Global Copper Clad Laminates Market Size, Share, and COVID-19 Impact Analysis, By Type (Rigid, Flexible), By Material Type (Glass Fiber, Paper Base, Compound Materials, Others), By Resin Type (Epoxy, Phenolic, Polyimide, Others), By End-Use (Computers, Communication Systems, Consumer Appliances, Vehicle Electronics, Healthcare Devices, Defense Technology, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Advanced MaterialsGlobal Copper Clad Laminates Market Insights Forecasts to 2032.

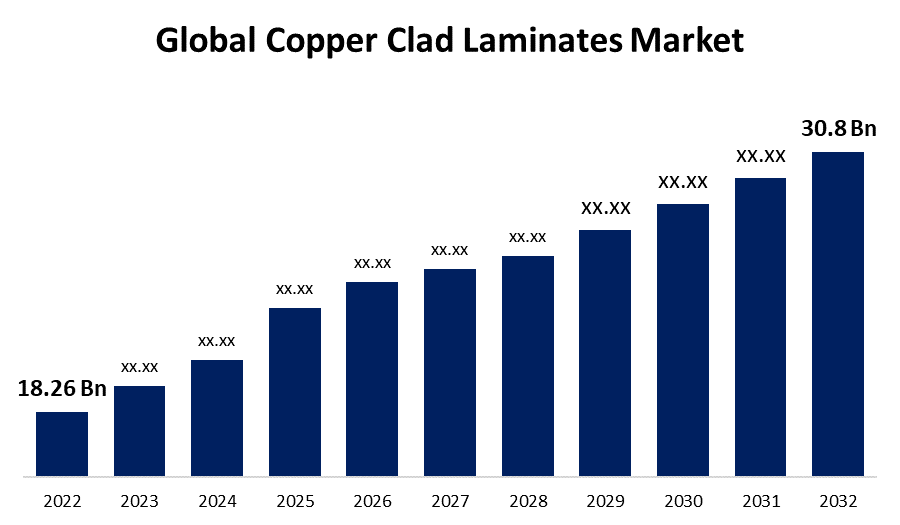

- The Global Copper Clad Laminates Market Size was valued at USD 18.26 Billion in 2022.

- The Market is Growing at a CAGR of 5.37% from 2022 to 2032

- The Worldwide Copper Clad Laminates Market Size is expected to reach USD 30.8 Billion by 2032

- Europe is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Copper Clad Laminates Market Size is expected to reach USD 30.8 Billion by 2032, at a CAGR of 5.37% during the forecast period 2022 to 2032.

Copper Clad Laminate, shortened as CCL, is a type of substrate used to create printed circuit boards that are the most extensively and importantly employed. The copper clad laminate, on the other hand, is a type of material that is coated with copper on one or both surfaces after being soaked in resin and reinforced with electronic glass fiber or another type of reinforcing material. Electronic circuits that form a component of printed wiring boards are the end results of processing. It's commonly used in television, radio, computers, mobile phones, and other electronic devices.

In today's technological era, the incorporation and assembly density of multiple lightweight and compact components on the circuit boards is higher, resulting in more heat production. As a result, in order to remove this quantity of heat, materials with excellent heat transfer capabilities are required. There are two main varieties of copper-clad laminates on the market: rigid copper laminate and flexible copper laminate. Furthermore, these copper-clad laminates are widely employed in a variety of end-use applications, including conventional electronic circuit boards, high-speed communication applications (4G-LTE, 5G base stations / Radar applications), automotive-ADAS radar uses, and avionic-radar applications.

The key players in the global copper clad laminate market include Panasonic, Taiwan Union Technology Corporation, Kingboard Laminates, Shengyi Technology, Chang Chun Plastics, Nan Ya Plastics Corporation, Hitachi Chemical, Grace Electron, and Doosan Corporation. Expansions, mergers and acquisitions collaborations, and the development of new products are some of the primary strategies used by these leading players to strengthen their competitive edge in the copper clad laminates market.

For instance, on January 2023, MBK Partners is promoting the acquisition of Nexflex, a Korean company that manufactures flexible copper-clad laminate (FCCL) for telephones. MBK Partners has signed a Memorandum of Understanding and is performing due diligence on Nexplex, following which the stock transfer agreement will be signed.

Global Copper Clad Laminates Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 18.26 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.37% |

| 2032 Value Projection: | USD 30.8 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Material Type, By Resin Type, By End-Use, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Panasonic Corporation, Taiwan Union Technology Corporation, Rogers Corporation, Kingboard Laminates Holdings Ltd., Shengyi Technology Co., Ltd, Chang Chun Plastics, Current Inc., DuPont de Nemours, Inc., Nan Ya Plastics Corporation, Hitachi Chemical, Isola Group, AGC Inc., Grace Electron, RISHO KOGYO CO., LTD., Doosan Corporation, Shandong Jinbao Electric Co., Ltd. and other key venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ongoing development of printed circuit boards (PCB) manufacturing, electronic assembly, semiconductor production, and electronic machine products are among the major factors that are expected to boost the global copper clad laminates market growth over the forecast period. The automotive PCB industry has expanded rapidly as a result of vehicle electronics popularity. This, in turn, has a favorable impact on the market for copper clad laminates. Furthermore, rising consumer demand for highly sophisticated vehicle models equipped with theft prevention systems, integrated audio & video systems, and other modern features has created new possibilities for the copper-clad laminates market.

Copper-clad laminates are used in 5G infrastructure to enhance the propagation of signals, prevent delamination, manage the heat produced, reduce weight, regulate moisture, and improve net efficiency and affordability, which is projected to drive up demand for the copper clad laminates market. Furthermore, as copper clad laminates are employed for constructing automation systems, the expansion in developing infrastructure initiatives such as smart cities and home automation systems increases demand for the copper clad laminates market. In addition, legislative efforts to increase the utilization of energy generated from renewable sources, such as solar and wind power, have contributed to rising demand for copper clad laminates, which are employed in the production of photovoltaic cells and wind generators.

Restraining Factors

However, there are two obstacles that serve a significant role in limiting the market for copper-clad laminates: increasing costs of raw materials and the availability of these materials. Because the availability and pricing of raw materials such as copper foils, resins, glass fiber, and others fluctuate by place. Furthermore, an interruption in the manufacturing supply chain network, which disrupts raw material availability, is a big challenge in the copper-clad laminates market.

Market Segmentation

By Type Insights

The flexible segment is dominating the market with the largest revenue share over the forecast period.

On the basis of type, the global copper clad laminates market is segmented into the rigid and flexible. Among them, the flexible segment has the highest revenue share of 78.6% over the projection period. Flexible copper-clad laminates are available in one layer or double-layer configurations, with either PI film or polyester film as the substrate layer. This copper-clad laminate serves as an insulated and compact copper foil conductor with interface flexibility. Flexible copper-clad laminates have many electromechanical qualities, as well as strong anti-moisture properties and a relatively low melting temperature. These flexible copper clad laminates are lightweight, thin, and versatile, making them suitable for usage in a variety of electronic products such as cell phones, digital cameras, car GPS, and laptops.

By Resin Type Insights

The epoxy segment is witnessing significant CAGR growth over the forecast period.

On the basis of resin type, the global copper clad laminates market is segmented into epoxy, phenolic, polyimide, and others. Among these, the epoxy segment is witnessing significant CAGR growth over the forecast period. Epoxy resin has good moisture and temperature resistance, mechanical durability, and dielectric characteristics, and it may be used to insulate parts for various electrical machines, engines, generators, electrical devices, and moist conditions. A number of variables factors growing demands for various household appliances, including rapid urbanization, expanding consumer demands, and swift transitions in consumer behaviors, increased the demand for copper-clad laminates market over the research period.

By End-Use Insights

The vehicle electronics segment accounted for the largest revenue share of more than 41.3% over the forecast period.

On the basis of end-use, the global copper clad laminates market is segmented into computers, communication systems, consumer appliances, vehicle electronics, healthcare devices, defense technology, and others. Among these, the vehicle electronics segment is dominating the market with the largest revenue share of 41.3% over the forecast period. They have an expanding market for modern automotive and public conveyance security and automated driving systems such as collision avoidance and brake assistance, blind spot detection, and lane departure signaling, among others, which contributes to the increasing popularity of the copper clad laminates market over the predicted time frame. Copper-clad Laminates are commonly utilized in a variety of vehicle electrical components, including touchscreen panels, anti-theft systems, air-bag controllers, audio systems, ignition timing systems, and numerous other applications.

Regional Insights

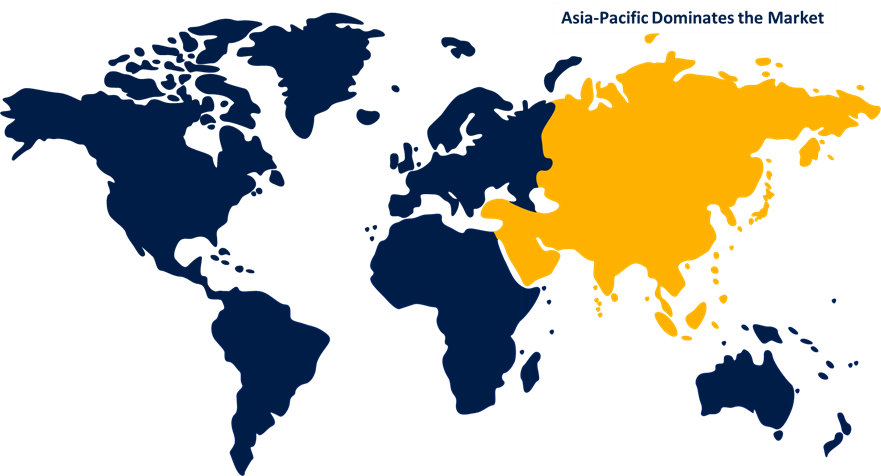

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 53.7% market share over the forecast period. Asia Pacific region is the world's largest hub of the electronic market for both manufacturing and supply chains. The region's printed circuit boards market is being fueled by the region's fast-growing electronics and automotive markets, affordable production expenses, the readily available supply of materials needed for manufacturing at affordable prices, higher economic development rate, and lower labor as well as transportation costs, that consequently boosts the demand for copper clad laminates market. Furthermore, rising demand for 5G connectivity and electric vehicles in the context would propel the copper clad laminates market for a variety of different applications throughout the estimated time frame.

North America, on the contrary, is expected to grow the fastest during the forecast period. The rising demand for electronic gadgets such as mobile phones, tablets, and laptops has accelerated the copper clad laminates market in North America. Furthermore, the rising popularity of the Internet of Things (IoT) and 5G technology boosts demand for copper clad laminates, which are employed in the production of PCBs for these types of technology.

List of Key Market Players

- Panasonic Corporation

- Taiwan Union Technology Corporation

- Rogers Corporation

- Kingboard Laminates Holdings Ltd.

- Shengyi Technology Co., Ltd

- Chang Chun Plastics

- Current Inc.

- DuPont de Nemours, Inc.

- Nan Ya Plastics Corporation

- Hitachi Chemical

- Isola Group

- AGC Inc.

- Grace Electron

- RISHO KOGYO CO., LTD.

- Doosan Corporation

- Shandong Jinbao Electric Co., Ltd.

Key Market Developments

- On January 2022, DuPont Interconnect Solutions, a division within the Electronics & Industrial segment, announced the completion of its Circleville, Ohio plant expansion project. The $250 million investment will increase manufacturing of Kapton® polyimide film and Pyralux® flexible circuit materials, assuring a committed supply to meet expanding worldwide demand in DuPont's automotive, consumer electronics, telecommunications, specialized industrial, and defense markets. The Kapton® polyimide film is also at the core of DuPont's Pyralux® line of flexible copper clad laminates, which come in a wide range of copper types, thicknesses, and construction options and offer excellent thermal, chemical, electrical, and mechanical qualities.

- On August 2022, Taiflex Scientific, a manufacturer of flexible CCL (copper-clad laminate), disclosed that it had purchased a manufacturing site in eastern Thailand and will invest USD 35 million in the first phase to develop a flexible copper clad laminate facility there, with production beginning in the first half of 2024.

- On December 2022, Doosan Corp. is developing its flexible cooper clad layers (FCCL) production line in Gimje, North Jeolla, to increase competitiveness in electronic materials and parts. The new factory, which will be built on a 13,000-square-meter (3.2-acre) site, is expected to be completed in the second half of 2024. Doosan made a 60 billion won ($47.3 million) investment in the project.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Copper Clad Laminates Market based on the below-mentioned segments:

Copper Clad Laminates Market, Type Analysis

- Rigid

- Flexible

Copper Clad Laminates Market, Material Type Analysis

- Glass Fiber

- Paper Base

- Compound Materials

- Others

Copper Clad Laminates Market, Resin Type Analysis

- Epoxy

- Phenolic

- Polyimide

- Others

Copper Clad Laminates Market, End-Use Analysis

- Computers

- Communication Systems

- Consumer Appliances

- Vehicle Electronics

- Healthcare Devices

- Defense Technology

- Others

Copper Clad Laminates Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Copper Clad Laminates market?The Global Copper Clad Laminates Market is expected to grow from USD 18.26 billion in 2022 to USD 30.8 billion by 2032, at a CAGR of 5.37% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?Panasonic Corporation, Taiwan Union Technology Corporation, Rogers Corporation, Kingboard Laminates Holdings Ltd., Shengyi Technology Co., Ltd, Chang Chun Plastics, Current Inc., DuPont de Nemours, Inc., Nan Ya Plastics Corporation, Hitachi Chemical, Isola Group, AGC Inc., Grace Electron, RISHO KOGYO CO., LTD., Doosan Corporation, Shandong Jinbao Electric Co., Ltd.

-

3. Which segment dominated the Copper Clad Laminates market share?The vehicle electronics segment in end-use type dominated the Copper Clad Laminates market in 2022 and accounted for a revenue share of over 41.3%.

-

4. What are the elements driving the growth of the Copper Clad Laminates market?Growth in 5G infrastructure, rising usage of PCBs in various applications such as LEDs, consumer electronics, industrial equipment, automotive components, aerospace components, safety and security equipment, telecom equipment, and others are the major elements driving the demand of the copper clad laminates market.

-

5. Which region is dominating the Copper Clad Laminates market?Asia Pacific is dominating the Copper Clad Laminates market with more than 53.7% market share.

-

6. Which segment holds the largest market share of the Copper Clad Laminates market?The flexible segment based on type holds the maximum market share of the Copper Clad Laminates market.

Need help to buy this report?