Global Crop Insurance Market Size, Share & Trends, COVID-19 Impact Analysis Report, By Type (Multiple Peril Crop Insurance, Actual Production History, and Crop Revenue Coverage), By Coverage (Localized Calamities, Sowing/Planting/Germination Risk, Standing Crop Loss, and Post-harvest Losses), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Banking & FinancialCROP INSURANCE MARKET: OVERVIEW

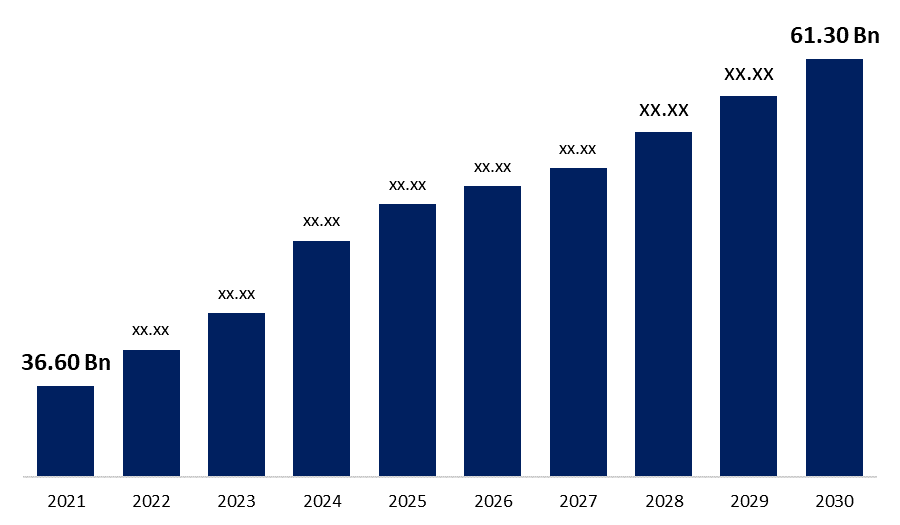

The Crop Insurance Market was valued at USD 36.7 Billion in 2021, the market is projected to grow USD 61.30 Billion in 2030, at a CAGR of 5.90 %. Agricultural insurance has long been thought of as a risk management tool for farmers in both developing and industrialized economies, although policy paths toward sustainability differ from country to country. To increase coverage rates, private insurance companies work in tandem with the government-run insurance corporation. The viability of a heavily subsidized crop insurance, especially in developing economies, depends on identifying qualified beneficiaries. Farming is always a risky business, but adding the unpredictable and severe weather to the mix may make things even more challenging. Farmers are well aware that a major hailstorm, fire, or other unforeseen calamity can wreak havoc on their crops (and, as a result, their source of revenue) during the growing season.

Get more details on this report -

COVID-19 ANALYSIS

The COVID-19 pandemic has had a moderate impact on the crop insurance market, owing to widespread fear of the virus and unprecedented transportation restrictions, which have disrupted supply chains for selling crops. Furthermore, a labor shortage for harvesting and supplying crops in the market is indirectly affecting the crop insurance market during the pandemic. As a result, crop harvesting and supply challenges reduce demand for crop insurance. However, following the recovery from the COVID-19 pandemic, the crop insurance market is expected to thrive in the coming years.

CROP INSURANCE MARKET: TREND

Growing Adoption of Climate index insurance

When a specified value on an index (e.g. a percentile of rainfall) is realized, climate index insurance (also known as parametric, weather index, or index-based insurance) pays the policyholder. Climate index insurance often has lower rates than yield-based or revenue-based insurance because it does not require costly on-the-ground inspections and reduces moral hazards caused by information gaps or fraudulent loss reporting. Climate index insurance may be a widely acceptable and effective tool for farmers to transfer climate risks due to its potentially lower premiums. Despite its potential benefits, considerable basis risk, limited hazards, and a lack of technical ability, expertise, and data typically prevent climate index insurance from being used. Many problems exist in the development of successful climate index insurance products, which necessitate the attention and participation of scientists, policymakers, and industry.

CROP INSURANCE MARKET: DRIVERS

Increasing Government Subsidies for Agricultural Weather Insurance Drive Market Growth

In recent years, governments in developing nations have been more active in supporting commercial crop insurance programs. In order for crop insurance to be widely adopted in global market, government subsidies are likely to be required. It's also feasible to focus a subsidy to a specific group of farmers, which could result in a higher benefit-to-cost ratio, though the expenses are still likely to outweigh the benefits overall. There are government interventions that address the barriers and help to facilitate the development of the agricultural weather insurance.

Global Crop Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 36.7 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 5.90 %. |

| 2030 Value Projection: | USD 61.30 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 208 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Coverage, By Region, COVID-19 Impact Analysis |

| Companies covered:: | Agriculture Insurance Company of India Limited (AIC), American Financial Group, Inc, Chubb, Fairfax Financial Holdings Limited, ICICI Lombard General Insurance Company Limited, PICC, QBE Insurance Group Limited, Sompo International Holdings Ltd, Tokio Marine HCC, Zurich |

| Growth Drivers: | 1) Increasing Government Subsidies for Agricultural Weather Insurance Drive Market Growth 2) Lack Of Awareness in Developing Countries Market Growth |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

CROP INSURANCE MARKET: RESTRAIN

Lack Of Awareness in Developing Countries Market Growth

Crop insurance policies are scarce due to a lack of knowledge and understanding, as well as higher prices, limiting market growth. Satellites, remotely sensed data, and artificial intelligence are used to aid in the enrollment of farmer information and location, as well as the collection of premiums and payment of claims. As a result, these factors are expected to create profitable opportunities for the expanding market during the forecast period.

CROP INSURANCE MARKET: SEGMENTATION

The global Crop Insurance Market is segmented by Type (Multiple Peril Crop Insurance, Actual Production History, and Crop Revenue Coverage), By Coverage (Localized Calamities, Sowing/Planting/Germination Risk, Standing Crop Loss, and Post-harvest Losses) and Region (North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa).

SEGMENTATION: BY REGION

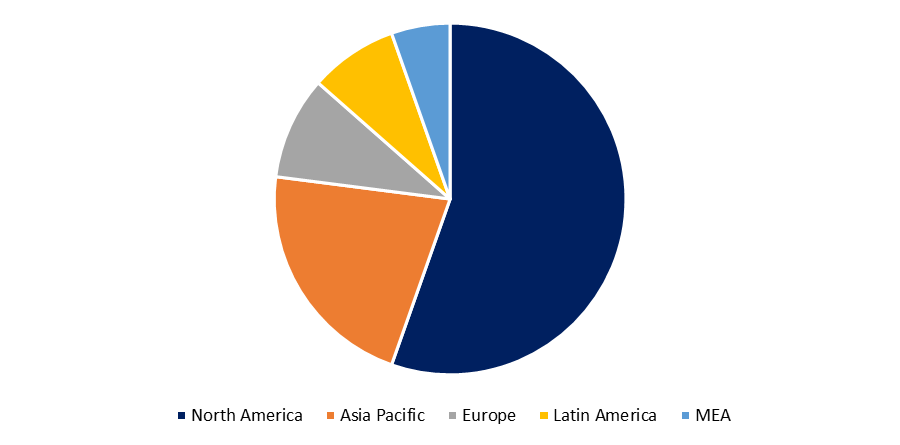

Based on the Region, the Global Crop Insurance Market is categorized into North America, Europe, Asia-Pacific, Latin America, the Middle East and Africa.

North America region is dominating share of the global Crop Insurance market due to the proportion of cropped land has increased on North America cropping farms. Farmers and ranchers in the United States want to develop and maintain profitable crop production by obtaining prominent crop insurance coverage. Furthermore, insurers are expanding existing products and educating agricultural producers to ensure the maximum safety of food and fiber crops for consumption in the region.

Get more details on this report -

The Asia Pacific will offer the most market growth opportunities. According to our research, the region will account for 35% of global market growth over the forecast period. APAC's crop insurance market is dominated by China and India. Crop insurance market growth in APAC will be driven by the presence of large tracts of agricultural land and favorable climatic conditions during the forecast period. Australian agricultural insurance industry, there are some new and emerging products. For the Australian market, established and new insurance companies have recently started testing a variety of agricultural insurance products and product distribution methodologies. The products and methods are based on lessons learned from overseas markets and previous experiences in the Australian market.

CROP INSURANCE MARKET: KEY PLAYERS

- Agriculture Insurance Company of India Limited (AIC)

- American Financial Group, Inc.

- Chubb

- Fairfax Financial Holdings Limited

- ICICI Lombard General Insurance Company Limited

- PICC

- QBE Insurance Group Limited

- Sompo International Holdings Ltd.

- Tokio Marine HCC

- Zurich

- Others

CROP INSURANCE MARKET: RECENT DEVELOPMENT

- December 2020- Sompo International Holdings Ltd. (SIH), a Bermuda-based specialty provider of property and casualty insurance and reinsurance, has acquired DCIS Diversified Crop Insurance Services, a subsidiary of CGB Enterprises, Inc. (CGB).

CROP INSURANCE MARKET: REPORT OVERVIEW

The scope of the report includes a detailed study of regional markets for Global Crop Insurance Market. The Global Crop Insurance Market is segmented by Type, Coverage, and Region. It reveals the market situation and future forecast. The study also covers the significant data presented with the help of graphs and tables. The report covers information regarding the competitive outlook including the market share and company profiles of the key participants operating in the Global Crop Insurance Market.

Need help to buy this report?