Global Composites In the Aerospace Interior Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Commercial Aircraft, General Aviation), By Fiber Type (Carbon Fiber, Glass Fiber), By Application (Interior, Exterior), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Composites In the Aerospace Interior Market Insights Forecasts to 2033

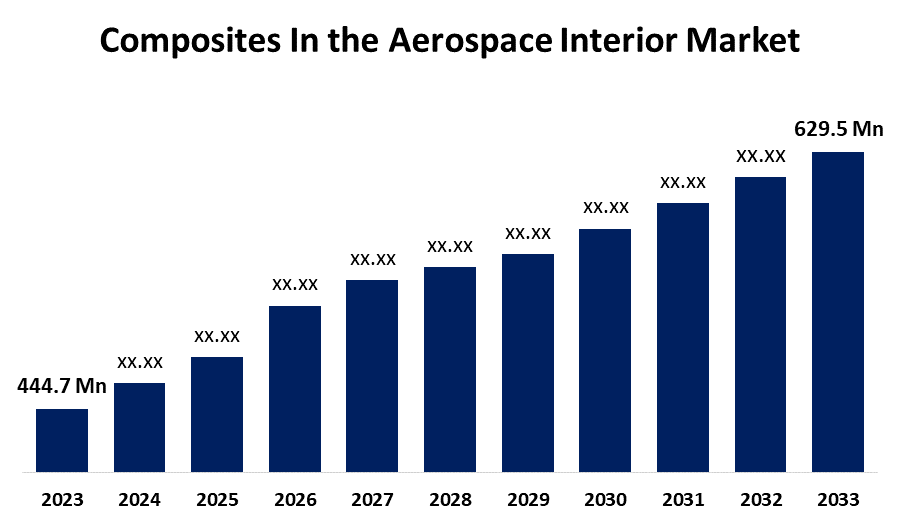

- The Composites In the Aerospace Interior Market was valued at USD 444.7 Million in 2023.

- The Market Size is growing at a CAGR of 3.54% from 2023 to 2033.

- The Global Composites In the Aerospace Interior Market is expected to reach USD 629.5 Million by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Composites In the Aerospace Interior Market Size is expected to reach USD 629.5 Million by 2033, at a CAGR of 3.54% during the forecast period 2023 to 2033.

The aerospace interior market is increasingly integrating composite materials due to their lightweight, strength, and design flexibility. Composites, primarily carbon fiber reinforced plastics (CFRP) and glass fiber reinforced plastics (GFRP), enhance fuel efficiency by reducing overall aircraft weight, thereby lowering operational costs. They are extensively used in cabin components, including seats, overhead bins, and panels, offering improved aesthetics and durability. Additionally, composites allow for complex shapes and customized designs, catering to evolving passenger preferences for comfort and luxury. As environmental concerns rise, manufacturers are also focusing on sustainable composite solutions, aligning with regulatory demands for lower emissions. Overall, the aerospace interior market is poised for growth, driven by technological advancements and an increasing emphasis on passenger experience and efficiency.

Composites In the Aerospace Interior Market Value Chain Analysis

The value chain of composites in the aerospace interior market involves several key stages, from raw material sourcing to end-user delivery. It begins with the procurement of raw materials, such as carbon fibers and resins, which are processed into composite materials. These materials undergo manufacturing processes like molding and curing to create components such as seats, panels, and cabin structures. The next stage involves collaboration with aerospace manufacturers to integrate these components into aircraft designs, focusing on compliance with safety and regulatory standards. Once produced, the components are distributed to OEMs (Original Equipment Manufacturers) and MROs (Maintenance, Repair, and Overhaul providers). The final stage involves installation in aircraft and ongoing maintenance, emphasizing the importance of quality, performance, and sustainability throughout the value chain.

Composites In the Aerospace Interior Market Opportunity Analysis

The aerospace interior market presents significant opportunities for composite materials due to increasing demand for lightweight, high-performance components. With airlines prioritizing fuel efficiency and reduced emissions, composites offer a compelling solution by minimizing aircraft weight, which directly impacts operational costs. The trend toward enhanced passenger experience drives the need for innovative designs and custom interiors, where composites can provide versatility in aesthetics and functionality. Additionally, as sustainability becomes a critical focus, the development of eco-friendly composites aligns with regulatory requirements and consumer preferences for greener solutions. The growing emphasis on retrofitting existing fleets with modern interiors further expands market opportunities. Overall, advancements in composite technology and manufacturing processes position the aerospace interior market for substantial growth, attracting investments and fostering innovation.

Composites In the Aerospace Interior Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 444.7 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.54% |

| 2033 Value Projection: | USD 629.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Aircraft Type, By Fiber Type, By Application, and By Region |

| Companies covered:: | Toray Advanced Composites,Hexcel Corporation,BASF SE,Solvay,Gurit Holding,SGL Carbon,JPS Composite Materials,Aim Altitude,Argosy International Inc.,Axioms Materials |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Composites In the Aerospace Interior Market Dynamics

Growing Air Travel Demand to Drive the Market Growth

Growing air travel demand is a significant driver of market growth for composites in the aerospace interior sector. As the global economy rebounds and passenger numbers rise, airlines are compelled to invest in modernizing their fleets and enhancing passenger experiences. Composites offer lightweight solutions that contribute to fuel efficiency and lower operational costs, making them an attractive choice for new aircraft designs. Additionally, airlines are increasingly retrofitting existing aircraft interiors with composite materials to improve aesthetics, comfort, and durability. This trend is further supported by a growing emphasis on sustainability, as airlines seek eco-friendly materials that align with environmental regulations. Overall, the surge in air travel is fueling the need for innovative composite solutions, positioning the aerospace interior market for robust growth in the coming years.

Restraints & Challenges

One significant challenge is the high manufacturing and material costs, which can impact budget constraints for airlines and manufacturers. Additionally, the complex supply chain and sourcing of quality raw materials can lead to delays and inconsistencies in production. Technical issues related to the fabrication and integration of composite materials into existing aircraft designs may also arise, necessitating specialized knowledge and skills. Furthermore, while composites offer durability, concerns over their long-term performance and potential environmental impact during disposal remain. Lastly, regulatory compliance with stringent aerospace safety standards can complicate the development and certification processes for new composite materials and designs, posing hurdles for manufacturers looking to innovate.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Composites In the Aerospace Interior Market from 2023 to 2033. Major players in the region, including Boeing and Airbus, are focusing on innovative composite solutions to enhance fuel efficiency and passenger comfort. The region's strong aerospace manufacturing base and significant investments in research and development support the adoption of advanced composites, such as carbon fiber reinforced plastics (CFRP). Additionally, the rise in air travel and retrofitting of existing aircraft interiors are propelling market demand. North America also benefits from a well-established supply chain and skilled workforce, facilitating the efficient production and integration of composite materials.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. As the region invests heavily in aviation infrastructure, the demand for lightweight, high-performance materials is rising. Composites, particularly carbon fiber and glass fiber reinforced plastics, are gaining traction due to their ability to reduce aircraft weight, enhance fuel efficiency, and improve passenger comfort. The presence of major aircraft manufacturers and suppliers in the region, alongside a growing focus on sustainable practices, drives innovation in composite materials. Furthermore, collaborations between local firms and international aerospace companies are enhancing technological advancements. However, challenges such as regulatory compliance and high production costs need to be addressed to fully capitalize on market potential.

Segmentation Analysis

Insights by Aircraft Type

The commercial aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. As airlines strive to reduce operational costs and improve profitability, the use of composite materials in cabin components such as seats, overhead bins, and wall panels becomes increasingly attractive. Composites offer superior strength-to-weight ratios, contributing to significant weight reductions that enhance fuel efficiency and reduce emissions. Additionally, evolving passenger preferences for enhanced comfort and aesthetics are prompting manufacturers to innovate with composite designs. The resurgence of air travel following the pandemic further fuels this segment’s growth, as airlines invest in fleet upgrades and retrofits. Overall, the commercial aircraft segment is poised for substantial expansion, driven by technological advancements and a focus on sustainability.

Insights by Fiber Type

The carbon fiber segment accounted for the largest market share over the forecast period 2023 to 2033. As airlines prioritize fuel efficiency and reduced operational costs, carbon fiber composites offer a compelling solution for lightweight aircraft interiors, such as seats, cabin panels, and storage compartments. The increasing emphasis on passenger comfort and aesthetics further fuels demand, as carbon fiber allows for innovative designs and finishes. Additionally, advancements in carbon fiber manufacturing processes are making it more accessible and cost-effective for aerospace applications. Regulatory pressures for lower emissions are also pushing manufacturers to adopt lightweight materials like carbon fiber. Overall, the carbon fiber segment is well-positioned for continued growth as it aligns with industry trends toward sustainability and enhanced passenger experiences.

Insights by Application

The exterior segment accounted for the largest market share over the forecast period 2023 to 2033. Composites, particularly carbon fiber and glass fiber reinforced plastics, are increasingly utilized in structural components like fuselage skins, wing components, and empennages. Their lightweight nature contributes to improved fuel efficiency and reduced emissions, aligning with regulatory mandates for sustainability. Additionally, advancements in composite manufacturing techniques, such as automated fiber placement and resin infusion, enhance production efficiency and reduce costs. The ongoing trend towards newer aircraft models with higher performance standards also propels the demand for composite materials in exterior applications. As airlines and manufacturers focus on enhancing performance and durability while minimizing maintenance, the exterior segment is set for significant growth in the aerospace industry.

Recent Market Developments

- On March 2023, Hexcel Corporation has announced the opening of a new Center of Research & Technology Excellence in Utah. This center will assist the company in advancing the development of next-generation composite technologies.

Competitive Landscape

Major players in the market

- Toray Advanced Composites

- Hexcel Corporation

- BASF SE

- Solvay

- Gurit Holding

- SGL Carbon

- JPS Composite Materials

- Aim Altitude

- Argosy International Inc.

- Axioms Materials

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Composites In the Aerospace Interior Market, Aircraft Type Analysis

- Commercial Aircraft

- General Aviation

Composites In the Aerospace Interior Market, Fiber Type Analysis

- Carbon Fiber

- Glass Fiber

Composites In the Aerospace Interior Market, Application Analysis

- Interior

- Exterior

Composites In the Aerospace Interior Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Composites In the Aerospace Interior Market?The global Composites In the Aerospace Interior Market is expected to grow from USD 444.7 million in 2023 to USD 629.5 million by 2033, at a CAGR of 3.54% during the forecast period 2023-2033.

-

2. Who are the key market players of the Composites In the Aerospace Interior Market?Some of the key market players of the market are Toray Advanced Composites, Hexcel Corporation, BASF SE, Solvay, Gurit Holding, SGL Carbon, JPS Composite Materials, Aim Altitude, Argosy International Inc., and Axioms Materials.

-

3. Which segment holds the largest market share?The exterior segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Composites In the Aerospace Interior Market?North America dominates the Composites In the Aerospace Interior Market and has the highest market share.

Need help to buy this report?