Global Construction Robots Market Size, Share, and COVID-19 Impact Analysis, By Type (Traditional Robots, Autonomous Robots, Robotic Arms, 3D Printing Robots, Demolition Robots), By Level of Automation (Fully Autonomous, Semi-Autonomous, and Remote Controlled), By Application (Commercial Buildings, Residential Buildings, Public Infrastructure, Industrial Construction), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Construction & ManufacturingGlobal Construction Robots Market Insights Forecasts to 2033

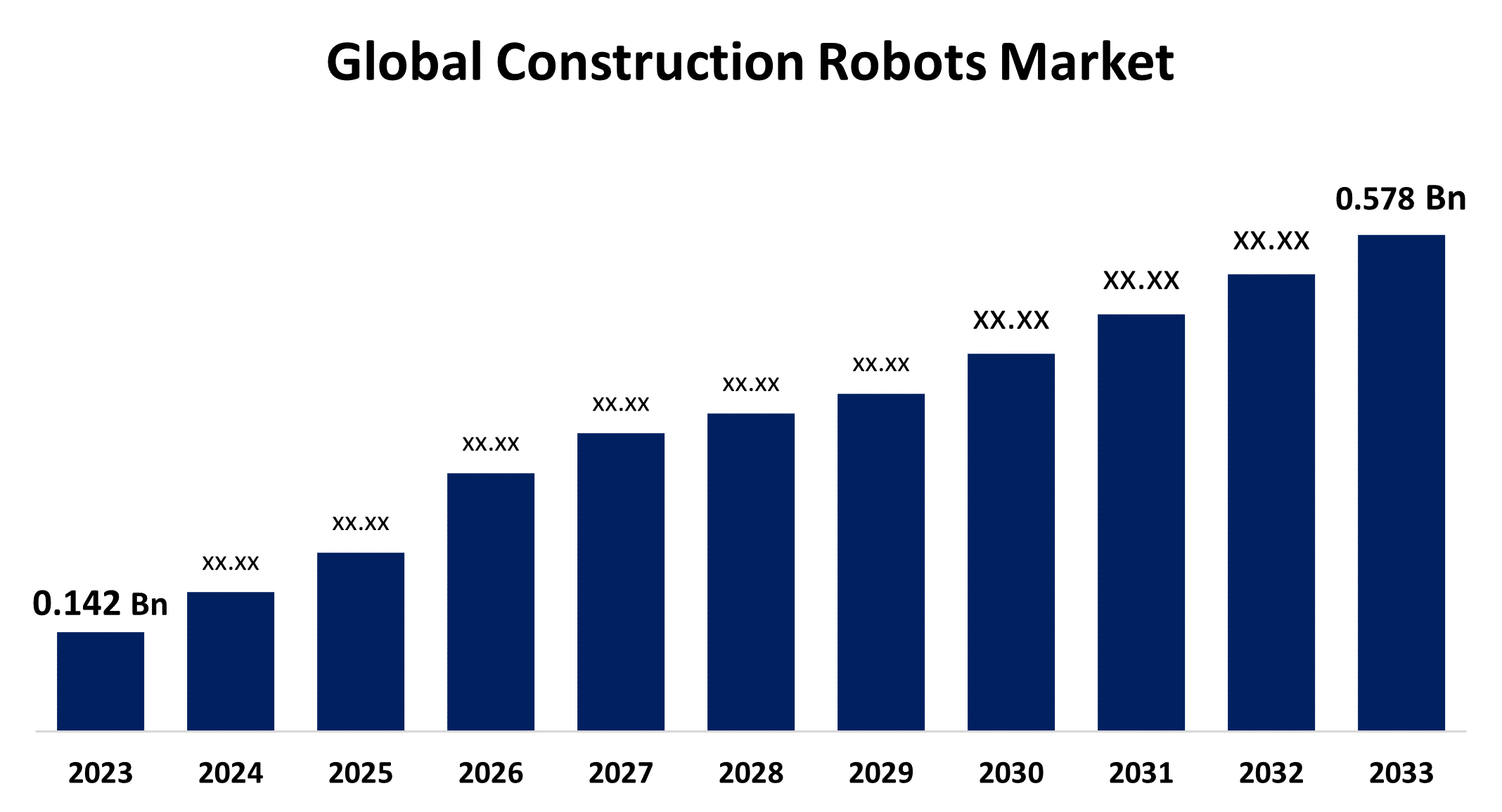

- The Global Construction Robots Market Size was Valued at USD 0.142 Billion in 2023

- The Market Size is Growing at a CAGR of 15.07% from 2023 to 2033

- The Worldwide Construction Robots Market Size is Expected to Reach USD 0.578 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Construction Robots Market Size is Anticipated to Exceed USD 0.578 Billion by 2033, Growing at a CAGR of 15.07% from 2023 to 2033.

Market Overview

Construction robots are also called “field robots” that operate in dynamic environments and are increasingly used in manufacturing and production due to their robustness, safety, efficiency, accuracy, and productivity. Equipped with sensors, cameras, and AI-driven systems, they navigate construction sites, analyze real-time data, and execute tasks with minimal human intervention. They perform tasks like bricklaying, concrete pouring, welding, demolition, and 3D printing. These systems can reduce construction time and increase safety by replacing humans in dangerous operations. The feasibility of using robots in building construction is determined by comparing the robotic versus manual performance of relevant tasks. With this feasibility analysis guidelines for developing future equipment can be carried out more economically. As per the data provided by the U.S. Census Bureau July 2024 construction spending was estimated at $2,162.7 billion, 0.3 percent below the revised June estimate of $2,169.0 billion.

Report Coverage

This research report categorizes the market for the global construction robots market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global construction robots market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global construction robots market.

Global Construction Robots Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 0.142 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 15.07% |

| 2033 Value Projection: | USD 0.578 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 209 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Level of Automation, By Application, By Region |

| Companies covered:: | Boston Dynamics, Caterpillar Inc., Komatsu, Cyberdyne, Trimble Inc., FANUC Corporation, KUKA AG, Samsung C&T Corporation, RoboBuilder, Advanced Construction Robotics, Schindler Group, Brokk AB, Makita Corporation, SANY Group, Xian Robotics, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Construction robots facilitate cost efficiency by reducing labor shortages, technological advancements in robotics, AI, machine learning, safety, and faster project completion. The declining skilled workforce necessitates automation, while robots reduce labor costs, improve productivity, and minimize delays. Safety is a key driver, as robots take over high-risk tasks, reducing accidents and ensuring safer working conditions. The growing trend of sustainable and smart construction practices also encourages the adoption of robotics to meet environmental and regulatory standards.

Restraining Factors

Construction robots face challenges due to high upfront costs, complex integration, inability to adapt to unpredictable environments, displacement concerns, regulatory restrictions, safety standards, and the need for constant maintenance and refurbishment. These factors render these robotic devices less applicable for small and medium-sized companies, and also ongoing technological advances and uncertainty about long-term performance and ROI can make some companies hesitant to invest.

Market Segmentation

The global construction robots market share is classified into type, level of automation, and application.

- The autonomous robots segment is expected to hold the largest share of the global construction robots market during the forecast period.

Based on the type, the global construction robots market is divided into traditional robots, autonomous robots, robotic arms, 3d printing robots, and demolition robots. Among these, the autonomous robots segment is expected to hold the largest share of the global construction robots market during the forecast period. The autonomous robot segment will see significant growth due to advances in AI and machine learning which enables these robots to perform tasks like site inspection, surveying, and monitoring with minimal human intervention. The demand for automation in large construction projects and their adaptability to different environments are driving the growth.

- The fully autonomous segment is expected to grow at the fastest CAGR in the global construction robots market during the forecast period.

Based on the level of automation, the global construction robots market is divided into fully autonomous, semi-autonomous, and remote-controlled. Among these, the fully autonomous robots segment is expected to grow at the fastest CAGR in the global construction robots market during the forecast period. The fully autonomous segment of the construction robotics market is expected to witness significant growth owing to advancements in artificial intelligence, machine learning, and sensor technologies. These robots can operate autonomously with minimal human intervention, increasing productivity, efficiency, and safety in complex construction projects. Increased focus on automation and the development of smart infrastructures supports the growth of this sector.

- The public infrastructure segment is expected to grow at the fastest CAGR in the global construction robots market during the forecast period.

Based on the application, the global construction robots market is divided into commercial buildings, residential buildings, public infrastructure, and industrial construction. Among these, the public infrastructure segment is expected to grow at the fastest CAGR in the global construction robots market during the forecast period. The public infrastructure segment is expected to experience the most growth in the construction robot market due to increased investment in large-scale infrastructure projects, driven by urbanization and government initiatives. Robots can enhance efficiency, reduce construction time, and improve safety in these complex projects.

Regional Segment Analysis of the Global Construction Robots Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

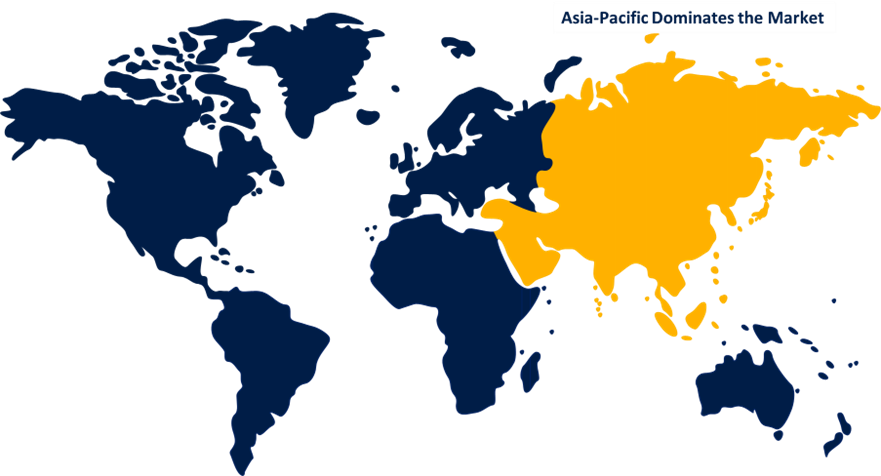

Asia Pacific is anticipated to hold the largest share of the global construction robots market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global construction robots market over the predicted timeframe. The region is expected to dominate the global construction robots market due to rapid urbanization, infrastructure development, and investment in technology. Countries like China and India are leading this growth, with government policies and advanced technologies driving the expansion. The region's strong manufacturing base and technological advancements also contribute to its dominance.

North America is expected to grow at the fastest pace in the global construction robots market during the forecast period. The construction robots market in this region is expected to grow due to advancements in robotics and automation technologies, as well as the need to improve productivity and safety in construction projects. The U.S. is a major player in this market, with significant investments in infrastructure development and labor shortages. Government initiatives supporting innovation and sustainability are expected to contribute to the growth of the construction robots market in this region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global construction robots market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Boston Dynamics

- Caterpillar Inc.

- Komatsu

- Cyberdyne

- Trimble Inc.

- FANUC Corporation

- KUKA AG

- Samsung C&T Corporation

- RoboBuilder

- Advanced Construction Robotics

- Schindler Group

- Brokk AB

- Makita Corporation

- SANY Group

- Xian Robotics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, GITAI USA successfully demonstrated its robotics technology for constructing a 5-meter-high communication tower in a lunar surface environment, marking a significant milestone in lunar infrastructure construction.

- In September 2023, ANELLO Photonics announced the availability of the ANELLO IMU+ with Optical Gyroscope Technology for various applications in autonomous construction, robotics, mining, trucking, and defense.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global construction robots market based on the below-mentioned segments:

Global Construction Robots Market, By Type

- Traditional Robots

- Autonomous Robots

- Robotic Arms

- 3d Printing Robots

- Demolition Robots

Global Construction Robots Market, By Level of Automation

- Fully Autonomous

- Semi-Autonomous

- Remote-Controlled

Global Construction Robots Market, By Application

- Commercial Buildings

- Residential Buildings

- Public Infrastructure

- Industrial Construction

Global Construction Robots Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Boston Dynamics, Caterpillar Inc., Komatsu, Cyberdyne, Trimble Inc., FANUC Corporation, KUKA AG, Samsung C&T Corporation, RoboBuilder, Advanced Construction Robotics, Schindler Group, Brokk AB, Makita Corporation, SANY Group, Xian Robotics, and Others.

-

2. What is the size of the global construction robots market?The Global Construction Robots Market is expected to grow from USD 0.142 Billion in 2023 to USD 0.578 Billion by 2033, at a CAGR of 15.07% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global construction robots market over the predicted timeframe.

Need help to buy this report?