Global Crop Protection Chemicals Market Size, Share, Growth, and Industry Analysis, By Type (Herbicides, Fungicides, Insecticides), By Form (Liquid, Solid), By Application (Foliar Spray, Seed Treatment, Soil Treatment), and Regional Crop Protection Chemicals and Forecast to 2033

Industry: Chemicals & MaterialsGlobal Crop Protection Chemicals Market Insights Forecasts to 2033

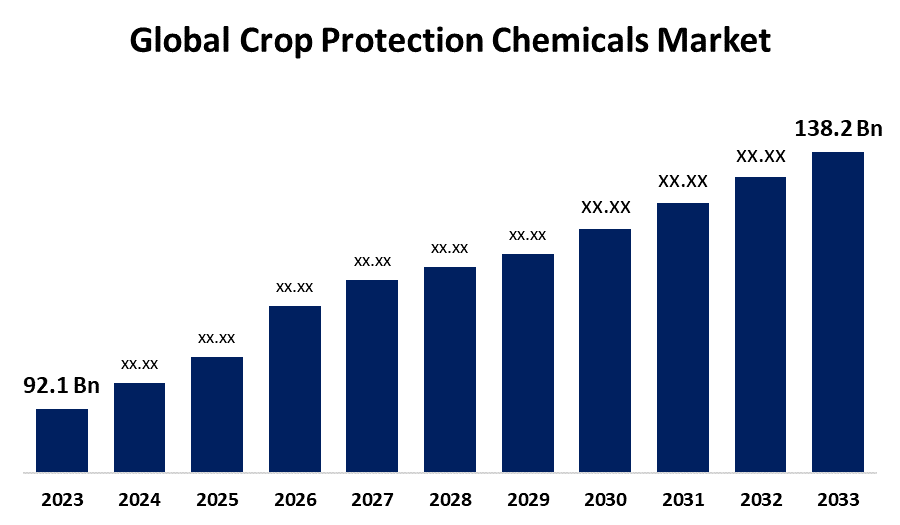

- The Global Crop Protection Chemicals Market Size was Valued at USD 92.1 Billion in 2023

- The Market Size is Growing at a CAGR of 4.14 % from 2023 to 2033

- The Worldwide Crop Protection Chemicals Market Size is Expected to Reach USD 138.2 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Crop Protection Chemicals Market Size is Anticipated to Exceed USD 138.2 Billion by 2033, Growing at a CAGR of 4.14 % from 2023 to 2033.

CROP PROTECTION CHEMICALS MARKET REPORT OVERVIEW

Chemicals used in farming to shield crops against pests, illnesses, and weeds are referred to as crop protection chemicals or agricultural pesticides. These substances are essential to maintaining agricultural productivity and profitability. Insecticides, herbicides, fungicides, and rodenticides are just a few of the many items classified as crop protection chemicals. Each is made to target a particular pest or plant disease. Insects that can harm crops by eating leaves, stems, or fruits are controlled and eliminated with the application of insecticides. For the purpose of minimizing their impact on non-target creatures, modern products are made to be extremely selective in their actions. For example, selective activity makes it possible to manage fungi that are growing on plants without harming the plants themselves, or to control a variety of weed species without endangering the crop plants that the weeds are growing among. Herbicides such as glyphosate can be used in place of cultivating since they inhibit the growth of a wide range of plants, including weeds and crops. Scientists at Syngenta made the discovery and developed azoxystrobin (4), the fungicide with the highest global sales volume. By attaching to a particular location on cytochrome b, this fungicide prevents fungus from respiring their mitochondria, which stops them from producing adenosine triphosphate (ATP) and suppresses the metabolic cycle. The crop protection business places a lot of emphasis on the research and development of these compounds. A common occurrence is the development of pesticide resistance in response to repeated exposure over time. Because of this, producers of crop protection chemicals must constantly develop new and enhanced versions of their products.

Report Coverage

This research report categorizes the market for the global crop protection chemicals market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global crop protection chemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global crop protection chemicals market.

Global Crop Protection Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 92.1 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.14 % |

| 2033 Value Projection: | USD 138.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 65 |

| Segments covered: | By Type, By Form, By Application |

| Companies covered:: | The Dow Chemical Company, Dupont, Sumitomo Chemical Co., Ltd, Syngenta AG, Bayer CropScience AG, FMC Corporation, NufarmLimited, Adama Agricultural Solutions Ltd., Verdesian Life sciences, Bioworks Inc., Valent, Arysta Lifesciences Corporation, America Vanguard Corporation, Chr. Hansen, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

DRIVING FACTORS:

The increasing farming methods could accelerate the market expansion.

The need for crop protection chemicals is rising due to the spread of agricultural techniques like intensive cropping systems and commercial farming. Larger-scale farming operations have increased the need to control weeds, pests, and diseases that can result in considerable yield losses. Chemicals for crop protection provide farmers with efficient ways to safeguard their crops and maximize yield in these intensive farming systems. Farmers might maximize their yields and financial returns by using these pesticides to restrict weed growth, fight illnesses, and manage pests.

RESTRAINING FACTORS

The extensive usage of these chemicals could restrict plant growth and hamper the market growth.

Herbicide overuse can be extremely harmful to crop plants at various phases of growth and development. It can inflict exceptional harm by preventing growth and upsetting physiological processes, which lowers crop quality and production. These chemicals have negative impacts that result in harm to both land and water. Furthermore, excessive exposure to hazardous herbicides and irresponsible handling practices can cause acute poisoning with grave health risks.

Market Segmentation

The crop protection chemicals market share is classified into type, form, and application.

The herbicides segment has the highest share of the market over the forecast period.

Based on type, the crop protection chemicals are classified into herbicides, fungicides, and insecticides. Herbicides are helpful in agriculture because they allow crop growers flexibility by controlling weeds at nearly any stage of growth. Although its primary application is in agriculture, herbicides are often utilized in other industries where the removal of unwanted plants is important. Herbicides classified as systemic or translocated are ones that enter the plant through the vascular system and are absorbed by the plant, moving from the point of absorption to areas of action where the chemicals regulate the plant's growth. Herbicides that are not systemic, sometimes known as contact herbicides, destroy the plant components they come into contact with. The most popular kind of equipment used in large-scale farming to apply herbicides is the boom sprayer. The most crucial part of a sprayer's various parts is its nozzles, which divide the herbicide into numerous tiny droplets and shoot them into the air, where they fall on the intended target.

The liquid form has the highest share of the market during the forecast period.

Based on form, the crop protection chemicals are classified into liquid, and solid. Liquid formulations are convenient and simple to use. Crops can be effectively covered by them since they are simple to combine, spray, and disperse over wide regions. Because liquid formulations might be sprayed using a variety of tools, including irrigation systems and sprayers, they are appropriate for a range of agricultural techniques and crop kinds. For many farmers, liquid formulations are the favored option because of their convenience and versatility. The liquid form ensures optimal contact and uptake of the active components by pests or target organisms by facilitating greater diffusion and adhesion to the plant surface. Liquid formulations are becoming more and more common in crop protection because of their increased efficacy. In addition, liquid formulations frequently provide superior storage stability in comparison to other forms.

The foliar spray segment has the largest market share throughout the forecast period.

Based on application, the crop protection chemicals are classified into foliar spray, seed treatment, and soil treatment. Plant leaves can be directly and specifically treated with foliar spray. This kind of application makes it possible to apply crop protection agents effectively and efficiently to the foliage, which is a common habitat for weeds, diseases, and pests. Foliar sprays cover a large area of the plant's surface, improving contact with the target organisms and enhancing the chemical's effectiveness. The foliar spray also allows for systemic circulation within the plant. Foliar sprays also provide both application and timing flexibility. Because they can be administered at various stages of the plant's growth, farmers can respond to particular pest or disease threats as they materialize. Foliar sprays can be used with a variety of crops and agricultural systems since they work well with a broad range of crop types. The application of micronutrient-embedded fertilizer as a foliar nutrition supplement boosts soil biological activity, biofortification, and eggplant productivity.

Regional Segment Analysis of the Global Crop Protection Chemicals Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific will have the biggest share of the crop protection chemicals market throughout the forecast period.

Get more details on this report -

The Asia Pacific region's huge agricultural base and the growing need to maximize productivity in order to feed an ever-increasing population, crop protection chemicals are dominant and growing rapidly. The region's crops face significant insect and disease threats due to its varied climate, which raises the need for crop protection chemicals. The widespread presence of pests such as the fall armyworm has resulted in significant losses to crops, forcing governments and farmers to make investments in effective pest control measures. The market for cutting-edge crop protection products is undoubtedly being helped by China, Japan, and Australia's increasing adoption of sophisticated farming methods and technologies. The Chinese crop protection chemicals market, which is the largest regional market, is extremely fragmented and home to a number of both local and international competitors.

North America is the fastest-growing region over the projected timeframe.

North America boasts a huge agricultural industry, with vast farming operations and a wide variety of crops grown all throughout the continent. Particularly the United States is one of the world's leading producers of agricultural products, renowned for both its significant crop yield and export potential. The need for crop protection chemicals is driven by North America's high level of agricultural activity, as farmers look for efficient ways to shield their crops from weeds, pests, and diseases.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global crop protection chemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Dow Chemical Company

- Dupont

- Sumitomo Chemical Co., Ltd

- Syngenta AG

- Bayer CropScience AG

- FMC Corporation

- NufarmLimited

- Adama Agricultural Solutions Ltd.

- Verdesian Life sciences

- Bioworks Inc.

- Valent

- Arysta Lifesciences Corporation

- America Vanguard Corporation

- Chr. Hansen

- Others

Key Market Developments

- In May 2024, the top supplier of agri-solutions in India, Coromandel International Limited, unveiled ten new products with the goal of increasing crop output, preventing pest infestations, and promoting sustainable farming methods all throughout the nation. In collaboration with ISK Japan, the company has introduced Prachand, a patented product that uses cutting-edge Japanese technology to protect paddy crops from harmful pests like leaf folders and stem borers, potentially saving farmers up to 70% on yield losses.

- In January 2024, using a platform that shortens the time needed for R&D discovery, Syngenta Crop Protection, a pioneer in agricultural innovation worldwide, and crop health business Enko announced today the discovery of innovative chemistry to prevent fungal disease in crops.

- In October 2023, Agriculture Post reports that a major crop protection and nutrition company has advanced significantly in its "discovery molecules" research and development efforts. In the last ten years, OAT & IIL India Laboratories, a joint venture with OAT Agrio Co., the largest chemical conglomerate in Japan, has submitted eleven patents for crop protection technologies.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global crop protection chemicals market based on the below-mentioned segments:

Global Crop Protection Chemicals Market, By Type

- Herbicides

- Fungicides

- Insecticides

Global Crop Protection Chemicals Market, By Form

- Liquid

- Solid

Global Crop Protection Chemicals Market, By Application

- Foliar Spray

- Seed Treatment

- Soil Treatment

Global Crop Protection Chemicals Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global crop protection chemicals market over the forecast period?The global crop protection chemicals market size is expected to grow from USD 92.1 Billion in 2023 to USD 138.2 Billion by 2033, at a CAGR of 4.14% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global crop protection chemicals market?Asia-Pacific is projected to hold the largest share of the global crop protection chemicals market over the forecast period.

-

3. Who are the top key players in the crop protection chemicals market?The Dow Chemical Company, Dupont, Sumitomo Chemical Co., Ltd, Syngenta AG, Bayer Cropscience AG, FMC Corporation, NufarmLimited, Adama Agricultural Solutions Ltd, Verdesian Life Sciences, Bioworks Inc, Valent, Arysta Lifesciences Corporation, America Vanguard Corporation, Chr. Hansen, and Others.

Need help to buy this report?