Global Companion Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Technology (Polymerase Chain Reaction, Next-Generation Sequencing, In Situ Hybridization, Immunohistochemistry, and Others), By Indication (Cancer, Neurology, Infectious Diseases, and Others), By End-User (Hospitals, Research Laboratories, Pharmaceutical and Biotechnology, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Companion Diagnostics Market Insights Forecasts to 2033

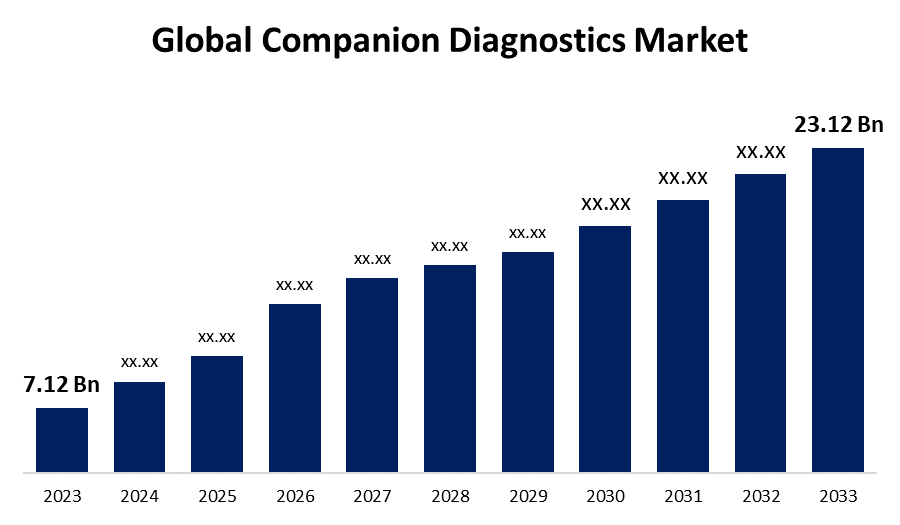

- The Global Companion Diagnostics Market Size was Valued at USD 7.12 Billion in 2023

- The Market Size is Growing at a CAGR of 12.50% from 2023 to 2033

- The Worldwide Companion Diagnostics Market Size is Expected to Reach USD 23.12 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Companion Diagnostics Market Size is Anticipated to Exceed USD 23.12 Billion by 2033, Growing at a CAGR of 12.50% from 2023 to 2033.

Market Overview

Companion diagnostics are tests or assays that assist in identifying patients who are likely to benefit from a specific treatment or medication. These tests are often used by accurate drugs to adapt treatments to individual patients based on their particular characteristics, like genetic makeup, biomarker expression, or other diagnostic criteria. Several regulatory bodies, like the U.S. Food and Drug Administration (FDA), require companion diagnostic tests for the acceptance of certain targeted therapies. Significant companion diagnostic values are necessary for obtaining regulatory approval for these treatments. Companion tests can be carried out on either a tissue biopsy or blood sample by using various genomic (e.g., next-generation sequencing, qPCR) or protein-based technologies (e.g., immunohistochemistry). When a patient has cancer, a companion diagnostic test can determine whether the tumor has a particular genomic abnormality, such as a mutation or changed protein expression, which could indicate that the treatment medicine would work better. There are six main stages involved in companion diagnostic tests developing, and all of these stages must be concurred with the development of the drug: scientific validation, analytical validation, clinical validation, demonstration of clinical utility, marketing authorization, and marketing and post-commercialization. In the last few years, there has been a fast advancement in medical technology, leading to significant changes in therapies and medicine. This progress has contributed to the considerable growth of the companion diagnostics market. Factors like the rising importance of companion diagnostics in drug development, the increasing cases of cancer, and the increasing adoption of targeted therapies are propelling the expansion of the market.

Report Coverage

This research report categorizes the market for the global companion diagnostics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global companion diagnostics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global companion diagnostics market.

Global Companion Diagnostics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.12 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.50% |

| 2033 Value Projection: | USD 23.12 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Indication, By End-User, By Region |

| Companies covered:: | Agilent technologies, Inc, Abbott Laboratories, Inc., Danaher Corporation, bioMerieux SA, Sysmex Corporation, Abnova Corporation, Icon Plc.,, Hoffmann-La Roche AG, QIAGEN N.V, Almac Group, Illumina, Inc., Myriad Genetics, Inc., Thermo Fisher Scientific Inc., Guardant Health, Inc., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Increasing cases of cancer are one of the main factors driving the growth of the companion diagnostics market. Additionally, technical advancements in the area of companion diagnostics include authorized personalized treatment approaches that are key factors in propelling the growth of the companion diagnostics market. Next-generation sequencing (NGS) technologies and protein biomarker analysis techniques are permitting the recognition of mutations, gene expression levels, and other molecular indicators with higher sensitivity and specificity. Moreover, the investment in research and development (R&D) projects related to companion diagnostics from government and non-profit organizations has notably raised over the last few years. Companion diagnostics helps to determine specific biomarkers that help to identify which patients are likely to respond to a specific therapeutic product. This targeted therapy permits improved results and fewer adverse effects by treating only patients with a high probability of responding to that therapy.

Restraining Factors

Regulatory problems surrounding the approval and execution of companion diagnostics are a key restraint to the growth of the market. Tough regulations and the absence of reimbursement schemes for these tests have made it demanding for companies to introduce new companion diagnostic tools. Policies require us to catch up with the science for this encouraging field to reach its future. Lack of trained professionals is one of the key factors hindering the growth of the companion diagnostics market. Companion diagnostics is a developing field that requires highly trained workers to perform complex tasks such as validation of diagnostic tests, assay development, molecular analysis, biomarker discovery, and clinical trials. Although there is a critical shortage of professionals with expertise in domains such as accurate medicines, molecular biology, cancer biology, and genomics.

Market Segmentation

The global companion diagnostics market share is classified into technology, indication, and end-user.

- The polymerase chain reaction segment is anticipated to hold the largest share of the global companion diagnostics market during the forecast period.

On the basis of the technology, the global companion diagnostics market is divided into polymerase chain reaction, next-generation sequencing, in situ hybridization, immunohistochemistry, and others. Among these, the polymerase chain reaction segment is anticipated to hold the largest share of the global companion diagnostics market during the forecast period. Polymerase chain reaction technique is easy to use, and there is a there is a sizable availability of PCR kits & reagents for companion diagnostic testing. In addition, PCR’s expanding uses in identifying gene mutants with limited or low dominant frequencies further contributed to its power in the market.

- The cancer segment is anticipated to hold the highest share of the global companion diagnostics market during the forecast period.

On the basis of the indication, the global companion diagnostics market is divided into cancer, neurology, infectious diseases, and others. Among these, the cancer segment is anticipated to hold the highest share of the global companion diagnostics market during the forecast period. Factors, such as the rising use of biomarkers in cancer diagnosis and the increasing importance of companion diagnostics in personalized medicine. Notable changes in gene sequence and expression patterns have been detected in cancer research, which can serve as the foundation for targeted therapy. Additionally, various malignancies have different biomarkers for which companion diagnostics have been generated. Some cancer types, like lung cancer, colorectal cancer, breast cancer, and blood cancer, which are the main causes of mortality, require companion diagnostics.

- The pharmaceutical and biotechnology segment is anticipated to hold the largest share of the global companion diagnostics market during the forecast period.

On the basis of end-user, the global companion diagnostics market is divided into hospitals, research laboratories, pharmaceutical and biotechnology, and others. Among these, the pharmaceutical and biotechnology segment is anticipated to hold the largest share of the global companion diagnostics market during the forecast period. This was propelled by the increasing adoption of companion diagnostics because of their rising significance in drug development and the growing importance placed on companion diagnostic biomarkers.

Regional Segment Analysis of the Global Companion Diagnostics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global companion diagnostics market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global companion diagnostics market over the predicted timeframe. The development of the development of the companion diagnostics market in North America can be attributed to the presence of several driving companion diagnostics sellers and public clinical research centers, the simple availability of advanced devices and instruments, and the completely evolved medical services structure in the U.S. and Canada. The use of companion diagnostics is seen as a significant treatment option for various oncology drugs, which is further reflected in how the FDA orders these examinations regarding risk. The growing rate of diseases in the U.S. is additionally predicted to propel the development of the market. These factors drive the growth of the companion diagnostics market over the predicted timeframe.

Asia-Pacific is anticipated to grow at the fastest rate in the global companion diagnostics market over the predicted timeframe. Asia Pacific offers central players in the companion diagnostics industry fulfilling opportunities, an authorized high public base, development in attention to companion diagnostics, improvement in medical care foundations, and growth in population for advanced treatments. In the last five years, the acquisition of next-generation sequencing has expanded exponentially around the main Asia-Pacific markets, like China, India, Japan, and South Korea. The government organizations in these nations have undertaken large-scale genome sequencing projects to better understand the genetic variations among their populations. These factors drive the growth of the companion diagnostics market over the predicted timeframe in this region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global companion diagnostics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Agilent technologies, Inc

- Abbott Laboratories, Inc.

- Danaher Corporation

- bioMerieux SA

- Sysmex Corporation

- Abnova Corporation

- Icon Plc.,

- Hoffmann-La Roche AG

- QIAGEN N.V

- Almac Group

- Illumina, Inc.

- Myriad Genetics, Inc.

- Thermo Fisher Scientific Inc.

- Guardant Health, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2023, Tempus announced that the FDA has approved the advanced device designation for its HLA-LOH assay as a companion diagnostic (CDx) test. The test can use a machine learning model to examine sequence data.

- In July 2023, Allarity Therapeutics and DRP Companion Diagnostics signed a deal with FivepHusion in order to support the clinical development of DeflexifolTM used for the treatment of solid tumors.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global companion diagnostics market based on the below-mentioned segments:

Global Companion Diagnostics Market, By Technology

- Polymerase Chain Reaction

- Next-Generation Sequencing

- In Situ Hybridization

- Immunohistochemistry

- Others

Global Companion Diagnostics Market, By Indication

- Cancer

- Neurology

- Infectious Diseases

- Others

Global Companion Diagnostics Market, By End-User

- Hospitals

- Research Laboratories

- Pharmaceutical and Biotechnology

- Others

Global Companion Diagnostics Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the global companion diagnostics market?The Global Companion Diagnostics Market Size is Expected to Grow from USD 7.12 Billion in 2023 to USD 23.12 Billion by 2033, at a CAGR of 12.50% during the forecast period 2023-2033.

-

2. Which are the key companies in the companion diagnostics market?Agilent technologies, Inc, Abbott Laboratories, Inc., Danaher Corporation, bioMerieux SA, Sysmex Corporation, Abnova Corporation, Icon Plc., Hoffmann-La Roche AG, QIAGEN N.V, Almac Group, Illumina, Inc., Myriad Genetics, Inc., Thermo Fisher Scientific Inc., Guardant Health, Inc., and Others are the key companies in the companion diagnostics market.

-

3. Which indication segment accounted for the largest share in the global companion diagnostics market?The cancer segment is anticipated to hold the highest share of the global companion diagnostics market during the forecast period.

Need help to buy this report?