Global Construction & Demolition Waste Management Market Size, Share, and COVID-19 Impact Analysis, By Material (Concrete & Gravel, Bricks & Ceramics, Asphalt & Tar, Timber & Wood Products, Metals, and Others), By Source (Demolition, Construction, and Renovation), By Service (Disposal and Collection), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Advanced MaterialsGlobal Construction & Demolition Waste Management Market Insights Forecasts to 2033

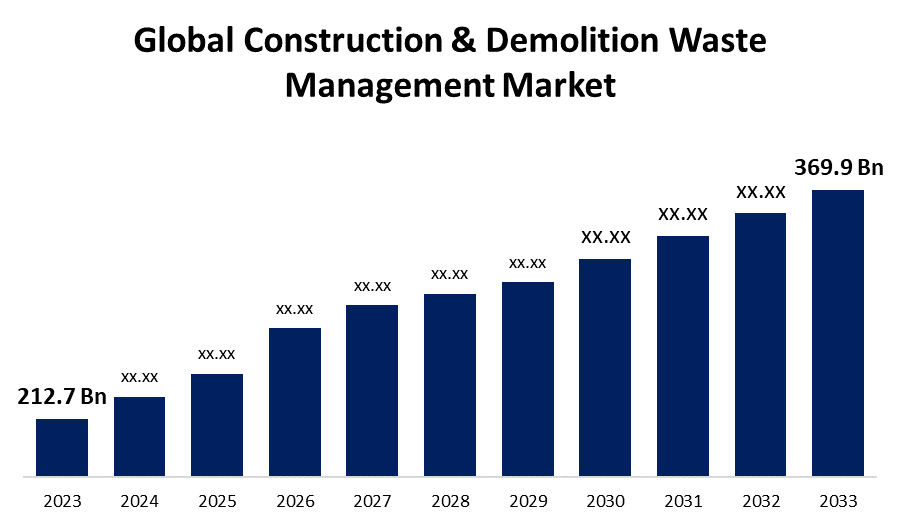

- The Global Construction & Demolition Waste Management Market Size was Valued at USD 212.7 Billion in 2023

- The Market Size is Growing at a CAGR of 5.69% from 2023 to 2033

- The Worldwide Construction & Demolition Waste Management Market Size is Expected to Reach USD 369.9 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Construction & Demolition Waste Management Market Size is Anticipated to Exceed USD 369.9 Billion by 2033, Growing at a CAGR of 5.69% from 2023 to 2033.

Market Overview

Construction is essential for meeting all of the requirements, including water, electricity, and materials, but it also generates trash. This garbage is known as construction and demolition (C&D) waste because it is generated during the construction, administration, and disposal stages. The construction waste market includes debris from damaged properties, real estate changes, roadways, flyovers, and civil infrastructure maintenance. Construction waste management encompasses procedures such as warehousing and separation, transportation and disposal, reuse and recycling, and disposal. The collection and transportation of construction and demolition trash involves efficiently processing and moving materials from construction sites, rehabilitation projects, and demolition sites to authorized recycling or disposal facilities. The waste recycling and processing component focuses on the recycling and processing of building and demolition waste materials. Waste materials are sorted, separated, and processed into reused or recyclable components including aggregates, metals, wood, plastics, and concrete using various technologies and methods. Furthermore, governments around the world have been working hard to recycle and reuse waste debris from demolition and restoration sites, which has contributed to the development of a circular economy in the waste management industry.

Report Coverage

This research report categorizes the market for the construction & demolition waste management market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the construction & demolition waste management market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the construction & demolition waste management market.

Construction & Demolition Waste Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 212.7 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.69% |

| 023 – 2033 Value Projection: | USD 369.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material, By Source, By Service, By Region |

| Companies covered:: | Clean Harbors, Inc., Republic Services, FCC Environment, Inc., Veolia Environment, Kiverco, Daiseki Co., Ltd., Windsor Waste, CDE Global Ltd., Renewi plc, Waste Management, Biffa, Covanta Holding, Axens, WM Intellectual Property Holdings, L.L.C., Progressive Waste Solutions Ltd., Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The usage of recycled construction raw materials is becoming more prevalent among famous builders and developers. These materials offer several advantages, including cost-effectiveness, eco-friendliness, quick availability, and greater flexibility in raw material development. However, government and infrastructure agencies around the world are currently prioritizing investment in waste recycling facilities. These initiatives intend to improve and more effectively manage building garbage while also reducing the consumption of natural resources.

Restraining Factors

Building dust is a major concern at several stages of the construction process. Construction dust is harmful to any environment that comes into contact with it. It is produced during the start and maintenance of construction activities, including maintenance, deconstruction, the transportation of building materials, units, and machinery, and the management of construction waste and garbage.

Market Segmentation

The construction & demolition waste management market share is classified into material, source, and services.

- The concrete & gravel segment is dominating the market with the largest revenue share through the forecast period.

The construction & demolition waste management market is classified by material into concrete & gravel, bricks & ceramics, asphalt & tar, timber & wood products, metals, and others. Among these, the concrete & gravel segment is dominating the market with the largest revenue share through the forecast period. The considerable output of concrete and gravel in total recyclable garbage contributes to the country's position as a global market leader. The increased usage of recycled and recovered concrete and stone in new construction and restoration projects strengthens the concrete and gravel segment's position.

- The demolition segment is expected to grow the highest market share through the forecast period.

Based on the source, the construction & demolition waste management market is categorized demolition, construction, and renovation. Among these, the demolition segment is expected to grow the highest market share through the forecast period. Establishing and modernizing existing public infrastructure are critical aspects of improving market development prospects for the demolition market at a dominating pace. The expansion of commercial facilities, corporate buildings, and industrial production clusters across numerous regions has increased demolition trash generation and recycling opportunities.

- The collection segment is projected to grow at the highest CAGR during the forecast period.

Based on the services, the construction & demolition waste management market is categorized disposal and collection. Among these, the collection segment is projected to grow at the highest CAGR during the forecast period. The availability of simple collection and trash and debris transportation solutions is helping the collection segment gain a significant proportion of the global market. Many manufacturers are ready to provide hassle-free, dependable, and safe collection services that enable the easy and secure lifting and transportation of nonhazardous garbage for recycling.

Regional Segment Analysis of the Construction & Demolition Waste Management Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the construction & demolition waste management market over the predicted timeframe.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the construction & demolition waste management market over the forecast period. Asia Pacific had the largest market because governments increased emphasis on infrastructure development, particularly in emerging economies like China, Japan, and India. The ongoing development of numerous building and construction projects in these countries adds significantly to market demand. Stringent controls on landfill operations, as well as environmental legislation promoting eco-friendly buildings, are expected to support region growth.

North America is expected to grow at the fastest CAGR growth of the construction & demolition waste management market during the forecast period. The region's market is developing due to the growing demand for environmentally friendly construction practices and increased pressure on builders and developers to reduce raw material costs. Furthermore, the United States is driving the industry's growth because various market participants have made large investments to build and operate new recycling facilities in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the construction & demolition waste management market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Clean Harbors, Inc.

- Republic Services

- FCC Environment, Inc.

- Veolia Environment

- Kiverco

- Daiseki Co., Ltd.

- Windsor Waste

- CDE Global Ltd.

- Renewi plc

- Waste Management, Biffa

- Covanta Holding

- Axens

- WM Intellectual Property Holdings, L.L.C.

- Progressive Waste Solutions Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Vermeer Corp., an Iowa-based firm, introduced the LS3600TX low-speed shredder. The new shredder has superior processing capabilities for light construction and demolition waste.

- In March 2023, WM, a comprehensive waste management service provider, completed its acquisition of Specialized Environmental Technologies, Inc.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the construction & demolition waste management market based on the below-mentioned segments:

Global Construction & Demolition Waste Management Market, By Material

- Concrete & Gravel

- Bricks & Ceramics

- Asphalt & Tar

- Timber & Wood Products

- Metals

- Others

Global Construction & Demolition Waste Management Market, By Source

- Demolition

- Construction

- Renovation

Global Construction & Demolition Waste Management Market, By Services

- Disposal

- Collection

Global Construction & Demolition Waste Management Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the construction & demolition waste management market over the forecast period?The construction & demolition waste management market is to expand at 5.69% during the forecast period.

-

2. Which region is expected to hold the highest share in the construction & demolition waste management market?The Asia Pacific region is expected to hold the largest share of the construction & demolition waste management market

-

3. Who are the top key players in the construction & demolition waste management market?The key players in the construction & demolition waste management market are Clean Harbors, Inc., Republic Services, FCC Environment, Inc., Veolia Environment, Kiverco, Daiseki Co., Ltd., Windsor Waste, CDE Global Ltd., Renewi plc, Waste Management, Biffa, Covanta Holding, Axens, WM Intellectual Property Holdings, L.L.C., Progressive Waste Solutions Ltd., Others, and

Need help to buy this report?