Global Core Banking Software Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution and Service), By Deployment (Cloud and On-premise), By End-use (Banks, Financial Institutions, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Information & TechnologyGlobal Core Banking Software Market Insights Forecasts to 2033

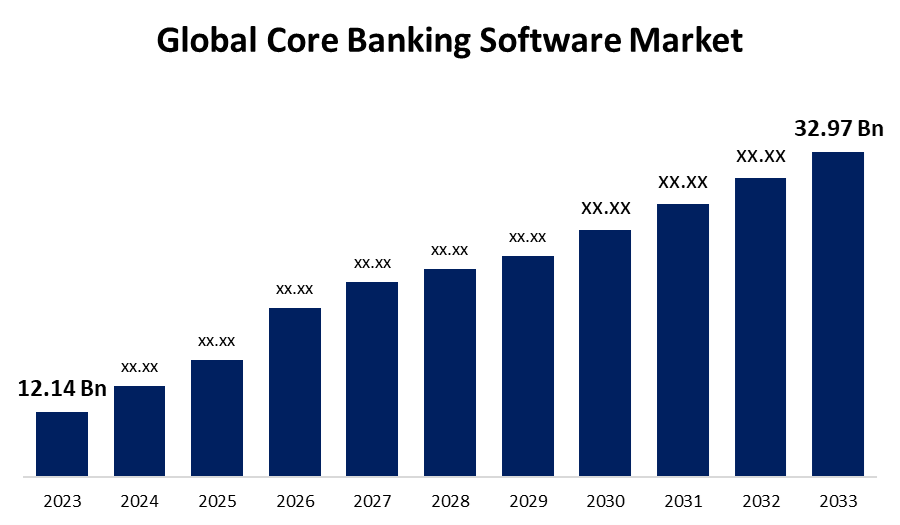

- The Global Core Banking Software Market Size Was Estimated at USD 12.14 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 10.51% from 2023 to 2033

- The Worldwide Core Banking Software Market Size is Expected to Reach USD 32.97 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Core Banking Software Market Size is anticipated to exceed USD 32.97 Billion by 2033, Growing at a CAGR of 10.51% from 2023 to 2033. The market growth is rising due to the banking sector's digital transformation and increasing demand for efficient, secure solutions. Continued innovation and enhanced customer experiences will drive further growth in this market.

Market Overview

The core banking software market refers to the sector that supplies software and technical solutions to banks and other financial organizations so they may handle their primary banking operations. Account management, transaction processing, client data management, loan management, and financial reporting are examples of these fundamental tasks. Banks may improve customer service, increase efficiency, streamline operations, and guarantee regulatory compliance with the aid of core banking software. As more companies adopt digital finance and financial institutions broaden their service offerings, the market for core banking software is expanding quickly. By 2025, companies hoping to increase customer satisfaction and streamline operations must implement core banking technologies. Fintech and non-fintech businesses can more easily provide integrated financial services through core banking systems, which enable the smooth integration of numerous banking functions like account administration, transaction processing, and customer onboarding.

Report Coverage

This research report categorizes the core banking software market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the core banking software market. Recent market developments and competitive strategies such as expansion, Type of Software launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the core banking software market.

Global Core Banking Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 12.14 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 10.51% |

| 2033 Value Projection: | USD 32.97 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Deployment, By End-use, and By Region. |

| Companies covered:: | Finastra, Infosys Limited, Capgemini, Fiserv, Inc., Unisys, Oracle Corporation, HCL Technologies Limited, Jack Henry & Associates, Inc., FIS, Temenos AG, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The core banking software market is experiencing rapid growth, driven by the banking sector is increasingly adopting modern technology and shifting toward digitization. The increased usage of smartphones, digital payments, and mobile banking solutions is driving demand for more efficient and secure banking software. Core banking systems include advantages such as improved data analytics, remote account administration, and fraud prevention. As competition and cyber dangers grow, banks are investing in new technologies to enhance the customer experience and operational efficiency. Continued technology innovation and customer interaction methods are projected to fuel market expansion.

Restraining Factors

The market growth is hindered by the concerns about data loss, mobile viruses, software defects, and unencrypted data have increased as a result of the proliferation of sophisticated core banking software. Concerns about data security and privacy may result in a decline in revenue for credit unions, corporate banks, and financial institutions. Additionally, not all core banking software provides operational flexibility at scale, which raises issues with data security and the law.

Market Segmentation

The global Core Banking Software market is classified into component, deployment, and end use.

- The solutions segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the component, the core banking software market is categorized into solutions and services. Among these, the solution segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the need for core banking solutions is increasing as banks and financial institutions seek to improve operations and client experiences. To remain competitive, many institutions are updating their infrastructure by implementing advanced technologies. Core banking solutions for loans provide critical capabilities for streamlining and optimizing loan management procedures.

- The on-premises segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the deployment, the core banking software market is categorized into cloud and on-premise. Among these, the on-premises segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the businesses taking full responsibility for integration and any security and IT-related risks when they establish an on-premise solution. Businesses that use legacy platforms frequently collaborate with IT service providers to recover data, lower operating expenses, and address security issues. It gives the operational infrastructure additional control.

- The banks segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the core banking software market is categorized into banks, financial institutions, and others. Among these, the banks segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the growing investments in contemporary IT infrastructure are responsible for the segment's expansion. Automated systems reduce incorrect data entry by ensuring accurate data processing and entry. Banks may make data-driven decisions by gaining important insights into consumer behavior, tastes, and financial trends through access to real-time data and sophisticated analytics.

Regional Segment Analysis of the Core Banking Software Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the core banking software market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the core banking software market over the predicted timeframe. The regional growth can be attributed to the region's robust IT and telecom sectors, the existence of several banks committed to digital transformation, and the accessibility of cutting-edge technologies, which facilitate availability. Early adoption of technology across industries is a hallmark of the North American area. Regional growth is anticipated to be fueled by the increasing focus of major regional banks on modernizing key infrastructure.

Asia Pacific is expected to grow at the fastest CAGR of the Core Banking Software market during the forecast period. This market is largely influenced by the expanding quantity of digital transactions, customers' increasing usage of digital technology, and the growing demand for core banking technologies that are scalable and secure. The expansion is also being aided by the entry of numerous international banking and financial firms into this region's untapped markets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the core banking software market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Finastra

- Infosys Limited

- Capgemini

- Fiserv, Inc.

- Unisys

- Oracle Corporation

- HCL Technologies Limited

- Jack Henry & Associates, Inc.

- FIS

- Temenos AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2025, Fiserv, Inc., a payment and financial services technology provider, acquired Payfare Inc., a provider of program management technology solutions. The acquisition is intended to improve Fiserv's embedded financial solutions capabilities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the core banking software market based on the below-mentioned segments:

Global Core Banking Software Market, By Component

- Solution

- Service

Global Core Banking Software Market, By Deployment

- Cloud

- On-premise

Global Core Banking Software Market, By End-use

- Banks

- Financial Institutions

- Others

Global Core Banking Software Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the core banking software market over the forecast period?The core banking software market is projected to expand at a CAGR of 10.51% during the forecast period.

-

2. What is the market size of the core banking software market?The Global Core Banking Software Market Size is expected to grow from USD 12.14 Billion in 2023 to USD 32.97 Billion by 2033, at a CAGR of 10.51% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the core banking software market?North America is anticipated to hold the largest share of the core banking software market over the predicted timeframe.

Need help to buy this report?