Global Corn Starch Market Size, Share, and COVID-19 Impact Analysis, By Type (Native Starch, Modified Starch, and Sweeteners), By Application (Food & Beverages, Animal Feed, Pharmaceuticals & Chemicals, Textile, Paper & Corrugates, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Food & BeveragesGlobal Corn Starch Market Insights Forecasts to 2033

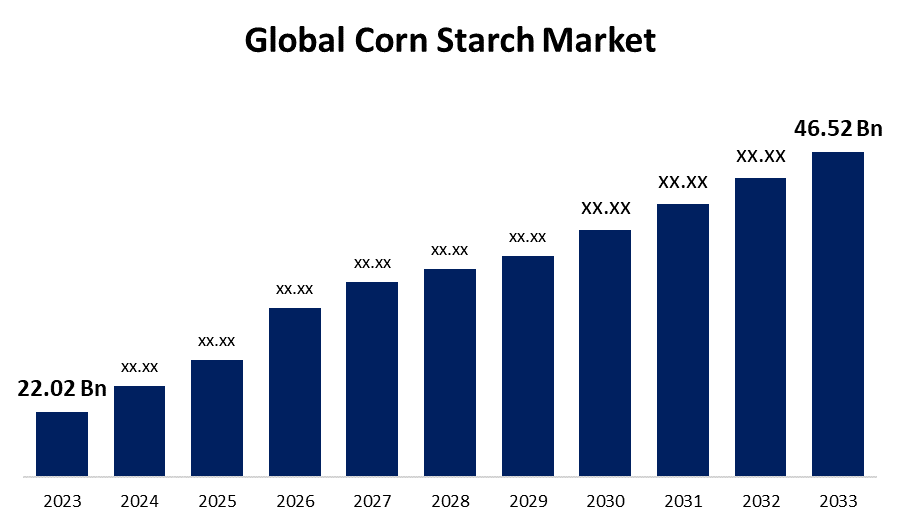

- The Global Corn Starch Market Size was Valued at USD 22.02 Billion in 2023

- The Market Size is Growing at a CAGR of 7.77% from 2023 to 2033

- The Worldwide Corn Starch Market Size is Expected to Reach USD 46.52 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Corn Starch Market Size is Anticipated to Exceed USD 46.52 Billion by 2033, Growing at a CAGR of 7.77% from 2023 to 2033.

Market Overview

The carbohydrate known as cornstarch, or cornflour, is taken out of the endosperm of corn. There are several industrial, domestic, and culinary uses for this white, powdery material. Starches are being used more and more as food additives for a variety of purposes, including thickening sauces, molding gums, and binding baking component viscosity control agents. The primary raw material used to produce starch and its derivatives is corn. Compared to starch made from other raw materials including rice, potatoes, cassava, and others, corn starch has an important share of the starch market. The growing market demand for processed and convenience foods has led to a rise in the need for corn starch in the food and beverage sector. Several key factors are driving the corn starch market including the growing demand for products from the food and beverage (F&B) sector, improvements in extraction and modification technologies, growing consumer awareness of sustainable practices, the rapid globalization of trade, and the widespread use of products in the pharmaceutical market.

Report Coverage

This research report categorizes the corn starch market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the corn starch market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the corn starch market.

Global Corn Starch Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 22.02 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.77% |

| 2033 Value Projection: | USD 46.52 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 175 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, and By Region. |

| Companies covered:: | DFE Pharma,Ingredion Incorporated,Tate and Lyle Plc,Cargill Incorporated,AGRANA Beteiligungs AG,Archer-Daniels-Midland Company,Tereos Syral S.A.S,Associated British Foods plc,Roquette Frères S.A.,Kent Corporation,Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Corn starch is mostly used in the food industry for gelling, adhesion, and stability because of its versatility. It also demonstrates rheology-modifying characteristics, which have led to widespread adoption and accelerated global market expansion. The rising demand for convenience food products, along with the increasing use of corn starch as a thickening and stabilizing agent in various products, is strengthening the corn starch market growth. The growing consumer preferences for natural and organic ingredients in food products are driving the demand for corn starch market.

Restraining Factors

It is anticipated that the usage of starches from other sources, such as rice starch, tapioca starch, potato starch, and others, can restrict the growth of the corn starch market.

Market Segmentation

The corn starch market share is classified into type and application.

- The sweeteners segment is estimated to hold the largest market revenue share through the projected period.

Based on the type, the corn starch market is classified into native starch, modified starch, and sweeteners. Among these, the sweeteners segment is estimated to hold the largest market revenue share through the projected period. The majority of food manufacturers use sweeteners made from this product due to they are affordable. The three main sweeteners with the highest concentration of concentrated starch are dextrose, glucose syrup, and high fructose syrup.

- The food & beverages segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the corn starch market is divided into food & beverages, animal feed, pharmaceuticals & chemicals, textiles, paper & corrugates, and others. Among these, the food & beverages segment is anticipated to hold the largest market share through the forecast period. A highly versatile component with a wide range of uses in food and beverage production is corn starch. It is an essential ingredient in many recipes due to it is frequently used as a thickening agent, stabilizer, and texturizer in a wide range of products.

Regional Segment Analysis of the Corn Starch Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the corn starch market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the corn starch market over the predicted timeframe. The United States is the world's biggest producer of corn and its derivatives in North America. A different factor driving the market expansion is the rise in the consumption of RTE snacks and convenience foods. North America, being a developed region with robust distribution networks, promotes the sale of food and beverages. The usage of corn starch as a sweetener in packaged and unpackaged foods is growing, which has a significant positive influence on the market's growth in North America.

Asia Pacific is expected to grow at the fastest CAGR growth of the corn starch market during the forecast period. The consumption of packaged foods and beverages has increased significantly in the Asia Pacific region, which has increased demand for items made from corn starch and drives the market's growth. The rapid economic growth of the Asia-Pacific region has resulted in changes in the spending patterns and lifestyles of its inhabitants.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the corn starch market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DFE Pharma

- Ingredion Incorporated

- Tate and Lyle Plc

- Cargill Incorporated

- AGRANA Beteiligungs AG

- Archer-Daniels-Midland Company

- Tereos Syral S.A.S

- Associated British Foods plc

- Roquette Frères S.A.

- Kent Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2024, Ingredion Incorporated, a leading global supplier of specialty ingredient solutions to the food and beverage manufacturing industry and a pioneer in the development of clean-label ingredients, announced the launch of NOVATION Indulge 2940 starch, a new addition to their clean-label texturizer line that offers the first non-GMO functional native corn starch, giving popular dairy and alternative dairy products and desserts a unique texture for gelling and co-texturizing.

- In January 2022, to expand its range of nutraceuticals, DFE Pharma launched three new starch-based excipients. The three products are native corn starch Nutroféli ST100, slightly pre-gelatinized corn starch Nutroféli ST200, and fully gelatinized corn starch Nutroféli ST300.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the corn starch market based on the below-mentioned segments:

Global Corn Starch Market, By Type

- Native Starch

- Modified Starch

- Sweeteners

Global Corn Starch Market, By Application

- Food & Beverages

- Animal Feed

- Pharmaceuticals & Chemicals

- Textile

- Paper & Corrugated

- Others

Global Corn Starch Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the corn starch market over the forecast period?The corn starch market is projected to expand at a CAGR of 7.77% during the forecast period.

-

2. What is the market size of the corn starch market?The Global Corn Starch Market Size is Expected to Grow from USD 22.02 Billion in 2023 to USD 46.52 Billion by 2033, at a CAGR of 7.77% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the corn starch market?North America is anticipated to hold the largest share of the corn starch market over the predicted timeframe.

Need help to buy this report?