Global Credit Card Market Size, Share, and COVID-19 Impact Analysis, By Card Type (General-Purpose Credit Cards, Specialty Credit Cards, and Others), By Application (Food and Groceries, Health and Pharmacy, Consumer Electronics, Media and Entertainment, and Others), By Provider (Visa, Mastercard, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Credit Card Market Insights Forecasts to 2033

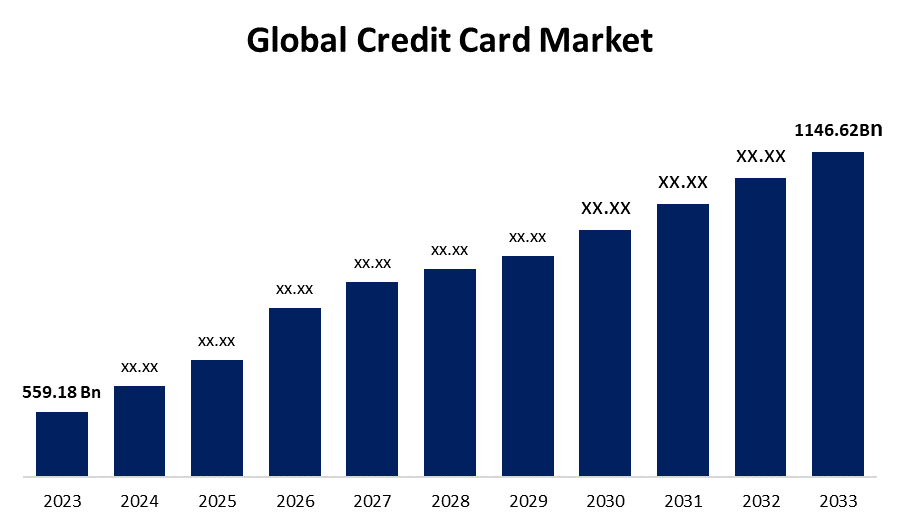

- The Global Credit Card Market Size was Valued at USD 559.18 Billion in 2023

- The Market Size is Growing at a CAGR of 7.45% from 2023 to 2033

- The Worldwide Credit Card Market Size is Expected to Reach USD 1146.62 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Credit Card Market Size is Anticipated to Exceed USD 1146.62 Billion by 2033, Growing at a CAGR of 7.45% from 2023 to 2033.

Market Overview

A credit card is a small, rectangular piece of metal or plastic, that is provided by a bank or other financial services provider. Cardholders can use their credit cards to borrow money to pay for products and services from businesses that accept credit cards. Credit cardholders are required to repay the borrowed funds in full by the billing date or over time, together with any relevant interest and any other costs that were agreed upon. The credit card issuer might offer customers a separate cash line of credit (LOC) in addition to the regular credit limit. This allows customers to borrow money through cash advances, which they can access through ATMs, bank tellers, or credit card convenience checks. The ideal course of action is always to pay off credit card debt in full each month, but even in those situations, it's crucial to make a minimal payment. By paying the minimum amount due, one can prevent multiple credit card fees and a delinquent mark on the credit report. Having a great credit rating can help consumers qualify for the best credit cards and the most competitive rates for mortgages, auto loans, and other lending products. The global market for credit card payments is growing as a result of the growing need for easy substitutes for cash as well as the widespread availability of more reasonably priced credit cards. Additionally, the growing need for credit cards in developing nations is beneficial to the market's growth. The market for credit card payments growing

Report Coverage

This research report categorizes the market for the global credit card market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global credit card market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global credit card market.

Global Credit Card Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 559.18 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.45% |

| 2033 Value Projection: | USD 1146.62 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 290 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Card Type, By Application, By Provider, By Region |

| Companies covered:: | Capital One, Chase, Citibank, Discover, HSBC, ICICI Bank, JPMorgan, Mastercard, MUFG, Santander, SBI Cards, State Farm, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

A positive market outlook is being offered by the increasing demand for credit card payments brought about by consumers' growing emphasis on greater convenience and flexibility. Accordingly, the market is expanding as more and more consumers choose safe payment options. Additionally, credit cards make it simple for people to make purchases in real establishments as well as online. In addition, credit cards help people avoid carrying around significant sums of cash and provide an extra security measure in the event of theft or loss, which makes them a desirable option. These cards also offer a line of credit, which helps customers effectively manage their money. The dominance of credit card payments in the digital world might be attributed to the rise in e-commerce activities and the growing acceptance of online transactions. Credit cards are preferred by customers for their convenience, security, and buyer protection features when customers shop online on a variety of platforms.

Restraining Factors

There are serious security flaws and fraud concerns in the credit card payment system. Fraudsters continue to target credit card transactions despite advancements in security technologies, leading to data breaches, identity theft, and unauthorized access to private information. Moreover, millions of credit card details have been made public due to widely reported data breaches that have affected major online retailers, banks, and other organizations.

Market Segmentation

The global credit card market share is segmented into card type, application, and provider.

- The general-purpose credit cards segment dominates the market with the largest market share through the forecast period.

Based on the card type, the global credit card market is segmented into general-purpose credit cards, specialty credit cards, and others. Among these, the general-purpose credit cards segment dominates the market with the largest market share through the forecast period. Cardholders can make a variety of transactions with general-purpose credit cards, which are flexible financial tools. The cards can be used for both conventional online and offline purchases, as they are not limited to any particular businesses or industries. Depending on the cardholder's creditworthiness, general-purpose credit cards are frequently provided with a predefined credit limit. Stores, restaurants, and service providers are just a few of the places where they are commonly accepted. In addition, credit cards are widely used by customers seeking a flexible payment option because they often come with benefits like cashback incentives, loyalty programs, and introductory interest rates.

- The food and groceries segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the application, the global credit card market is segmented into food and groceries, health and pharmacy, consumer electronics, media and entertainment, and others. Among these, the food and groceries segment is anticipated to grow at the fastest CAGR growth through the forecast period. Paying for groceries and meals with credit cards is widespread. Credit cards are widely used by customers for paying their restaurant and grocery bills. This group of credit cards offers rewards or cashback rewards for purchases made in grocery stores, restaurants, and supermarkets, which makes them a desirable payment option for individuals who maintain control of their household spending.

- The visa segment accounted for the largest revenue share through the forecast period.

Based on the provider, the global credit card market is segmented into visa, mastercard, and others. Among these, the visa segment accounted for the largest revenue share through the forecast period. Visa is a global payment network that makes credit card and electronic money transfers possible. Due to their widespread acceptance in millions of locations worldwide, visa-branded credit cards are a popular choice for both businesses and consumers. Visa offers a range of credit card alternatives, such as co-branded cards with other financial institutions, rewards cards, and general-purpose cards. Visa cards are a flexible and widely available payment method for customers in a range of industries and companies due to their widespread network and global presence.

Regional Segment Analysis of the Global Credit Card Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global credit card market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global credit card market over the predicted timeframe. Owing to the presence of prominent merchant banking service providers. Additionally, individuals becoming more and more interested in quick and easy ways to make payments. Consequently, the industry is expanding due to technological developments in payment processing, including the increasing use of mobile wallets and contactless payments. The ease and security of using credit cards is also improved by these advancements.

Europe is expected to grow at the fastest CAGR growth of the global credit card market during the forecast period. Due to the expansion of credit card reward points granted by businesses to gain market share, the rise in loyalty programs, and the growing trend of credit card use among young people in industrialized nations. Additionally, since people in this region prefer to pay with cash, a lot of credit card firms are promoting their products to increase their market share and revenue, which creates profitable possibilities for the local market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global credit card market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Capital One

- Chase

- Citibank

- Discover

- HSBC

- ICICI Bank

- JPMorgan

- Mastercard

- MUFG

- Santander

- SBI Cards

- State Farm

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, American Express and Delta Air Lines launched the enhanced Delta SkyMiles American Express Cards, designed to enhance the travel experience and offer everyday value to customers and business owners.

- In January 2024, Bank of America announced the availability of CashPro Insights, a digital application that analyzes data via the CashPro platform.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global credit card market based on the below-mentioned segments:

Global Credit Card Market, By Card Type

- General-Purpose Credit Cards

- Specialty Credit Cards

- Others

Global Credit Card Market, By Application

- Food and Groceries

- Health and Pharmacy

- Consumer Electronics

- Media and Entertainment

- Others

Global Credit Card Market, By Provider

- Visa

- Mastercard

- Others

Global Credit Card Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Capital One, Chase, Citibank, Discover, HSBC, ICICI Bank, JPMorgan, Mastercard, MUFG, Santander, SBI Cards, State Farm, and Others.

-

2. What is the size of the global credit card market?The Global Credit Card Market Size is Expected to Grow from USD 559.18 Billion in 2023 to USD 1146.62 Billion by 2033, at a CAGR of 7.45% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global credit card market over the predicted timeframe.

Need help to buy this report?