Global Construction Equipment Market Size, Share, and COVID-19 Impact Analysis, By Equipment Type (Earthmoving Equipment, Material Handling Equipment, Heavy Construction Vehicles, Others), By Product Type (Wheel Bulldozer, Front Loaders, Dump Trucks, Backhoe loader, Grader, Crawler Dozers, Compactors, Excavators, Forklifts, Concrete Mixer Truck, Others), By End User (Oil & gas, Construction & Infrastructure, Manufacturing, Mining, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Construction & ManufacturingGlobal Construction Equipment Market Insights Forecasts to 2032

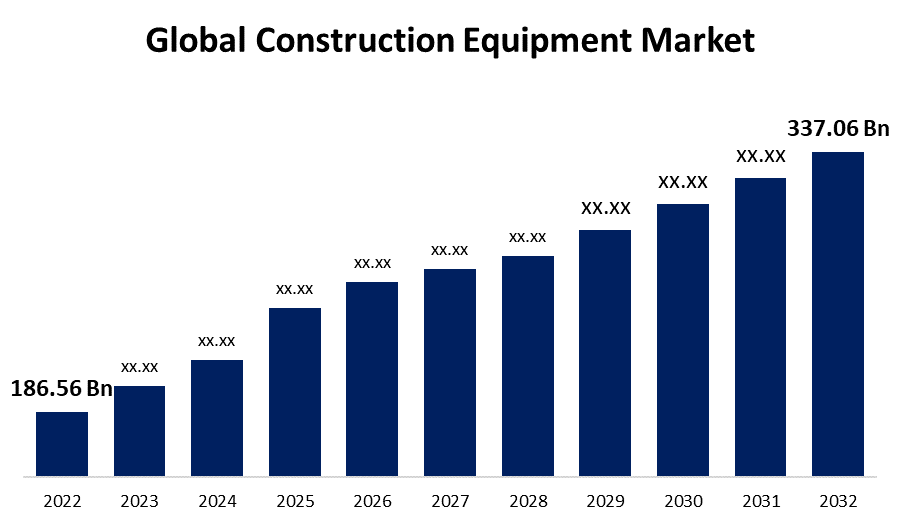

- The Construction Equipment Market Size was valued at USD 186.56 Billion in 2022.

- The Market is Growing at a CAGR of 6.09% from 2022 to 2032

- The Worldwide Construction Equipment Market Size is expected to reach USD 337.06 Billion by 2032

- Europe is expected To Grow the fastest during the forecast period

Get more details on this report -

The Global Construction Equipment Market Size is expected to reach USD 337.06 billion by 2032, at a CAGR of 6.09% during the forecast period 2022 to 2032. The global financial market has a significant impact on the construction industry. Product demand is frequently driven by new construction projects. As increasing urbanization accelerates, investments from the public and private sectors in the development of infrastructure are expected to fuel demand for the construction equipment market.

Construction equipment is commonly referred to as heavy-duty vehicles and other machinery that are specifically designed to carry out construction tasks. These tasks most frequently involve large-scale earthmoving operations or other construction projects. These construction machines typically include a material handler, grader, track-type, excavator, skid-steer, track loader, backhoe, paving, hydromatic tool, pipelayer, compactor, loader, and others. These machines are used for a variety of tasks such as the drilling process, hauling, excavating, paving, grading, lifting, and so on. Construction equipment and related supplies are essential components for any building construction or infrastructure project. In addition, construction equipment production companies are attempting to constantly keep up with rapidly evolving technology, emerging market norms, cost-cutting initiatives, and the constantly evolving demands of their consumers. They are therefore focusing on the market needs and implementing technological modifications that cater to the general demands. The Caterpillar and Komatsu are two of the world's largest manufacturers of construction equipment, including excavation equipment, wheel loaders, pavers, and concrete mixing equipment.

Global Construction Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 186.56 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.09% |

| 2032 Value Projection: | USD 337.06 Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Equipment Type, By Product Type, By End User, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Sany, Manitou BF, Zoomlion, John Deere, Komatsu, HIAB, Volvo AB, Escorts Limited, CNH Industrial N.V., Sumitomo Heavy Industries, Ltd., Terex Corporation, Kobelco Construction Machinery Co., Ltd, Liebherr-International Deutschland GmbH, Hidromek, Hyundai Heavy Industries, Ingersoll Rand, J C Bamford Excavators Ltd., New Holland, Track Marshall, Caterpillar, Hitachi Construction Machinery Co., Ltd., Volvo Construction Equipment, Xuzhou Construction Machinery Group |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

Following the outbreak of the pandemic in 2020, the construction equipment market grew gradually owing to a resurgence of stalled construction projects and organized additional investments in the construction industry as part of the growth in infrastructure projects. Infrastructure investments, developments to both residential and commercial infrastructures, and an increase in corporate capital spending on a global scale include some factors boosting the development of construction equipment manufacturers.

Furthermore, the increasing popularity of electric construction equipment is expected to create new revenue streams for Original Equipment Manufacturers over the forecast period. These battery-operated tools offer a variety of advantages, such as a lower expense for upkeep, much fewer disturbances from vibration, and improved operator comfort for field technicians. They are currently in the stages of development but are expected to increase in number over the duration of the forecast.

The growing emphasis on construction projects as well as the advancement of digitization, connectivity, and automation in construction and manufacturing applications, has had an enormous influence on the market's expansion. The railways and roadways construction machinery market has grown significantly in the past decade as a result of more extensive development projects implemented by central and regional governments, particularly in the Asia Pacific region. Furthermore, due to the high cost of construction equipment and their upkeep, the demand for renting or leasing construction equipment has grown significantly. Rental service providers supply the equipment, as well as the necessary skilled equipment operators and commuters. Furthermore, rental companies are preparing to capitalize on emerging technologies in order to meet the increasing demand for technologically advanced construction machinery and substitute older fleets combined with modernized or improved machinery fleets.

Restraining Factors

However, the majority of the challenges to the adoption of the construction equipment market during the forecast period are anticipated to be the high initial upfront costs. In addition, the overall absence of qualified and experienced operators is impeding the widespread utilization of construction equipment. Furthermore, the government's strict regulations for mining and construction operations as well as legislation prohibiting machinery from emitting carbon dioxide are expected to slow the expansion of the market for construction equipment.

Market Segmentation

By Equipment Type Insights

The material handling equipment segment is dominating the market with the largest revenue share over the forecast period.

On the basis of equipment type, the global construction equipment market is segmented into earthmoving equipment, material handling equipment, heavy construction vehicles, and others. Among these, the material handling equipment segment is dominating the market with the largest revenue share of 38.7% over the forecast period. . It is attributed to a rise in the demand for crawler cranes used in non-residential construction, particularly in the industrial, manufacturing, and commercial construction industries. Storage, control, and protection of materials, goods, and products in manufacturing, distribution, consumption, and disposal are examples of material handling actions. Cranes are frequently used for such tasks. Cranes, for instance, are utilized for hoisting massive objects such as stones, sculptures, and other heavy materials from locations such as truck beds, grounds, and more. The demand for the material handling equipment segment is expected to be driven by increasing industrial construction operations and the growth of commercial initiatives during the predicted time frame.

By Product Type Insights

The excavators segment dominated the market and accounted for the largest revenue share of over the forecast period.

On the basis of product type, the global construction equipment market is segmented into wheel bulldozers, front loaders, dump trucks, backhoe loaders, graders, crawler dozers, compactors, excavators, forklifts, concrete mixer trucks, and others. Among these, the excavators segment dominated the market and accounted for the largest revenue share of over the forecast period. The digging of the construction site is typically carried out with excavators. Due to the fact that almost all construction sites require digging work, it is a very common piece of equipment. Furthermore, the market share for wheeled loaders is estimated to be the second-largest in the construction equipment market. In the construction, quarry, and crusher segments, this construction equipment is mainly utilized for laden/unladen and bulk material transportation. These are commonly employed in large-scale infrastructure construction projects like highways and roadways, train lines, and the construction of dams, ports, and airports. As a result, its affordable price, lightweight design, and low operating costs are expected to boost the use of wheeled loaders in the construction sector.

By End Users Insights

The construction & infrastructure segment accounted the largest revenue share of more than 55% over the forecast period.

On the basis of end users, the global construction equipment market is segmented into oil & gas, construction & infrastructure, manufacturing, mining, and others. Among these, construction & infrastructure are dominating the market with the largest revenue share of 75% over the forecast period. This segment’s growth is anticipated to be fueled by increasing construction activity around the world. Infrastructure, including residential and commercial ones, as well as roads, rails, and other public works, are constructed using construction equipment. The market's general demand is expected to rise as the popularity of highly technological construction equipment rises.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 54.2% market share over the forecast period. Government initiatives to support construction projects in developing nations like China, India, and Southeast Asian nations are mainly contributing to the construction equipment market growth. The development of the public-private partnership (PPP) model is anticipated to benefit from an increase in the number of supportive government policies over the course of the forecast period, which is also expected to be positive for the market for construction equipment. Furthermore, the Asia Pacific region's growing population, particularly in China, India, and South Asia, demands the construction of upgraded facilities such as residences, educational institutions, medical facilities, and venues like stadiums, government establishments, and airports as well. In addition, due to lower housing costs and growing urbanization in India and China, the need for construction equipment is rising in the residential development market. Furthermore, China is one of the world's largest exporters of construction equipment.

Europe, on the other hand, is expected to grow the fastest during the forecast period, due to increasing consumer demand for new housing units, improved employment levels, and further developments. Furthermore, Europe is expected to have a significant opportunity for development over the forecast period because Germany is home to Europe's best-performing machine and equipment sector. Additionally, the development of this market in North America is being aided by the notable companies Caterpillar and Sany America's strong presence. The market for these companies in North America is also anticipated to be influenced by the direct initiatives made by these businesses in terms of technological advancements, strategic alliances, acquisitions, and a focus on third-party offerings.

List of Key Market Players

- Sany

- Manitou BF

- Zoomlion

- John Deere

- Komatsu

- HIAB

- Volvo AB

- Escorts Limited

- CNH Industrial N.V.

- Sumitomo Heavy Industries, Ltd.

- Terex Corporation

- Kobelco Construction Machinery Co., Ltd

- Liebherr-International Deutschland GmbH

- Hidromek

- Hyundai Heavy Industries

- Ingersoll Rand

- J C Bamford Excavators Ltd.

- New Holland

- Track Marshall

- Caterpillar

- Hitachi Construction Machinery Co., Ltd.

- Volvo Construction Equipment

- Xuzhou Construction Machinery Group

Key Market Developments

- On February 2023, Hitachi Construction Machinery Co., Ltd. begins production of remanufactured parts for construction machinery, such as medium to large-sized hydraulic excavators and medium-sized wheel loaders, in March 2023 at Hitachi Construction Machinery Southern Africa Co., (Pty) Ltd., Hitachi Construction Machinery's base for sales and services in the Republic of South Africa. In Southern Africa, Hitachi Construction Machinery Zambia and H-E Parts are currently collaborating to remanufacture parts for mining machinery such as ultra-large hydraulic excavators and dump trucks.

- On May 2022, Tangent Energy Solutions (US), a provider of energy-as-a-service (EaaS), was acquired by Caterpillar. Tangent Energy Solution's EaaS offerings complement Caterpillar's broad portfolio of electric power products, allowing Caterpillar to better serve customers by providing them with reliable, efficient, sustainable, and connected power solutions that support business operations.

- On December 2022, Komatsu announced the acquisition of GHH Group GmbH (GHH), a manufacturer of underground mining, tunneling, and special civil engineering equipment based in Gelsenkirchen, Germany. Komatsu intends to maintain GHH's excellent service and to support business as usual following the acquisition. The combined team will then collaborate to expand Komatsu's underground mining equipment offering and increase customer access to products in new markets.

- On December 2022, Caterpillar Inc. announced a partnership with Luck Stone, the nation's largest family-owned and operated producer of crushed stone, sand, and gravel, to deploy Caterpillar's autonomous solution at the Bull Run Plant in Chantilly, Virginia. This will be Caterpillar's first autonomous deployment in the aggregates industry, and it will add the 100-ton-class (90-tonne-class) Cat® 777 to the company's autonomous truck fleet. This project promotes the acceleration of autonomous technology for operations with fewer mobile assets, allowing for a significant increase in safety and productivity, as is currently seen in large mining operations.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Construction Equipment Market based on the below-mentioned segments:

Construction Equipment Market, Equipment Type Analysis

- Earthmoving Equipment

- Material Handling Equipment

- Heavy Construction Vehicles

- Others

Construction Equipment Market, Equipment Type Analysis

- Wheel Bulldozer

- Front Loaders

- Dump Trucks

- Backhoe loader

- Grader

- Crawler Dozers

- Compactors

- Excavators

- Forklifts

- Concrete Mixer Truck

- Others

Construction Equipment Market, End User Analysis

- Oil & gas

- Construction & Infrastructure

- Manufacturing

- Mining

- Others

Construction Equipment Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?