Global Confectionery Market Size, Share, and COVID-19 Impact Analysis By Product Type (Hard-boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, and Others), By Age Group (Children, Adult, Geriatric), By Price Point (Economy, Mid-range, Luxury), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Food & BeveragesGlobal Confectionery Market Insights Forecasts to 2033

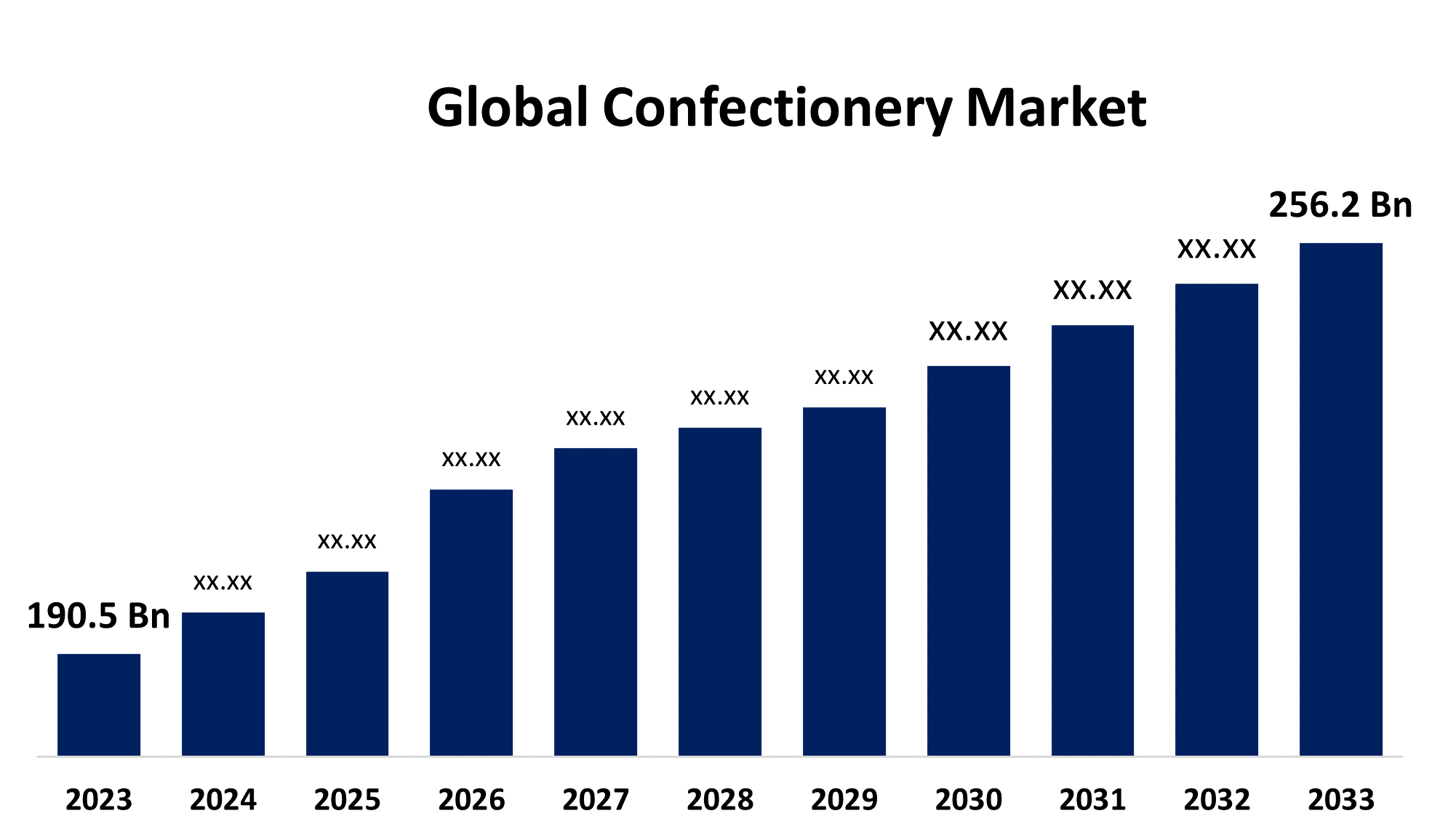

- The Global Confectionery Market Size was Valued at USD 190.5 Billion in 2023

- The Market Size is Growing at a CAGR of 3.01% from 2023 to 2033

- The Worldwide Confectionery Market Size is Expected to Reach USD 256.2 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Confectionery Market Size is Anticipated to Exceed USD 256.2 Billion by 2033, Growing at a CAGR of 3.03% from 2023 to 2033.

Market Overview

Food products with high sugar and sweet content, such as chocolates, candies, caramels, toffees, biscuits, lollipops, and many more, are produced by confectionery markets. Sugar-free confections have been more and more popular in recent years as a result of several causes such as the rising obesity rate, the rise in diabetes patients, growing worries about nutrition and health, and shifting lifestyles. Treats with a lot of sugar and carbohydrates are called confections. Among the products on offer are chocolates, biscuits, bars, candies, mints, and other sweets. Consumer tastes, interests, and behaviors are always shifting. Confectionery innovation as a result of this is propelling market expansion. Manufacturers are adding tropical fruit, organic herbal fillings, useful additives, and nut-based & exotic flavors to their product formulations in order to accommodate changing consumer demands. Moreover, industry development has been facilitated in recent years by the practice of offering confectionery products like chocolates, cookies, bakery items, and others. As candy is so widely consumed, companies are always coming up with new, interesting ways to catch consumers' attention. Food items that are consumed worldwide in both established and developing nations, such as chocolate, honey, almonds, fruits, milk, sugar, and many more, make up the majority of the market for confectionary products. In general, confectionery is high in calories and carbs but poor in micronutrients.

Report Coverage

This research report categorizes the market for the global confectionery market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global confectionery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global confectionery market.

Global Confectionery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 190.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.03% |

| 2033 Value Projection: | USD 256.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 197 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Age Group, By Price Point, By Region |

| Companies covered:: | Mars, Incorporated, Ezaki Glico Co., Ltd., Haribo GmbH & Co. K.G., Grupo Arcor, Pladis, Nestlé S.A., Meiji Co., Ltd., Ferrero Group, Chocoladefabriken Lindt & Sprüngli AG, Perfetti Van Melle, The Hershey Company, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the main factors supporting market expansion is the variations in flavor and format innovation, which have forced producers to accommodate the various preferences of a broad client base around the globe. These factors have a significant impact on the global confectionery market share. Furthermore, the expansion of the confectionery industry is mostly driven by consumer demand for premium items, which are defined as luxurious and pleasant confections. Owing to global health trends, individuals demand for sugar-free and low-calorie products is increasing, which accelerates product formulation innovation and fuels the need for sweets. Moreover, the market is supported by the confectionery market study as more distribution channels, particularly online ones, increase customer choice and accessibility. In order to provide customers with a balanced diet, producers and marketers are heavily leveraging the introduction and promotion of a variety of chocolate snacks, including chocolate bars and on the go snacks. They concentrate on providing customers with tiny, convenient packets that let them fit bars and candy in their purses. The popularity of dark chocolate is growing due to its supposed health advantages. For instance, it has a high antioxidant content that lowers blood pressure and enhances insulin sensitivity.

Restraining Factors

Sugar and cocoa are two basic ingredients that are used mostly in the production of confections worldwide. Since their supply and demand in the worldwide market fluctuate quickly, sugar and cocoa prices have fluctuated during the past few years. The smooth flow of supply and demand for cocoa and sugar in the market is hampered by a variety of economic variables, including poor weather, crop illnesses, labor shortages, stock ratios, and other issues. The average yearly price of the raw materials varies from low to high as a result, which causes an excess or understock to be produced and sold as sugar and chocolate products. Therefore, it is anticipated that in the next years, changes in the price of raw materials would reduce demand overall.

Market Segmentation

The global confectionery market share is classified into product type, age group, price point, and distribution channel.

- The chocolate segment is expected to hold the largest share of the global confectionery market during the forecast period.

Based on the product type, the global confectionery market is divided into hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others. Among these, the chocolate segment is expected to hold the largest share of the global confectionery market during the forecast period. The growing consumer knowledge of chocolate's health advantages, especially its high cocoa content, which is linked to antioxidants and possible cardiovascular benefits, is driving the market for the product. The growing affluence of upscale and artisanal dark chocolates among sophisticated customers in search of refinement and decadence drives market expansion. Customers growing desire for familiar and approachable delicacies is driving the milk chocolate market with tastes that evoke nostalgia and comfort. The global rise of milk chocolate is further facilitated by its adaptability in numerous applications, such as the beverage, baking, and confectionery sectors.

- The adult segment is expected to hold the largest share of the global confectionery market during the forecast period.

Based on the age group, the global confectionery market is divided into children, adult, and geriatric. Among these, the adult segment is expected to hold the largest share of the global confectionery market during the forecast period. The market for adult confections is fueled by the growing need from mature palates looking for distinctive flavor experiences for their decadent and sophisticated flavor profiles. Customers in this market are frequently drawn to premium ingredients like single-origin cocoa beans or artisanal nuts, as well as rich and nuanced tastes like dark chocolate with hints of spices or exotic fruits. Furthermore, the health advantages of dark chocolate are becoming more widely recognized, as health-conscious individuals find its antioxidant qualities and reduced sugar level to be attractive. The growing trend of experiential consumption also has an impact on the adult market, as customers look for confections that provide not just great taste but also unique sensory experiences, such guided wine pairings or chocolate tastings.

- The economy segment is expected to hold the largest share of the global confectionery market during the forecast period.

Based on the price point, the global confectionery market is divided into economy, mid-range, and luxury. Among these, the economy segment is expected to hold the largest share of the global confectionery market during the forecast period. A number of important variables that affect both consumer and production behavior are the main drivers of the confectionery market's economic division. First and foremost, customers' price sensitivity is important, particularly in emerging countries and among cost-conscious groups. Affordability frequently plays a decisive role in these markets, which pushes producers to concentrate on bulk supplies and economical production. Second, the price and accessibility of raw materials have a direct bearing on how much it costs to produce candies. Price swings for dairy, cocoa, and sugar can force manufacturers to change how they operate in order to preserve profit margins and keep costs down. The growing rivalry between domestic and foreign businesses is another important factor, which frequently results in aggressive pricing tactics and advertising to capture a larger market share.

- The supermarkets and hypermarkets segment is expected to hold the largest share of the global confectionery market during the forecast period.

Based on the distribution channel, the global confectionery market is divided into supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others. Among these, the supermarkets and hypermarkets segment is expected to hold the largest share of the global confectionery market during the forecast period. Consumers' growing need for convenience and variety is driving the supermarket and hypermarket sectors. These retail formats provide convenience in shopping by offering a large variety of confectionary items under one roof, accommodating a wide range of consumer tastes. Supermarkets and hypermarkets also frequently use strategic site methods, setting up shop in busy locations to draw customers and profit from impulsive candy purchases. Additionally, the budget-conscious customers drawn to these establishments by their low pricing and promotional offers increase the volume of sales in the confectionery sector. Supermarkets and hypermarkets also spend a lot of money on eye-catching display setups and comprehensive marketing efforts to draw attention to and increase the visibility of confectionery items. As customers stock up, this industry also benefits from the growing trend of bulk purchasing.

Regional Segment Analysis of the Global Confectionery Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

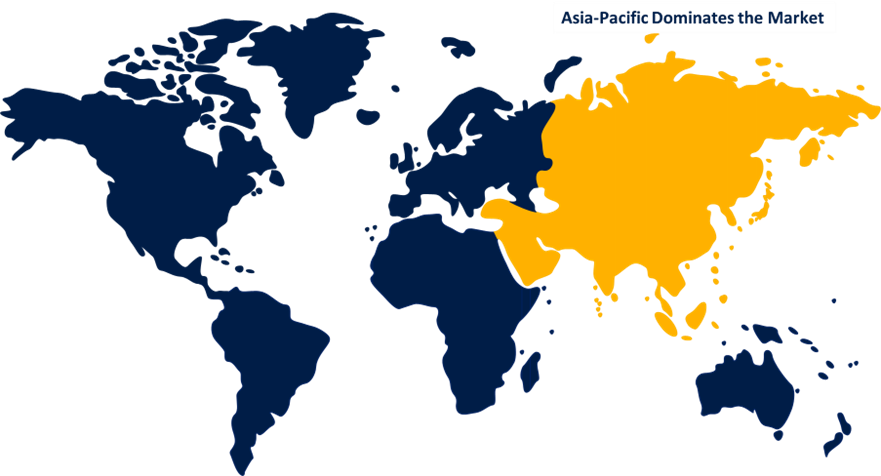

Asia Pacific is anticipated to hold the largest share of the global confectionery market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global confectionery market over the predicted timeframe. The main drivers of the expansion of the regional market are the youthful, dynamic population, rapid urbanization, rising disposable income, and easy access to confections in consumer packs. The manufacturers are taking advantage of these opportunities by aggressively pursuing facility expansions as well as mergers and acquisitions with local firms. Over the course of the forecast period, rising consumer acceptability, popularity, and technical improvements for these products are expected to be the key drivers of the market's overall expansion. Limited edition seasonal chocolate confections are introduced by producers to leverage customer demand for items with a winter theme. In the region, foreign brands outweigh local brands. The primary drivers in the region are the rise in per capita disposable income, the expansion of market participants' investments, and the general increase in the consumption of sweets products.

North America is expected to grow at the fastest pace in the global confectionery market during the forecast period. Sales of sugar and chocolate products are significantly growing in North America as customers increasingly view these products as comfort food. The region's tendency of between meal snacking has raised demand for cereal bars and other snacks. One of the main markets for people willing to spend money on artisanal confections that improve in taste and appearance is the United States. The region's growing manufacturing facilities, new technology being used, and manufacturers stepping up their efforts have all contributed to the demand's overall expansion. The two most popular candy categories in North America are chocolate and sugar. There is a stagnation in the amount of sugar confectionery consumed due to the changes in the population, such as an aging population and low population growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global confectionery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mondelez International, Inc.

- Mars, Incorporated

- Ezaki Glico Co., Ltd.

- Haribo GmbH & Co. K.G.

- Grupo Arcor

- Pladis

- Nestlé S.A.

- Meiji Co., Ltd.

- Ferrero Group

- Chocoladefabriken Lindt & Sprüngli AG

- Perfetti Van Melle

- The Hershey Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, after securing a prominent position with Target and its connected online businesses, the functional chocolate company saw a boost in visibility. Rich dark chocolate that is naturally gluten-free and vegan is combined, according to the US-based firm, with a unique blend of nutraceuticals that are suited to certain ailments, such vitamins, minerals, botanicals, and amino acids. Since these unique combinations address so many common health issues including energy, focus, sleep, stress, and much more there has been an increase in demand for them.

- In February 2024, Reliance Consumer Products (RCPL) paid Rs 27 crore to acquire all intellectual property rights, including recipes and trademarks, from the manufacturer of sugar-boiled candies, Ravalgaon Sugar Farm Ltd., according to a statement from the company. Pan Pasand and Coffee Break are just two of the nine confectionary brands that Ravalgaon holds, all of which are in keeping with RCPL's goal of revitalizing failing ancient Indian businesses, as demonstrated by its prior acquisition of the Campa soft drink brand.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global confectionery market based on the below-mentioned segments:

Global Confectionery Market, By Product Type

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

Global Confectionery Market, By Age Group

- Children

- Adult

- Geriatric

Global Confectionery Market, By Price Point

- Economy

- Mid-range

- Luxury

Global Confectionery Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

Global Confectionery Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?Mondelez International, Inc., Mars, Incorporated, Ezaki Glico Co., Ltd., Haribo GmbH & Co. K.G., Grupo Arcor, Pladis, Nestlé S.A., Meiji Co., Ltd., Ferrero Group, Chocoladefabriken Lindt & Sprüngli AG, Perfetti Van Melle, The Hershey Company, Others.

-

2.What is the size of the global confectionery market?The global confectionery market is expected to grow from USD 190.5 Billion in 2023 to USD 256.2 Billion by 2033, at a CAGR of 3.01% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global confectionery market over the predicted timeframe.

Need help to buy this report?