Global Construction Tape Market Size, Share, and COVID-19 Impact Analysis, By Product (Double-Sided Tapes, Masking Tapes, Duct Tapes, and Other Tapes), By Application (Flooring, Walls & Ceiling, Windows, Doors, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Construction & ManufacturingGlobal Construction Tape Market Insights Forecasts to 2033

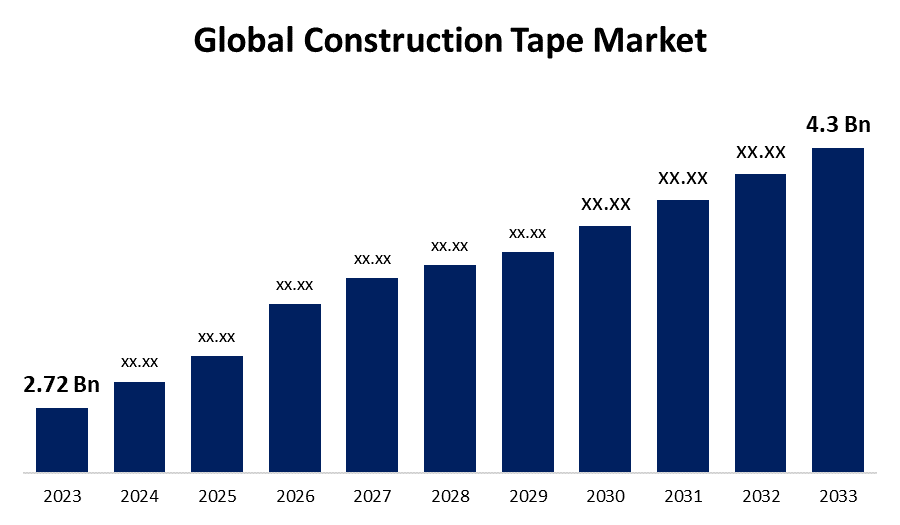

- The Global Construction Tape Market Size was Valued at USD 2.72 Billion in 2023

- The Market Size is Growing at a CAGR of 4.69% from 2023 to 2033

- The Worldwide Construction Tape Market Size is Expected to Reach USD 4.3 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Construction Tape Market Size is Anticipated to Exceed USD 4.3 Billion by 2033, Growing at a CAGR of 4.69% from 2023 to 2033.

Market Overview

Construction tape is a type of adhesive tape used for a variety of purposes in construction. Construction tape can be used to keep water out of assemblies, such as by sealing the seams of a water-resistive barrier (WRB). It can also be used to protect window and door sills and to seal penetrations through walls. Construction tape can be used to protect walls, floors, and other surfaces from paint, plaster, dirt, and debris. Masking tape is a common type of construction tape used for this purpose. Acrylic tape is a type of construction tape that can be used to create airtight seals on interior walls. Double-sided tape is a common type of construction tape used to hold insulation in place. Construction tape can be used to cover joints between drywall sheets before plastering. Construction tapes come in a variety of types, including duct tape, masking tape, electrical tape, carpet tape, and window glazing tape.

Report Coverage

This research report categorizes the market for construction tape based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the construction tape market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the construction tape market.

Global Construction Tape Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.72 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.69% |

| 2033 Value Projection: | USD 4.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By Region |

| Companies covered:: | L&L Products Inc., tesa SE, DuPont, 3M Company, PPG Industries, American Biltrite Inc., Adchem Corporation, Avey Dennison Corporation, Saint Gobain, Berry Plastics, Lintec, Jonson Tapes Limited, Scapa, Shurtape Technologies LLC, Henkel AG., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Rapid urbanization, population growth, economic development, and increase in construction activities are significantly impacting the global construction tape market. Demand for housing and infrastructure is rising, as an increasing number of people are shifting to urban areas. Green building practices require the usage of materials that are environmentally friendly and energy efficient. This includes the usage of specialized tapes for insulation and sealing. These environmentally friendly tapes help improve energy efficiency by reducing the amount of air leakage and improving insulation in buildings. The construction sector is increasingly focusing on fire safety. Fire-resistant tapes are designed to prevent the spread of fire and smoke in buildings.

Restraining Factors

PVC, PP, acrylic, SBR, plastics, and paper are the key raw materials used to manufacture tapes for various applications. Since crude oil is the source of these raw materials, changes in oil prices will probably affect raw material prices, which will then affect the total cost of the tape. Synthetic rubber is one of the primary raw materials for manufacturing adhesives. However, the prices of styrene-butadiene rubber (SBR) fluctuate owing to variations in crude oil prices, which are anticipated to affect the profitability of construction tape manufacturers.

Market Segmentation

The construction tape market share is classified into product and application.

- The masking tapes segment is estimated to hold the highest market revenue share through the projected period.

Based on the product, the construction tape market is classified into double-sided tapes, masking tapes, duct tapes, and other tapes. Among these, the masking tapes segment is estimated to hold the highest market revenue share through the projected period. This is due to the purpose of masking tape is to safeguard surfaces from overspray, leaks, and other types of damage. The affordability and dependability of masking tape make it especially attractive for industrial applications. The primary expense associated with masking tape is the adhesive, with silicone-based options being among the more costly. However, these costs are still significantly lower compared to other protective measures. Masking tape is engineered to meet a wide range of needs, from withstanding high temperatures in stove enamel applications to protecting moldings during painting. Its adaptability has led to its use extending beyond home painting to industrial settings, including automobile production lines.

- The walls & ceiling segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the construction tape market is divided into flooring, walls & ceilings, windows, doors, and others. Among these, the walls & ceiling segment is anticipated to hold the largest market share through the forecast period. Construction tapes offer quality covering between the plaster borders on walls and ceilings. Various types of tape can be used to cover walls and ceilings. Fiberglass drywall tape is among the options available. Both professionals and individuals who prefer to do things themselves can gain advantages from the robustness and long-lasting nature of fiberglass drywall tape. Fiberglass tape has gained widespread acceptance in the industry as a preferred choice for drywall repair, owing to its exceptional strength and capacity to effectively seal cracks and other imperfections on the surface.

Regional Segment Analysis of the Construction Tape Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the construction tape market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the construction tape market over the predicted timeframe. Rapid urbanization, extensive infrastructure development projects, and proactive government initiatives are driving the construction tape market in the Asia Pacific region. This surge in construction activity is generating a high demand for construction materials, including construction tapes. These tapes offer a cost-effective and time-saving alternative to traditional mechanical fasteners, aligning well with the priorities of builders in the APAC region who are focused on optimizing project timelines and budgets. Technological advancements in the region are further enhancing the appeal of construction adhesive tapes. Manufacturers are actively developing new and improved tapes that boast features such as enhanced durability, heat resistance, and suitability for diverse weather conditions.

North America is expected to grow at the fastest CAGR growth of the construction tape market during the forecast period. This is due to well-established construction industry, with its ongoing residential and non-residential projects, drives a consistent demand for various construction materials, including construction tapes. This sector’s emphasis on speed and efficiency further fuels the adoption of adhesive tapes, as they offer significant advantages over traditional mechanical fasteners. The faster application process of construction adhesive tapes enhances workflow efficiency and helps meet the industry’s focus on quicker project completion times. Technological advancements by North American manufacturers are continually pushing the boundaries of construction tape performance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the construction tape market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- L&L Products Inc.

- tesa SE

- DuPont

- 3M Company

- PPG Industries

- American Biltrite Inc.

- Adchem Corporation

- Avey Dennison Corporation

- Saint Gobain

- Berry Plastics

- Lintec

- Jonson Tapes Limited

- Scapa

- Shurtape Technologies LLC

- Henkel AG.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, DuPont added two new accessories to its commercial construction portfolio: DuraGard WD Self-Adhered Flashing Tape and LiquidArmor FJ Flashing and Joint Compound. Both products are designed to help provide air and water barrier continuity and integrate seamlessly with the DuPont ArmorWall System, a high-performance 5-in-1 exterior wall assembly.

- In January 2024, Sustainable materials company Bioaqualife launched a shrink wrap tape to provide the performance of traditional marine grade shrink wrap tapes while safely biodegrading in natural environments.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the construction tape market based on the below-mentioned segments:

Global Construction Tape Market, By Product

- Double-Sided Tapes

- Masking Tapes

- Duct Tapes

- Other Tapes

Global Construction Tape Market, By Application

- Flooring

- Walls & Ceiling

- Windows

- Doors

- Others

Global Construction Tape Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the construction tape market over the forecast period?The construction tape market is projected to expand at a CAGR of 4.69% during the forecast period.

-

2. What is the market size of the construction tape market?The Global Construction Tape Market Size is Expected to Grow from USD 2.72 Billion in 2023 to USD 4.3 Billion by 2033, at a CAGR of 4.69% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the construction tape market?Asia Pacific is anticipated to hold the largest share of the construction tape market over the predicted timeframe.

-

1. What is the CAGR of the construction tape market over the forecast period?The construction tape market is projected to expand at a CAGR of 4.69% during the forecast period.

-

2. What is the market size of the construction tape market?The Global Construction Tape Market Size is Expected to Grow from USD 2.72 Billion in 2023 to USD 4.3 Billion by 2033, at a CAGR of 4.69% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the construction tape market?Asia Pacific is anticipated to hold the largest share of the construction tape market over the predicted timeframe.

Need help to buy this report?