Global Commercial Food and Biomedical Refrigerators and Freezers Market Size, Share, and COVID-19 Impact Analysis, By Capacity (Small (Up to 50 Liters), Medium (51 to 300 Liters), and Large (Above 300 Liters)), By Distribution Channel (Distributors and Wholesalers, and Retailers), By End Use (Hospitality, Food & Beverage Retail, Healthcare & Lifesciences, Pharmaceuticals, Chemicals, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Commercial Food and Biomedical Refrigerators and Freezers Market Insights Forecasts to 2033

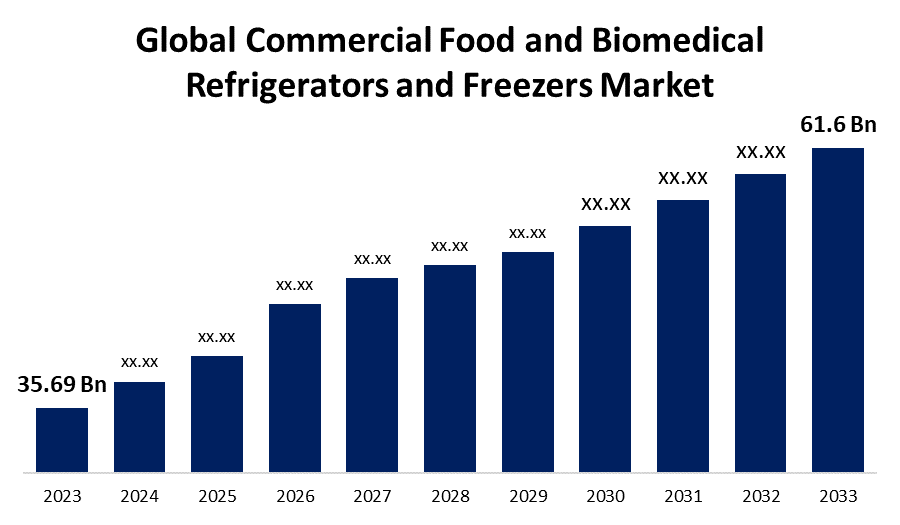

- The Global Commercial Food and Biomedical Refrigerators and Freezers Market Size was Valued at USD 35.69 Billion in 2023

- The Market Size is Growing at a CAGR of 5.61% from 2023 to 2033

- The Worldwide Commercial Food and Biomedical Refrigerators and Freezers Market Size is Expected to Reach USD 61.6 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Commercial Food and Biomedical Refrigerators and Freezers Market Size is Anticipated to Exceed USD 61.6 Billion by 2033, Growing at a CAGR of 5.61% from 2023 to 2033.

Market Overview

There are commercial freezers and fridges designed for spaces located in the busiest parts of your establishment, such as kitchens where doors open constantly to keep precious food cold. Biomedical refrigerators and freezers are medical equipment used to store various biological samples whether they be blood, vaccines or just general tissues,and DNA. As long as the samples are handled properly, they should be safe during storage. The development of hospitals, clinics and research institutions in conjunction with the rise in government funding as well public/private financing will bolster demand for biomedical freezers & refrigerators used to frigid medical supplies. The demand in the market is also expected to skyrocket because of personalized medicine, which individualizes treatment according to a patient. Powered by this demand are biomedical storage freezers that operate at cryogenic-level temperatures for the preservation of biological samples such as tissue and genetic material.

Commercial Refrigerators and Freezers: A product category subject to ENERGY STAR efficiency requirements. The U.S. Department of Energy's Federal Energy Management Program (FEMP) provides recommendations for purchasing these items. Agencies shall purchase ENERGY STAR-qualified or FEMP-designated products in all product categories covered by these programs and in any acquisition actions that are not specifically exempted from purchasing based on the laws, regulations, or standards of a federal government.

For instance, B Medical Systems, leading company in the medical cold chain, are delighted to announce that the TCW40SDD Solar Direct Drive Vaccine Refrigerator and Ice-Pack Freezer has been official granted with ACT label by My Green Lab. The award is an evidence of B Medical Systems long-term commitment to environmentally superior solutions in medical cold chain systems and its continuing advocacy for sustainability. There are already several eligible systems listed at ACT and the Solar Direct Drive Ice-Pack Freezer to Vaccine Refrigerator presented with the TCW40SDD, has received an award as a first... NOTE: Only your nominated products which pass ALC tests.

Report Coverage

This research report categorizes the market for commercial food and biomedical refrigerators and freezers based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the commercial food and biomedical refrigerators and freezers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the commercial food and biomedical refrigerators and freezers market.

Global Commercial Food and Biomedical Refrigerators and Freezers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 35.69 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.61% |

| 2033 Value Projection: | USD 61.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Capacity, By Distribution Channel, By End Use, By Region |

| Companies covered:: | Arctiko, KW Apparecchi Scientifici srl, Aegis Scientific Inc., Angelantoni Life Science, B Medical Systems India Private Limited, Biomedical Solutions Inc (BSI), Blue Star Limited; Eppendorf AG, Fiocchetti Scientific S.R.L., Froilabo SAS, Gram Scientific ApS (Gram BioLine), Haier Biomedical, Helmer Scientific Inc., IC Biomedical, LLC., Jeio Tech Co., Ltd., KW Apparecchi Scientifici srl, LabRepCo, LIEBHERR Group, NuAire, Inc., PHC Corporations, Philips Kirsch GmbH, Terumo Corporation, Thermofisher Scientific Inc., Vestfrost Solutions (A/S Vestfrost), Zhongke Meiling Cryogenics Co., Ltd., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges ,Growth, Analysis. |

Get more details on this report -

Driving Factors

Regarding to the commercial food and biomedical refrigerator and freezer, they should continual at certain temperature and correct cold chain preservation to ensure the quality and freshness and safety of the perishable products. These types of refrigeration units are of special significance in the preservation of medicinal compounds, vaccines, temperatures sensitive samples and other biological products in the biomedical industry. Other factors include the change in standards of legislations relating to use of refrigerant gases, awareness towards energy efficient models, Technological changes and enhancement in the cooling systems in so far as they ease on size, operations, friendly nature of models and reliability.

Restraining Factors

The disadvantage of using commercial food and biomedical refrigerators and freezers is that they are expensive to acquire and to install for use because of their initial costs of purchase and establishing them including the costs incurred in the provision of energy and maintenance costs in the future. They have also pressed on the design frontier to limit manufacturer abilities to design simultaneously for economy and energy friendliness as regard to friendly environment refrigerants. Backup power supply to provide cooling during emergency like power outages as well as temperature controlling for important process, makes chillers even more complicated and expensive.

Market Segmentation

The commercial food and biomedical refrigerators and freezers market share is classified into capacity, distribution channel, and end use.

- The medium (51 to 300 liters) segment is estimated to hold the highest market revenue share through the projected period.

Based on the capacity, the commercial food and biomedical refrigerators and freezers market is classified into small (up to 50 liters), medium (51 to 300 liters), and large (Above 300 liters). Among these, the medium (51 to 300 liters) segment is estimated to hold the highest market revenue share through the projected period. Self contained refrigeration equipment with storage capacity between 51 and 300 liters is expected to generate most of the industry revenue since it meets most commercial food service and biomedical requirements. The mid-sized sector of storage centers can become the embodiment of the perfect ratio between occupying a small area that is significant to companies with limited space and the ability to provide as much storage as needed for such companies as pharmacy, convenience shops, and research laboratories. External factors also operate in favour of the medium category based on the capacity to manufacture more of these models and access the commercial as well as medical needs.

- The retailers segment is anticipated to hold the largest market share through the forecast period.

Based on the distribution channel, the commercial food and biomedical refrigerators and freezers market is divided into distributors and wholesalers, and retailers. Among these, the retailers segment is anticipated to hold the largest market share through the forecast period. Similarly for the duration of the forecast period it is expected that the grocery retail segment including the use of supermarkets, convenience shops, stores, grocery stores as well as other retailer stores will continue to have the highest market share in commercial refrigeration units. This is even more so the case bearing in mind that some of the foods being sold in the current retail outlets need these refrigeration and freezer systems for display. Since the retailers have to conform to certain legal regulations concerning issues of food handling, then they are inevitably forced to incur a lot of expenses on efficient, high quality, and specialty refrigeration systems for purposes of cooling and preserving the merchandise. Slim and energy efficient commercial refrigerator equipment that does not consume selling floor space is still popular because customers increasingly choose a number of individual concept stores and an improvement for home delivery services of groceries.

The food & beverage retail segment is expected to dominate the global commercial food and biomedical refrigerators and freezers market during the forecast period.

Based on the end use, the commercial food and biomedical refrigerators and freezers market is divided into hospitality, food & beverage retail, healthcare & lifesciences, pharmaceuticals, chemicals, and others. Among these, the food & beverage retail segment is expected to dominate the global commercial food and biomedical refrigerators and freezers market during the forecast period. The food and beverage retail segment is likely to portray a considerably high uptake of commercial refrigerators and freezers, since grocery shops, supermarkets, convenience stores, and other types of retail outlets selling perishable goods are likely to register a leading revenue share by end. That is in part due to the fact that these cold storage units are to the functioning and profitability of outlets; they ensure food and beverage items remain of quality, safety, along with freshness. But more than that, retailers will also face the need to invest heavily in state-of-the-art commercial refrigeration technology so they can offer fresh and high-quality fruit and vegetables, dairy, and all other kinds of chilled items while at the same time adhering to the rigid food safety guidelines imposed upon them by their shoppers.

Regional Segment Analysis of the Commercial Food and Biomedical Refrigerators And Freezers Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the commercial food and biomedical refrigerators and freezers market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the commercial food and biomedical refrigerators and freezers market over the predicted timeframe. This may be result from highly developed food service and healthcare industries in the region, a strict regulatory framework controlling both food safety and cold chain storage, and large manufacturers and other industry players. It is the sophisticated infrastructure, wide adoption of energy-saving technologies, and growing demand for fresh and high-end foods that continue to fuel demand for new and reliable commercial refrigeration equipment in North America. Furthermore, the geographic presence makes biomedical refrigerators and freezers specifically important to cope with temperatures for the storage of thermally unstable medication and samples of any kind.

Asia Pacific is expected to grow at the fastest CAGR growth of the commercial food and biomedical refrigerators and freezers market during the forecast period, It is impelled by various critical factors. With growth in the middle class, increased disposable incomes, and demand for fresh and quality foods, this brings about increased demand for good cold storage facilities. This increase in demand comes as a result of the rapidly growing food service and retail industries, more specifically in countries like China, India, and Japan. Moreover, the fast-growing biotechnology and pharmaceutical sectors in this region create a further demand for the latest biomedical refrigeration equipment to facilitate drug discovery, medical research, and healthcare delivery. Besides, government initiatives to improve cold chain infrastructure and food safety measures are combined with growing concern towards the environment, which is speeding up the adoption of green technology and energy efficiency in the Asia Pacific market for commercial refrigeration systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the commercial food and biomedical refrigerators and freezers market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arctiko

- KW Apparecchi Scientifici srl

- Aegis Scientific Inc.

- Angelantoni Life Science

- B Medical Systems India Private Limited

- Biomedical Solutions Inc (BSI)

- Blue Star Limited; Eppendorf AG

- Fiocchetti Scientific S.R.L.

- Froilabo SAS

- Gram Scientific ApS (Gram BioLine)

- Haier Biomedical

- Helmer Scientific Inc.

- IC Biomedical, LLC. Jeio Tech Co., Ltd.

- KW Apparecchi Scientifici srl

- LabRepCo

- LIEBHERR Group

- NuAire, Inc.

- PHC Corporations

- Philips Kirsch GmbH

- Terumo Corporation

- Thermofisher Scientific Inc.

- Vestfrost Solutions (A/S Vestfrost)

- Zhongke Meiling Cryogenics Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, a wide range of energy-efficient and environmentally friendly deep freezers, with capacities ranging from 60 to 600 liters, were introduced by Blue Star Limited to meet the needs of a variety of client segments and applications.

- In February 2024, a new model in the PHCbi brand VIP ECO SMART ultra-low temperature (ULT) freezer series was introduced for use in medical facilities, universities, and pharmaceutical companies. PHC Corporation of North America (PHCNA) is the supplier of the PHCbi brand of cell preservation and growth products in the North American and Latin American markets. The MDF-DU703VHA-PA is the first dual-voltage ULT freezer from the PHCbi brand. It enables labs to alternate between 115V and 220V power sources while still enjoying the superior security and energy-saving performance of the VIP ECO SMART series, which has won several awards.

- In March 2024, the United Nations Children's Fund (UNICEF) donated over 1,400 specialized freezers from December 2023 to February 2024, providing efficient vaccine storage in 23 locations around Ukraine.

- In April 2024, Samsung Electronics Co., Ltd. declared that their new 75cm Wide Combi Fridge Freezer, which uses less energy, available in Europe. The refrigerator made its debut on April 3 during the worldwide launch event "Welcome to BESPOKE AI," which took place at Les Pavillon des Étangs in Paris. As a product, it has a high energy rating, and when used with SmartThings Energy, its Wi-Fi capabilities enable even greater energy savings.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the commercial food and biomedical refrigerators and freezers market based on the below-mentioned segments:

Global Commercial Food and Biomedical Refrigerators and Freezers Market, By Capacity

- Small (up to 50 Liters)

- Medium (51 to 300 Liters)

- Large (Above 300 Liters)

Global Commercial Food and Biomedical Refrigerators and Freezers Market, By Distribution Channel

- Distributors and Wholesalers

- Retailers

Global Commercial Food and Biomedical Refrigerators and Freezers Market, By End Use

- Hospitality

- Food & Beverage Retail

- Healthcare & Lifesciences

- Pharmaceuticals

- Chemicals

- Others

Global Commercial Food and Biomedical Refrigerators and Freezers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the commercial food and biomedical refrigerators and freezers market over the forecast period?The commercial food and biomedical refrigerators and freezers market is projected to expand at a CAGR of 5.61% during the forecast period.

-

2. What is the market size of the commercial food and biomedical refrigerators and freezers market?The Global Commercial Food and Biomedical Refrigerators and Freezers Market Size is Expected to Grow from USD 35.69 Billion in 2023 to USD 61.6 Billion by 2033, at a CAGR of 5.61% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the commercial food and biomedical refrigerators and freezers market?North America is anticipated to hold the largest share of the commercial food and biomedical refrigerators and freezers market over the predicted timeframe.

Need help to buy this report?