colorectal cancer inflammatory diseases owing to sedentary lifestyles, lack of physical activities, lack of immunity in adults, poor diet, low intake of fiber, frequent alcoholic consumption, and obesity, frequent use of the NSAID’s may lead to inflammatory bowel diseases and genetics.

- The colorectal cancer segment accounted for the largest share in 2023 and is predicted to grow at a significant CAGR throughout the projected timeframe.

Based on the application, the global colonoscopes market is categorized into Crohn’s disease, colorectal cancer, ulcerative colitis, lynch syndrome, polyps, and others. Among these, the colorectal cancer segment accounted for the largest share in 2023 and is predicted to grow at a significant CAGR throughout the projected timeframe. The segment expansion is ascribed to the dietary habits, innovations in the colonoscopes, rising research and development activities of the biomarkers of colorectal cancer disease, aesthetic living of patients drives the early detection of diseases, and rising demand for diagnostic tests for the screening of colorectal cancer.

- The hospitals & clinics segment dominated the global colonoscopes market in 2023 and is expected to grow at a substantial CAGR throughout the projected timeframe.

Based on the end-user, the global colonoscopes market is categorized into ambulatory surgical centers, hospitals & clinics, and others. Among these, the hospitals & clinics segment dominated the global colonoscopes market in 2023 and is expected to grow at a substantial CAGR throughout the projected timeframe. This sector growth is accelerated by the accessibility of advanced and emerging medical facilities, availability of the oncologist and proctologist, rising proportion of in-patient services and out-patient services, rising demand for modernized staff and medical consumables and equipment, and enhanced health outcomes of the patients.

Regional Segment Analysis of the Global Colonoscopes Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global colonoscopes market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global colonoscopes market over the predicted timeframe. This is attributed to the rising prevalence of colorectal cancer among Americans, the rising demand for colonoscopy diagnostic tests, and an increasing proportion of the geriatric population. North America is a leading player in the healthcare sector, with significant investments in medical imaging technologies, endoscopy equipment, and colonoscopy devices. This saturation of key market players facilitates technological advancements, research, and development. North America's well-established awareness programs and screening initiatives for colorectal health drive the demand for advanced devices. As these factors continue to shape the healthcare landscape, the market is expected to thrive, providing opportunities for further innovation and advancements in colonoscopes.

Asia Pacific is anticipated to grow at the fastest CAGR throughout the projected timeframe. The colonoscopes industry is experiencing significant growth, driven by rising demand for minimally invasive procedures in emerging markets like India and China. The growing healthcare expenditures in these countries are expected to further boost market growth. The large patient populations in these countries contribute to the market's expansion. The increasing incidence of colorectal cancer in China has prompted increased awareness and the need for early detection through screening procedures. The aging population in China, particularly those over 65, also drives demand for colonoscopy services, as they are crucial for addressing age-related gastrointestinal disorders.

Competitive Analysis:

- The report offers the appropriate analysis of the key organizations/companies involved within the global colonoscopes market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pentax Medical

- Smith Nephew plc

- Cantel Medical Corp.

- Olympus Corporation

- Boston Scientific Corporation

- Stryker Corporation

- Karl Storz GmbH Co. KG

- Medtronic plc

- Fujifilm Holdings Corporation

- Teleflex Incorporated

- Smith Nephew plc

- Applied Medical Technologies, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, Odin Medical Ltd. received FDA 510(k) clearance for the CADDIE™ computer-aided detection (CADe) device, the first cloud-based AI technology to assist gastroenterologists in detecting suspected colorectal polyps during [PV2] colonoscopy procedures.

- In April 2021, Fujifilm Medical Systems launched the G-EYE® 700 Series Colonoscope, a technology developed by Smart Medical for visualization, stabilization, and control during routine examinations. The technology has been shown to improve polyp detection compared to standard colonoscopy, expanding [PV3] Fujifilm's innovative colonoscope portfolio offering.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global colonoscopes market based on the below-mentioned segments:

Global Colonoscopes Market, By Type

- Fiber Optic Colonoscopes

- Video Colonoscopes

Global Colonoscopes Market, By Procedure Type

- Therapeutic

- Diagnostic

Global Colonoscopes Market, By Age

- Pediatric

- Adult

Global Colonoscopes Market, By Application

- Crohn’s Disease

- Colorectal Cancer

- Ulcerative Colitis

- Lynch Syndrome

- Polyps

- Others

Global Colonoscopes Market, By End-User

- Ambulatory Surgical Centers

- Hospitals & Clinics

- Others

Global Colonoscopes Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global colonoscopes market?The global colonoscopes market is projected to expand at 7.52% during the forecast period.

-

2. Who are the top key players in the global colonoscopes market?The key players in the global colonoscopes market are Pentax Medical, Smith Nephew plc, Cantel Medical Corp., Olympus Corporation, Boston Scientific Corporation, Stryker Corporation, Karl Storz GmbH Co. KG, Medtronic plc, Fujifilm Holdings Corporation, Teleflex Incorporated, Smith Nephew plc, Applied Medical Technologies, Inc., and others.

-

3. Which region holds the largest share of the market?North America is anticipated to hold the largest share of the global colonoscopes market over the predicted timeframe.

Need help to buy this report?