Global Composite Process Materials Market Size, Share, and COVID-19 Impact Analysis, By Resin (Thermoplastic, Thermoset), By Fiber (Carbon Fiber, Glass Fiber, Natural Fiber, Others), By End-User (Automotive, Aerospace & Defense, Wind Energy, Construction, Marine, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Advanced MaterialsGlobal Composite Process Materials Market Insights Forecasts to 2033

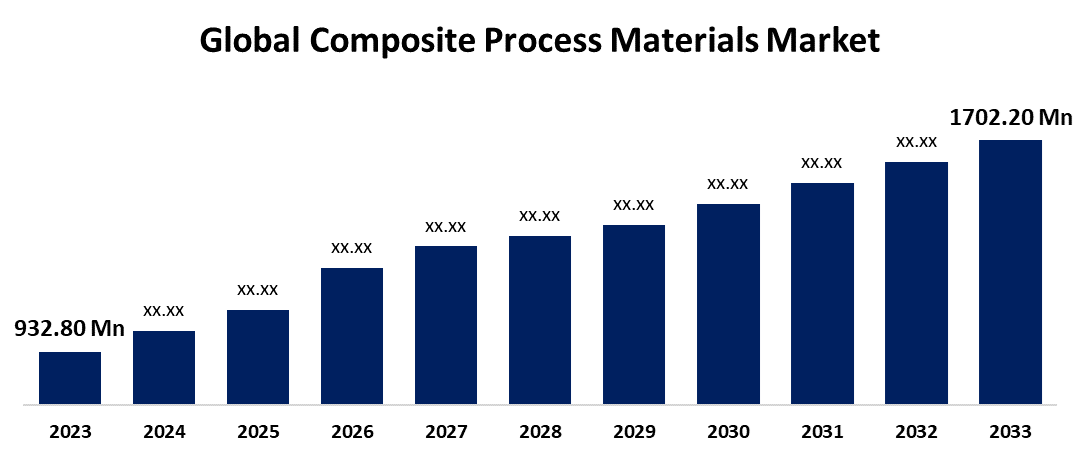

- The Global Composite Process Materials Market Size was Valued at USD 932.80 Million in 2023

- The Market Size is Growing at a CAGR of 6.20% from 2023 to 2033

- The Worldwide Composite Process Materials Market Size is Expected to Reach USD 1702.20 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Composite Process Materials Market Size is Anticipated to Exceed USD 1702.20 Million by 2033, Growing at a CAGR of 6.20% from 2023 to 2033.

Market Overview

Composite process materials refer to a combination of two or more distinct materials that combine and create a new material with different chemical properties. The composite process materials market is propelled due to its strength-to-weight ratios, sustainability focus, technological advancements, renewable energy expansion, urbanization, and infrastructure development.

Composite materials are used in various industries due to their unique properties, including aerospace, automotive, renewable energy, construction, marine, sports, consumer goods, medical devices, and industrial tools. They enhance fuel efficiency, reduce weight, and provide corrosion resistance, making them versatile and efficient.

For Instance, In September 2024, Toray Advanced Composites introduced Toray Cetex TC1130 PESU thermoplastic composite material, designed for lightweight, environmentally sustainable aircraft interior applications, offering significant benefits to the aerospace industry.

Report Coverage

This research report categorizes the market for composite process materials based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the composite process materials market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the composite process materials market.

Global Composite Process Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 932.80 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.20% |

| 2033 Value Projection: | USD 1702.20 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Resin, By Fiber, By End-User, By Region, COVID-19 Empact, Challenges, Future, Growth, & Analysis |

| Companies covered:: | Toray Industries Inc., Teijin Limited, Mitsubishi Chemical Holdings Corporation, Hexcel Corporation, SGL Group, Nippon Electric Glass Co. Ltd., Koninklijke Ten Cate BV., Huntsman International LLC., Solvay, Hexion, E. I. Du Pont Nemours and Co., Weyerhaeuser Company, Chongqing Polycomp International Corporation, Jushi Group Co. Ltd., Taishan Fiberglass Inc. (CTG), and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the composite process materials market is propelled by several driving factors including the demand for lightweight, high-strength materials that enhance fuel efficiency in industries such as aerospace and automotive. Growing environmental concerns are pushing industries toward sustainable and recyclable materials, with innovations in manufacturing processes improving performance and application versatility. The expansion of the renewable energy sector, particularly in wind energy, is increasing the use of composites in turbine production. Furthermore, rapid urbanization and infrastructure development in emerging economies are boosting the demand for durable construction materials. As production costs decrease and government initiatives support advanced materials, further contribute to market growth worldwide.

Restraining Factors

The composite process materials market is constrained by several factors including high initial costs and complex manufacturing processes that can deter manufacturers from adopting composites, as these materials often require specialized equipment and expertise. Furthermore, some composites are recyclable, and many, particularly thermosets, present challenges for recycling, raising environmental concerns. Performance limitations in certain applications, such as heat resistance and chemical stability, also pose obstacles compared to traditional materials.

Market Segmentation

The composite process materials market share is classified into resin, fiber, and end-user.

- The thermoplastic segment is estimated to hold the highest market revenue share through the projected period.

Based on the resin, the composite process materials market is classified into thermoplastic and thermoset. Among these, the thermoplastic segment is estimated to hold the highest market revenue share through the projected period. The segment's dominance is propelled by their versatility which can reprocessed and recycled, making them appealing for sustainable applications. Furthermore, thermoplastic composites facilitate faster production rates and lower cycle times, which are vital for high-demand industries like automotive and aerospace. Their superior impact resistance and ductility further enhance thermoplastic performance in crucial applications.

- The glass fiber segment is anticipated to hold the largest market share through the forecast period.

Based on the fiber, the composite process materials market is divided into carbon fiber, glass fiber, natural fiber, and others. Among these, the glass fiber segment is anticipated to hold the largest market share through the forecast period. The segment prominence can be attributed to several factors including glass fibers are cost-effective and offer a good balance of strength, weight, and durability, making them suitable for a wide range of applications, including automotive, construction, and consumer goods. Their excellent electrical insulation properties and resistance to moisture further enhance their appeal in various industries. Furthermore, the growing demand for lightweight and high-performance materials in numerous sectors is boosting the adoption of glass fiber composites, solidifying the glass fiber segment-leading position in the market.

- The wind energy segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the end-user, the composite process materials market is categorized into automotive, aerospace & defense, wind energy, construction, marine, and others. Among these, the wind energy segment is anticipated to grow at the fastest CAGR growth through the forecast period. The rapid expansion is driven by the increasing demand for renewable energy solutions and the demand for lightweight, durable materials in wind turbine manufacturing. Composites, particularly those made from glass and carbon fibers, offer excellent strength-to-weight ratios and resistance to environmental factors, making them ideal for improving turbine efficiency and longevity. As countries continue to invest in renewable energy infrastructure, the wind energy sector is poised for significant expansion.

Regional Segment Analysis of the Composite Process Materials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

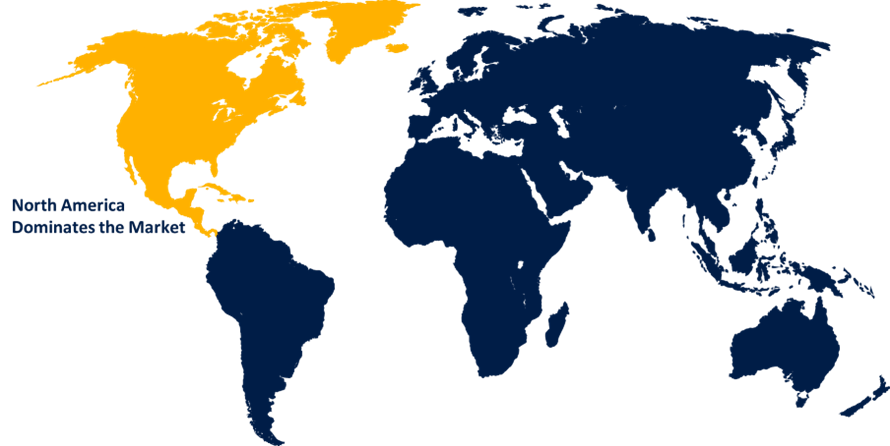

North America is anticipated to hold the largest share of the composite process materials market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the composite process materials market over the predicted timeframe. The region's dominance is attributed to a strong presence in key industries such as aerospace, automotive, and wind energy, where the demand for lightweight and high-performance materials is particularly high. Furthermore, government initiatives promoting renewable energy, significant investments in research and development, and fuel efficiency in transportation are further driving the adoption of composite materials in North America.

Asia Pacific is expected to grow at the fastest CAGR growth of the composite process materials market during the forecast period. The Asia Pacific rapid expansion is propelled by several factors including rapid industrialization, increasing demand for lightweight materials in automotive and aerospace applications, and a rising focus on renewable energy sources. Countries like China and India are investing heavily in infrastructure development and manufacturing capabilities, which is boosting the demand for composites. Furthermore, the region's expanding automotive industry is increasingly adopting composite materials to enhance fuel efficiency and performance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the composite process materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Toray Industries Inc.

- Teijin Limited

- Mitsubishi Chemical Holdings Corporation

- Hexcel Corporation

- SGL Group

- Nippon Electric Glass Co. Ltd.

- Koninklijke Ten Cate BV.

- Huntsman International LLC.

- Solvay, Hexion

- E. I. Du Pont Nemours and Co.

- Weyerhaeuser Company

- Chongqing Polycomp International Corporation

- Jushi Group Co. Ltd.

- Taishan Fiberglass Inc. (CTG)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, UBE Corporation announced the launch of new composite products aimed at reducing greenhouse gas (GHG) emissions and environmental effects.

- In February 2024, Toray Innovative Composites, a leading developer and manufacturer of innovative composite materials, announced the introduction of a Life Cycle Assessment (LCA) program for its Toray Cetex line of thermoplastic composite materials. This strategic step demonstrates the company's commitment to environmental responsibility by quantifying and reducing the environmental effects of its manufacturing operations.

- In August 2023, ALUULA Composites, a Canadian advanced materials technology company, announced that it is working with the University of British Columbia (UBC) to create world-first recycling applications for ALUULA's high-performance, UHMWPE-based composites.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the composite process materials market based on the below-mentioned segments:

Global Composite Process Materials Market, By Resin

- Thermoplastic

- Thermoset

Global Composite Process Materials Market, By Fiber

- Carbon Fiber

- Glass Fiber

- Natural Fiber

- Others

Global Composite Process Materials Market, By End-User

- Automotive

- Aerospace & Defense

- Wind Energy

- Construction

- Marine

- Others

Global Composite Process Materials Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the composite process materials market over the forecast period?The composite process materials market is projected to expand at a CAGR of 6.20% during the forecast period.

-

What is the market size of the composite process materials market?The Global Composite Process Materials Market Size is Expected to Grow from USD 932.80 Million in 2023 to USD 1702.20 Million by 2033, Growing at a CAGR of 6.20% during the forecast period 2023-2033.

-

Which region holds the largest share of the composite process materials market?North America is anticipated to hold the largest share of the composite process materials market over the predicted timeframe

Need help to buy this report?