Global Corneal Implants Market Size, Share, and COVID-19 Impact Analysis, By Disease Type(Fuchs Dystrophy, Infectious Keratitis, Keratoconus, Others), By Surgery Method (Penetrating Keratoplasty, Endothelial Keratoplasty), By End-use (Ophthalmic Centers, Hospitals, Ambulatory Surgical Centers), and By Region (North America, Europe, Asia-Pacific, South America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Industry: HealthcareGlobal Corneal Implants Market Insights Forecasts to 2033

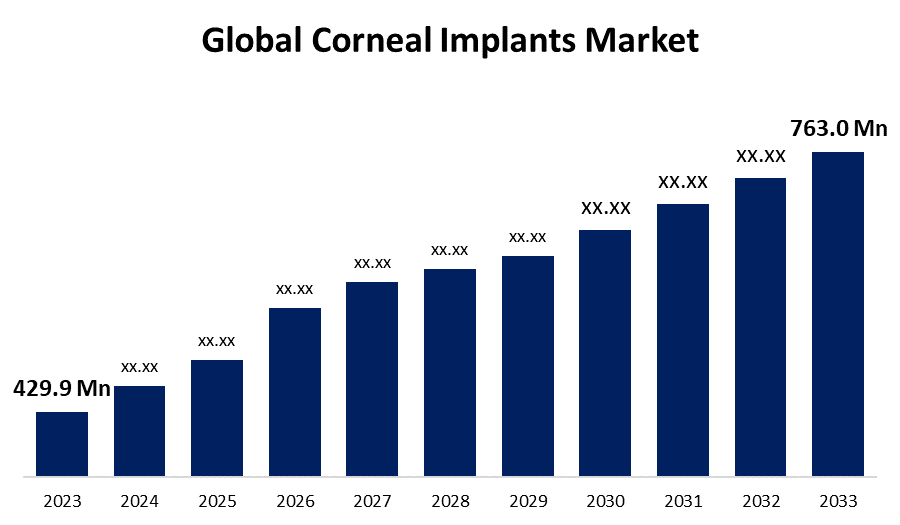

- The Global Corneal Implants Market Size was Valued at USD 429.9 Million in 2023.

- The Market Size is Growing at a CAGR of 5.9% from 2023 to 2033.

- The Worldwide Corneal Implants Market Size is Expected to Reach USD 763.0 Million by 2033.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Corneal Implants Market Size is Anticipated to Exceed USD 763.0 Million by 2033, Growing at a CAGR of 5.9% from 2023 to 2033.

Market Overview

A corneal implant (also known as a corneal graft) is a surgical procedure that uses a donor cornea to swap out a damaged cornea. The cornea is the translucent dome-shaped outermost layer of the eye that concentrates light onto the retina, making it crucial to vision. The corneal implant method is applied to treat keratoconus and other degenerative disorders, as well as to correct hyperopia, myopia, and astigmatism. Corneal transplants are available in a variety of types, targeting different parts of the corneal with partial-thickness (lamellar) and full-thickness (penetrating) transplants. Technological improvements in corneal implants, a growing percentage of the elderly population, and rising incidences of eye illnesses worldwide have all contributed significantly to market expansion. These factors are causing a significant need for corneal implants in healthcare centers. Fuchs' dystrophy is more common among the elderly, and it is treated with endothelial keratoplasty. Furthermore, requests for collagen-based artificial corneas are rising because of their interface and low cost, prompting the production of bio-engineered artificial corneas. Additionally, increased R&D efforts in this field are adding to market expansion.

Report Coverage

This research report categorizes the market for the global corneal implants market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global corneal implants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global corneal implants market.

Global Corneal Implants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 429.9 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.9% |

| 2033 Value Projection: | USD 763.0 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Disease Type, By Surgery Method, By End-use, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Florida Lions Eye Bank, Alcon Inc., Massachusetts Eye and Ear, Aurolab, CorneaGen, Presbia Plc, Mediphacos, EyeYon Medical, AJL Opthalmic SA, KeraMed, Inc, CorNeat Vision, LinkoCare Life Sciences AB, DIOPTEX, San Diego Eye Bank, and other key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Corneal disease is the fifth most common reason for blindness worldwide. Growing healthcare expenditure, the production of cutting-edge goods in the pharmaceutical business, government-sponsored campaigns, and more disposable money among people are all drivers driving market expansion. Furthermore, raising awareness about the significance of eye donation is likely to help the sector grow. The development of eye care services, eye banking platforms, and cornea trade procedures in emerging nations is likely to play a major part in meeting a rising need for corneal implants, consequently contributing to market expansion. This is why these characteristics will boost corneal tissue accessibility and enhance eye care quality, making it simple for patients to receive treatment for corneal problems. As a result, the market is expected to grow in developing nations, increasing the corneal implant share in the market. In addition, the availability of USFDA-approved corneal implant surgery, as well as the development of advanced Xenia corneal implant procedures such as Deep Anterior Lamellar Keratoplasty (DALK), are expected to propel the market's growth throughout the forecast period. The other component involves the application of corneal implants for presbyopia and post-operative cataract edema, inherited corneal abnormalities, and any sort of mechanical or chemical injury to the cornea.

Restraining Factors

Despite corneal implantation being a secure procedure, it does carry several dangers, including eye infection, corneal edema, pressure within the eyeball, and donor cornea rejection, all of which could hinder industry share. Furthermore, the scarcity of cornea tissues because of donor shortages may emerge as a key growth limitation in the approaching years.

Market Segmentation

The global corneal implants market share is classified into disease type, surgery method, and end-use.

- The fuchs' dystrophy segment is expected to hold the largest share of the global corneal implants market during the forecast period.

Based on the disease type, the global corneal implants market is categorized into fuchs' dystrophy, infectious keratitis, keratoconus, and others. Among these, the fuchs' dystrophy segment is expected to hold the largest share of the global corneal implants market during the forecast period. Greater awareness of ocular health and Fuchs' dystrophy is becoming more widespread therefore the fuchs' dystrophy segment witnessed the largest revenue share in the corneal implants market. Whenever a person has Fuchs' dystrophy, the transparent layer (cornea) in the front of the eye becomes blocked with fluid, causing it to grow and thicken. As a result, glare, cloudy or blurred vision, and eye pain may occur.

- The penetrating keratoplasty segment is expected to grow at the fastest CAGR during the forecast period.

Based on the surgery method, the global corneal implants market is categorized into penetrating keratoplasty and endothelial keratoplasty. Among these, the penetrating keratoplasty segment is expected to grow at the fastest CAGR during the forecast period. Penetrating keratoplasty is the most often used treatment for corneal transplantation due to its proven safety and success. Its acceptance rate has recently reduced due to the presence of substitute treatments that produce positive results. Its distinct benefits over newer methods, such as avoiding the stromal interface and healing large core holes efficiently, are projected to keep its market share stable.

- The hospital segment is expected to hold a significant share of the global corneal implants market during the forecast period.

Based on the end-use, the global corneal implants market is categorized into ophthalmic centers, hospitals, and ambulatory surgical centers. Among these, the hospital segment is expected to hold a significant share of the global corneal implants market during the forecast period. The abundance of highly trained healthcare experts, as well as the increase of coverage for hospital-based healthcare services under individual and group insurance policies. Hospitals also have specific furnishings and services, such as operating rooms, intensive care units, and units for specialty eye surgery. As a consequence, with the availability of specialists and high-tech apparatus to execute these surgeries, the hospital segment's growth is likely to grow faster over the forecast period.

Regional Segment Analysis of the Global Corneal Implants Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global corneal implants market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the global corneal implants market over the forecast period. Although conditions like impaired vision demand surgical treatment, there is a large patient base for corneal implant procedures. The increasing prevalence of corneal diseases, such as keratoconus, dystrophies, and corneal scarring, has raised the demand for corneal implants. Advances in corneal implant technology have improved therapy safety and efficacy. Artificial corneas and more biocompatible materials have enhanced surgical outcomes and attracted the attention of patients and doctors in these implants. Moreover, the presence of key market participants, effective reimbursement regulations, and increased R&D activities for corneal implants are projected to fuel market expansion in the region. However, the growing elderly population and a greater vulnerability of older persons to a variety of chronic diseases, including diabetes. Diabetic patients are more likely to have eye problems that cause vision loss. Such factors are anticipated to hold the largest share of the global corneal implants market for the North America region.

Asia Pacific is expected to grow at the fastest CAGR growth of the global corneal implants market during the forecast period. The presence of various rising markets, as well as severely unmet clinical requirements in countries such as China, Indonesia, and the Philippines, is likely to fuel regional expansion. For instance, in January 2023, a union hospital in China associated with the Tongji medical college at Huazhong University of Science and technology in Wuhan executed its first artificial cornea transplant operation on a 25-year-old woman. These factors are projected to drive the region's expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global corneal implants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Florida Lions Eye Bank

- Alcon Inc.

- Massachusetts Eye and Ear

- Aurolab

- CorneaGen

- Presbia Plc

- Mediphacos

- EyeYon Medical

- AJL Opthalmic SA

- KeraMed, Inc

- CorNeat Vision

- LinkoCare Life Sciences AB

- DIOPTEX

- San Diego Eye Bank

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Alcon, the top eye care company focused on improving vision, revealed encouraging top-line findings from two crucial phase 3 trials (COMET-2 and COMET-3) assessing the effectiveness and safety of AR-15512, a potential remedy for dry eye disease symptoms and signs.

- In December 2023, Kubota Vision Inc., the clinical-stage specialist ophthalmology firm and a wholly-owned unit of Kubota Pharmaceutical Holdings Co., Ltd., revealed the signing of a collaborative agreement of commitment with AUROLAB.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global corneal implants market based on the below-mentioned segments:

Global Corneal Implants Market, By Disease Type

- Fuchs' Dystrophy

- Infectious Keratitis

- Keratoconus

- Others

Global Corneal Implants Market, By Surgery Method

- Penetrating Keratoplasty

- Endothelial Keratoplasty

Global Corneal Implants Market, By End-Use

- Ophthalmic Centers

- Hospitals

- Ambulatory Surgical Centers

Global Corneal Implants Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global corneal implants market over the forecast period?The global corneal implants market is projected to expand at a CAGR of 5.9% during the forecast period.

-

2. What is the projected market size & growth rate of the global corneal implants market?The global corneal implants market was valued at USD 429.9 Million in 2023 and is projected to reach USD 763.0 Million by 2033, growing at a CAGR of 5.9% from 2023 to 2033.

-

3. Which region is expected to hold the highest share in the global corneal implants market?The North America region is expected to hold the highest share of the global corneal implants market.

Need help to buy this report?