Global Consumer Foam Market Size By Type (Rigid Foam and Flexible Foam), By End-Use (Bedding & Furniture, Automotive), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Chemicals & MaterialsGlobal Consumer Foam Market Insights Forecasts to 2033

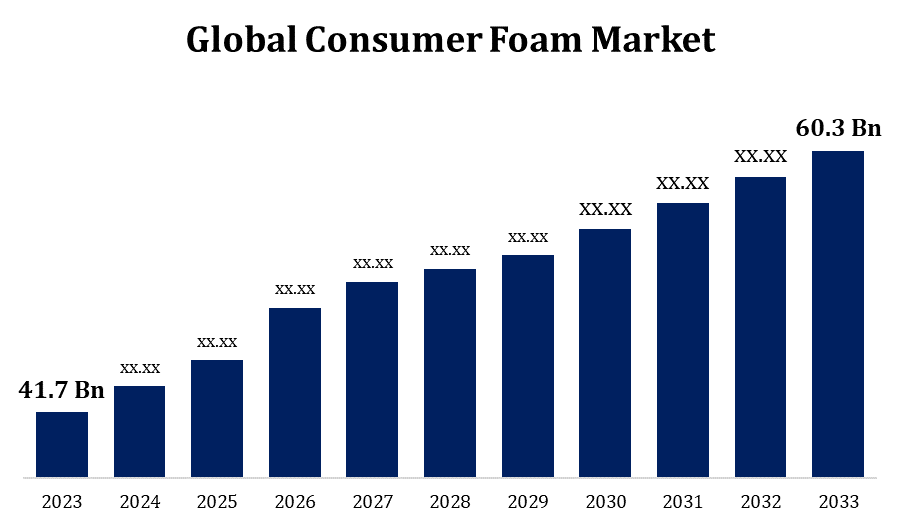

- The Global Consumer Foam Market Size was valued at USD 41.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.76% from 2023 to 2033.

- The Worldwide Consumer Foam Market Size is expected to reach USD 60.3 Billion By 2033.

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Consumer Foam Market is expected to reach USD 60.3 Billion by 2033, at a CAGR of 3.76% during the forecast period 2023 to 2033.

Customers are becoming more aware of the advantages of foam goods, such as increased comfort, durability, and support. This increased awareness increases demand for foam-based products such as mattresses, pillows, and furniture. As individuals realise the value of good sleep, there is an increasing demand for soft mattresses and pillows. Memory foam, latex, and other specialised foams meet this desire by offering customised and supportive sleep options. With the rise of e-commerce platforms, consumers now have easier access to a large range of foam items online. Direct-to-consumer mattress businesses, for example, use internet channels to reach a larger audience, hence driving market growth. Beyond beds, foam is used in a variety of industries, including automotive, packaging, and healthcare. These industries' progress adds to the overall growth of the consumer foam market. As customers prioritise products that contribute to their entire well-being, foam products designed to address health and wellness problems, such as orthopaedic mattresses or ergonomic pillows, are gaining momentum.

Consumer Foam Market Value Chain Analysis

The manufacture of raw ingredients such as polyurethane chemicals, latex, and other additives starts the value chain. These compounds are supplied by chemical suppliers to foam makers. Foam makers are critical players in the value chain. They employ the raw materials to make a variety of foams, including polyurethane foam, memory foam, and latex foam. Manufacturing may include mixing, moulding, and curing. Some foam products, particularly in industries such as automotive and furniture, necessitate the addition of extra components. Fabric covers, zippers, and other materials may be included. Suppliers of these components are part of the value chain as well. Foam is used in a variety of consumer products, including mattresses, pillows, furniture, and automobile components. The value chain includes companies that specialise in the assembly of these products. Following the assembly of the products, they must be distributed to shops or directly to consumers. Retailers are the final link before reaching the end consumer, whether through physical storefronts or online platforms. Individuals purchasing mattresses, pillows, or furniture for personal use are the ultimate users of foam items.

Consumer Foam Market Opportunity Analysis

Environmentally friendly foam products are in high demand. This rising market niche can be reached by developing and marketing foams manufactured from recycled materials, bio-based sources, or using sustainable production procedures. Smart mattresses with sleep-tracking capabilities or temperature-regulating foams, for example, can cater to the tech-savvy customer population. With an increasing emphasis on health and well-being, there is a potential to create foam products that are specifically tailored to address sleep disorders, orthopaedic issues, and overall well-being. The expansion of e-commerce offers tremendous potential to reach a larger consumer base. Direct-to-consumer formats and online sales platforms can be used to boost market reach and sales. Educating customers on the advantages of various foam types can impact their purchasing decisions.

Global Consumer Foam Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 41.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.76% |

| 2033 Value Projection: | USD 60.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By End-Use, By Region And Segment Forecasts, By Geographic Scope And Forecast |

| Companies covered:: | BASF SE, Covestro AG, Huntsman Corporation, INOAC Corporation, Recticel NV, Rogers Corporation, Sekisui Chemical Co. Ltd., The DOW Chemical Company, The Woodbridge Group, Ube Industries, Ltd., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Market Dynamics

Consumer Foam Market Dynamics

Rise of end-use sectors in developing countries

Rapid urbanisation and population expansion are common in developing countries. This increases demand for housing, furniture, and other consumer items, which drives demand for foam products in industries like furniture and bedding. Purchasing power rises when the middle class expands in developing countries. Middle-class consumers prefer higher-quality and more comfortable products, such as mattresses, couches, and other foam-based furniture, which contributes to market growth. Infrastructure projects such as housing, transportation, and commercial spaces are funded by developing countries. This increases the need for foam in the construction and automotive industries. Foam is utilised in automobile seating, interior components and building insulation. Increased demand for medical and orthopaedic items results from improvements in healthcare infrastructure and awareness.

Restraints & Challenges

Key raw material prices, such as polyurethane chemicals and latex, can be volatile. Fluctuations in raw material costs can have an impact on foam manufacturers' profit margins and lead to pricing issues in the market. Profit margins may be eroded as a result of price wars and aggressive pricing practices. To remain competitive, businesses must differentiate their products and emphasise value-added characteristics. Economic factors influence consumer spending patterns. Uncertainties, such as economic downturns, can have an impact on consumer spending power, affecting demand for foam goods. Natural disasters, geopolitical tensions, and global health crises can all interrupt the supply chain, causing production and delivery delays. To remain competitive, businesses must spend in research and development.

Regional Forecasts

North America Market Statistics

North America is anticipated to dominate the Consumer Foam Market from 2023 to 2033. The ease of internet buying has aided the expansion of the consumer foam market via e-commerce platforms. Direct-to-consumer approaches have grown in popularity, allowing customers to buy foam items online. There is a growing emphasis on environmentally friendly and sustainable foam products. North American consumers are becoming more cognizant of the environmental impact of their purchases, creating a demand for greener alternatives. In foam products, consumers prioritise comfort and health-related aspects. This includes pillows with ergonomic support and mattresses built for greater sleep quality. The North American consumer foam market is characterised by a varied spectrum of participants, ranging from well-established manufacturers to creative startups.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Rapid economic expansion in many APAC nations has contributed to an increase in consumer spending, propelling the consumer foam market forward. Foam is used in the automobile sector in APAC in car seats, headrests, and interior components. The growth of e-commerce platforms in the APAC area has made foam products more accessible to a broader consumer base. Direct-to-consumer business concepts are becoming increasingly common. The Asia-Pacific consumer foam market is a mix of domestic and international players. In terms of consumer trust and awareness, established brands and those with excellent marketing tactics typically have an advantage. Some APAC countries' diversified terrain and distribution constraints might cause logistical challenges, reducing supply chain efficiency.

Segmentation Analysis

Insights by Type

The flexible foam segment accounted for the largest market share over the forecast period 2023 to 2033. Polyurethane foams, for example, are renowned for their softness and flexibility, providing a high level of comfort. Because of this, they are suitable for use in mattresses, pillows, and upholstered furniture. Memory foam and other specialty foams, in particular, have gained favour in the bedding industry. Customers like how these foams adjust to the body, offering support and comfort for a good night's sleep. The increased emphasis on health and wellness has increased demand for ergonomic and orthopaedic foam products. Flexible foams are frequently used in mattresses and pillows that are intended to give optimal spinal alignment and support.

Insights by End Use

The bedding and furniture segment accounted for the largest market share over the forecast period 2023 to 2033. The rise of e-commerce has aided the expansion of the bedding and furnishings market. Direct-to-consumer approaches enable customers to purchase mattresses and furniture online, increasing market accessibility. The expansion of foam mattresses and pillows has been driven by consumer desire for pleasant sleeping options. Memory foam, latex foam, and other specialty foams support and conform to individual body forms, improving overall comfort. As people become more aware of the importance of sleep health, there is a greater demand for orthopaedic mattresses that give optimal spinal alignment and support. Consumers are actively educated about the benefits of foam in bedding and furniture, with aspects such as pressure alleviation, motion isolation, and breathability being highlighted.

Recent Market Developments

- In February 2020, Huntsman Corporation acquired Icynene-Lapolla (US), a manufacturer and supplier of spray polyurethane foam (SPF) insulation solutions for residential and commercial applications.

Competitive Landscape

Major players in the market

- BASF SE

- Covestro AG

- Huntsman Corporation

- INOAC Corporation

- Recticel NV

- Rogers Corporation

- Sekisui Chemical Co. Ltd.

- The DOW Chemical Company

- The Woodbridge Group

- Ube Industries, Ltd.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Consumer Foam Market, Type Analysis

- Rigid Foam

- Flexible Foam

Consumer Foam Market, End Use Analysis

- Bedding & Furniture

- Automotive

Consumer Foam Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?