Global Construction Glass Market Size, Share, and COVID-19 Impact Analysis, By Application (Commercial, Residential, and Others), By Type (Flat Glass, and Special Glass), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Construction & ManufacturingGlobal Construction Glass Market Insights Forecasts to 2033

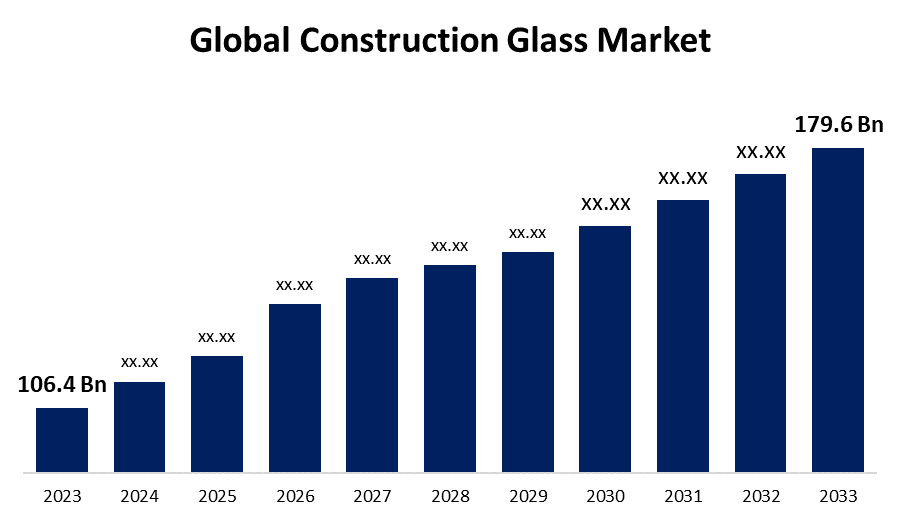

- The Global Construction Glass Market Size was Valued at USD 106.4 Billion in 2023

- The Market Size is Growing at a CAGR of 5.37% from 2023 to 2033

- The Worldwide Construction Glass Market Size is Expected to Reach USD 179.6 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Construction Glass Market Size is Anticipated to Exceed USD 179.6 Billion by 2033, Growing at a CAGR of 5.37% from 2023 to 2033.

Market Overview

Construction glass, a solid material widely used in construction for purposes such as windows, doors, skylights, and more, consists of various types, each possessing distinct properties. Toughened glass, also referred to as tempered or safety glass is designed to reduce the likelihood of breakage and shatter into smaller, safer pieces if it does break. This type of glass finds common applications in household interiors such as shower screens, kitchen splashbacks, and swimming pool fencing. Chromatic glass serves the purpose of protecting interiors from sunlight, while energy-efficient glass aids in lowering building energy costs. Insulated glazing provides additional thermal insulation, and annealed float glass is recognized as high-quality structural glass suitable for construction purposes. The selection of glass type is based on the specific requirements of each individual project. While the fundamental components of glass include silica, lime, and soda, the addition of various substances allows for the attainment of different qualities.

For Instance, the Environmental Protection Agency (EPA) plans to launch a labeling system and directory in 2026, to help consumers easily identify and purchase materials with lower carbon footprints. This initiative will also establish clean material requirements for publicly funded projects by federal agencies and is expected to be adopted by local authorities, universities, and the private sector. The initial focus of the $100 million program will be on labeling concrete, glass, asphalt, and steel due to their high embodied emissions and large government purchase volumes. According to the EPA, the US federal government, which spent over $694 billion on procurement in 2022, is the world's largest purchaser of goods and services. It is estimated that government-funded projects account for over 50% of all concrete used in the US and generate more than 30% of the country's construction-related emissions.

Report Coverage

This research report categorizes the market for construction glass based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the construction glass market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the construction glass market.

Global Construction Glass Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 106.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.37% |

| 2033 Value Projection: | USD 179.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By Type, By Region |

| Companies covered:: | S.A. Bendheim Ltd., AGC Glass Company North America, Inc., Schott AG, Central Glass Co. Ltd., PPG Industries, Inc., Saint-Gobain S.A., Nippon Sheet Glass Co., Ltd., JE Berkowitz, LP, AGNORA, Guardian Industries Corp Ltd., China Glass Holdings Limited, Xinyi Glass Holdings Limited, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The increasing demand for energy-efficient and environmentally friendly building materials, as well as the growth of urbanization and infrastructure development globally, is the primary driver of the construction glass market. Architects and builders are turning to advanced glass products that provide thermal insulation, UV protection, and visual appeal as cities expand and the need for modern residential and commercial buildings rises. Furthermore, government initiatives that promote green construction practices and the adoption of smart glass technologies contribute to the market's growth, enabling better energy management and comfort in buildings. These factors collectively create a strong demand for construction glass in various sectors, including residential, commercial, and industrial applications.

Restraining Factors

The construction glass market encounters various factors that can impede its growth. The high production costs related to advanced glass technologies, such as tempered and laminated glass, may make these products less accessible for projects with budget constraints. Moreover, fluctuations in raw material prices and disruptions in the supply chain can affect manufacturers' ability to maintain competitive pricing. Environmental concerns surrounding glass recycling and waste management also present challenges as the construction industry increasingly prioritizes sustainability.

Market Segmentation

The construction glass market share is classified into application and type.

- The commercial is estimated to hold the highest market revenue share through the projected period.

Based on the type, the construction glass market is classified into commercial, residential, and others. Among these, the commercial segment is estimated to hold the highest market revenue share through the projected period. The demand for contemporary and visually appealing designs incorporating energy-efficient glazing systems is increasing as urban areas undergo significant investments in commercial infrastructure. These developments not only improve the aesthetic appeal of nonresidential buildings but also lead to energy savings and enhanced occupant comfort. Moreover, the growing emphasis on sustainable building practices and regulatory mandates for energy efficiency are propelling the adoption of high-performance glass solutions in commercial projects, further establishing the nonresidential segment's strong foothold in the market.

- The special glass segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the construction glass market is divided into flat glass and special glass. Among these, the special glass segment is anticipated to hold the largest market share through the forecast period. This is due to its wide range of uses and technological advancements that meet specific industry needs. This category includes products like tempered glass, laminated glass, and smart glass, which provide improved safety, security, and energy efficiency. The increasing demand for unique architectural designs and the growing focus on sustainability are fueling the use of special glass in residential and commercial settings. Additionally, the expansion of smart buildings incorporating intelligent glass solutions that can adapt transparency and heat retention based on environmental conditions is a major driver of the market's expansion. As industries strive to enhance both functionality and visual appeal, the special glass segment is positioned to become a dominant force in the overall construction glass market.

Regional Segment Analysis of the Construction Glass Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the construction glass market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the construction glass market over the predicted timeframe. Rapid urbanization, substantial infrastructure development, and increased investments in residential and commercial construction projects are leading to a construction boom in countries like China and India. This is primarily driven by population growth, rising disposable incomes, and government efforts to enhance urban infrastructure. Furthermore, the region's emphasis on sustainable building practices and energy-efficient solutions is amplifying the demand for advanced glass products such as low-E glass and insulated glazing. With the influx of multinational companies and technological advancements in glass manufacturing, the Asia Pacific region is increasingly positioned as a key player in the global construction glass landscape.

North America is expected to grow at the fastest CAGR growth of the construction glass market during the forecast period. The construction sector's strong recovery and the increasing focus on sustainable building practices are driving growth in the region. Stringent building codes and regulations have led to a heightened emphasis on energy efficiency, creating demand for advanced glass solutions like low-emissivity (low-E) glass and smart glass technologies. The use of high-performance glass is being encouraged in residential and commercial projects due to the rise of green building initiatives and the integration of innovative architectural designs. North America's substantial investments in infrastructure and the growing trend toward urban revitalization position it well to lead the market's growth, attracting both domestic and international players to take advantage of emerging opportunities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the construction glass market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- S.A. Bendheim Ltd.

- AGC Glass Company North America, Inc.

- Schott AG

- Central Glass Co. Ltd.

- PPG Industries, Inc.

- Saint-Gobain S.A.

- Nippon Sheet Glass Co., Ltd.

- JE Berkowitz

- LP

- AGNORA

- Guardian Industries Corp Ltd.

- China Glass Holdings Limited

- Xinyi Glass Holdings Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Saint-Gobain Glass India joined forces with 'Build Ahead', a coalition spearheaded by Xynteo, to expedite decarbonization efforts in the Indian construction industry. This cooperation is designed to help India in its aspiration to achieve net-zero emissions by 2070. The announcement of this partnership took place at 'The Exchange' event in New Delhi in February 2024.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the construction glass market based on the below-mentioned segments:

Global Construction Glass Market, By Application

- Commercial

- Residential

- Others

Global Construction Glass Market, By Type

- Flat Glass

- Special Glass

Global Construction Glass Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the construction glass market over the forecast period?The construction glass market is projected to expand at a CAGR of 5.37% during the forecast period.

-

2. What is the market size of the construction glass market?The Global Construction Glass Market Size is Expected to Grow from USD 106.4 Billion in 2023 to USD 179.6 Billion by 2033, at a CAGR of 5.37% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the construction glass market?Asia Pacific is anticipated to hold the largest share of the construction glass market over the predicted timeframe.

Need help to buy this report?