Global Commercial Real Estate Market Size, Share, and COVID-19 Impact Analysis, By Type (Rental, and Sales), By Property (Offices, Retail, Leisure, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Commercial Real Estate Market Insights Forecasts to 2033

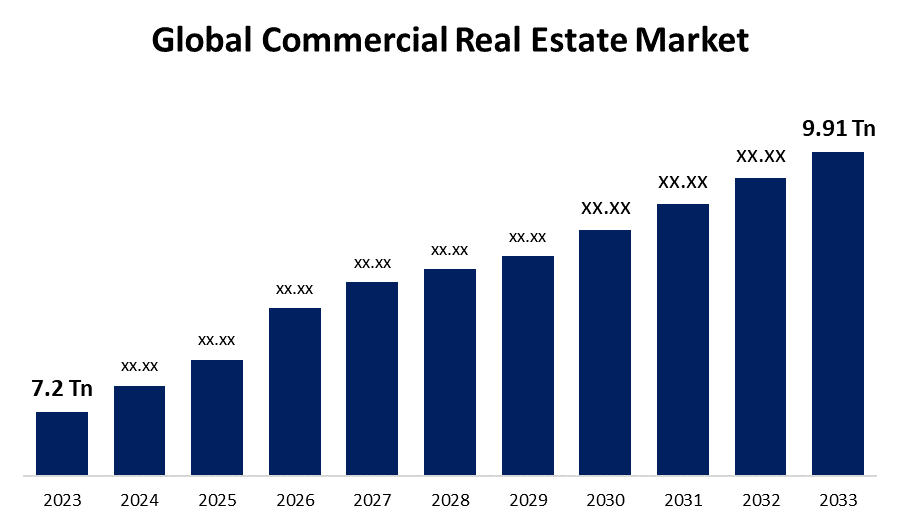

- The Global Commercial Real Estate Market Size was Valued at USD 7.2 Trillion in 2023

- The Market Size is Growing at a CAGR of 3.25% from 2023 to 2033

- The Worldwide Commercial Real Estate Market Size is Expected to Reach USD 9.91 Trillion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Commercial Real Estate Market Size is Anticipated to Exceed USD 9.91 Trillion by 2033, Growing at a CAGR of 3.25% from 2023 to 2033.

Market Overview

Commercial real estate (CRE) refers to the market primarily used for business or investment purposes. These include hotels, residential buildings, stores, office towers, storage facilities, and medical properties, along with other unique real estate. The commercial real estate (CRE) market caters to investors, developers, and corporations looking to leverage real estate assets for financial gain, in contrast to the residential real estate market aimed at individual homeowners. Factors such as GDP growth, employment rates, and consumer spending, along with the increasing demand for various types of spaces like office, retail, and industrial areas, are playing a key role in driving overall economic strength and growth. Additionally, the commercial real estate industry is being driven by ongoing technological advancements, evolving tenant desires for flexible workspaces, and increasing demand for data centers and logistics facilities. Organizations or financial backers typically claim CRE and it is funded through tenant rental payments. The business real estate sector is a crucial part of the world economy due to its provision of essential workspaces for companies, job creation, and generation of local revenue. Economic conditions and demographic trends like population growth, service rates, and consumer spending affect the performance of the commercial real estate market. In addition, investors need to closely monitor and assess their portfolios, taking into account various property types and economic factors that impact the commercial real estate market to maximize their investments. Investing in commercial real estate can offer portfolio diversification, long-term appreciation, consistent cash flow, tax benefits, and additional perks.

Report Coverage

This research report categorizes the market for the global commercial real estate market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global commercial real estate market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global commercial real estate market.

Commercial Real Estate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.2 Trillion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.25% |

| 2033 Value Projection: | USD 9.91 Trillion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 290 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Property, By Region |

| Companies covered:: | Brookfield Asset Management Inc., ATC IP LLC., Prologis, Inc., SIMON PROPERTY GROUP, L.P., Coldwell Banker, RE/MAX, LLC., Keller Williams Realty, Inc., CBRE Group, Inc., Sotheby’s International Realty Affiliates LLC., Colliers, Boston Commercial Properties Inc., Dalian Wanda Group, DLF Ltd., Link Asset Management Limited, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The main factor driving market growth is the expanding global commercial sector. Anticipated growth in urbanization and industrialization in countries like Thailand, China, Malaysia, and Indonesia is expected to positively impact commercial building. There has been a rise in the construction of commercial spaces, institutional buildings, manufacturing units, and public works in the Middle East. The integration of technology in the real estate industry will fuel the expansion of the market. Technological innovation is changing the business-focused real estate market. Using more creative tools will boost output and lower expenses for everyone involved. Growing technological trends in the market include smart sensors, cloud computing, virtual reality, 3D image processing, cloud-based apps for mobile devices, networking systems, and data analytics. These solutions not only cut down project expenses but also boost energy efficiency by going eco-friendly. Cloud-based technology acts as a record-keeping system for property managers overseeing their processes and client relationships. Therefore, the integration of technology is expected to drive market expansion during the forecast period.

Restraining Factors

The growing desire for remote work is a major challenge for the growth of the commercial real estate market. The growing embrace of remote work has significantly influenced industry growth in recent years. Businesses have cut costs by implementing remote work policies, particularly in heavily populated urban areas. Additionally, numerous companies, particularly those in the IT sector, are putting in substantial work to offer their staff the opportunity to work remotely indefinitely. Consequently, the growing need for remote work setups could pose a major challenge to the market in the forecast period.

Market Segmentation

The global commercial real estate market share is classified into type and property.

- The rental segment is expected to hold the largest share of the global commercial real estate market during the forecast period.

Based on the type, the global commercial real estate market is divided into rental and sales. Among these, the rental segment is expected to hold the largest share of the global commercial real estate market during the forecast period. The increase in the number of renters is caused by the increasing home prices in developed countries, leading to growth in that segment. The evolving business environment and the increasing variety of sectors are driving market expansion. The top companies need office spaces, retail stores, and industrial buildings to conduct their activities and operations efficiently. Additionally, the increasing entrepreneurship and the rising popularity of startups worldwide are also having a positive impact on the commercial real estate market.

- The offices segment is expected to hold the largest share of the global commercial real estate market during the forecast period.

Based on the property, the global commercial real estate market is divided into offices, retail, leisure, and others. Among these, the offices segment is expected to hold the largest share of the global commercial real estate market during the forecast period. Businesses rent office buildings to carry out operations, administrative tasks, and professional services. The cost of renting office space is usually determined by criteria like location, building standards, facilities, and demand in the market. Additionally, the changing tastes of customers and businesses and the rising need for stylish, appealing, and practical office spaces to support employees, encourage teamwork, and streamline business activities are also strengthening the market share of commercial real estate.

Regional Segment Analysis of the Global Commercial Real Estate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

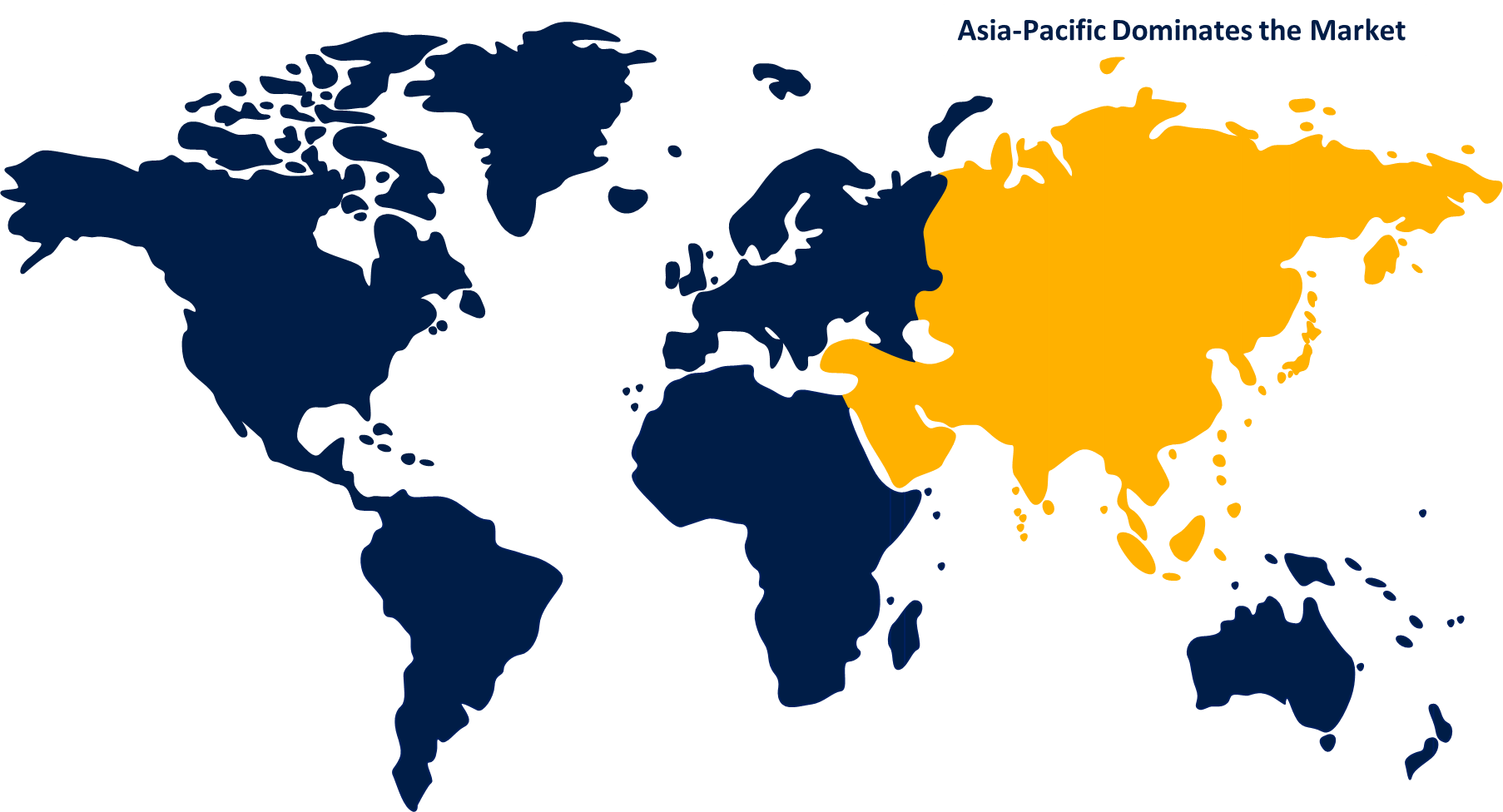

Asia Pacific is anticipated to hold the largest share of the global commercial real estate market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global commercial real estate market over the predicted timeframe. The increase is mainly due to the increasing rates of people owning homes in the area. China is projected to hold the highest position in the global commercial real estate market. Due to the rapid economic growth, urbanization, and changing demographics in developing countries like India, Philippines, Indonesia, Thailand, and Vietnam, the increasing influx of tourists is also expected to boost market growth in the region. China and Japan have the biggest real estate markets in the region, with a strong need for office, retail, and logistics properties. Singapore and Hong Kong are crucial financial hubs that attract international capital.

North America is expected to grow at the fastest pace in the global commercial real estate market during the forecast period. There are various factors, like a strong economy, minimal joblessness, and a growing population, responsible for this. Furthermore, companies are now able to easily participate in commercial real estate transactions because capital is more accessible and interest rates are low. The technology sector is driving growth in the commercial real estate industry in North America. Companies in this sector are expanding rapidly, leading to a requirement for more office space. The demand for commercial real estate in the area has risen due to this. The increasing popularity of mixed-use developments is another reason driving the commercial real estate sector in North America. By integrating office, retail, and residential areas, these complexes generate a vibrant and attractive environment for both businesses and residents. estate sector is projected to experience significant growth in the coming years.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global commercial real estate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Brookfield Asset Management Inc.

- ATC IP LLC.

- Prologis, Inc.

- SIMON PROPERTY GROUP, L.P.

- Coldwell Banker

- RE/MAX, LLC.

- Keller Williams Realty, Inc.

- CBRE Group, Inc.

- Sotheby’s International Realty Affiliates LLC.

- Colliers

- Boston Commercial Properties Inc.

- Dalian Wanda Group

- DLF Ltd.

- Link Asset Management Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2022, Colliers CAAC, a regional holding company, that currently has exclusive sublicenses for Central America, the Caribbean, and some Andean countries from Colliers International, revealed the purchase of a real estate consultancy in Costa Rica.

- In October 2022, M&G Plc's property sector purchased a top office building in Yokohama for over USD 700 million, part of the company's ongoing growth in Japan. M&G Real Estate bought the 21-story Minato Mirai Center Building for the M&G Asia Property Fund.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global commercial real estate market based on the below-mentioned segments:

Global Commercial Real Estate Market, By Type

- Rental

- Sales

Global Commercial Real Estate Market, By Property

- Offices

- Retail

- Leisure

- Others

Global Commercial Real Estate Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?