Global Composite Materials And Aluminum Alloys in Aerospace Market Size, Share, and COVID-19 Impact Analysis, By Type (Aluminum Alloys, Titanium Alloys, Steel Alloys, Composites), By Application (Commercial Aircraft, Military Aircraft, Helicopters, Business and General Aviation, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Composite Materials And Aluminum Alloys in Aerospace Market Insights Forecasts to 2033

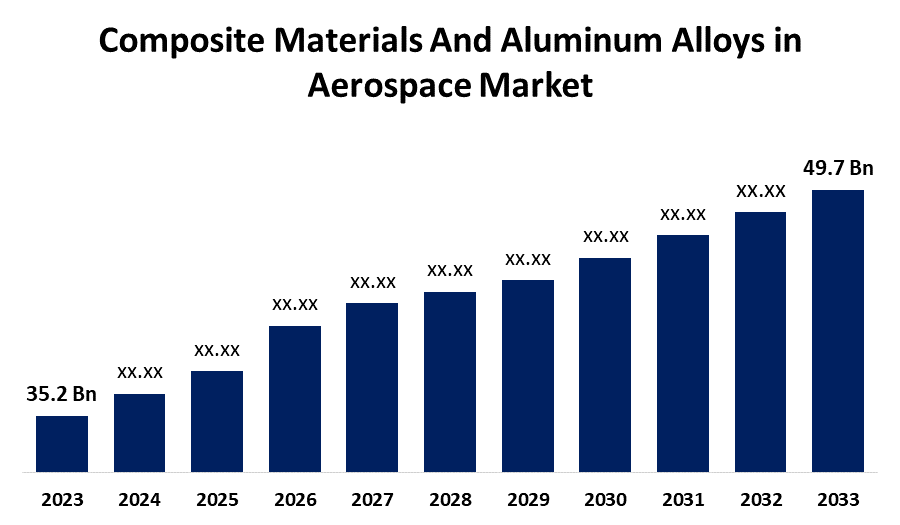

- The Composite Materials And Aluminum Alloys in Aerospace Market was valued at USD 35.2 Billion in 2023.

- The Market Size is growing at a CAGR of 3.51% from 2023 to 2033.

- The Global Composite Materials And Aluminum Alloys in Aerospace Market is expected to reach USD 49.7 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Composite Materials And Aluminum Alloys in Aerospace Market Size is expected to reach USD 49.7 Billion by 2033, at a CAGR of 3.51% during the forecast period 2023 to 2033.

The aerospace market is increasingly embracing composite materials and aluminum alloys due to their advantageous properties, including lightweight and high strength, which are crucial for enhancing fuel efficiency and performance in aircraft. Composites, such as carbon fiber reinforced polymers, offer exceptional strength-to-weight ratios and corrosion resistance, making them ideal for modern aircraft designs. Meanwhile, aluminum alloys continue to play a vital role due to their cost-effectiveness and ease of fabrication. The growing demand for more fuel-efficient and environmentally friendly aircraft is driving innovation in these materials. Additionally, advancements in manufacturing techniques and a focus on sustainability are fostering the development of hybrid materials, further expanding the applications of composites and aluminum alloys in the aerospace sector, ultimately leading to safer and more efficient aviation solutions.

Composite Materials And Aluminum Alloys in Aerospace Market Value Chain Analysis

The value chain analysis of composite materials and aluminum alloys in the aerospace market involves several key stages. It begins with raw material sourcing, where suppliers provide carbon fibers, resins, and aluminum alloys. The next stage involves material processing, where these components are transformed into usable forms through techniques like pultrusion, molding, and casting. Following this, manufacturers utilize advanced engineering and design processes to create aircraft components, focusing on weight reduction and structural integrity. The assembly stage combines these components into aircraft, with a strong emphasis on quality assurance and regulatory compliance. Finally, the distribution and aftermarket services ensure that these materials and components reach OEMs and MROs efficiently. This integrated approach enhances collaboration and innovation, ultimately contributing to the aerospace industry's growth and sustainability.

Composite Materials And Aluminum Alloys in Aerospace Market Opportunity Analysis

The aerospace market presents significant opportunities for composite materials and aluminum alloys driven by evolving industry trends. Increasing demand for fuel-efficient aircraft is prompting manufacturers to seek lighter materials, with composites offering a key advantage due to their high strength-to-weight ratio. The rise of sustainable aviation practices is also propelling the use of eco-friendly composites, as regulatory frameworks increasingly prioritize environmental considerations. Furthermore, advancements in manufacturing technologies, such as 3D printing and automated fiber placement, are enhancing the production efficiency of these materials. The growing interest in electric and hybrid aircraft creates additional demand for lightweight components. Additionally, the expansion of the aerospace sector in emerging markets provides new avenues for growth, making the composite and aluminum alloy segments essential for future innovations in aviation.

Composite Materials And Aluminum Alloys in Aerospace Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 35.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.51% |

| 2033 Value Projection: | USD 49.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Type, By Application, and By Region |

| Companies covered:: | Spirit AeroSystems,General Dynamics,Hexcel Corporation,Safran,Lockheed Martin,Solvay,Cytec Industries,L3Harris Technologies,Airbus,Raytheon Technologies,Boeing,Toray Industries,Dassault Aviation,Northrop Grumman,Alcoa Corporation |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Composite Materials And Aluminum Alloys in Aerospace Market Dynamics

The development of new aircraft models necessitates the use of advanced materials to meet performance

As manufacturers design next-generation aircraft, they prioritize weight reduction, fuel efficiency, and improved structural integrity. Composites, such as carbon fiber reinforced polymers, provide exceptional strength-to-weight ratios, enabling the creation of lighter, more efficient aircraft. Meanwhile, advanced aluminum alloys offer enhanced durability and corrosion resistance, crucial for the demanding aerospace environment. These materials facilitate innovative designs, allowing for aerodynamic improvements and reduced drag. Additionally, the integration of composites and aluminum alloys helps manufacturers comply with environmental regulations, as lighter aircraft contribute to lower emissions. Overall, the collaboration of these advanced materials is pivotal in shaping the future of aerospace engineering.

Restraints & Challenges

One significant hurdle is the high cost of raw materials and manufacturing processes, which can limit widespread adoption, especially for smaller manufacturers. Additionally, the complexity of working with composites requires specialized skills and advanced technology, leading to potential skill shortages in the workforce. Quality control and testing protocols for composite materials can be more rigorous compared to traditional metals, raising concerns about certification and compliance. Furthermore, the repair and recycling of composite materials pose challenges due to their unique properties, which complicate maintenance and end-of-life management. Finally, fluctuating prices of aluminum alloys and raw materials can impact budgeting and project feasibility, adding another layer of complexity to aerospace manufacturing.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Composite Materials And Aluminum Alloys in Aerospace Market from 2023 to 2033. The region is home to major aircraft manufacturers like Boeing and Airbus, which are increasingly integrating advanced materials to enhance fuel efficiency and reduce emissions. The growing emphasis on lightweight designs drives the demand for composites, such as carbon fiber reinforced polymers, which are used extensively in commercial and military aircraft. Additionally, North America boasts a robust supply chain and advanced manufacturing technologies, facilitating innovation in material development. Government initiatives supporting research and development, along with investments in sustainable aviation, further stimulate market growth. Moreover, the region's strategic focus on aerospace defense and the increasing demand for next-generation aircraft underscore the critical role of composite materials and aluminum alloys in North America's aerospace landscape.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Driven by increasing air travel demand and expanding airline fleets, countries are investing heavily in aerospace manufacturing and R&D. Composites, known for their lightweight and high strength, are being integrated into commercial and military aircraft to improve fuel efficiency and reduce environmental impact. Additionally, the region's growing emphasis on indigenous aircraft production has led to advancements in material technologies. Collaboration between international manufacturers and local suppliers is also enhancing the supply chain and production capabilities. Government support for aerospace initiatives, coupled with rising disposable incomes and urbanization, further bolsters the demand for advanced materials, positioning Asia-Pacific as a key player in the global aerospace industry.

Segmentation Analysis

Insights by Type

The aluminium alloys segment accounted for the largest market share over the forecast period 2023 to 2033. As aircraft manufacturers strive for enhanced fuel efficiency and reduced emissions, advanced aluminum alloys are increasingly being utilized in airframes, wings, and other critical components. These alloys offer a combination of strength, durability, and resistance to corrosion, making them ideal for modern aerospace applications. Additionally, innovations in alloy formulations and manufacturing processes are expanding their use in next-generation aircraft. The increasing focus on cost-effective solutions, combined with robust demand from emerging markets, is further propelling the segment’s growth. As the aerospace industry evolves, the versatility and performance of aluminum alloys will play a vital role in supporting sustainable aviation goals and improving overall aircraft performance.

Insights by Application

The commercial aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. As airlines strive to reduce operational costs, manufacturers are increasingly incorporating lightweight composite materials and advanced aluminum alloys into aircraft designs. Composites, such as carbon fiber reinforced polymers, offer superior strength-to-weight ratios, enabling significant weight reduction and improved fuel efficiency. Meanwhile, aluminum alloys continue to play a critical role due to their durability and ease of fabrication. The growth of low-cost carriers and the expansion of air travel in emerging markets are further fueling demand for new commercial aircraft. Additionally, advancements in manufacturing technologies are enhancing the production processes, enabling quicker delivery times and supporting the segment's expansion in the global aerospace market.

Recent Market Developments

- On February 2022, Sovay has announced its commitment to enhance its PVDF production capacity in Europe to meet the growing demand for electric vehicle (EV) batteries.

Competitive Landscape

Major players in the market

- Spirit AeroSystems

- General Dynamics

- Hexcel Corporation

- Safran

- Lockheed Martin

- Solvay

- Cytec Industries

- L3Harris Technologies

- Airbus

- Raytheon Technologies

- Boeing

- Toray Industries

- Dassault Aviation

- Northrop Grumman

- Alcoa Corporation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Composite Materials And Aluminum Alloys in Aerospace Market, Type Analysis

- Aluminum Alloys

- Titanium Alloys

- Steel Alloys

- Composites

Composite Materials And Aluminum Alloys in Aerospace Market, Application Analysis

- Commercial Aircraft

- Military Aircraft

- Helicopters

- Business and General Aviation

- Others

Composite Materials And Aluminum Alloys in Aerospace Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Composite Materials And Aluminum Alloys in Aerospace Market?The global Composite Materials And Aluminum Alloys in Aerospace Market is expected to grow from USD 35.2 billion in 2023 to USD 49.7 billion by 2033, at a CAGR of 3.51% during the forecast period 2023-2033.

-

2. Who are the key market players of the Composite Materials And Aluminum Alloys in Aerospace Market?Some of the key market players of the market are Spirit AeroSystems, General Dynamics, Hexcel Corporation, Safran, Lockheed Martin, Solvay, Cytec Industries, L3Harris Technologies, Airbus, Raytheon Technologies, Boeing, Toray Industries, Dassault Aviation, Northrop Grumman, Alcoa Corporation.

-

3. Which segment holds the largest market share?The commercial aicraft segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Composite Materials And Aluminum Alloys in Aerospace Market?North America dominates the Composite Materials And Aluminum Alloys in Aerospace Market and has the highest market share.

Need help to buy this report?