Global Copper Scrap Market Size, Share, and COVID-19 Impact Analysis, By Feed Material (Old Scrap, New Scrap), By Grade (Bare Bright, #1 Copper, #2 Copper Scrap), By Application (Wire Rod Mills, Brass Mills, Ingots Makers, Other), By End-use (Building & Construction, Electrical & Electronics, Industrial Machinery & Equipment, Transportation Equipment, Consumer & General Products), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Copper Scrap Market Insights Forecasts to 2033

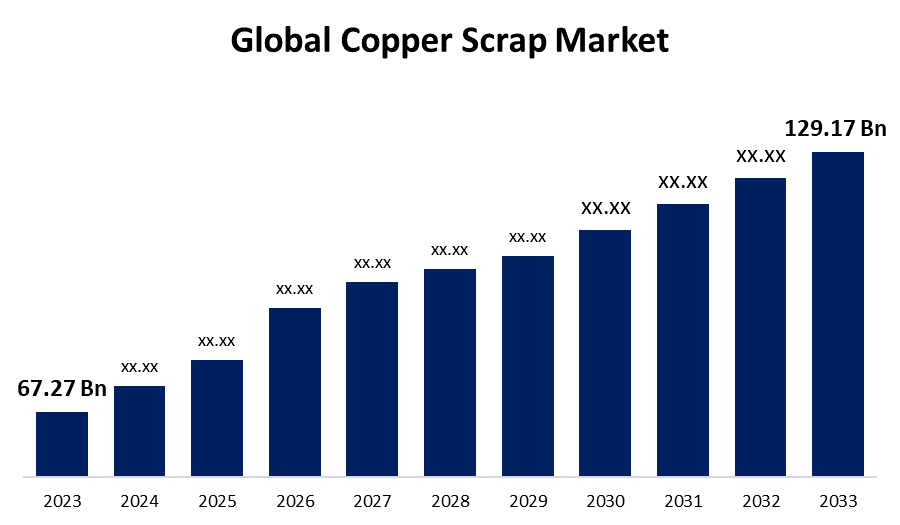

- The Global Copper Scrap Market Size was Valued at USD 67.27 Billion in 2023

- The Market Size is Growing at a CAGR of 6.74% from 2023 to 2033

- The Worldwide Copper Scrap Market Size is Expected to Reach USD 129.17 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Copper Scrap Market Size is Anticipated to Exceed USD 129.17 Billion by 2033, Growing at a CAGR of 6.74% from 2023 to 2033.

Market Overview

Copper is essential in many different industries due to its excellent conductivity and corrosion resistance. Compared to conventional mining and refining, reprocessing scrap copper into new goods is a more ecologically friendly and energy-efficient choice. Copper scrap, which comes from things like old electrical wire, plumbing, and other copper-based goods, continues to be one of the most valuable recyclable resources. It is widely sought after in many industries due to its capacity to be recycled without deteriorating quality. Copper recycling is in line with sustainable business practices and resource efficiency since it not only saves energy when compared to the extraction and processing of virgin copper, but it also drastically lowers operating expenses, environmental effects, and carbon emissions. Growth in the copper scrap market is anticipated due to the growing need for copper in a variety of sectors, such as electronics, renewable energy, construction, and transportation. The world's biggest consumer of copper scrap is the electrical and electronics sector. In EV technology and associated infrastructure, copper is crucial. Stainless steel demand is expected to increase over the period of time projected. Stainless steel can be utilized as a structural material in buildings and architecture. This element appears to increase the market share of copper scrap.

Report Coverage

This research report categorizes the market for the global copper scrap market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global copper scrap market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global copper scrap market.

Global Copper Scrap Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 67.27 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.74% |

| 2033 Value Projection: | USD 129.17 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 214 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Feed Material, By Grade, By Application, By End-use, and By Region. |

| Companies covered:: | Aurubis, Commercial Metals, Sims Limited, HKS Metals, Jansen Recycling Group, Kuusakoski, Enerpat Group, European Metal Recycling, Olin Brass, OmniSource Corporation, Trademark Metals Recycling LLC, Mallin Companies, David J. Joseph, Mid-West Recycling, American Metal Recycling, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Construction, electronics, the automobile industry, and renewable energy are just a few of the industries that use copper. The need for copper scrap is driven by the expansion of these industries. Applications for infrastructure projects include telecommunications networks, plumbing systems, electrical wiring, and infrastructure development. Incorporating copper scrap and recycled materials into infrastructure projects is a cost-effective and sustainable way to enhance resource efficiency and waste management techniques. The expansion of the copper scrap market is mostly driven by this component. In addition, the growing demand for automobiles, stringent government laws, stringent energy-saving programs, and the global market for electric vehicles and future prospects are probably going to be facilitated by the expanding use of electric vehicles and the recently found use of copper scrap in the healthcare sector.

Restraining Factors

Factors including fluctuating import and customs duties and fluctuating raw material prices, among others, could prevent the global copper scrap market from growing. The increasing demand for iron ore from various industries, however, makes it especially volatile. Therefore, factors including fluctuating import and customs duties and fluctuating raw material prices, among others, could prevent the global copper scrap market from growing. Nickel price volatility, stringent environmental laws, and possible health risks associated with increased sulfur dioxide emissions from the melting of copper waste are likely to hamper the global copper scrap market's expansion.

Market Segmentation

The global copper scrap market share is classified into feed material, grade, application, and end-use.

- The old scrap segment is expected to hold the largest share of the global copper scrap market during the forecast period.

Based on the feed material, the global copper scrap market is categorized into old scrap and new scrap. Among these, the old scrap segment is expected to hold the largest share of the global copper scrap market during the forecast period. End-of-life scrap is the material that is produced when a product is disposed of after reaching the end of its useful life. End-of-life scrap is the material that is produced when a product is disposed of after reaching the end of its useful life. Other names for this scrap include old scrap and consumer scrap. Because of the substantial amount of insulation, sheathing, and covering that needs to be ripped out, this scrap is commonly referred to as dirty scrap. Before being deemed clean scrap, this filthy scrap needs to undergo more cleaning. At this point, it is sorted, baled, and stored for further use or sale. Old scrap is most frequently obtained from C&D, ELVs, WEE, IEW, and INEW.

- The #2 copper scrap segment is expected to grow at the fastest CAGR during the forecast period.

Based on the grade, the global copper scrap market is categorized into bare bright, #1 Copper, #2 copper scrap. Among these, the #2 copper scrap segment is expected to grow at the fastest CAGR during the forecast period. It is made up of solid metal, pipe, or unalloyed wire that has been painted, coated, or soldered. It is utilized in the production of wire, fittings, pipes, and tubes and contains at least 94–96% copper. Wires must be bare—that is, devoid of insulation—and have a diameter of less than 1/16 inch in order to qualify as this form of waste. Wires with extremely low diameters, however, may lower the scrap value.

- The brass mills segment is predicted to dominate the global copper scrap market during the forecast period.

Based on the application, the global copper scrap market is categorized into wire rod mills, brass mills, ingots makers, and others. Among these, the brass mills segment is predicted to dominate the global Copper Scrap market during the forecast period. Copper and zinc are combined to make brass. Brass mills create tubes, sheets, strips, bars, rods, extrusions, forgings, and mechanical wires by melting and using scrap copper and alloy. Copper scrap makes up over half of the copper input used in these mills. The final products are made from melted and cast feedstock using fabrication techniques like hot rolling, cold rolling, drawing, and extrusion.

- The electrical & electronics segment is expected to grow at the fastest CAGR during the forecast period.

Based on the end-use, the global copper scrap market is categorized into building & construction, electrical & electronics, industrial machinery & equipment, transportation equipment, consumer and general products. Among these, the electrical & electronics segment is expected to grow at the fastest CAGR during the forecast period. Copper scrap use is rising across a range of end-use industries, particularly in the electrical and electronics sectors, due to rising global demand for electronic goods and greater awareness of energy conservation. Additionally, it is anticipated that the automotive and transportation sectors will have a greater need for copper scrap as a result of increased investments in the production of electric vehicles.

Regional Segment Analysis of the Global Copper Scrap Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

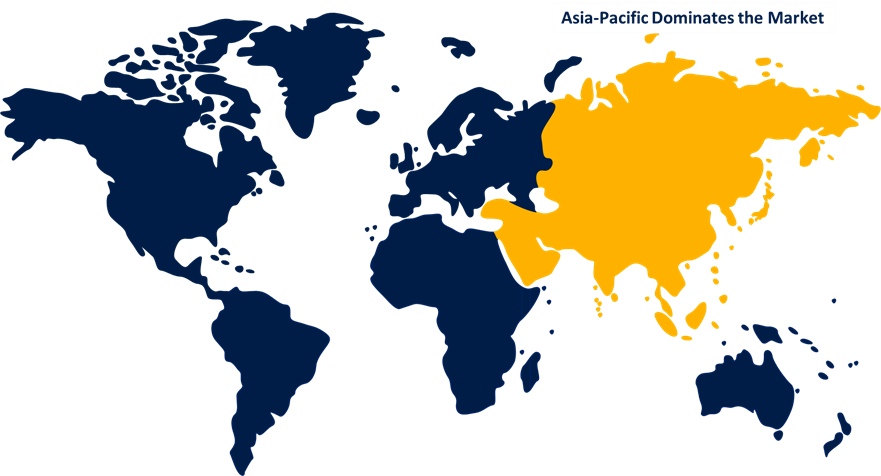

Asia-Pacific is projected to hold the largest share of the global copper scrap market over the forecast period.

Get more details on this report -

Asia-Pacific is projected to hold the largest share of the global copper scrap market over the forecast period. In recent years, the area has experienced an impressive rise in both urbanization and industrialization. Copper scrap developments have increased demand for copper and products derived from copper, particularly scrap copper. Asia-Pacific has a substantial consumer market for electrical and electronic devices. The increased use of mobile devices, consumer electronics, and appliances is driving up demand for copper and copper scrap in the area. Asia-Pacific is home to strong industrial bases for the automotive, electrical, and electronics sectors. These sectors require a lot of copper to create wires, cables, pipelines, and other copper-based components. Due to the need for scrap copper in these industries, Asia-Pacific now controls the majority of the market.

North America is expected to grow at the fastest CAGR growth of the global copper scrap market during the forecast period. In North America, recycling copper waste is essential to meeting the rising demand for copper in the renovation of aged infrastructure. Scraps of recycled copper are frequently utilized in construction and electric vehicles. The desire to create a green economy is another factor driving the region's demand for copper scrap. Copper scraps can be used as an alternative to primary metal production because of their sustainable nature, which is essential for reducing carbon emissions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global copper scrap market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aurubis

- Commercial Metals

- Sims Limited

- HKS Metals

- Jansen Recycling Group

- Kuusakoski

- Enerpat Group

- European Metal Recycling

- Olin Brass

- OmniSource Corporation

- Trademark Metals Recycling LLC

- Mallin Companies

- David J. Joseph

- Mid-West Recycling

- American Metal Recycling

- Others

Key Market Developments

- In July 2023, Hong Kong-based Global Metals Network (GMN), a manufacturer of recycled metals, was purchased by UK-based financial services firm Marex. Marex is anticipated to gain from this deal by reaching a wider audience of customers, growing its network of suppliers, and boosting sales.

- In June 2023, Elemental Holding Group, a mining and e-waste recycling firm located in Luxembourg, purchased Colt Recycling LLC, a UK-based e-waste recycler with facilities in North Carolina, USA, and New Hampshire, UK. This will assist the former in broadening its geographic reach.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global copper scrap market based on the below-mentioned segments:

Global Copper Scrap Market, By Feed Material

- Old Scrap

- New Scrap

Global Copper Scrap Market, By Grade

- Bare Bright

- #1 Copper

- #2 Copper Scrap

Global Copper Scrap Market, By Application

- Wire Rod Mills

- Brass Mills

- Ingots Makers

- Other

Global Copper Scrap Market, By End-use

- Building & Construction

- Electrical & Electronics

- Industrial Machinery & Equipment

- Transportation Equipment

- Consumer & General Products

Global Copper Scrap Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global copper scrap market over the forecast period?The global copper scrap market Size is expected to grow from USD 67.27 billion in 2023 to USD 129.17 billion by 2033, at a CAGR of 6.74% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share of the global copper scrap market?Asia-Pacific is projected to hold the largest share of the global copper scrap market over the forecast period.

-

3. Who are the top key players in the global copper scrap market?Aurubis, Commercial Metals, Sims Limited, HKS Metals, Jansen Recycling Group, Kuusakoski, Enerpat Group, European Metal Recycling, Olin Brass, OmniSource Corporation, Trademark Metals Recycling LLC, Mallin Companies, David J. Joseph, Mid-West Recycling, American Metal Recycling and Others.

Need help to buy this report?