Global Consumer Automotive Financial Services Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Financing, Leasing, Insurance, and Others), By Provider (Banks, OEMs, Credit Unions, and Others), By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By End-User (Individual, Corporate), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Consumer Automotive Financial Services Market Insights Forecasts to 2033

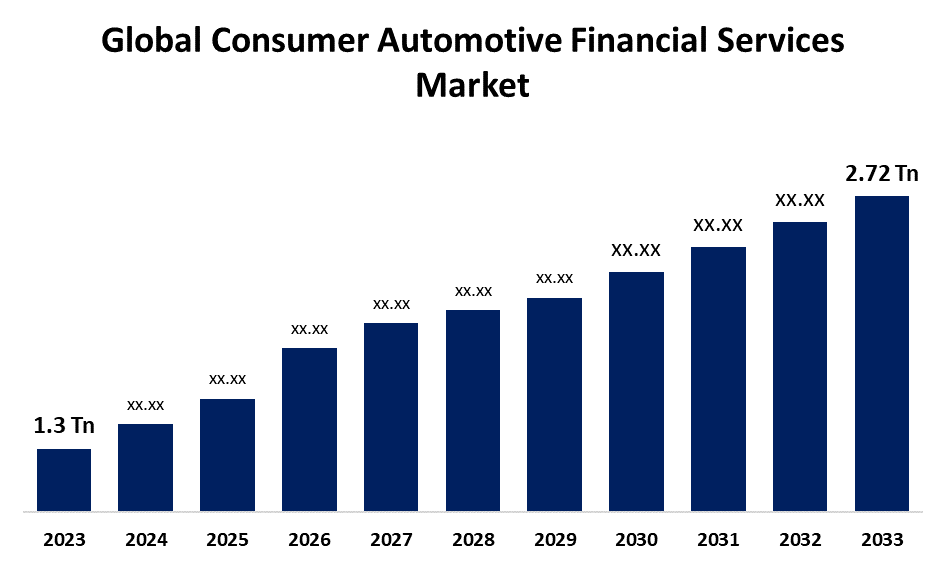

- The Global Consumer Automotive Financial Services Market Size Was Estimated at USD 1.3 Trillion in 2023

- The Market Size is Expected to Grow at a CAGR of around 7.66% from 2023 to 2033

- The Worldwide Consumer Automotive Financial Services Market Size is Expected to Reach USD 2.72 Trillion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Consumer Automotive Financial Services Market Size was valued at USD 1.3 Trillion in 2023 and is Expected to reach USD 2.72 Trillion by 2033, Growing at a CAGR of 7.66% from 2023 to 2033. The global market of consumer automotive financial services is driven by rising urbanization and growth, as there are more cars on the road globally, which increases the demand for financial aid to support vehicle maintenance and purchase. Younger consumers are increasingly choosing leasing over traditional ownership, which is fueling the growth of the automotive financial services industry. Consumer accessibility and transparency are enhanced by the digitalization of financial services, especially in the automobile finance industry, which also propels market growth.

Market Overview

The consumer automotive financial services industry includes the process of funding for the sale of pre-owned cars and new cars to buyers. This procedure includes prepaid service contracts, creditor insurance, extended warranties, and auto insurance. The rise of the consumer automotive financial services business is aided by the increase in sales of both new and used passenger automobiles due to growing customer demand.

Rising urbanization due to the continuous urban migrations, which provides many employment opportunities, helps to empower people economically by rising their income sources and amount. This increased income allows them to purchase a vehicle due to the growing consumer demand for personal mobility and convenience. These expanding cities increase the need for personal transportation. Also, the new features and improvements in car models attract buyers.

Moreover, rising personal income, cost-effectiveness, and evolving lifestyles contribute to higher car sales and an increased number of buyers. Changes in lifestyle and human behaviour position automobiles as status symbols and enhance the overall quality of life. As of the second quarter of 2024, there were approximately 291.1 million vehicles on American highways. In the United States, between the second quarter of 2023 and the second quarter of 2024, around 38.9 million used cars changed ownership, while nearly 15.5 million new car registrations were recorded during the same period. This number is expected to grow due to the rising per capita income and changing consumer behavior, respectively, with cars and other vehicles purchased.

Report Coverage

This research report categorizes the global consumer automotive financial services market based on various segments and regions, forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global consumer automotive financial services market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global consumer automotive financial services market.

Consumer Automotive Financial Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1.3 Trillion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.66% |

| 2033 Value Projection: | USD 2.72 Trillion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service Type, By Provider, By Vehicle Type, By End-User |

| Companies covered:: | Westpac Banking Corporation, Zurich Insurance Group Ltd., Ally Financial, Bank of America, LeasePlan, Hertz, Allstate, JPMorgan Chase & Co., Toyota Financial Services, Volkswagen Financial Services, Wells Fargo & Company., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The increasing employment and overall income of consumer leads to the enhanced interest towards using cars to build their status and lifestyle. Particularly, the awareness about the maintenance and increased expenses makes shifts towards automotive leasing facilities that are increasing due to the lower monthly payments, access to newer models, reduced maintenance costs, flexibility in vehicle choice, and lower financial risk from depreciation. These benefits make leasing an attractive option for many consumers seeking affordability and convenience. This increasing trend for leasing of the conventional ownership model has become popular among the young generation, which helps to drive the growth of automotive financial services.

Additionally, a growing trend of financial service providers and automotive companies forming strategic alliances that allow for creative solutions catered to specific client needs. The range of services provided has increased as a result of these collaborations, from traditional funding to subscription-based strategies. Another factor impacting the market is consumers' increasing preference for leasing and flexible ownership options over direct ownership. Younger consumers who value the flexibility to regularly improve cars without the obligations of ownership are particularly likely to make this shift. Furthermore, it is projected that the rise in global urbanization and the resulting need for customized mobility options will fuel the expansion of automotive financial services.

Restraints and challenges:

Concerned about economic uncertainty, such as incidences of a decline in business investment, which makes implementation of cost-cutting measures, and layoffs of workers. This reduces the consumer confidence, spending, and market volatility, further weakening demand for goods and services. this market volatility and employment instability deter customers from committing to long-term financial obligations like car loans and leases. which may hamper the growth of the consumer automotive financial services industry.

Market Segmentation

The global consumer automotive financial services market share is classified into service type, provider, vehicle type, and end-user.

- The Financing segment secured a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the service type, the global consumer automotive financial services market is separated into financing, leasing, insurance, and others. Among these, the financing segment held a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. This significance shares because it immediately addresses the need for individuals and businesses to be able to purchase cars without having to pay the full amount up front. With auto finance, consumers may spread out the cost of a car over time, which makes big expenditures more manageable. The availability of many financing options, including hire purchases and loans, has increased this service's appeal. In order to make financing an alluring choice for customers, financial institutions and automakers have collaborated to create enticing packages with competitive interest rates.

- The banks segment held a significant share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the provider, the global consumer automotive financial services market is categorized as banks, OEMs, credit unions, and others. Among these, the banks segment held a significant share in 2023 and is expected to grow at a significant CAGR during the forecast period. Banks' substantial financial resources and developed customer trust allowed them to hold a sizable portion of the market. In order to give clients alluring loan packages, they usually work with auto dealers to offer a variety of leasing and financing options. Banks are reliable partners in automobile financial services, offering borrowers ease and security due to their extensive networks and proficiency in risk management.

- The passenger vehicles segment accounted for the highest share in 2023 and is anticipated to grow at a prominent CAGR during the forecast period.

Based on the vehicle type, the global consumer automotive financial services market is divided into passenger vehicles and commercial vehicles. Among these, the passenger vehicles segment accounted for the highest share in 2023 and is anticipated to grow at a prominent CAGR during the forecast period. This segmental growth is driven by a strong demand from customers for personal transportation choices. Low-cost financing options have been more widely available, which has significantly increased the number of people who can now own passenger cars. Increased urbanization and changing consumer behaviour are expected to support the growing demand for passenger cars in emerging regions as their economies develop.

- The individual segment held a significant share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-user, the global consumer automotive financial services market is classified into individual and corporate. Among these, the individual segment held a significant share in 2023 and is expected to grow at a significant CAGR during the forecast period. The increasing demands for personal vehicles and their major holdings by individual ownership raised the request for appropriate financial solutions. As consumers become more financially literate and aware of their options, the demand for personalized financial services is increasing. Also, these financial services offered by the schemes such as insurance, discount in vehicle maintenance services, and funding for the purchasing. These all things make it easy to purchase cars and increase vehicle ownership.

Regional Segment Analysis of the Global Consumer Automotive Financial Services Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global consumer automotive financial services market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global consumer automotive financial services market over the forecast period. This regional dominance is derived by offering streamlined processes, enhanced customer experiences, and increased accessibility. These platforms leverage technologies like AI, big data, and mobile applications to provide personalized financial solutions, faster loan approvals, and seamless transactions. This efficiency attracts more consumers.

Moreover, the prevalence of car ownership, the use of advanced online finance systems, and the rising demand from consumers for leasing services. In order to improve service delivery, emphasis is concentrated on expanding the options for auto financing and incorporating artificial intelligence (AI). According to a report published by House Grail, approximately one in four vehicles in the United States was leased. With around 286.9 million registered vehicles in the country, this means that about 71.7 million vehicles were on leasing service during 2024. The increasing demand for vehicle leasing services fuels the industry growth and improvements in technology, and a growing trend toward electric vehicles, which are aided by government subsidies. The market has expanded as a result of the integration of digital platforms, which has also improved consumer access to automotive financial services.

Asia Pacific consumer automotive financial services market is expected to grow with the fastest CAGR during the forecasting period. The increasing per capita income, growing urbanisation due to migration, as well as a growing middle class with a heightened desire for car ownership. In this region, countries like India, China and South Korea are involved with a majority of the middle-class population, which drives the inclination in the sale of cars and pre-owned cars in response to changing consumer behaviours with the trends. Also, increasing awareness among people and supportive government policies made it easier to purchase environmentally friendly vehicles or electric cars. Additionally, the rising adoption of digital financial services is also aiding in the market's expansion across the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global consumer automotive financial services market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Westpac Banking Corporation

- Zurich Insurance Group Ltd.

- Ally Financial

- Bank of America

- LeasePlan

- Hertz

- Allstate

- JPMorgan Chase & Co.

- Toyota Financial Services

- Volkswagen Financial Services

- Wells Fargo & Company.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, HSBC also launched SemFi, a joint venture with fintech company Tradeshift, to deliver embedded finance solutions to business clients.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global consumer automotive financial services market based on the below-mentioned segments:

Global Consumer Automotive Financial Services Market, By Service Type

- Financing

- Leasing

- Insurance

- Others

Global Consumer Automotive Financial Services Market, By Provider

- Banks

- OEMs

- Credit Unions

- Others

Global Consumer Automotive Financial Services Market, Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

Global Consumer Automotive Financial Services Market, By End-User

- Individual

- Corporate

Global Consumer Automotive Financial Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global consumer automotive financial services market over the forecast period?The global consumer automotive financial services market size was valued at USD 1.3 trillion in 2023 and is expected to reach USD 2.72 trillion by 2033, growing at a CAGR of 7.66% from 2023 to 2033.

-

2. Which region holds the largest share of the global consumer automotive financial services market?North America is estimated to hold the largest share of the global consumer automotive financial services market over the predicted timeframe.

-

3. Who are the top key players in the global consumer automotive financial services market?Westpac Banking Corporation, Zurich Insurance Group Ltd., Ally Financial, Bank of America, LeasePlan, Hertz, Allstate, JPMorgan Chase & Co., Toyota Financial Services, Volkswagen Financial Services, Wells Fargo & Company, and Others.

Need help to buy this report?