Global Commercial Aircraft Windshield and Windows Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Narrow Body, Wide Body, Freighter Aircraft, Regional Jets), By Material (Acrylic, Polycarbonate), By End Use (OEM, Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Commercial Aircraft Windshield and Windows Market Insights Forecasts to 2033

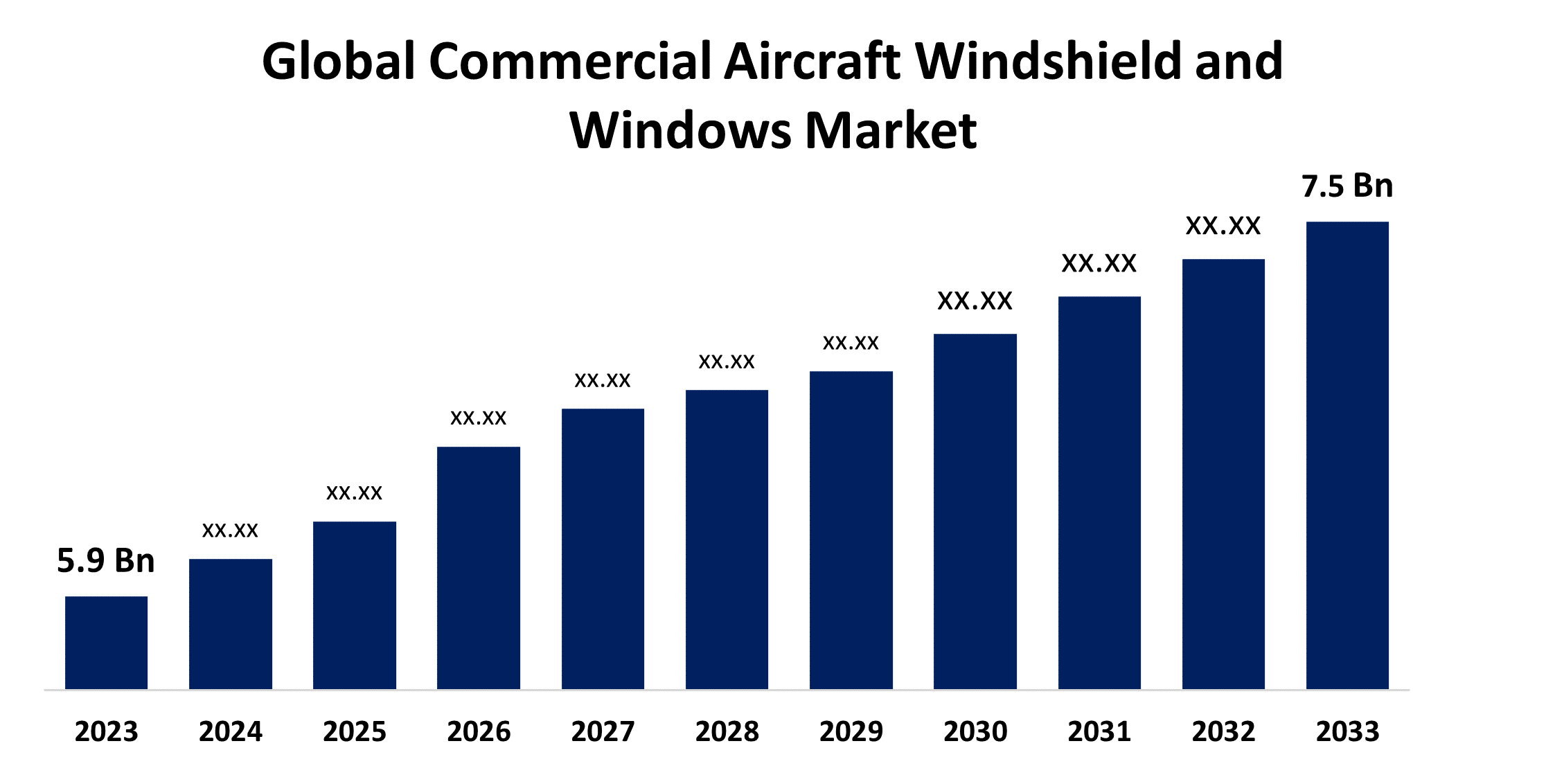

- The Global Commercial Aircraft Windshield and Windows Market Size was valued at USD 5.9 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.43% from 2023 to 2033

- The Worldwide Commercial Aircraft Windshield and Windows Market Size is expected to reach USD 7.5 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Commercial Aircraft Windshield and Windows Market Size is expected to reach USD 7.5 Billion by 2033, at a CAGR of 2.43% during the forecast period 2023 to 2033.

Modern aircraft windows and windshields allow passengers to enjoy ambient views while ensuring protection from external elements. Designed with a fail-safe concept, these windows significantly minimize the risk of complete failure. Constructed with multiple layers of glass, they also act as thermal energy storage materials. The outer glass layer shields passengers from the cold external environment, while the inner layer prevents condensation and freezing. The rising demand for new aircraft has concurrently increased the demand for robust commercial aircraft windows and windshields. Several significant causes contribute to this expansion, including technology breakthroughs in aviation, increased air travel demand, and industry-wide strategic alliances. Smart windows with variable tinting, anti-fogging technologies, and integrated sensors improve passenger safety and comfort, making them a popular choice among airlines and aircraft builders.

Commercial Aircraft Windshield and Windows Market Value Chain Analysis

The value chain of the commercial aircraft windshield and windows market encompasses multiple stages, from raw material procurement to end-user delivery. Initially, raw materials such as polycarbonate, acrylic, and specialized glass are sourced from suppliers. These materials are then manufactured into windows and windshields through advanced processes involving lamination, coating, and precision cutting to meet stringent aviation standards. The products are then distributed via OEMs (Original Equipment Manufacturers) and aftermarket channels, with OEMs supplying directly to aircraft manufacturers for new builds, while the aftermarket supports maintenance and replacement needs. Finally, the windows and windshields are integrated into aircraft by airlines and maintenance providers, ensuring passenger safety and comfort.

Global Commercial Aircraft Windshield and Windows Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.9 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.43% |

| 2033 Value Projection: | USD 7.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 203 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Aircraft Type, By Material, By End Use, By Region |

| Companies covered:: | GKN Plc, PPG Industries, Inc., Gentex Corporation, The NORDAM Group, Inc., Saint-Gobain S.A., Control Logistics Inc., Plexiweiss GmbH, Llamas Plastics, Inc., Air-Craftglass Inc., Aerospace Plastic Components, Lee Aerospace, LP Aero Plastics, Inc., Tech-Tool Plastics Inc., VT San Antonio Aerospace Nagias, and Others Key Vendors. |

| Growth Drivers: | Increased use of dimmable passenger windows will lead to innovative developments |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Commercial Aircraft Windshield and Windows Market Opportunity Analysis

The commercial aircraft windshield and windows market is poised for significant development, driven by technological advancements, rising air travel demand, and increased aircraft manufacturing. Smart windows with variable tinting, anti-fogging features, and integrated sensors improve passenger safety and comfort, making them appealing to airlines and manufacturers alike. Lightweight and energy-efficient materials, such as polycarbonate and acrylic, offer opportunities for improving aircraft performance and fuel efficiency. Global air travel, especially in expanding countries like Asia-Pacific and the Middle East, is increasing demand for new aircraft, leading to a greater requirement for upgraded windows and windscreens.

Market Dynamics

Commercial Aircraft Windshield and Windows Market Dynamics

Increased use of dimmable passenger windows will lead to innovative developments

The rising usage of dimmable passenger windows is expected to considerably boost growth and innovation in the commercial aircraft windscreen and windows market. These sophisticated windows, which allow passengers to alter the tint for optimal light and heat control, increase passenger comfort while reducing the need for mechanical shades, increasing the overall cabin experience. Dimmable windows, like as those created by Gentex Corporation and used in Boeing's 787 Dreamliner, are a significant advancement in aviation technology, using electrochromic materials that can be manipulated electronically. The introduction of such smart window technologies is projected to drive market innovation as manufacturers strive to build more efficient, durable, and lightweight solutions.

Restraints & Challenges

One major obstacle is the high expense of developing and implementing new window technologies, such as smart windows with changeable tinting and electrochromic materials. These technologies necessitate significant expenditure in R&D, which can be an impediment for smaller businesses and new entrants. Another issue is the strict regulatory requirements and safety standards enforced by aviation authorities, which can cause delays in the introduction of new products and technology to the market. Meeting strict requirements requires significant testing and certification, which may be time-consuming and costly. Another issue is the strict regulatory requirements and safety standards enforced by aviation authorities, which can cause delays in the introduction of new products and technology to the market.

Regional Forecasts

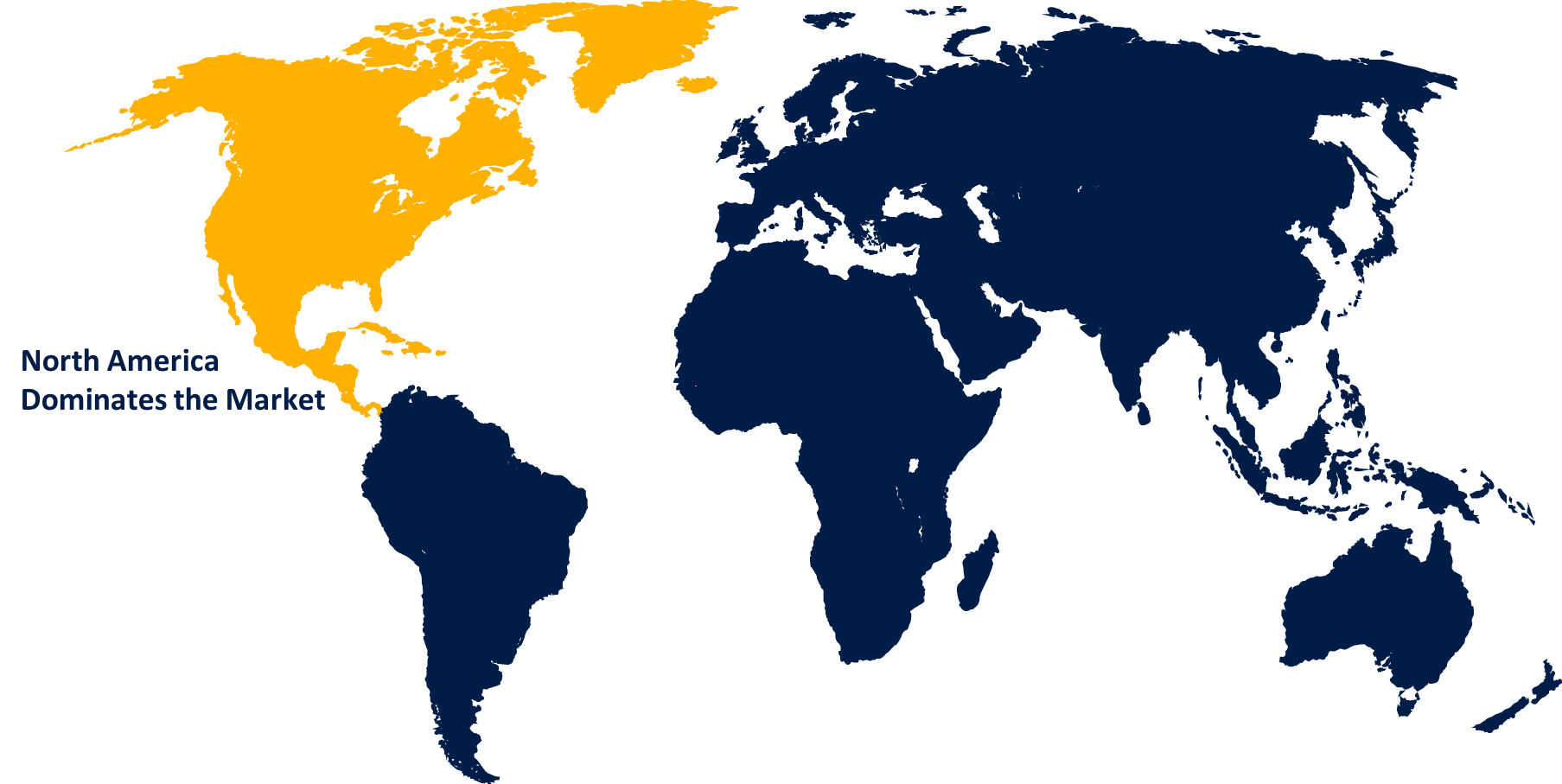

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Commercial Aircraft Windshield and Windows Market from 2023 to 2033. The demand for new aircraft and replacement parts such as windscreens and windows is strongly driven by airline purchasing trends. Fleet expansion, the retirement of older aircraft, and technology breakthroughs can all contribute to increased demand. Advances in materials science and engineering enable the creation of lightweight, robust, and more resistant materials for aeroplane windscreens and windows. Smart windows with built-in sensors or coatings that improve visibility and durability can have an impact on market trends. Competition among manufacturers and suppliers in the North American region, as well as overseas businesses, has an impact on market dynamics such as pricing tactics, product offerings, and technological advances.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific region is experiencing robust growth in air travel demand, driven by factors such as rising disposable incomes, urbanization, and the expansion of low-cost carriers. This growth fuels demand for new aircraft as well as replacement parts like windshields and windows. Airlines in the Asia-Pacific region are continuously expanding their fleets to meet growing passenger demand. This expansion leads to increased demand for new aircraft, which in turn drives demand for related components including windshields and windows.

Segmentation Analysis

Insights by Aircraft Type

The narrow body segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines worldwide, especially low-cost carriers and regional airlines, are increasingly relying on narrow-body aircraft to meet the growing demand for short- to medium-haul routes. This trend has led to substantial orders for narrow-body aircraft from manufacturers like Boeing and Airbus, resulting in increased demand for related components, including windshields and windows. Many older narrow-body aircraft are reaching the end of their operational lives and are being retired from service. Airlines replacing these aging aircraft often opt for newer models with modernized components, including windshields and windows, leading to increased demand for replacements and upgrades in this segment.

Insights by Material

The polycarbonate segment is dominating the market with the largest market share over the forecast period 2023 to 2033. Polycarbonate is significantly lighter than traditional materials like glass, making it an attractive option for aircraft manufacturers aiming to reduce weight and improve fuel efficiency. As airlines seek to lower operating costs and enhance performance, there is a growing preference for lightweight materials in aircraft construction, including windshields and windows. Polycarbonate can be molded into complex shapes, allowing for more versatile and aerodynamically efficient windshield and window designs. This flexibility enables manufacturers to optimize the aerodynamic performance of aircraft, leading to improved fuel efficiency and performance.

Insights by End User

The aftermarket segment is dominating the market with the largest market share over the forecast period 2023 to 2033. Aftermarket service providers often specialize in aircraft windshield and window maintenance and repair, possessing the necessary expertise, tools, and facilities to perform these tasks efficiently and effectively. Airlines rely on the specialized skills of these providers to ensure the safety and reliability of their aircraft fleets, driving demand for aftermarket services. MRO facilities specializing in aircraft windshield and window maintenance and repair are expanding globally to meet the growing demand for aftermarket services. This expansion allows service providers to offer convenient and accessible solutions to airlines operating across different regions, further driving growth in the aftermarket segment.

Recent Market Developments

- In November 2021, Llamas Plastics Inc. has signed a long-term contract with the Defence Logistics Agency Aviation for V-22 aircraft windscreens. The contract is valued at $14.23 million.

Competitive Landscape

Major players in the market

- GKN Plc

- PPG Industries, Inc.

- Gentex Corporation

- The NORDAM Group, Inc.

- Saint-Gobain S.A.

- Control Logistics Inc.

- Plexiweiss GmbH

- Llamas Plastics, Inc.

- Air-Craftglass Inc.

- Aerospace Plastic Components

- Lee Aerospace

- LP Aero Plastics, Inc.

- Tech-Tool Plastics Inc.

- VT San Antonio Aerospace Nagias

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Commercial Aircraft Windshield and Windows Market, Aircraft Type Analysis

- Narrow Body

- Wide Body

- Freighter Aircraft

- Regional Jets

Commercial Aircraft Windshield and Windows Market, Material Analysis

- Acrylic

- Polycarbonate

Commercial Aircraft Windshield and Windows Market, End User Analysis

- OEM

- Aftermarket

Commercial Aircraft Windshield and Windows Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Commercial Aircraft Windshield and Windows Market?The global Commercial Aircraft Windshield and Windows Market is expected to grow from USD 5.9 billion in 2023 to USD 7.5 billion by 2033, at a CAGR of 2.43% during the forecast period 2023-2033.

-

2.Who are the key market players of the Commercial Aircraft Windshield and Windows Market?Some of the key market players of the market are GKN Plc, PPG Industries, Inc., Gentex Corporation, The NORDAM Group, Inc., Saint-Gobain S.A., Control Logistics Inc., Plexiweiss GmbH, Llamas Plastics, Inc., Air-Craftglass Inc., Aerospace Plastic Components, Lee Aerospace, LP Aero Plastics, Inc., Tech-Tool Plastics Inc., VT San Antonio Aerospace Nagias.

-

3.Which segment holds the largest market share?The polycarbonate segment holds the largest market share and is going to continue its dominance.

-

4.Which region is dominating the Commercial Aircraft Windshield and Windows Market?North America is dominating the Commercial Aircraft Windshield and Windows Market with the highest market share.

Need help to buy this report?