Global Continuous Delivery Market Size, Share, and COVID-19 Impact Analysis, By Deployment (On-premise and Cloud), By Enterprise Size (SMEs and Large Enterprises), By End-use (BFSI, Telecommunications, Media and Entertainment, Retail and E-commerce, Healthcare, Manufacturing, Education, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Information & TechnologyGlobal Continuous Delivery Market Insights Forecasts to 2033

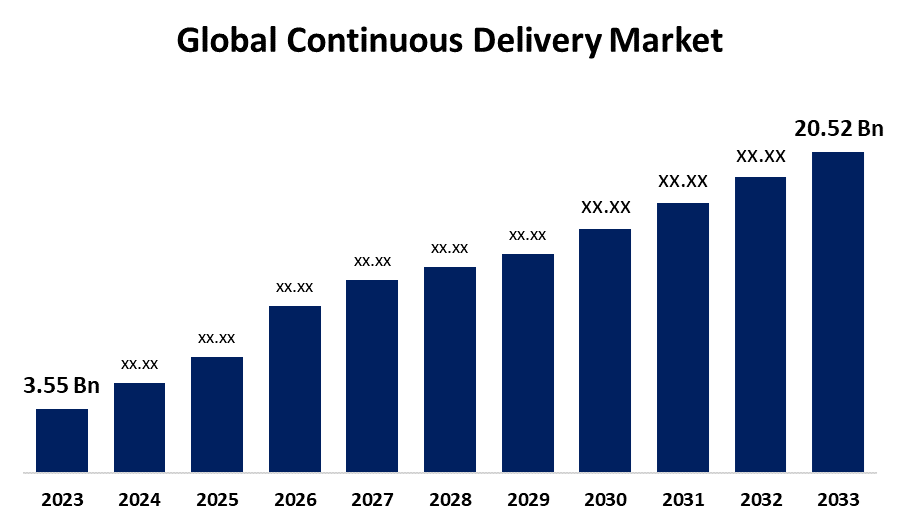

- The Global Continuous Delivery Market Size Was Estimated at USD 3.55 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 19.18% from 2023 to 2033

- The Worldwide Continuous Delivery Market Size is Expected to Reach USD 20.52 Billion by 2033

- Europe is expected to Grow the Fastest during the Forecast Period.

Get more details on this report -

The Global Continuous Delivery Market Size is Anticipated to exceed USD 20.52 Billion By 2033, Growing at a CAGR of 19.18% From 2023 to 2033. The Market Growth is due to continuous delivery, which enables faster, automated, and more reliable software releases, improving efficiency and meeting market demands. It also enhances collaboration, quality, and compliance across development teams, supporting agile and DevOps practices.

Market Overview

The continuous delivery market refers to the sector concentrated on offering tools and solutions that let companies automate and optimize the software development and deployment process. Software updates can be delivered more quickly and reliably through the software engineering technique known as continuous delivery, which makes sure code changes are automatically created, verified, and sent to production consistently and effectively. This is used to automate and streamline software development, resulting in faster and more consistent delivery of updates and new features. It enhances software quality by using automated testing and lowering deployment risks with incremental upgrades. Continuous delivery improves team cooperation, scalability, and customer experiences by providing frequent, high-quality software releases while minimizing operational expenses. The market is boosted by the increased desire for faster time-to-market, scalability, and cloud-based solutions, which is propelling the use of continuous delivery systems. These platforms increase efficiency, improve quality, and encourage cross-team communication. Continuous delivery is critical for automating operations, following regulatory standards, and providing dependable software releases in today's competitive market.

Report Coverage

This research report categorizes the continuous delivery market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the continuous delivery market. Recent market developments and competitive strategies such as expansion, Type of Software launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the continuous delivery market.

Global Continuous Delivery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.55 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 19.18% |

| 2033 Value Projection: | USD 20.52 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Deployment, By Enterprise Size, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | IBM, Google LLC, Microsoft, Xebia, CloudBees, Inc., Broadcom, Atlassian, Accenture, Flexagon LLC, Clarive Software and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expansion of the market is driven by the rising demand for software development cycles. Continuous delivery is critical for firms that want to remain competitive by enabling faster and more reliable software releases. Its importance in supporting DevOps processes, eliminating human error, and assuring software stability extends across industries such as finance, healthcare, and retail. The transition to microservices architecture emphasizes the need for continuous delivery solutions that improve agility and scalability. As the digital transition proceeds, continuous delivery will be a critical enabler of innovation and operational efficiency.

Restraining Factors

The growth of the continuous delivery market is hindered by the complexity of deploying and integrating continuous delivery solutions, which poses a significant challenge, especially for enterprises with legacy systems. Security, regulatory concerns, and cultural resistance all impede adoption, particularly in heavily regulated businesses. Furthermore, the demand for skilled labor, resource constraints, and vendor lock-in all limit market expansion. Despite these obstacles, continuous delivery is still an important facilitator of faster and more reliable software development.

Market Segmentation

The continuous delivery market share is classified into deployment, enterprise size, and end use.

- The cloud segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the deployment, the continuous delivery market is classified into on-premise and cloud. Among these, the cloud segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be propagated to the growing use of hybrid and multi-cloud strategies. To balance workloads, prevent vendor lock-in, and improve system stability, businesses are using more and more cloud providers. Applications may be developed, tested, and deployed across various cloud infrastructures with ease through continuous delivery platforms that support hybrid and multi-cloud environments. This adaptability improves software delivery pipelines' resilience and agility, which is essential in the quickly changing corporate world of now.

- The large enterprises segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the enterprise size, the continuous delivery market is classified into SMEs and large enterprises. Among these, the large enterprises segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be propagated to compliance, and the Compliance and regulatory requirements promote the adoption of continuous delivery, particularly in banking, healthcare, and government. These solutions provide automated compliance and security testing across the development process, guaranteeing that software fulfills regulatory requirements. As a result, firms may retain both compliance and faster delivery times.

- The BFSI segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the continuous delivery market is segmented into BFSI, telecommunications, media and entertainment, retail and e-commerce, healthcare, manufacturing, education, and others. Among these, the BFSI segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be propagated to the banking sector's need for digital transformation. BFSI companies must create and implement software more quickly to satisfy the changing expectations of their customers, who are increasingly looking for digital banking, mobile applications, and online financial services. Financial institutions can automate their development pipelines through continuous delivery, facilitating the timely and dependable deployment of customer-facing apps, security upgrades, and new features. In a market where consumers now place a high value on digital ease, this is essential for remaining competitive.

Regional Segment Analysis of the Continuous Delivery Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the Continuous Delivery market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the continuous delivery market over the predicted timeframe. The region's growth can be attributed to the broad use of technologies that are native to the cloud. Because cloud platforms like AWS, Microsoft Azure, and Google Cloud have built-in support for continuous delivery methods, businesses from a variety of industries are moving to them. CI/CD pipelines coupled with cloud infrastructure are becoming more and more popular as companies place a higher priority on scalability, flexibility, and cost-effectiveness. In sectors like finance, healthcare, and education, where digital transformation programs are essential to preserving competitiveness, this trend is especially noticeable.

Europe is expected to grow at the fastest CAGR of the continuous delivery market during the forecast period. In the region in which businesses can improve operational efficiency, lower manual error rates, and expedite decision-making, businesses are progressively incorporating artificial intelligence (AI) and machine learning (ML) into their CD pipelines. Predictive maintenance, spotting possible problems before they arise, and streamlining processes are all made possible by AI-driven data. This tendency is particularly noticeable in the financial services, telecom, and automotive sectors, where automated procedures and real-time data are crucial for gaining a competitive edge.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the continuous delivery market along with a comparative evaluation primarily based on their Type of Software offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes Type of Software development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IBM

- Google LLC

- Microsoft

- Xebia

- CloudBees, Inc.

- Broadcom

- Atlassian

- Accenture

- Flexagon LLC

- Clarive Software

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2025, Semaphore's move to open-source under the Apache 2.0 license marks a new era for DevOps professionals, offering a blend of flexibility and reliability. The platform's transparency and community-driven development allow for deeper customization, fostering innovation while maintaining enterprise-level scalability. With a tiered approach to meet various needs, Semaphore is reshaping the future of CI/CD tools and empowering teams to evolve their deployment processes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the continuous delivery market based on the below-mentioned segments:

Global Continuous Delivery Market, By Deployment

- On-premise

- Cloud

Global Continuous Delivery Market, By Enterprise Size

- SMEs

- Large Enterprises

Global Continuous Delivery Market, By End-use

- BFSI

- Telecommunications

- Media and Entertainment

- Retail and E-commerce

- Healthcare

- Manufacturing

- Education

- Others

Global Continuous Delivery Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the continuous delivery market over the forecast period?The continuous delivery market is projected to expand at a CAGR of 19.18% during the forecast period.

-

2. What is the market size of the continuous delivery market?The Global Continuous Delivery Market Size is Expected to Grow from USD 3.55 Billion in 2023 to USD 20.52 Billion by 2033, at a CAGR of 19.18% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the Continuous Delivery market?North America is anticipated to hold the largest share of the continuous delivery market over the predicted timeframe.

Need help to buy this report?