Global Controlled Environment Agriculture Market Size, Share, and COVID-19 Impact Analysis, By Crop Type (Pepper, Tomato, Strawberries, Leafy Greens, Cucumber, Cannabis, and Others), By Method (Aeroponics, Aquaponics, and Hydroponics), By Offering (Heating Systems, Lighting Systems, Growing Media, Nutrients, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: AgricultureGlobal Controlled Environment Agriculture Market Insights Forecasts to 2033

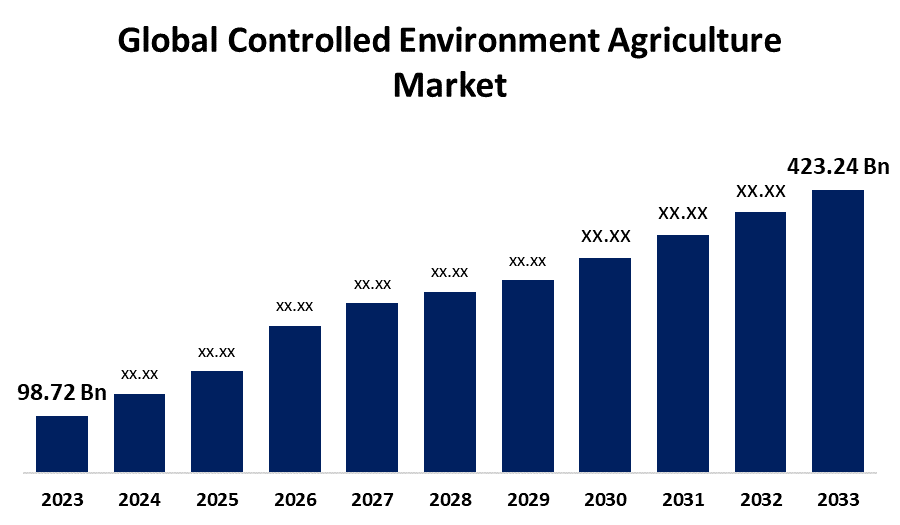

- The Global Controlled Environment Agriculture Market Size was Valued at USD 98.72 Billion in 2023

- The Market Size is Growing at a CAGR of 15.67% from 2023 to 2033

- The Worldwide Controlled Environment Agriculture Market Size is Expected to Reach USD 423.24 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Controlled Environment Agriculture Market Size is Anticipated to Exceed USD 423.24 Billion by 2033, Growing at a CAGR of 15.67% from 2023 to 2033.

Market Overview

Controlled-environment agriculture, or CEA, is the technique of cultivating plants indoors using computer-managed greenhouse control systems, plant science, and engineering principles to maximize plant growth, quality, and productivity. Through the use of carbon dioxide absorber, light, temperature, and root-zone growing medium control, CEA might produce high-value, attractive, and edible plants in a healthy and year-round manner. When compared to outdoor agricultural methods, growing crops indoors on vertical or horizontal racks can conserve land and produce higher crop yields.

Indoor plant cultivation has become more cost-effective owing to factors including climate change, growing customer preferences for locally grown and healthier food, advancements in plant science, and significantly lower costs for LED artificial light sources. Microgreens are high-value products with short shelf life that need to be handled carefully. As such, they make excellent candidates for CEA facilities.

For instance, in June 2024, Agritecture and CEAg World, a Meister Media Worldwide joint venture, announced their collaboration on the largest Controlled Environment Agriculture (CEA) Census worldwide. Now in its fourth year, this much-awaited project offers producers worldwide the chance to participate in the most precise and thorough industry census to date.

This market's growth is primarily driven by the increasing awareness of health benefits and willingness to pay a premium for fresh, healthful food is driving up demand for it. Fresh and nutritious food might be produced year-round due to CEA, regardless of geographic location or climate.

Report Coverage

This research report categorizes the market for the global controlled environment agriculture market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global controlled environment agriculture market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global controlled environment agriculture market.

Global Controlled Environment Agriculture Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 98.72 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 15.67% |

| 2033 Value Projection: | USD 423.24 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 201 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Crop Type, By Method, By Offering, By Region |

| Companies covered:: | Aero Farms, Jingpeng, Infinite Harvest, Mirai, Lufa Farms, Green Sense Farms, Metro Farms, Plenty (Bright Farms), Greenland, Scafil, Sky Greens, Idea Protected Horticulture, Metropolis Farms, Gotham Greens, Garden Fresh Farms, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

By 2050, there will likely be close to 10 billion population, making it extremely difficult to sustainably feed everyone's growing appetite. In reaction, governments and farmers alike are gradually using sophisticated farming practices such as soil-based farming, hybrids, hydroponics, aeroponics, and aquaponics. A wide variety of crops, including tomatoes, leafy greens, cannabis, microgreens, flowers, strawberries, cucumbers, peppers, herbs, mushrooms, onions, leeks, hops, figs, sweet corn, fish, eggplant, insects, carrots, and shrimp, are grown using these techniques. This has led to a rapid expansion of the global market for controlled environment agriculture and the emergence of both small and big indoor farms. Demand for related products like growing media and fertilizers is also being driven by this trend.

For Instance, in January 2024, the controlled environment horticulture activities of Texas A&M AgriLife are being expanded. The researchers are working with a variety of technologies, including well-established techniques like hydroponic and aquaponic systems, high tunnels, and greenhouses. Additionally, they are working on ideas like precision agriculture, which gathers a variety of data about plant and environmental conditions using cutting-edge technologies like remote sensors. Growers might use additional cutting-edge innovations like automation, robots, and artificial intelligence to control plants thanks to sensing technology.

Restraining Factors

Due to a controlled environment, agriculture has a high energy consumption and intensive production system, its operational costs are considerable. In addition, skilled labor is required year-round and at a significantly higher rate than in traditional agriculture. Since the crop cycle in the CEA is therefore quite short, choosing when to carry out a particular operation is essential. In this industry, there is also a dearth of experienced laborers with proper training. The market is constrained by these considerations.

Market Segmentation

The global controlled environment agriculture market share is classified into crop type, method, and offering.

- The tomato segment is estimated to hold the highest market revenue share through the projected period.

Based on the crop type, the global controlled environment agriculture market is classified into pepper, tomato, strawberries, leafy greens, cucumber, cannabis, and others. Among these, the tomato segment is estimated to hold the highest market revenue share through the projected period. This is a result of artificial heating and cooling, which drives up the capital expenses of agriculture in controlled environments. Thus, suitable crops with strong economic value are required, such as tomatoes. Tomatoes are hydroponically grown, have a lower risk of plant disease, grow more quickly, and produce more food overall. Furthermore, it is in high demand all over the world and widely utilized in food preparation.

For instance. In February 2023, A study conducted by Texas A&M is currently being conducted to utilize innovative hydroponics techniques to greatly increase tomato productivity in Qatar, a Middle Eastern nation. To determine which tomato genotypes will do best in Qatar's hard climate, experts are evaluating tomato genotypes from throughout the globe. Additionally, they are looking into the effects of grafting, plant density, pest management, and pollination with bumblebee assistance.

- The hydroponics segment is anticipated to hold the largest market share through the forecast period.

Based on the method, the global controlled environment agriculture market is divided into aeroponics, aquaponics, and hydroponics. Among these, the hydroponics segment is anticipated to hold the largest market share through the forecast period. A controlled environment agriculture system (CEA) can be used to effectively integrate hydroponics and soilless agriculture. The advancements in smart farming and technology have made it possible to successfully implement CEA. With increasing advancements, artificial intelligence, adaptive data analysis, hardware-software interfaces, and complicated mathematical models are giving CEAs flexible design and control strategies to achieve higher levels of automation.

- The lighting systems segment dominates the market with the largest market share through the forecast period.

Based on the offering, the global controlled environment agriculture market is categorized into heating systems, lighting systems, growing media, nutrients, and others. Among these, the lighting systems segment dominates the market with the largest market share through the forecast period. In hydroponic systems, lighting can come from artificial lights alone, artificial lights in addition to natural sunshine, or both. The plants require between 12 and 16 hours of sunshine each day. In greenhouses, artificial light can be utilized as a supplement to natural light or to fully illuminate indoor systems. Hydroponic systems frequently utilize fluorescent, light-emitting diode (LED), and high-pressure sodium (HPS) lighting. Using light sensors and timers can maximize agricultural yields and improve energy efficiency.

Regional Segment Analysis of the Controlled Environment Agriculture Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global controlled environment agriculture market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global controlled environment agriculture market over the predicted timeframe. In recent years, there has been a surge in both public and private investments in alternative food production methods, and controlled environment agriculture (CEA). CEA refers to crop production systems that include horticultural and engineering methods beyond traditional soil-based outdoor production and are housed in greenhouses or other structures. In comparison to conventional large-scale outdoor farming, these methods might boost yields, enhance accessibility to local foods, offer year-round food access, and/or enhance nutritional results. By lowering the chance of crop failure in more harsh weather compared to typical outdoor systems, CEA also helps with climate change adaptation. In addition, The National Institute of Food and Agriculture, Agricultural Research Service, and USDA's Office of Urban and Innovative Agriculture have awarded contracts and grants totaling more than $50 million since 2022. This represents a significant increase in recent U.S. Department of Agriculture (USDA) funding for the development and commercialization of CEA systems.

Asia hjbA Asia Pacific is expected to grow at the fastest CAGR growth of the controlled environment agriculture market during the forecast period. Numerous arable lands are at risk due to the fast-increasing rate of industrialization. In Asia Pacific, controlled environment agriculture is the key to solving all of these issues. Using controlled environment agriculture to maintain agricultural practices is an innovative approach. In Asia-Pacific, polyhouse farming is the most common type of controlled environment agriculture. Poly-house agriculture is a protected method used in the Asia Pacific to increase fruit and vegetable harvests. For instance, in December 2023, in reaction to President Xi Jinping's demand for technological innovation to strengthen the country's food security, scientists from China launched the tallest unmanned vertical farm in the world in the southwest province of Sichuan.

Constructed in the downtown area of Chengdu, the provincial capital, this 20-story urban farm, overseen by the Chinese Academy of Agricultural Sciences, symbolizes the pinnacle of farming automation globally.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the controlled environment agriculture market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aero Farms

- Jingpeng

- Infinite Harvest

- Mirai

- Lufa Farms

- Green Sense Farms

- Metro Farms

- Plenty (Bright Farms)

- Greenland

- Scafil

- Sky Greens

- Idea Protected Horticulture

- Metropolis Farms

- Gotham Greens

- Garden Fresh Farms

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, Cox Farms is a new venture from Atlanta-based Cox Enterprises that focuses on sustainable agriculture and food. One of the biggest greenhouse operators in North America, Cox Farms harvests 360 million pounds of fruit a year, and its portfolio is expanding to include BrightFarms and Mucci Farms.

- In March 2024, Meister Media Worldwide is pleased to present CEAg World, a cutting-edge worldwide multi-media enterprise that is "Advancing Food Under CoverTM." This international trademark will stand for and unite all the developing market niches for crops cultivated in controlled conditions, such as vertical farms, hoop houses, high tunnels, greenhouses, and operations that use netting or shading.

- In October 2023, A new crop insurance scheme was introduced by the USDA, and it is intended for farmers that operate in regulated surroundings. The newly launched USDA Risk Management Agency (RMA) Controlled Environment program is designed exclusively for plants cultivated in completely enclosed controlled settings. It offers protection against plant diseases that are subject to destruction orders.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global controlled environment agriculture market based on the below-mentioned segments:

Global Controlled Environment Agriculture Market, By Crop Type

- Pepper

- Tomato

- Strawberries

- Leafy Greens

- Cucumber

- Cannabis

- Others

Global Controlled Environment Agriculture Market, By Method

- Aeroponics

- Aquaponics

- Hydroponics

Global Controlled Environment Agriculture Market, By Offering

- Heating Systems

- Lighting Systems

- Growing Media

- Nutrients

- Others

Global Controlled Environment Agriculture Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global controlled environment agriculture market over the forecast period?The controlled environment agriculture market is projected to expand at a CAGR of 15.67% during the forecast period.

-

2. What is the market size of the global controlled environment agriculture market?The global controlled environment agriculture market Size is Expected to Grow from USD 98.72 Billion in 2023 to USD 423.24 Billion by 2033, at a CAGR of 15.67% during the forecast period 2023-2033.

-

3. Which are the key companies that are currently operating within the market?Aero Farms, Jingpeng, Infinite Harvest, Mirai, Lufa Farms, Green Sense Farms, Metro Farms, Plenty (Bright Farms), Greenland, Scafil, Sky Greens, Idea Protected Horticulture, Metropolis Farms, Gotham Greens, Garden Fresh Farms, and Others.

Need help to buy this report?