Global Construction Camera Market Size, Share, and COVID-19 Impact Analysis, By Type (Fixed Camera, PTZ (Pan-Tilt-Zoom) Camera, and Mobile Camera Trailers), By Application (Jobsite Progress Monitoring, Security and Surveillance, and Marketing and Promotion), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Construction & ManufacturingGlobal Construction Camera Market Insights Forecasts to 2033

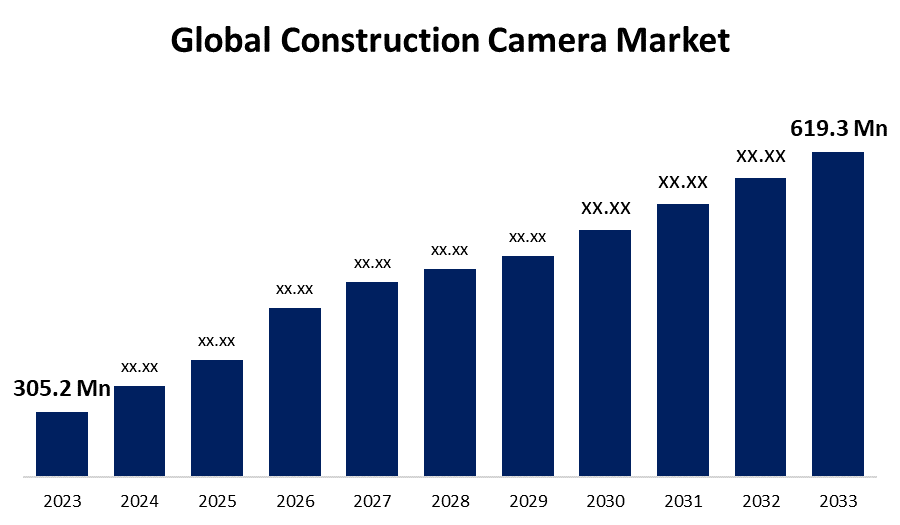

- The Global Construction Camera Market Size was Valued at USD 305.2 Million in 2023

- The Market Size is Growing at a CAGR of 7.33% from 2023 to 2033

- The Worldwide Construction Camera Market Size is Expected to Reach USD 619.3 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Construction Camera Market Size is Anticipated to Exceed USD 619.3 Million by 2033, Growing at a CAGR of 7.33% from 2023 to 2033.

Market Overview

A camera is a device commonly used in the construction and building industry to capture images or videos of various stages of construction, inspection, and maintenance. It is an essential tool for project managers, architects, engineers, and contractors to document progress, identify issues, and communicate with stakeholders. A construction camera is a camera that monitors construction sites to help project managers and stakeholders track progress, identify issues, and ensure that projects stay on schedule. Construction cameras can be used for a variety of purposes. Construction cameras allow project managers to remotely monitor the site and ensure that activities are on track. Time-lapse cameras can help identify issues and resolve them promptly. Time-lapse cameras can help teams learn from challenges and improve future projects. Time-lapse cameras can capture the entire construction process in a visually compelling way. Construction cameras can provide open-access features that allow clients to easily keep an eye on their investment. Construction cameras are often designed to be durable and weatherproof, with features such as High-definition resolution, Wide-angle lenses, motion detection, remote monitoring, and cloud storage.

Report Coverage

This research report categorizes the market for construction camera based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the construction camera market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the construction camera market.

Global Construction Camera Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 305.2 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.33% |

| 2033 Value Projection: | USD 619.3 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 231 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Brinno Inc.,, CamDo Solutions,, EarthCam, Inc.,, ECAMSECURE,, Enlaps (Tikee),, iBEAM Systems, Inc.,, SENSERA SYSTEMS,, TrueLook Construction Cameras,, US Relay Corporation,, Work Zone Cam,, LLC,, OxBlue Corporation,, Digilant (Moreton Bay Systems), Afidus, Outdoor Cameras Australia, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

As construction projects become more intricate and involve larger teams, it becomes challenging to track progress and identify issues effectively. Construction cameras provide real-time visual data, enabling project managers and stakeholders to remotely monitor the construction site, make informed decisions, and address any possible problems promptly. Construction cameras act as a deterrent to theft, vandalism, and unauthorized access, thereby enhancing site security. They also enable real-time monitoring of construction sites, allowing for early detection and response to safety hazards or emergencies. With advancements in digital imaging, remote access, and cloud storage, construction cameras have become more powerful and efficient. Digital technologies enable construction cameras to capture high-resolution images or videos, offering superior visual documentation of construction projects.

Restraining Factors

The cost of purchasing and installing construction cameras can be significant, construction sites often involve sensitive information, and ensuring privacy and data security when using construction cameras is crucial. Technological Limitations: Some construction sites may have limited access to high-speed internet or face environmental factors that affect camera performance.

Market Segmentation

The construction camera market share is classified into type and application.

- The PTZ (Pan–Tilt–Zoom) camera segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the construction camera market is classified into fixed cameras, PTZ (Pan–Tilt–Zoom) cameras, and mobile camera trailers. Among these, the PTZ (Pan–Tilt–Zoom) camera segment is estimated to hold the highest market revenue share through the projected period. This is due to their incomparable flexibility and comprehensive scope capabilities. Their capacity to pan, tilt, and zoom allows a single PTZ camera to screen huge development sites from different points, reducing the need for various settled cameras and reducing overall costs. In spite of higher initial costs, their wide scope and diminished need for different establishments make PTZ cameras a cost-effective arrangement in the long term, cutting down on establishment and support costs. PTZ cameras are compatible with progressed technologies such as AI and machine learning, enhancing their capabilities for mechanized advanced following, security checking, and prescient support. This integration makes them a profoundly effective and smart venture for modern construction projects.

- The job site progress monitoring segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the construction camera market is divided into job site progress monitoring, security and surveillance, and marketing and promotion. Among these, the job site progress monitoring segment is anticipated to hold the largest market share through the forecast period. This is due to its basic part in ensuring compelling venture management. This capability allows tracking construction exercises in real-time, ensuring projects stay on plan and inside budget by expeditiously distinguishing and tending to delays or issues. Visual monitoring enhances coordination and communication among different groups and subcontractors by advertising a clear visual context, making it easier to convey data and instructions precisely. It too helps in asset management by ensuring that materials, hardware, and labor are utilized proficiently, optimizing asset assignment, diminishing squandering, and boosting efficiency.

Regional Segment Analysis of the Construction Camera Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

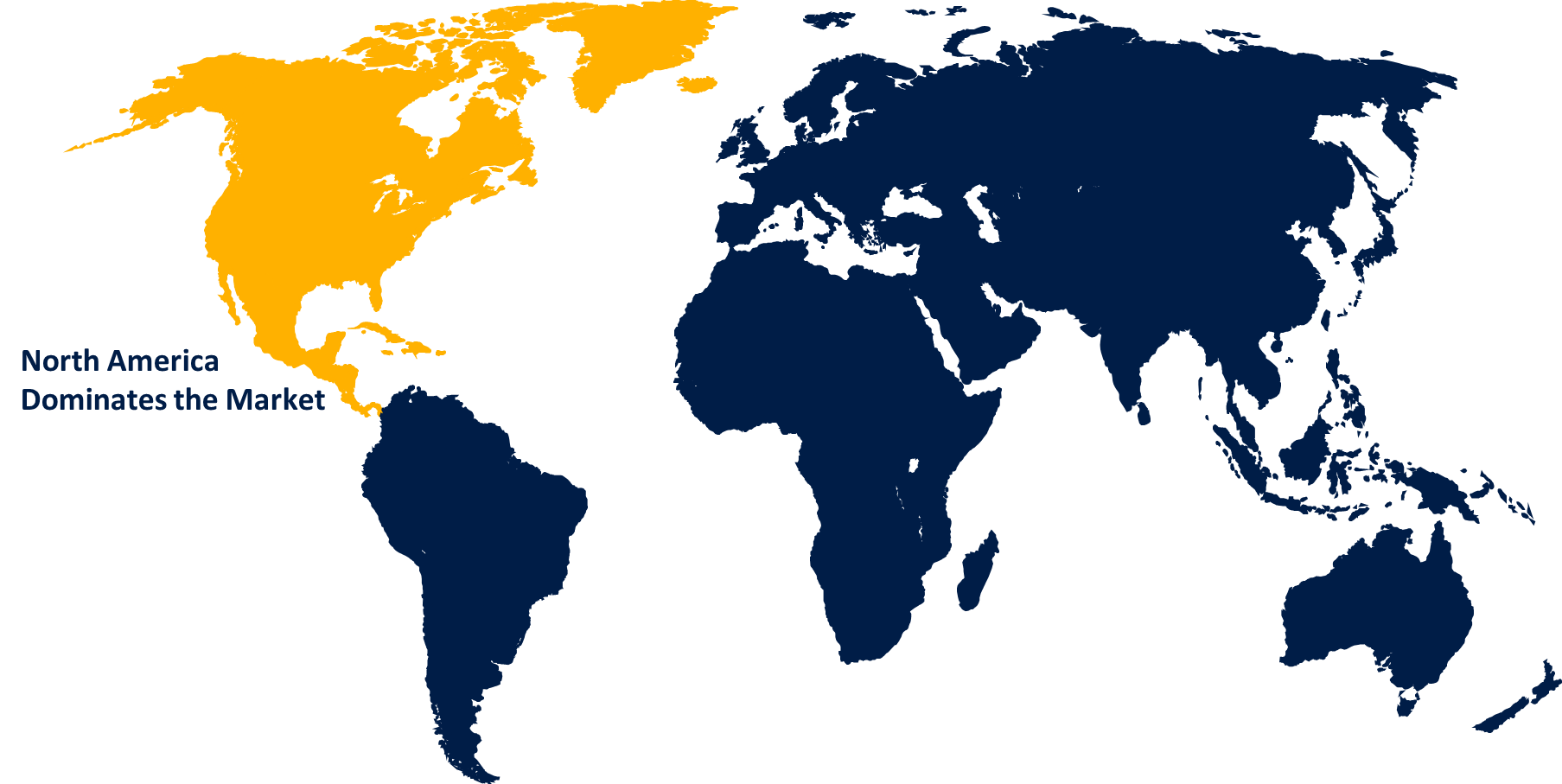

North America is anticipated to hold the largest share of the construction camera market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the construction camera market over the predicted timeframe. The region, especially the United States, experiences substantial construction action across residential, commercial, and infrastructure divisions, driving dependable requests for advanced monitoring and security solutions. Stringent regulatory necessities within the construction industry advance and amplify the requirement for strong checking and documentation. The North American market's maturity, characterized by a well-established framework for receiving and integrating new technologies, moreover contributes to its dominance. The presence of key industry players like EarthCam, OxBlue, and TrueLook solidifies the market’s quality. In addition, companies in North America are ceaselessly innovating, advertising upgraded features such as real-time inaccessible checking, AI-driven analytics, and automated advance detailing.

Asia Pacific is expected to grow at the fastest CAGR growth of the construction camera market during the forecast period. The region is experiencing significant infrastructure development, with numerous construction projects in sectors such as residential, commercial, industrial, and transportation. The demand for construction cameras to monitor and document these projects is consequently high. Additionally, rapid urbanization, population growth, and economic expansion in countries like China, India, and Southeast Asian nations are driving construction activities. Construction cameras are essential for ensuring project efficiency, safety, and quality, thus contributing to their widespread adoption. Moreover, advancements in technology, increasing digitalization, and the availability of affordable and reliable internet connectivity in many parts of Asia Pacific have facilitated the adoption of construction cameras.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the construction camera market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Brinno Inc.,

- CamDo Solutions,

- EarthCam, Inc.,

- ECAMSECURE,

- Enlaps (Tikee),

- iBEAM Systems, Inc.,

- SENSERA SYSTEMS,

- TrueLook Construction Cameras,

- US Relay Corporation,

- Work Zone Cam,

- LLC,

- OxBlue Corporation,

- Digilant (Moreton Bay Systems)

- Afidus

- Outdoor Cameras Australia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Panasonic announced the regional launch of its newest 4K PTZ camera, the AW-UE30. Boosting the brand’s robust line-up of 4K integrated cameras is the AW-UE30 with 20x Optical Zoom and a 74.1-degree wide-angle lens.

- In June 2024, Xiaomi has launched a new security camera, the Xiaomi Smart Camera C500 Dual-Camera Edition. It features a dual-lens setup and improved image quality for comprehensive home monitoring.

- In April 2024, Sony Electronics is releasing a flagship 4K 60p pan-tilt-zoom (PTZ) camera model with an integrated lens, the BRC-AM7. Incorporating PTZ Auto Framing technology, which uses artificial intelligence (AI) technology for advanced recognition, the camera facilitates accurate and natural automatic tracking of moving subjects. These innovations enable simplified high-quality video production for broadcast, live event, and sports productions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the construction camera market based on the below-mentioned segments:

Global Construction Camera Market, By Type

- Fixed Camera

- PTZ (Pan–Tilt–Zoom) Camera

- Mobile Camera Trailers

Global Construction Camera Market, By Application

- Jobsite Progress Monitoring

- Security and Surveillance

- Marketing and Promotion

Global Construction Camera Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the construction camera market over the forecast period?The construction camera market is projected to expand at a CAGR of 7.33% during the forecast period.

-

2. What is the market size of the construction camera market?The Global Construction Camera Market Size is Expected to Grow from USD 305.2 Million in 2023 to USD 619.3 Million by 2033, at a CAGR of 7.33% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the construction camera market?North America is anticipated to hold the largest share of the construction camera market over the predicted timeframe.

Need help to buy this report?