Global Construction Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Type (Admixtures, Flooring, Waterproofing, Repair & Rehabilitation, and Others), By Application (Residential, and Non-Residential), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Construction & ManufacturingGlobal Construction Chemicals Market Insights Forecasts to 2033

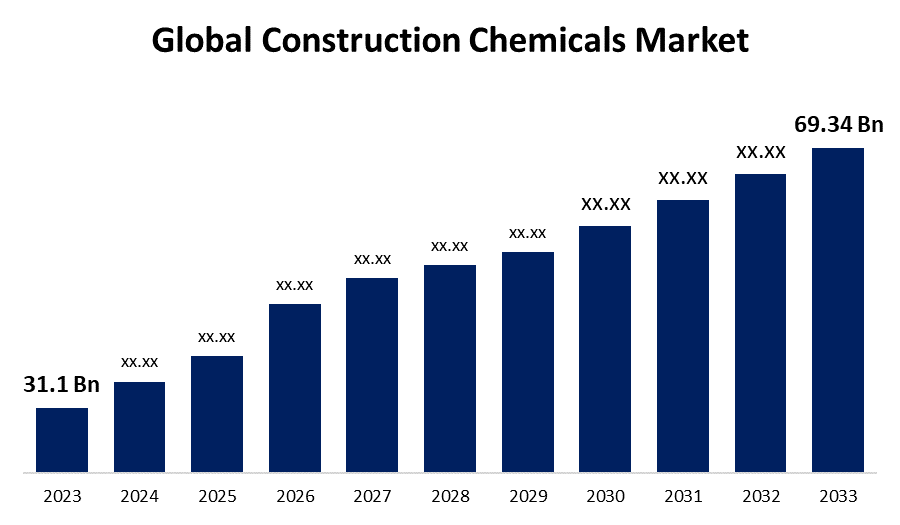

- The Global Construction Chemicals Market Size was Valued at USD 31.1 Billion in 2023

- The Market Size is Growing at a CAGR of 8.35% from 2023 to 2033

- The Worldwide Construction Chemicals Market Size is Expected to Reach USD 69.34 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Construction Chemicals Market Size is Anticipated to Exceed USD 69.34 Billion by 2033, Growing at a CAGR of 8.35% from 2023 to 2033.

Market Overview

Construction chemicals are crucial in any industrial or commercial building project particularly when there is a huge demand for infrastructure development driving the global economy. Construction chemicals are chemical compounds used to bind it with other construction materials like cement and concrete at the time of construction. Natural or synthetic materials are added to the construction mix to increase the binding strength, reduce cost and improve durability. They are also mixed with concrete and mortar to enhance the strength of the buildings. There are many types of construction chemicals used in binders, waterproofing and repair of structures. They are used as concrete curing compounds, polymer bonding agents, mould releasing agents, form release agents, protective and decorative coatings, concrete floor hardeners, non-shrink high strength grout and many more.

According to United States Geological Survey, Cement was produced at 99 plants in 34 States and in Puerto Rico. Texas, Missouri, California, and Florida were, in descending order of production, the four leading cement-producing States and accounted for approximately 43% of U.S. production. Overall, the U.S. cement industry’s growth continued to be constrained by closed or idle plants, underutilized capacity at others, production disruptions from plant upgrades, and relatively inexpensive imports. In 2023, shipments of cement were an estimated 110 million tons with an estimated value of $16 billion. In 2023, an estimated 70% to 75% of sales were to ready-mixed concrete producers, 11% to concrete product manufacturers, 8% to 10% to contractors, and 5% to 12% to other customer types. The value of total construction put in place in the United States increased by 5% during the first 9 months of 2023 compared with that in the same period in 2022. Nonresidential construction spending increased, but residential construction spending decreased. Construction starts of new housing units through September 2023 decreased by 12% compared with those during the same period in 2022. Reported cement shipments decreased slightly during the first 9 months of 2023 compared with those in the same period in 2022. The leading cement-consuming States continued to be Texas, Florida, and California, in descending order by tonnage.

Report Coverage

This research report categorizes the market for construction chemicals based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the construction chemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the construction chemicals market.

Global Construction Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 31.1 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.35% |

| 2033 Value Projection: | USD 69.34 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | BuildCore Chemicals, Croda International Plc, ACC Limited, BASF SE, Fosroc, Inc., CHRYSO India, SWC Brother Company Limited., Sika AG, 3M Company, Henkel AG of Germany, Evonik Industries AG, Tata Chemicals, Huntsman International LLC, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The rapid expansion of the construction industry, driven by urbanization, infrastructure growth, and increased investments in residential and commercial projects, is the primary factor propelling the construction chemicals market. Builders' growing preference for advanced construction materials that enhance durability, sustainability, and performance is also contributing to the rising demand for such products, as they aim to comply with environmental regulations and cater to consumer preferences for eco-friendly solutions. Furthermore, innovations in product formulations, such as high-performance concrete additives and waterproofing agents, are fueling market growth by providing enhanced functionality and efficiency in construction processes.

Restraining Factors

The construction chemicals market is hindered by various factors, including the volatility of raw material prices and supply chain disruptions that can impede production and raise costs. Stringent regulations regarding chemical compositions and environmental safety pose challenges for manufacturers, necessitating substantial investments in compliance and research. Moreover, the slow adoption of new technologies in certain regions, particularly in developing economies, may limit market expansion, as traditional construction methods remain prevalent.

Market Segmentation

The construction chemicals market share is classified into type and application.

- The admixtures segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the construction chemicals market is classified into admixtures, flooring, waterproofing, repair & rehabilitation, and others. Among these, the admixtures segment is estimated to hold the highest market revenue share through the projected period. Admixtures play a crucial role in improving the performance and characteristics of concrete. They are utilized to alter properties like workability, setting time, strength, and durability, which are essential for meeting specific construction needs. The rising need for high-performance concrete in diverse applications, such as infrastructure projects and commercial structures, is spurring the usage of these chemical additives. Moreover, the shift towards sustainable construction methods is promoting the use of environmentally friendly admixtures that decrease water consumption and enhance energy efficiency, further establishing the segment's supremacy in the construction chemicals market.

- The non-residential segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the construction chemicals market is divided into residential, and non-residential. Among these, the non-residential segment is anticipated to hold the largest market share through the forecast period. Significant investments in commercial spaces, industrial facilities, and public infrastructure primarily contribute to the market's growth. Economic resurgence and government initiatives focused on enhancing urban infrastructure also fuel the increased demand for construction chemicals tailored for non-residential applications. Additionally, the trend toward constructing energy-efficient and sustainable commercial structures necessitates advanced construction solutions, thereby promoting the adoption of specialized chemicals that improve performance and compliance with environmental standards. This emphasis on non-residential developments is expected to sustain its leading market position in the future.

Regional Segment Analysis of the Construction Chemicals Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the construction chemicals market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the construction chemicals market over the predicted timeframe. Robust infrastructure development, a thriving construction industry, and increased investments in residential and commercial real estate drive market growth in the region. The region's well-established regulatory framework promotes the use of advanced construction technologies and sustainable practices, leading to higher demand for specialized construction chemicals. Furthermore, the presence of key market players and ongoing innovations in product formulations contribute to the region's dominance, as stakeholders seek to enhance the durability and performance of construction materials amidst evolving environmental standards.

Asia Pacific is expected to grow at the fastest CAGR growth of the construction chemicals market during the forecast period. Market growth is fueled by rapid urbanization, population expansion, and significant infrastructure projects in emerging economies. Countries such as China and India are experiencing a surge in construction activities aimed at accommodating urban populations and improving transportation networks. The increasing focus on sustainable and high-performance construction materials further drives demand for innovative chemical solutions. Additionally, government initiatives and foreign investments in infrastructure development are anticipated to boost market growth, positioning Asia Pacific as a key region for future expansion in the construction chemicals market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the construction chemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BuildCore Chemicals

- Croda International Plc

- ACC Limited

- BASF SE

- Fosroc, Inc.

- CHRYSO India

- SWC Brother Company Limited.

- Sika AG

- 3M Company

- Henkel AG of Germany

- Evonik Industries AG

- Tata Chemicals

- Huntsman International LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, Saint-Gobain has plans to acquire the Mexican construction chemicals firm Ovniver Group for 815 million dollars. With this move, the company intends to further strength its worldwide presence in the construction chemicals sector.

- In May 2024, Bengaluru Headquartered Fosroc India inaugurated its new Integrated Construction Chemicals Plant in Hyderabad on 25th May 2024. Fosroc’s latest manufacturing facility will enhance Fosroc’s geographical coverage and service levels particularly for customers in South and Central India.

- In February 2024, Thermax Limited announced on February 20 that it has entered into a License and Technical Assistance Agreement with South Korea's Flowtech Co Ltd., to acquire the technology required for the manufacturing of Poly Carboxylate Ether (PCE) products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the construction chemicals market based on the below-mentioned segments:

Global Construction Chemicals Market, By Type

- Concrete Admixtures

- Flooring Chemicals

- Waterproofing Chemicals

- Repair & Rehabilitation Chemicals

- Others

Global Construction Chemicals Market, By Application

- Residential

- Non-Residential

Global Construction Chemicals Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the construction chemicals market over the forecast period?The construction chemicals market is projected to expand at a CAGR of 8.35% during the forecast period.

-

2. What is the market size of the construction chemicals market?The Global Construction Chemicals Market Size is Expected to Grow from USD 31.1 Billion in 2023 to USD 69.34 Billion by 2033, at a CAGR of 8.35% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the construction chemicals market?North America is anticipated to hold the largest share of the construction chemicals market over the predicted timeframe.

Need help to buy this report?