Global Commodity Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Product (Ester, Ether, Amine, Alcohol, and Aliphatic Hydrocarbon), By End-User (Mining, Oil & Gas, Household Industrial and Institutional, Building & Construction, and Automotive), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Commodity Chemicals Market Insights Forecasts to 2033

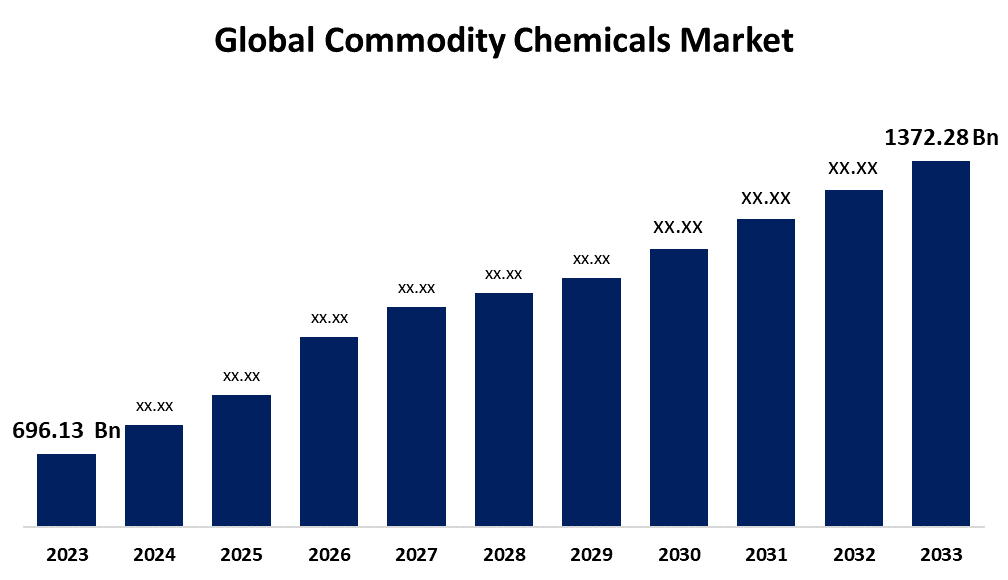

- The Global Commodity Chemicals Market Size was Valued at USD 696.13 Billion in 2023

- The Market Size is Growing at a CAGR of 7.02% from 2023 to 2033

- The Worldwide Commodity Chemicals Size is Expected to Reach USD 1372.28 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Commodity Chemicals Market Size is Anticipated to Exceed USD 1372.28 Billion by 2033, Growing at a CAGR of 7.02% from 2023 to 2033.

Market Overview:

Commodity chemicals also referred to as bulk chemicals can be established in large quantities by an extensive number of chemical producers. Commodity chemicals serve as building blocks of several industries such as pharmaceutical, textile, food & beverage, and agriculture which will aid in the development of market growth. The worldwide commodity chemical sector has produced lucrative opportunities for employment across numerous skill levels, from research and development to production and supply. This will lead to a direct impact on countries' GDP that will help in estimating the nation's growth and development. The growing requirement for basic chemicals like petrochemicals, fertilizers, and basic polymers is driven by automation and organization development in evolving markets, where the mandate for commodity chemicals is strongly associated with overall financial progress. For instance, India is the world's sixth-largest chemical manufacturer, as well as the third-largest in Asia. The nation's chemicals and petrochemicals business is valued at US$178 billion and is predicted to grow to US$300 billion by 2025. Chemical production in India is mostly focused in Maharashtra and Gujarat. The other main exporting states are West Bengal and Tamil Nadu. The rising world export of organic chemicals has shown a positive impact on the growth of the market. For instance, in 2022, the worldwide exports of "organic chemicals" reached $476 billion. It was $455 billion the prior year. China is the world’s largest exporter of organic chemicals having 21% of world exports ($101 billion). The USA has second position acquired 10.07% ($51 billion) and then Ireland has 9.72% ($46 billion).

Report Coverage:

This research report categorizes the market for the global commodity chemicals market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global commodity chemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global commodity chemicals market.

Global Commodity Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 696.13 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.02% |

| 2033 Value Projection: | USD 1372.28 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-User, By Region |

| Companies covered:: | AkzoNobel N.V.,The Dow Chemical Company,LyondellBasell Industries Holdings B.V.,DuPont de Nemours and Company,Mitsui Chemicals,Braskem SA,PPG Industries,Deepak Nitrite,Himadri Special,Elantas Beck,NOCIL,India Glycols,BASF SE,Bayer Group , and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors:

Instance the worldwide population grows and cities become more densely populated, so does the need for items such as plastics, fertilizers, and basic chemicals used in construction, farming, and consumer product manufacturing can drive the growth of the market. The emerging nations build infrastructure, expand their production capacity, and invest in farming, thus the demand for commodity chemicals is boosted by the gradual industrialization of emerging nations. The rising need for specialty chemicals is expected to drive the growth of the market.

Restraining Factors:

Commodity chemical producers have to make investments in pollution control technology, wastewater treatment plants, and regulatory compliance methods due to rigorous environmental rules governing emissions, waste disposal, and chemical security. This raises their operational expenses and the strain of complying with rules. Intense rivalry, overproduction, and pricing pressures are some of the issues that will limit market expansion.

Market Segmentation:

The global commodity chemicals market share is classified into product and end-user.

- The ester segment has the highest share of the market during the forecast period.

Based on the product, the global commodity chemicals market is categorized into ester, ether, amine, alcohol, and aliphatic hydrocarbon. Among these, the ester segment has the highest share of the market during the forecast period. Esters are versatile compounds with numerous uses in a variety of sectors due to their distinctive characteristics and attractive scents. Esters are significant components for the synthesis of commodity chemicals with diverse uses in medicines, polymers, solvents, and perfumes which will aid in driving the growth of the segment. The rising need for esters in several industries such as personal care, pharmaceutical, and food production causes the expansion of segment growth.

- The household industrial and institutional segment has the largest share of the market over the forecast period.

Based on the end-user, the global commodity chemicals market is categorized into mining, oil & gas, household industrial and institutional, building & construction, and automotive. Among these, the household industrial and institutional segment has the largest share of the market over the forecast period. In the home and industrial cleaning industries, sustainability information is equally important and drives consumer choice. People are worried about the chemicals in their products. As a result, people prefer to buy and utilize products that have some green, sustainable features. Another market growth driver is the demand for green, natural products that have less of an influence on people's health and the environment.

Regional Segment Analysis of the Global Commodity Chemicals Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is projected to hold the largest share of the global commodity chemicals market over the forecast period.

Get more details on this report -

Asia-Pacific is projected to hold the largest share of the global commodity chemicals market over the forecast period. Asia Pacific is by far the largest market for commodity chemicals, accounting for about half of the global market. The development prospects in Asia Pacific remain strong due to the increasing economy and the continued trend and support for the industrial sector in developing nations such as India, China, and Indonesia. Commodity chemicals are used in a broad variety of sectors, including personal care and aerospace. It is used either directly or indirectly in practically every manufacturing industry. The growing economies and rising GDPs of developed and emerging countries throughout the world are strengthening the worldwide commodity chemicals industry.

Europe region is also expected to fastest CAGR growth during the forecast period. The increasing demand for plastic resins and synthetic rubbers in the area is driving the market's growth. Furthermore, the rise might be attributed to an increase in demand for medical equipment and supplies derived from commodity chemicals. Customers' increased awareness of cleanliness is also driving the market's growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global commodity chemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies:

- AkzoNobel N.V.

- The Dow Chemical Company

- LyondellBasell Industries Holdings B.V.

- DuPont de Nemours and Company

- Mitsui Chemicals

- Braskem SA

- PPG Industries

- Deepak Nitrite

- Himadri Special

- Elantas Beck

- NOCIL

- India Glycols

- BASF SE

- Bayer Group

- Others

Key Market Developments:

- In September 2024, Andhra Petrochemicals rose 3.89% to Rs 100 after credit rating agency ICRA maintained the business's long-term rating as '[ICRA] A-' with a stable outlook.

- In September 2023, Peregrine Hydrogen disclosed an oversubscribed seed fundraising round of $7.8 million. Bidra leads the round, with participation from Builders, Gates Frontier, Presidio Ventures, RiSC Capital, and Schox. Peregrine plans to use the cash to enhance and scale up its patented technology, as well as develop into commodity chemical industries.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global commodity chemicals market based on the below-mentioned segments:

Global Commodity Chemicals Market, By Type

- Ester

- Ether

- Amine

- Alcohol

- Aliphatic Hydrocarbon

Global Commodity Chemicals Market, By Application

- Mining

- Oil & Gas

- Household Industrial and Institutional

- Building & Construction

- Automotive

Global Commodity Chemicals Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global commodity chemicals market over the forecast period?The global commodity chemicals market size is expected to grow from USD 696.13 Billion in 2023 to USD 1372.28 Billion by 2033, at a CAGR of 7.02 % during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global commodity chemicals market?Asia-Pacific is projected to hold the largest share of the global commodity chemicals market over the forecast period.

-

3. Who are the top key players in the commodity chemicals market?AkzoNobel N.V, The Dow Chemical Company, LyondellBasell Industries Holdings B.V, DuPont de Nemours and Company, Mitsui Chemicals, Braskem SA, PPG Industries, Deepak Nitrite, Himadri Special, Elantas Beck, NOCIL, India Glycols, BASF SE, Bayer Group, and Others.

Need help to buy this report?