Global Construction Plastics Market Size, Share, and COVID-19 Impact Analysis, By Type (Polyvinyl Chloride (PVC), Polystyrene (PS), Acrylics, Polyurethanes (PU), Thermoplastic Elastomers (TPE), Composite Materials, and Others), By Application (Pipes, Insulation, Flooring and Decking, Door Fittings, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Construction Plastics Market Insights Forecasts to 2033

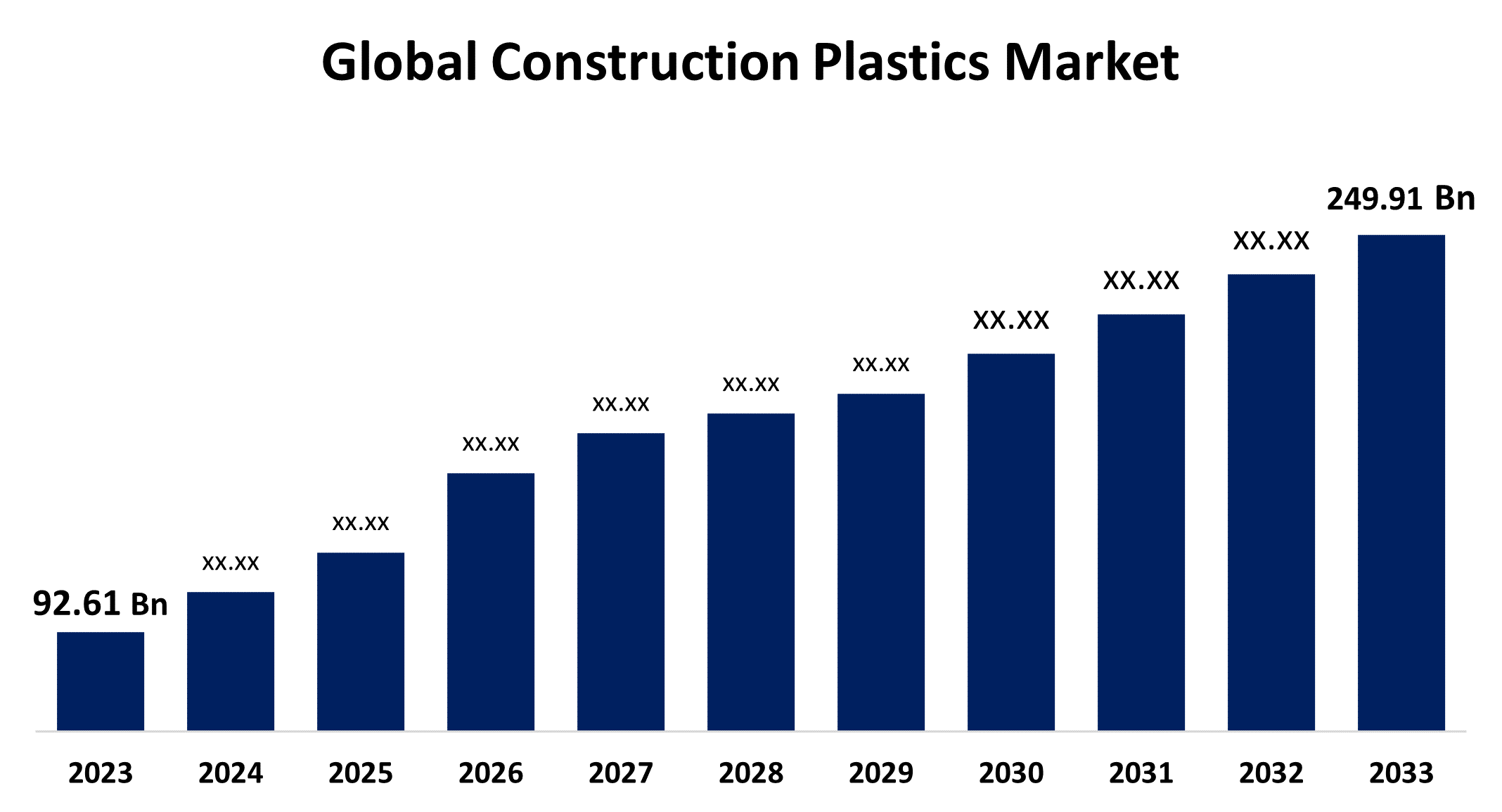

- The Global Construction Plastics Market Size was Valued at USD 92.61 Billion in 2023

- The Market Size is Growing at a CAGR of 10.44% from 2023 to 2033

- The Worldwide Construction Plastics Market Size is Expected to Reach USD 249.91 Billion by 2033

- The Middle East and Africa are Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Construction Plastics Market Size is Anticipated to Exceed USD 249.91 Billion by 2033, Growing at a CAGR of 10.44% from 2023 to 2033.

Market Overview

Plastics are synthetic or semi-synthetic organic polymers procured from petrochemicals or renewable sources. Construction plastics are a varied class of synthetics that find widespread applications in the construction arena for diverse purposes. These materials are subjected to a whole range of applications in construction. Various applications include piping, siding, insulation, panels, and even transparent building facades. This can be said to be versatile, strong, durable, and resistant to water and corrosion. Besides, they are lightweight, easily movable, and do not rot, or rust and also do not require repainting very frequently. Some of the general plastics utilized in building and construction include acrylics, composites, expanded polystyrene, ETFE, polycarbonate, polyethylene, polypropylene, and polyvinyl chloride or PVC. The industry of construction uses about 25% of the world's total consumption of plastic.

Such as, in February 2024 it was available for the first time: Ccycled products produced at one of its sites in the United States on feedstock from plastic waste. Making use of its global experience in the field of ChemCycling, BASF is in a unique position to offer its customers high-quality building blocks from recycled feedstock meeting the ISCC+ requirements. The products are manufactured at the BASF TotalEnergies Petrochemicals (BTP) facility in Port Arthur, Texas. According to this, ChemCycling means using conventional production with recycling feedstock in relation to plastic waste as part of the raw material, which thereby displaces the fossil resources.

Report Coverage

This research report categorizes the market for construction plastics based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the construction plastics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the construction plastics market.

Global Construction Plastics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 92.61 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.44% |

| 2033 Value Projection: | USD 249.91 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Mitsubishi Chemical Corporation Arkema SA, Covestro AG, LG Chem Ltd., Formosa Plastics Corporation, Dow, DuPont, BASF SE, Asahi Kasei Corporation, LyondellBasell Industries Holdings B.V., Borealis AG, Solvay S.A., Saudi Basic Industries Corporation (SABIC), Berry Plastics Corporation, Total S.A., Security Matters, Ltd, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Some critical factors have driven up the growth rate in the construction plastics market. First, there is an increasing demand for lightweight and durable materials from various construction projects. Indeed, this accelerates the usage of plastic materials since they bear high resistance to corrosion, moisture, and chemicals and are suitable for a wide range of applications including roofing, flooring, and insulation. Apart from that, the growth of sustainable building due to increased awareness is encouraging the use of recyclable plastics, which also agrees with environmental laws and appeals to consumer preference. Technological advancement also improved the performance characteristic of construction plastic, hence making the product more attractive. Furthermore, rapid urbanization and infrastructure development in emerging economies have driven up demand for the market, as new constructions call for effective and economic materials. Overall, new applications, trends pertaining to sustainability, and city growth are all fueling the growth of the construction plastics market.

Restraining Factors

The factors that restrain the growth of the construction plastics market are not insignificant. Among these strong forces is the growth in concern over the environment due to plastic waste. Governments from many countries have started to put tight control on plastic production and waste disposal, thus placing a strain on regulatory matters that could hamper the growth of the market. In addition, the fluctuating prices of the raw materials used in crude oil affect the manufacturing cost and, consequently, the profit margin of the manufacturers. There are challenges from other materials such as wood, metal, or concrete that could have better-feasible alternatives with superior performance for a particular application. There is also a certain degree of skepticism among consumers concerning the safety and sustainability of plastics, which could retard its adoption. All these factors together create problems that may hinder the growth of the construction plastics market.

Market Segmentation

The construction plastics market share is classified intotype and application.

- The polyvinyl chloride (PVC) segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the construction plastics market is classified into polyvinyl chloride (PVC), polystyrene (PS), acrylics, polyurethanes (PU), thermoplastic elastomers (TPE), composite materials, and others. Among these, the polyvinyl chloride (PVC) segment is estimated to hold the highest market revenue share through the projected period. The preferred material is PVC because it is versatile, resistant, and the process is more economical, which allows for its application in all fields under various uses in construction. Its resistance to water, chemicals, and UV radiation enables PVC to work very well indoors and outdoors. It is applied on pipes, siding, windows, and flooring; there is a wide area of application for this kind of material. It also witnessed the development of PVC technology to incorporate improved formulations for better performance characteristics, such as resistance to fire and impact. Sustainable building is also building demand for recyclable PVC products today. The PVC segment will continue to capture the biggest market share during the forecast period, driven by its established presence and widening demand for resilient building materials due to increasing infrastructural development and urbanization.

- The pipes segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the construction plastics market is divided into pipes, insulation, flooring and decking, door fittings, and others. Among these, the pipes segment is anticipated to hold the largest market share through the forecast period. The wide applications of plastic pipes in plumbing, drainage, and irrigation systems contribute to the growth of the sector. Plastic pipes, especially PVC, are privileged to be light in weight, corrosion-resistant, and easy to lay. All these aspects make them preferred over traditional materials such as metal and concrete. Additionally, rising demands for effective water management systems and infrastructure developments in urban and rural areas are encouraging the demand for plastic pipes. Construction projects keep on rising at a tremendous rate and support the pipe segment dominance; manufacturing techniques innovations and product development would continue even after the construction projects.

Regional Segment Analysis of the Construction Plastics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

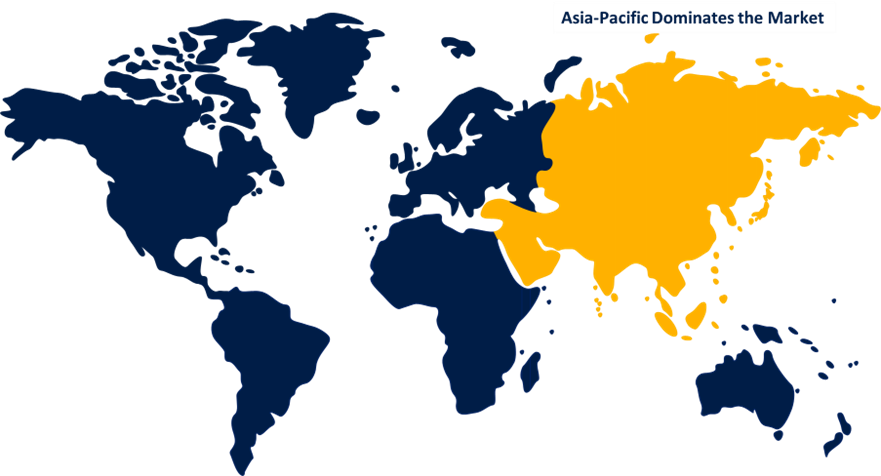

Asia Pacific is anticipated to hold the largest share of the construction plastics market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the construction plastics market over the predicted timeframe. The rapid urbanization and industrialization in countries like China and India have led to significant growth in the region, driving demand for various plastic materials in the booming construction sector, particularly for applications like pipes, roofing, and insulation. The adoption of construction plastics is being influenced by the increasing focus on sustainable building practices and energy-efficient solutions. The market growth is supported by the presence of a large number of manufacturers and suppliers, enhancing availability and reducing costs in the region. Overall, Asia Pacific is positioned as a key player in the construction plastics market due to its combination of economic growth, urban development, and technological advancements.

Middle East and Africa are expected to grow at the fastest CAGR growth of the construction plastics market during the forecast period. Ongoing infrastructure development projects and urbanization are fueling the growth of the construction plastics market in the region, driven by the rising demand for construction plastics as governments invest in housing, transportation, and commercial infrastructure. The adoption of innovative plastic materials is prompted by the growing emphasis on sustainable construction practices. The diverse climate in the region also drives the demand for durable and efficient construction solutions, further boosting the demand for construction plastics. As investment continues to flow into infrastructure projects, significant growth in the construction plastics sector is anticipated in the Middle East and Africa.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the construction plastics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Chemical Corporation Arkema SA

- Covestro AG

- LG Chem Ltd.

- Formosa Plastics Corporation

- Dow

- DuPont

- BASF SE

- Asahi Kasei Corporation

- LyondellBasell Industries Holdings B.V.

- Borealis AG

- Solvay S.A.

- Saudi Basic Industries Corporation (SABIC)

- Berry Plastics Corporation

- Total S.A.

- Security Matters, Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, Alltype Roofing Supplies, a roofing merchant based in London, introduced a specialized division for building plastics, marking its first venture beyond roofing products. The new division, Building Plastics on Demand, focuses on offering facias, guttering, roofing, plumbing, drainage, and outdoor living products from reputable brands like Polypipe and Brett Martin. This expansion complements the company's existing lineup of roofing solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the construction plastics market based on the below-mentioned segments:

Global Construction Plastics Market, By Type

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Acrylics

- Polyurethanes (PU)

- Thermoplastic Elastomers (TPE)

- Composite Materials

- Others

Global Construction Plastics Market, By Application

- Pipes

- Insulation

- Flooring and Decking

- Door Fittings

- Others

Global Construction Plastics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the construction plastics market over the forecast period?The construction plastics market is projected to expand at a CAGR of 10.44% during the forecast period.

-

2. What is the market size of the construction plastics market?The Global Construction Plastics Market Size is Expected to Grow from USD 92.61 Billion in 2023 to USD 249.91 Billion by 2033, at a CAGR of 10.44% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the construction plastics market?Asia Pacific is anticipated to hold the largest share of the construction plastics market over the predicted timeframe.

Need help to buy this report?