Global Construction Aggregates Market Size, Share, and COVID-19 Impact Analysis, By Product (Crushed Stone, Sand & Gravel, and Other Aggregates), By Application (Commercial, Residential, Industrial, and Infrastructure), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Construction & ManufacturingGlobal Construction Aggregates Market Insights Forecasts to 2033

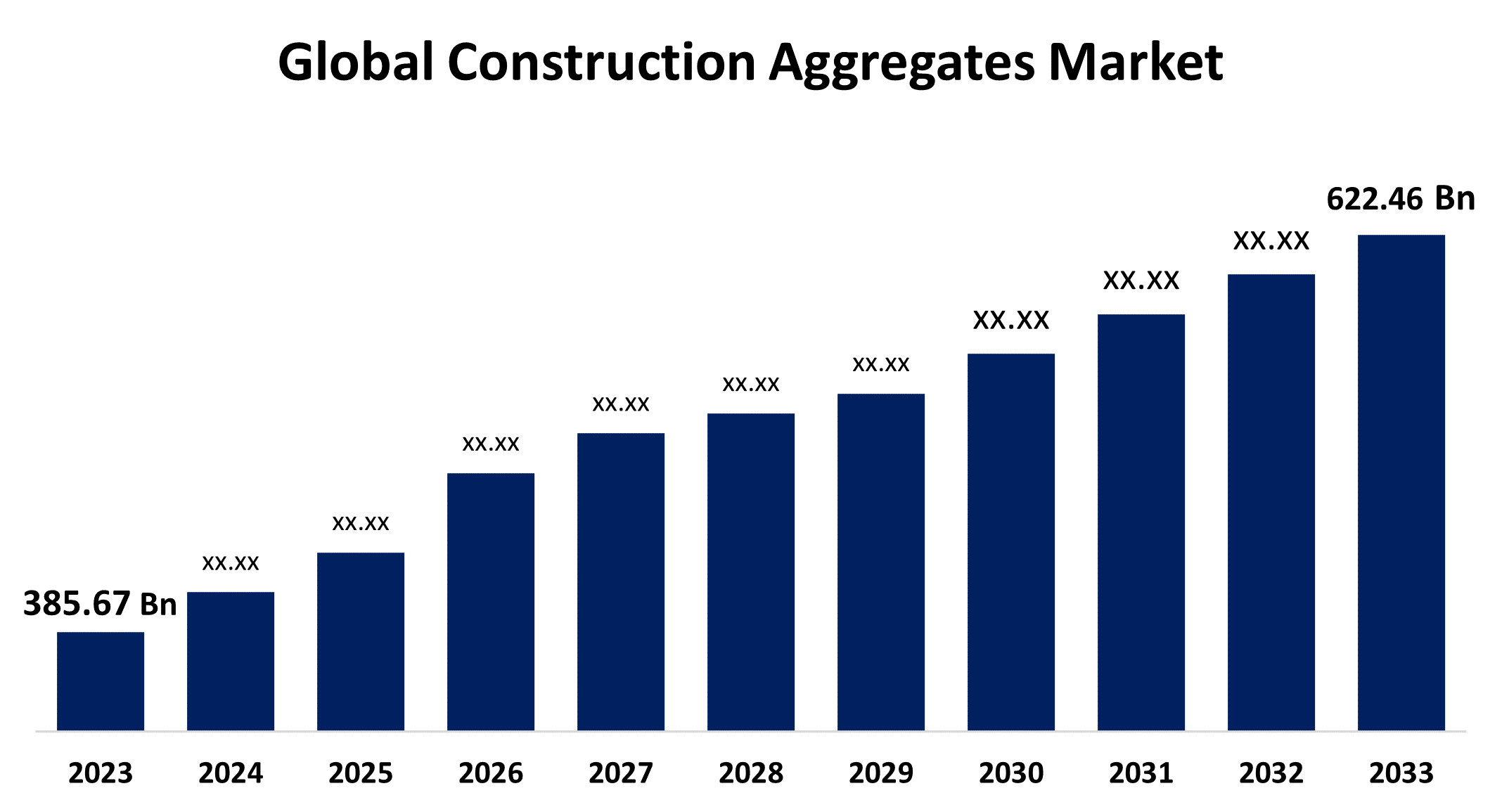

- The Global Construction Aggregates Market Size was Valued at USD 385.67 Billion in 2023

- The Market Size is Growing at a CAGR of 4.90% from 2023 to 2033

- The Worldwide Construction Aggregates Market Size is Expected to Reach USD 622.46 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Construction Aggregates Market Size is Anticipated to Exceed USD 622.46 Billion by 2033, Growing at a CAGR of 4.90% from 2023 to 2033.

Market Overview

Aggregates are raw materials used in construction that offer strength, stability, and durability to structures. They are granular materials that are combined with a binding medium like water, cement, or asphalt to appearance compound materials like concrete and asphalt concrete. According to the United States Geological Survey, In 2023, 920 million tons of construction sand and gravel esteemed at $11 billion was produced by an anticipated 3,400 companies operating 6,500 pits and over 200 sales and (or) distribution yards in 50 States. Foremost producing States were, in order of diminishing tonnage, Texas, California, Minnesota, Michigan, Arizona, Colorado, Ohio, Utah, Washington, and Nevada, which collectively accounted for about 53% of total output. An expected 43% of construction sand and gravel was used as portland cement concrete aggregates, 25% for road base and coverings, 12% for construction fill, 12% for asphaltic concrete aggregate and for other bituminous mixtures, and 4% for other miscellaneous uses. The remaining amount was used for concrete products, filtration, golf course maintenance, plaster and gunite sands, railroad ballast, road stabilization, roofing granules, and snow and ice control.

Report Coverage

This research report categorizes the market for construction aggregates based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the construction aggregates market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the construction aggregates market.

Global Construction Aggregates Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 385.67 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.90% |

| 2033 Value Projection: | USD 622.46 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By Region |

| Companies covered:: | Adbri Ltd (Adbri), Big City Crushed Concrete, CEMEX S.A.B. de C.V., CRH Plc. (CRH), Delta Sand & Gravel, Eurocement Group, Ferma Corp, Green Stone Materials, Heidelberg Cement AG, Holcim, Independence Recycling of Florida, Martin Marietta Materials, Rogers Group Inc., Tarmac, Top Grade Site Management, LLC, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The construction aggregates market is driven by several factors, including, Governments investing in infrastructure projects like highways, bridges, railways, and airports, which require large amounts of construction aggregates. As the world's population grows and more people move to cities, there's a need for more housing, transportation, and infrastructure i.e. rapid urbanization. There's a growing emphasis on eco-friendly construction practices, which is leading to more use of recycled and reclaimed aggregates. The construction industry is recovering in developed regions, and there are new construction opportunities in developing economies. New construction techniques are making infrastructure projects more efficient, which increases the demand for construction aggregates.

Restraining Factors

Transportation of construction aggregates is not a complicated concern; nevertheless, the high weight and volume of these materials can increase the cost associated with transportation. Sand and gravel reserves are depleting across the world and illegal mining has hindered the supply of these types of construction aggregates. Additionally, strict mining laws across several countries have resulted in a spike in product prices, which might impact the growth forecast in the market.

Market Segmentation

The construction aggregates market share is classified intoproduct and application.

- The sand & gravel segment is estimated to hold the highest market revenue share through the projected period.

Based on the product, the construction aggregates market is classified into crushed stone, sand & gravel, and other aggregates. Among these, the sand & gravel segment is estimated to hold the highest market revenue share through the projected period. Naturally occurring granular materials formed from the disintegration of rock and stone make up sand and gravel. These versatile building materials are easily accessible and can be processed near construction sites. The continuous development of infrastructure in major economies is a significant driving force behind the widespread use of sand and gravel. Large-scale projects in transportation, energy, and utilities heavily rely on sand and gravel for creating foundations, laying aggregate base courses for roads and highways, and producing ready-mix concrete.

- The infrastructure segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the construction aggregates market is divided into commercial, residential, industrial, and infrastructure. Among these, the infrastructure segment is anticipated to hold the largest market share through the forecast period. Mega construction projects necessitate large quantities of aggregate materials for building activities. These encompass the construction of roads, highways, railway networks, urban infrastructure like bridges and tunnels, energy production facilities, and large public buildings. Many countries are giving priority to infrastructure expenditure to enhance economic growth, connectivity, and urban expansion. Emerging economies are also significantly increasing infrastructure spending to bridge development disparities. The commercial infrastructure sector encompasses the construction of warehouses, distribution centers, and data centers, all of which involve aggregate-intensive civil works.

Regional Segment Analysis of the Construction Aggregates Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

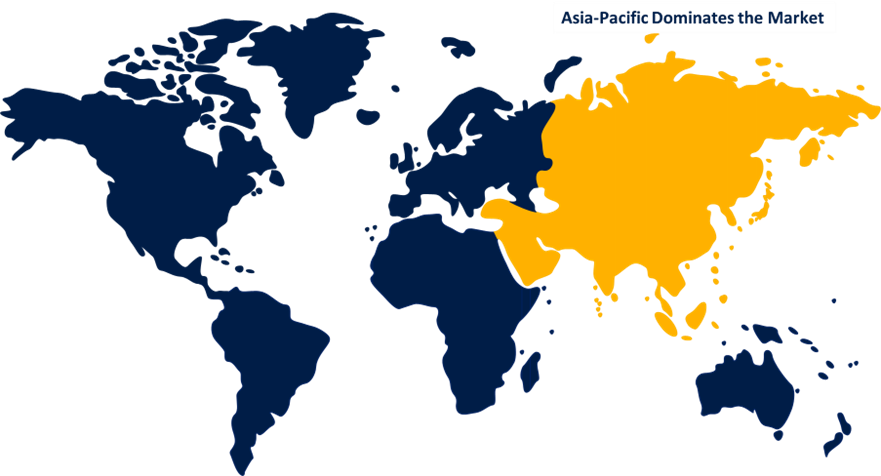

Asia Pacific is anticipated to hold the largest share of the construction aggregates market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the construction aggregates market over the predicted timeframe. This is due to increased urbanization, technological advancements, and rising disposable incomes. Key trends include a shift towards sustainability, with a growing emphasis on eco-friendly and energy-efficient products. The market also sees heightened demand for premium and innovative offerings, particularly in emerging economies like China and India. The Belt and Road project, along with other significant government infrastructure initiatives, leads to substantial demand for building new roads, railways, and housing throughout the region. The availability of affordable land and resources in the Asia Pacific region enables competitive pricing, which in turn drives demand. Increasing prosperity among the population creates additional potential in both commercial and residential construction, complementing the government's infrastructure investments. Positive economic forecasts indicate that Asia Pacific will sustain its rapid market growth.

North America is expected to grow at the fastest CAGR growth of the construction aggregates market during the forecast period. Housing refurbishment and ongoing home construction are estimated to drive development in the construction sector. This, in turn, is expected to raise demand for construction aggregates in the U.S. during the forecast period. Decades of industry presence and consolidation have provided U.S. firms with deep operational experience and global supply chains that allow them to access both domestic and international markets at scale. Alternative materials, including concrete, steel, and wood, are being replaced or supplemented by innovative technologies offering enhanced performance, sustainability, as well as cost-effectiveness. Due to their lightweight, toughness, and environmentally friendly characteristics, materials, including engineered wood, recycled plastic, bio-based composites, and sophisticated polymers, are becoming more popular.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the construction aggregates market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Adbri Ltd (Adbri)

- Big City Crushed Concrete

- CEMEX S.A.B. de C.V.

- CRH Plc. (CRH)

- Delta Sand & Gravel

- Eurocement Group

- Ferma Corp

- Green Stone Materials

- Heidelberg Cement AG

- Holcim

- Independence Recycling of Florida

- Martin Marietta Materials

- Rogers Group Inc.

- Tarmac

- Top Grade Site Management, LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Heidelberg Materials North America announced that it has entered into a definitive procure agreement to acquire Carver Sand & Gravel, the largest aggregates manufacturer in the Albany, New York, area. Included in this acquisition are four quarries, three sand and gravel pits, two asphalt plants, 70 million metric tonnes of aggregate reserves, a logistics business, and about 200 employees.

- In July 2024, Cemex announced a joint venture agreement with sand and gravel supplier Couch Aggregates and marine bulk product distributor Premier Holdings. This agreement is part of Cemex's ongoing strategy to accelerate growth in the U.S. and expand its aggregates business.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the construction aggregates market based on the below-mentioned segments:

Global Construction Aggregates Market, By Product

- Crushed Stone

- Sand & Gravel

- Other Aggregates

Global Construction Aggregates Market, By Application

- Commercial

- Residential

- Industrial

- Infrastructure

Global Construction Aggregates Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the construction aggregates market over the forecast period?The construction aggregates market is projected to expand at a CAGR of 4.90% during the forecast period.

-

2. What is the market size of the construction aggregates market?The Global Construction Aggregates Market Size is Expected to Grow from USD 385.67 Billion in 2023 to USD 622.46 Billion by 2033, at a CAGR of 4.90% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the construction aggregates market?Asia Pacific is anticipated to hold the largest share of the construction aggregates market over the predicted timeframe.

Need help to buy this report?