Global Controlled Release Fertilizers Market Size, Share, and COVID-19 Impact Analysis, By Type (Coated & Encapsulated, Slow Release, and Nitrogen Stabilizers), By Mode of Application (Fertigation, Foliar, and Soil), By End Use (Agricultural and Non-Agricultural), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: AgricultureGlobal Controlled Release Fertilizers Market Insights Forecasts to 2032

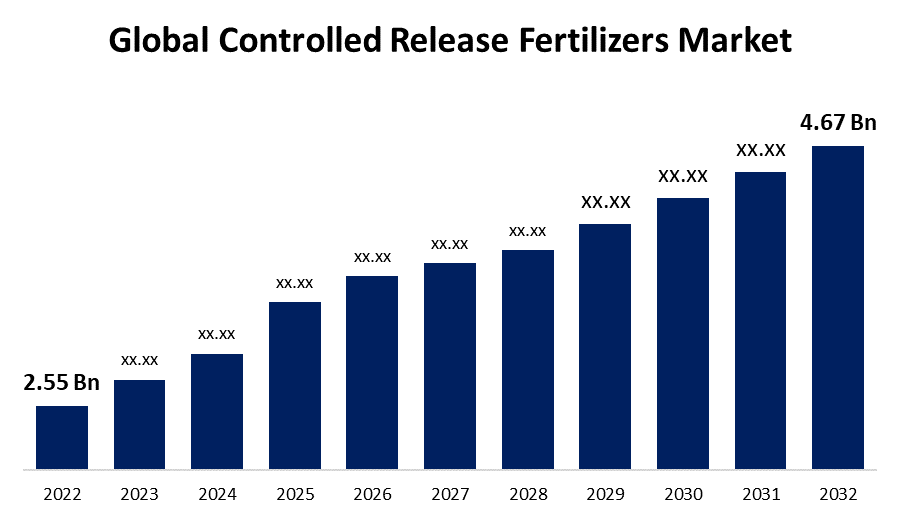

- The Global Controlled Release Fertilizers Market Size was valued at USD 2.55 Billion in 2022.

- The Market is Growing at a CAGR of 6.2% from 2022 to 2032

- The Worldwide Controlled Release Fertilizers Market Size is expected to reach USD 4.67 Billion by 2032

- North America is expected To Grow the fastest during the forecast period

Get more details on this report -

The Global Controlled Release Fertilizers Market Size is projected to exceed USD 4.67 Billion by 2032, growing at a CAGR of 6.2% from 2022 to 2032. The growing worldwide population, increasing rates of application in developing countries, and increasing demand for crops with high values are key factors expected to propel the controlled release fertilizer market over the study period.

Market Overview

The global controlled release fertilizers market is a rapidly growing sector within the agricultural industry. Controlled release fertilizers (CRFs) are fertilizers that release nutrients slowly over an extended period, in contrast to traditional fertilizers, which release nutrients rapidly and are prone to leaching and volatilization. The primary advantage of CRFs is that they improve fertilizer efficiency and reduce the need for frequent fertilization, thus reducing labor costs and minimizing environmental impact.

The market for CRFs is expected to grow at a significant rate over the next few years, driven by several factors, including the increasing demand for food due to the growing global population, the need for sustainable agricultural practices, and the rising adoption of precision farming techniques. Additionally, the growing awareness of the benefits of CRFs, such as improved crop yields, reduced nutrient losses, and reduced environmental impact, is expected to drive market growth further.

The major players in the global CRFs market include ICL Specialty Fertilizers, ScottsMiracle-Gro Company, Yara International ASA, Haifa Chemicals Ltd., and SQM S.A. These companies are focusing on expanding their product portfolios, investing in research and development, and forming strategic partnerships to strengthen their market position and drive growth.

For instance, in September 2022, ICL Introduced Revolutionary Biodegradable Coated Fertilizer Technologies. A revolutionary rapid biodegradable release technology developed for outdoor farming. This novel technique is accomplished through a coating, which assists farmers in optimizing agricultural crop performance while minimizing environmental impact by decreasing nutrient loss and increasing nutrient use efficiency (NUE) by up to 80%.

Report Coverage

This research report categorizes the market for global controlled release fertilizers market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the controlled release fertilizers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the controlled release fertilizers market.

Global Controlled Release Fertilizers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.55 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.2% |

| 2032 Value Projection: | USD 4.67 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Mode of Application, By End Use, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Yara International ASA (Norway), Haifa Chemicals, Helena Chemical, The Mosaic Company (US), Nufarm Ltd. (Australia), AGLUKON, ScottsMiracle-Gro (US), Pursell Agri-Tech, Koch Industries, SQM, JNC Corporation, Kingenta, ICL Group, Nutrien Ltd., Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the major concerns for farmers around the world is nutrient loss to the environment. In comparison to non-intensive uses such as pasture, heavily fertilized crops such as maize suffer significant losses. Significant nutrient losses are also caused by agricultural uses associated with poor land management practices that lead to erosion. The loss of nutrients can occur in a variety of ways, each of which has a significant environmental impact. The loss of nutrients in the water causes eutrophication on the surfaces of bodies of water, destroying the aquatic ecosystem. This concern about fertilizers as well as nutrients applied on soil has grown in recent years, so fertilizer sectors and associations around the world are promoting fertilizer best management practices, under which enhanced efficiency fertilizers (EEF) are developed and farmers are encouraged to use these fertilizers. These practices are associated with the proper application of fertilizers in the appropriate quantity, at the appropriate time, and in the appropriate location. As a result, they are driving the market for controlled release fertilizers.

Restraining Factors

The International Fertilizer Association (IFA) reports that controlled-release fertilizer prices have remained four to six times higher than conventional NPK (nitrogen, phosphorus, and potassium) prices. This is one of the most significant market restraints. One of the main restraints for the global controlled release fertilizers (CRFs) market is the high cost of these products. CRFs can be more expensive than traditional fertilizers due to the additional processing and manufacturing required to create them. Additionally, some types of CRFs may require specialized equipment or application methods, which can further increase costs. The higher cost of CRFs can limit their adoption in some markets, particularly in regions where farmers have limited financial resources. In these markets, farmers may be more likely to choose lower-cost traditional fertilizers, even if they are less effective or have a greater environmental impact.

Market Segmentation

The Global Controlled Release Fertilizers Market share is classified into type, mode of application, and end use.

- The coated & encapsulated segment is expected to hold the largest share of the global controlled release fertilizers market over the forecast period.

Based on the type, the global controlled release fertilizers market is divided into coated & encapsulated, slow release, and nitrogen stabilizers. Among these, the coated & encapsulated segment is expected to hold the largest share of the global controlled release fertilizers market over the forecast period. The growth can be attributed due to the coated & encapsulated are widely used and offer several benefits over traditional fertilizers. Coated and encapsulated CRFs have a protective coating or shell that slowly dissolves, releasing nutrients into the soil. The coating can be made from a variety of materials, such as sulfur, wax, resin, or polymer. The primary advantage of coated and encapsulated CRFs is their ability to control the release rate of nutrients, ensuring that plants receive a steady supply over an extended period.

- The fertigation segment is anticipated to grow at the fastest pace in the global controlled release fertilizers market during the forecast period.

The global controlled release fertilizers market is classified into three segments: fertigation, foliar, and soil. Among these, the fertigation segment is anticipated to grow at the fastest pace in the global controlled release fertilizers market during the forecast period. The growth can be attributed to factors such as increased productivity and higher yields. Because of its dependability and efficacy, this mode of application is gaining popularity. Due to improved efficiency, the litigation mode of application reduces application costs by 29% to 78%. Fertigation is a technique used by major countries in which fertilizer is mixed with irrigation water and employed via systems. This technique is more widely used than broadcasting and subsurface placement.

- The non agricultural segment is expected to hold the largest share of the global controlled release fertilizers market during the forecast period.

On the basis of the end use, the global controlled release fertilizers market is segmented into agricultural and non agricultural. Among these, the non agricultural segment is expected to hold the largest share of the global controlled release fertilizers market during the forecast period. The rise in purchasing power and increasing concerns about the environment have increased the demand for CRFs in non-agricultural sectors. The market is being driven by the increasing use of controlled-release fertilizers for turf and ornamental grass. CRF has been used for turf and ornamental grass in the United States for more than a decade; however, its demand has recently increased in developing countries. Thus, the ease with which controlled-release fertilizers can be applied to ornamental crops is a major factor driving its market.

Regional Segment Analysis of the Controlled Release Fertilizers Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is estimated to hold the largest share of the controlled release fertilizers market over the predicted timeframe.

Get more details on this report -

In terms of volume and value, Asia Pacific accounted for the largest share during the forecast period. Increased growth of high-value crops and increased farmer awareness of the beneficial environmental effects of controlled-release fertilizers are predicted to offer more opportunities for market growth. Government policies implemented in Asia Pacific countries, as well as large subsidies, sometimes up to 100% for small-scale farmers, offered on fertilizers, are major factors driving the region's growth in this market.

North America is expected to grow at the fastest pace in the global controlled release fertilizers market over the projected period. The North American market for controlled release fertilizers is being driven by the horticulture sector in the United States, Canada, and Mexico's heavy use of controlled-release fertilizers. The presence of several major players in the North American market, such as Pursell Agri-Tech, Nutrien, LESCO, and others, is also attributed to the increasing demand for effective and specialty fertilizers. The controlled-release fertilizer market in the United States is expanding at a rapid pace, owing to exceptional sales performance by brands such as Kugler Company, Koch Agronomic Services, Nutrien, and Lebanon Seaboard Corp.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global controlled release fertilizers along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yara International ASA (Norway)

- Haifa Chemicals

- Helena Chemical

- The Mosaic Company (US)

- Nufarm Ltd. (Australia)

- AGLUKON

- ScottsMiracle-Gro (US)

- Pursell Agri-Tech

- Koch Industries

- SQM

- JNC Corporation

- Kingenta

- ICL Group

- Nutrien Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2022, ICL Speciality Fertilizers in the United Kingdom launched an online knowledge hub to assist growers in understanding the various types of efficiency fertilizers and their benefits.

- In December 2021, Sumitomo Chemicals Co.Ltd. and Yara International ASA collaborated. The partnership with Sumitomo Chemicals has accelerated Japan's green energy transition and built on the growing momentum associated with clean ammonia.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Controlled Release Fertilizers Market based on the below-mentioned segments:

Global Controlled Release Fertilizers Market, By Type

- Coated & Encapsulated

- Slow Release

- Nitrogen Stabilizers

Global Controlled Release Fertilizers Market, By Mode of Application

- Fertigation

- Foliar

- Soil

Global Controlled Release Fertilizers Market, By End Use

- Agricultural

- Non Agricultural

Global Controlled Release Fertilizers Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?