Global Companion Animal Pharmaceuticals Market Size, Share, and COVID-19 Impact Analysis, By Animal (Dogs, Cats, Horses, and Others), By Route of Administration (Oral, Injectable, and Topical), By Product (Antibiotics, Anti-Inflammatory, Parasiticides, and Vaccines), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: HealthcareGlobal Companion Animal Pharmaceuticals Market Size Insights Forecasts to 2032.

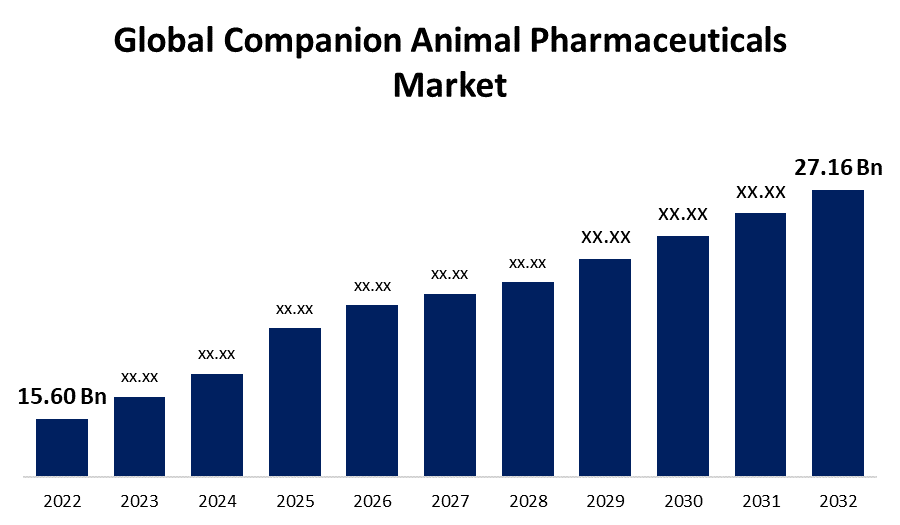

- The Global Companion Animal Pharmaceuticals Market Size was valued at USD 15.60 Billion in 2022.

- The Market is Growing at a CAGR of 5.7% from 2022 to 2032

- The Worldwide Companion Animal Pharmaceuticals Market Size is expected to reach USD 27.16 Billion by 2032

- Asia-Pacific is expected to grow fastest during the forecast period

Get more details on this report -

The Global Companion Animal Pharmaceuticals Market Size is expected to reach USD 27.16 billion by 2032, at a CAGR of 5.7% during the forecast period 2022 to 2032.

Market Overview

Companion animal pharmaceuticals is a leading company dedicated to the research, development, and distribution of high-quality pharmaceutical products specifically tailored to meet the healthcare needs of companion animals. With a strong commitment to animal well-being, the company offers a comprehensive range of medications and treatments for various conditions, including skin disorders, respiratory issues, gastrointestinal problems, and more. Utilizing cutting-edge technology and adhering to rigorous quality standards, their products are formulated to ensure safety, efficacy, and optimal results. The company's team of skilled veterinarians and researchers continually work to innovate and improve their offerings, striving to enhance the quality of life for pets and strengthen the bond between humans and their beloved animal companions.

Report Coverage

This research report categorizes the market for companion animal pharmaceuticals market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the companion animal pharmaceuticals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the companion animal pharmaceuticals market.

Global Companion Animal Pharmaceuticals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 15.60 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.7% |

| 2032 Value Projection: | USD 27.16 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Animal, By Route of Administration, By Product, By Region, and COVID-19 Impact Analysis. |

| Companies covered:: | Zoetis Inc., Merck Animal Health, Boehringer Ingelheim International GmbH, Elanco Animal Health Incorporated, Bayer AG, Virbac, Dechra Pharmaceuticals PLC, Vetoquinol SA, Ceva Sante Animale, Kindred Biosciences, Inc., Norbrook, IDEXX Laboratories, Inc., Animalcare Group PLC, Neogen Corporation, Heska Corporation and other key Venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The drivers of the companion animal pharmaceuticals market are influenced by several key factors because the increasing pet ownership worldwide is a major driver, as more people embrace the emotional and health benefits of having animal companions, leading to a higher demand for pet medications. Additionally, the growing awareness and emphasis on pet health and wellness drive the need for advanced pharmaceutical solutions to address various conditions in companion animals. Moreover, advancements in veterinary medicine and technology play a crucial role in boosting the market, enabling the development of innovative and effective pharmaceutical products. Furthermore, the rising disposable income in many regions allows pet owners to afford premium healthcare options, driving the demand for high-quality pharmaceuticals. Overall, the expansion of e-commerce and online platforms facilitates easy access to pet medications, contributing to market growth as well. Together, these drivers foster a thriving and competitive companion animal pharmaceuticals market globally.

Restraining Factors

The companion animal pharmaceuticals market faces several restraints that impede its growth and development. The stringent regulations and complex approval processes for veterinary drugs can hinder the introduction of new medications into the market, leading to delays and increased costs for manufacturers. The high costs associated with the research and development of pharmaceutical products for companion animals act as a deterrent for smaller companies to invest in this sector. Additionally, economic uncertainties and fluctuations in disposable income can impact pet owners' ability to afford expensive medications, affecting overall market demand. Moreover, the lack of awareness and education about advanced veterinary treatments in certain regions may limit the adoption of companion animal pharmaceuticals. Furthermore, the rise of alternative therapies and holistic approaches to pet health might divert some pet owners away from traditional pharmaceuticals.

Market Segmentation

- In 2022, the dogs segment accounted for around 46.5% market share

On the basis of the animal, the global companion animal pharmaceuticals market is segmented into dogs, cats, horses, and others. The dogs segment has emerged as a dominant force in the Companion Animal Pharmaceuticals market, exerting significant influence on its overall growth and dynamics. There are several key reasons behind the dominance of the dogs segment in the market, such as dogs are the most commonly kept companion animals globally, with a large population of households owning one or more dogs. This widespread dog ownership contributes to a substantial customer base for companion animal pharmaceuticals, driving market demand. Dogs are susceptible to a wide range of health conditions and diseases, including skin disorders, allergies, infections, joint problems, and more. As a result, there is a continuous need for various medications and treatments to address these specific health issues in dogs. This creates a robust market for pharmaceutical companies to develop and distribute dog-specific medications. Furthermore, dogs often require routine preventive care, such as vaccinations, heartworm prevention, and flea and tick control. This ongoing healthcare needs further contribute to the demand for pharmaceutical products in the dogs segment. Moreover, pet owners' increasing awareness and emphasis on dog health and wellness play a crucial role in driving the market. Many owners consider their dogs as integral family members and are willing to invest in their well-being, including providing them with appropriate medications and treatments. Additionally, advancements in veterinary medicine and pharmaceutical research have led to the development of innovative and specialized drugs specifically tailored for dogs. This includes medications for pain management, behavioral issues, and chronic conditions, among others, further strengthening the dominance of the dogs segment in the market. Overall, the combination of a large dog population, specific health needs, preventive care requirements, and pet owners' growing awareness and investment in dog health contribute to the dogs segment's dominance in the companion animal pharmaceuticals market.

- In 2022, the parasiticides segment dominated with more than 52.6% market share

Based on the product, the global companion animal pharmaceuticals market is segmented into antibiotics, anti-inflammatory, parasiticides, and vaccines. The parasiticides segment stands out as the leading category in the global companion animal pharmaceuticals market due to the prevalence of parasitic infections in companion animals. Fleas, ticks, and heartworms are common parasites that can cause severe health issues in pets and even transmit diseases to humans, raising concerns among pet owners. Consequently, there is a growing demand for preventive measures like parasiticides to safeguard their beloved companions from these harmful organisms. The continuous development of new and more effective parasiticide products further drives market growth in this segment, as pharmaceutical companies strive to offer safer and more efficient solutions. Meanwhile, the vaccines segment holds the second-highest share in the global market, primarily because vaccinations play a critical role in preventing infectious diseases in companion animals. Regular vaccination schedules are crucial components of animal healthcare routines to curb the spread of diseases. With pet owners becoming increasingly aware of the importance of vaccination, there has been a surge in demand for animal vaccines. Moreover, the rising incidence of zoonotic diseases (those that can be transmitted between animals and humans) has further emphasized the significance of vaccination for both pets and public health. Interestingly, the COVID-19 pandemic has also impacted the companion animal pharmaceuticals market, especially the vaccines segment. Many pet owners have sought to protect their furry friends from the virus, leading to an increase in demand for vaccines designed to mitigate the risks associated with the pandemic. This phenomenon has added momentum to the growth of the vaccines segment during these challenging times. In conclusion, the parasiticides segment's prominence can be attributed to the need to address parasitic infections in companion animals, while the vaccines segment's significance stems from its vital role in preventing infectious diseases and zoonotic transmission. Both segments continue to witness robust growth, driven by increased awareness, advancing technologies, and the ongoing pursuit of optimal healthcare for our cherished animal companions

Regional Segment Analysis of the Companion Animal Pharmaceuticals Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 38.9% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as a dominant force in the market of Companion Animal Pharmaceuticals. North America boasts a large pet population, with a significant number of households owning companion animals. This high pet ownership, coupled with a culture that places great importance on pet health and well-being, drives the demand for pharmaceutical products tailored to companion animals. Additionally, the region possesses advanced veterinary healthcare infrastructure, including state-of-the-art clinics, research facilities, and highly skilled veterinarians. This enables efficient diagnosis, treatment, and prescription of companion animal medications. Furthermore, North America is home to several leading pharmaceutical companies specializing in animal healthcare, which fuels product innovation and availability. Overall, the region's favorable regulatory environment and robust distribution channels facilitate the timely introduction and accessibility of companion animal pharmaceuticals.

Recent Developments

- In January 2022, The US Food and Drug Administration approved Zoetis' Simparica Trio chewable tablets, which have a new label indication for preventing Borrelia burgdorferi infections in dogs. The inclusion of this indication improves the product's performance, giving it a helpful choice for protecting dogs against viruses that cause Lyme disease.

- In November 2022, Virbac, a leading manufacturer of companion animal products in the United States, has introduced MOVOFLEX, a revolutionary joint supplement for dogs, to the European market. This new product is intended to support and promote joint health, as well as address mobility concerns and improve the general well-being of dogs in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global companion animal pharmaceuticals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Zoetis Inc.

- Merck Animal Health

- Boehringer Ingelheim International GmbH

- Elanco Animal Health Incorporated

- Bayer AG

- Virbac

- Dechra Pharmaceuticals PLC

- Vetoquinol SA

- Ceva Sante Animale

- Kindred Biosciences, Inc.

- Norbrook

- IDEXX Laboratories, Inc.

- Animalcare Group PLC

- Neogen Corporation

- Heska Corporation

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global companion animal pharmaceuticals market based on the below-mentioned segments:

Companion Animal Pharmaceuticals Market, By Animal

- Dogs

- Cats

- Horses

- Others

Companion Animal Pharmaceuticals Market, By Route of Administration

- Oral

- Injectable

- Topical

Companion Animal Pharmaceuticals Market, By Product

- Antibiotics

- Anti-Inflammatory

- Parasiticides

- Vaccines

Companion Animal Pharmaceuticals Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?