Global Consumer Finance Market Size, Share, and COVID-19 Impact Analysis, By Type (Secured Consumer Finance, Unsecured Consumer Finance), By Application (Bank & Financial Corporations, Non-Banking Financial Companies (NBFCs)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Consumer Finance Market Insights Forecasts to 2033

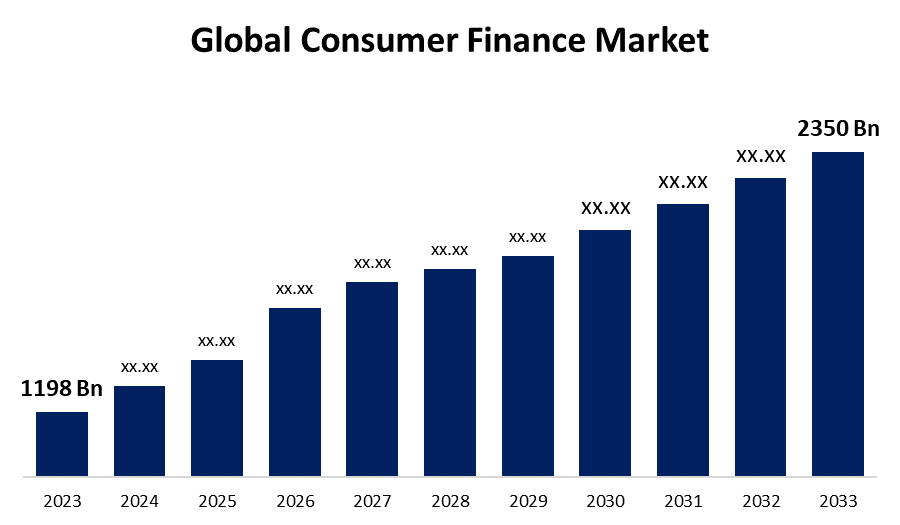

- The Global Consumer Finance Market Size was Valued at USD 1198 Billion in 2023

- The Market Size is Growing at a CAGR of 6.97% from 2023 to 2033

- The Worldwide Consumer Finance Market Size is Expected to Reach USD 2350 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Consumer Finance Market Size is Anticipated to Exceed USD 2350 Billion by 2033, Growing at a CAGR of 6.97% from 2023 to 2033.

Market Overview

Consumer financing allows individual customers to buy goods and services by payment through different types of loans at the point of sale. It provides various payment options other than debit cards, online payment, and cash. Consumer financing enables users to manage their cash flow and make purchases that would not have been possible with cash or debit cards. Consumer finance includes a wide range of financial products and services, such as installment plans, Buy Now Pay Later (BNPL), revolving credit, lease-to-own, and Business to Business (B2B) financing tailored according to the requirements of shoppers.

The consumer finance industry is continually changing and has a substantial impact on the economy. Some examples of consumer financing are credit cards, personal loans, mortgages, and automobile financing, providing individuals with the option to obtain funds for different purposes. The market is influenced by several factors, including consumer spending patterns and plans, economic circumstances, and regulatory policies. Therefore, financial firms and policymakers must observe and understand the dynamics of this market deeply. These insights help them in making informed decisions and ensure the stability and growth of the economy.

Furthermore, financial institutions keep modifying and updating their offerings to cater to the evolving needs of consumers, closely monitoring their spending habits. Hence, having a comprehensive understanding of the market dynamics is necessary for both financial institutions and policymakers to establish a strong and prosperous consumer finance system.

Report Coverage

This research report categorizes the market for the global consumer finance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global consumer finance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global consumer finance market.

Global Consumer Finance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1198 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 6.97% |

| 023 – 2033 Value Projection: | USD 2350 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 232 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | HSBC Group, Muthoot Finance, L&T Finance, Bank of America Corporation, Industrial and Commercial Bank of China, Citigroup Inc., BNP Paribas, Cholamandalam, Tata Capital, Wells Fargo, ICICI, Birla Global Finance, JPMorgan Chase & Co., LIC Housing Finance, Housing Development Finance Corporation, American Express Company, Bajaj Capital, Berkshire Hathaway Inc., Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

Technological advancements and changing customer preferences are causing big shifts in the consumer finance market. The access and use of financial services are being completely changed due to the digitalization of transactions, with a rise in mobile payments, online banking, and customized financial management tools. Financial inclusion Initiatives and sustainable investing are also gaining traction, which shows a larger cultural shift towards more inclusive and accountable financial practices.

The rise of fintech and embedded finance are other driving factors. Companies providing financial technology (Fintech) products and services are boosting the consumer finance sector. They provide technologically advanced financial products like automated wealth management tools, peer-to-peer lending platforms, and banking solutions optimized for mobile devices. The development of embedded finance enables the smooth incorporation of financial services into non-financial applications. Customers can now complete payments, access credit, and make investments directly from apps that they already use. The growth in customized banking options is also driving the consumer finance market.

Open banking laws are encouraging partnerships between fintech start-ups and established financial organizations. This makes it possible to share customer data with their permission and offer tailored financial services and products. The consumer finance industry is also improving because of the use of AI and ML. Automation of loan approvals, streamlining fraud detection, and customization of customer service interactions are all made possible by these technologies.

Restraining Factors

Changes in interest rates can significantly impact any company in the finance domain, including the consumer finance market. Higher interest rates increase the cost of loans, potentially reducing demand for loans. Conversely, very low interest rates might lead to excessive risk-taking and credit bubbles, which restrain the market growth. Moreover, strict regulatory requirements and compliance standards can pose challenges for lenders in the consumer finance market. Regulatory changes, especially those aimed at consumer protection or financial stability, might affect lenders, making it more challenging for some borrowers to access credit, hindering market growth.

The lack of security and privacy issues are other factors that might hamper the market growth. Security and safety issues are one of the most important disadvantages of digital payment. Improper and inefficient security might result in data loss and misuse for both consumers and businesses, resulting in stolen money for users and huge financial losses for business organizations. Insufficient privacy and anonymity are major concerns for digital payments among numerous people.

Market Segmentation

The global consumer finance market share is classified into type and application.

- The secured segment is expected to hold the largest share of the global consumer finance market during the forecast period.

Based on the type, the global consumer finance market is divided into secured consumer finance and unsecured consumer finance. Among these, the secured segment is expected to hold the largest share of the global consumer finance market during the forecast period. This is because it offers a high level of security to both lenders and borrowers. It offers risk reduction to lenders which increases their confidence in issuing loans by demanding collateral like house, land, or car. This allows them to offer lower interest rates to the borrowers. Moreover, secured consumer finance permits larger loan sums, rendering it an appealing choice for people seeking to finance significant acquisitions or consolidate debt.

- The bank & financial corporations segment is expected to grow at the fastest CAGR in the global consumer finance market during the forecast period.

Based on the application, the global consumer finance market is divided into bank & financial corporations, and non-banking financial companies (NBFCs). Among these, the bank & financial corporations segment is expected to grow at the fastest CAGR in the global consumer finance market during the forecast period. As they are established, have a strong reputation and brand recognition among consumers. Most consumers feel more comfortable trusting their finances with well-established banks that have been around for decades.

Furthermore, banking and financial firms often have a wider range of financial products and services, allowing consumers to access and manage all their banking needs in one place. This convenience factor works as an advantage for banks and financial corporations as it saves consumers time and effort to manage their finances, and they are ready to pay for the convenience.

Regional Segment Analysis of the Global Consumer Finance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global consumer finance market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global consumer finance market over the predicted timeframe. This is because the North American region has a well-established and strong financial infrastructure, with a deep-rooted banking system and a wide range of financial organizations, some are even backed by the government. This gives easy access to credit and other financial services, which, further drives consumer spending and economic growth.

It is also because of the global leaders of the BFSI sector in the USA and Canada, high-income levels, and high standard of living in this region. As technology progresses, an increasing number of individuals are turning to smartphones and other digital gadgets to manage their financials as they are faster and easier to access on the go. This trend has led to a significant rise in the popularity of consumer loans as it provides credit at the point of sale, and offer a hassle-free and secure method for accessing financial services. The widespread use of smartphones has opened up a vast opportunity for banks and other financial institutions to grow their customer base and provide tailored services to their clients.

Asia Pacific is expected to grow at the fastest pace in the global consumer finance market during the forecast period. The region has witnessed rapid economic growth in recent years, leading to a rise in disposable income. Also, the rise in the demand for consumer goods and services has led to a surge in demand for consumer finance. The region's substantial population base offers a wide customer base to cater to, thereby fuelling market expansion. The growth in this region can also be attributed to the rising GDP, number of businesses, income levels, and adoption of BFSI security solutions across India, China, Japan, and Australia.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global consumer finance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- HSBC Group

- Muthoot Finance

- L&T Finance

- Bank of America Corporation

- Industrial and Commercial Bank of China

- Citigroup Inc.

- BNP Paribas

- Cholamandalam

- Tata Capital

- Wells Fargo

- ICICI

- Birla Global Finance

- JPMorgan Chase & Co.

- LIC Housing Finance

- Housing Development Finance Corporation

- American Express Company

- Bajaj Capital

- Berkshire Hathaway Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, Mastercard announced partnerships with Instacart and Peacock to provide greater everyday value and convenience like online shopping and grocery delivery with Instacart, and streaming service subscription offering with Peacock.

- In April 2022, Consumer finance company Home Credit India partnered with Pine Labs to enhance its retail network.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global consumer finance market based on the below-mentioned segments:

Global Consumer Finance Market, By Type

- Secured Consumer Finance

- Unsecured Consumer Finance

Global Consumer Finance Market, By Application

- Bank & Financial Corporations

- Non-Banking Financial Companies (NBFCs)

Global Consumer Finance Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?HSBC Group, Muthoot Finance, L&T Finance, Bank of America Corporation, Industrial and Commercial Bank of China, Citigroup Inc., BNP Paribas, Cholamandalam, Tata Capital, Wells Fargo, ICICI, Birla Global Finance, JPMorgan Chase & Co., LIC Housing Finance, Housing Development Finance Corporation, American Express Company, Bajaj Capital, Berkshire Hathaway Inc., and Others.

-

2. What is the size of the global consumer finance market?The Global Consumer Finance Market is expected to grow from USD 1198 Billion in 2023 to USD 2350 Billion by 2033, at a CAGR of 6.97% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global consumer finance market over the predicted timeframe.

Need help to buy this report?