Global Cryogenic Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product (Tank, Valve, Vaporizer, Pump, Actuator, Bayonet Connection, and Others), By Cryogen Type (Nitrogen, Oxygen, Argon, Liquefied Natural Gas, Hydrogen, Helium, and Others), By End User (Oil & Gas, Metallurgy, Power Generation, Chemical & Petrochemical, Marine, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Energy & PowerGlobal Cryogenic Equipment Market Insights Forecasts to 2033

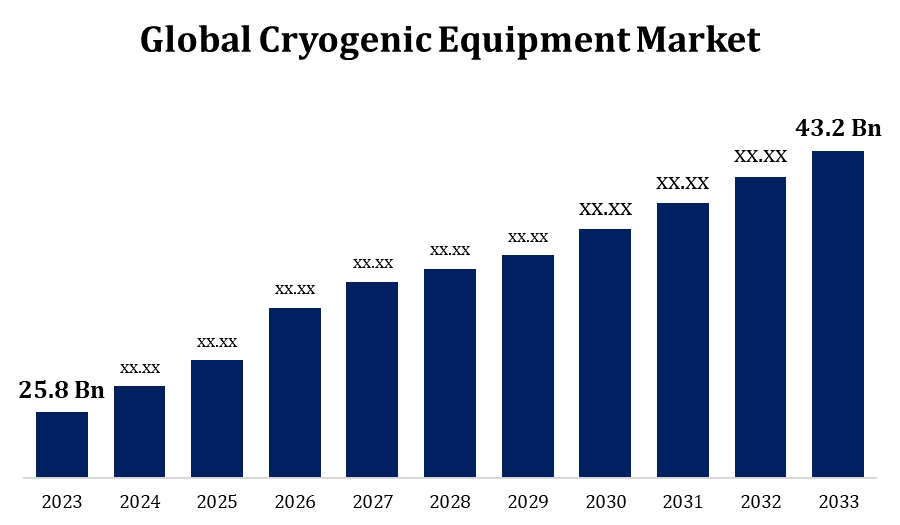

- The Cryogenic Equipment Market Size Was valued at USD 25.8 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.29% from 2023 to 2033.

- The Worldwide Cryogenic Equipment Market Size is expected to reach USD 43.2 Billion by 2033.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Cryogenic Equipment Market Size is expected to reach USD 43.2 Billion by 2033, at a CAGR of 5.29% during the forecast period 2023 to 2033.

The cryogenic equipment market is growing due to increasing demand for low-temperature preservation across industries such as healthcare, energy, and food processing. Key equipment includes tanks, valves, pumps, and vaporizers, essential for storing and transporting liquefied gases like nitrogen, oxygen, and argon at ultra-low temperatures. The healthcare sector drives demand, especially in cryosurgery and biobanking, while the energy sector sees rising usage for LNG (liquefied natural gas) storage and transport. Technological advancements in insulation and containment are improving equipment efficiency and reliability, supporting wider adoption. However, high initial costs and strict regulatory requirements pose challenges. North America and Asia-Pacific are significant markets, driven by investments in healthcare and energy infrastructure, positioning these regions as leaders in cryogenic equipment demand and innovation.

Cryogenic Equipment Market Value Chain Analysis

The cryogenic equipment market value chain consists of raw material suppliers, component manufacturers, equipment producers, and end-users. Stainless steel and aluminum suppliers provide raw materials for manufacturing cryogenic tanks, valves, and pumps due to their strength and low-temperature resilience. Component suppliers then produce parts like valves, insulation, and pressure regulators, essential for cryogenic applications. Equipment manufacturers assemble these components into cryogenic systems, focusing on quality control to ensure durability in extreme environments. Distributors link these manufacturers with end-users in sectors like healthcare, energy, and food processing, where equipment is used for low-temperature storage and transport. Service providers offer installation, maintenance, and repair, extending product lifespans. Regulatory compliance is critical across the chain, guiding standards for safe and effective cryogenic equipment handling and operation.

Cryogenic Equipment Market Opportunity Analysis

The cryogenic equipment market offers substantial growth opportunities due to expanding demand across healthcare, energy, and food industries. In healthcare, rising biobanking and cryosurgery applications drive the need for ultra-low temperature storage. The energy sector, particularly with the growing liquefied natural gas (LNG) market, sees increased reliance on cryogenic tanks and pumps for safe storage and transport. Emerging markets in Asia-Pacific show strong growth potential due to investments in medical infrastructure and energy projects. Additionally, advancements in material science are enabling more efficient, durable, and cost-effective cryogenic equipment, opening doors for adoption in smaller industries. Environmental regulations, promoting LNG as a cleaner fuel alternative, further bolster demand. These factors make the market ripe for innovation and expansion, with investment and R&D providing strategic growth avenues.

Global Cryogenic Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 25.8 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.29% |

| 2033 Value Projection: | USD 43.2 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Cryogen Type, By End User, and By Region. |

| Companies covered:: | Chart Industries, Inc. (U.S.), Cryofab, Inc. (U.S.), Linde (Germany), Nikkisso Cryoquip (U.S.), Nikkiso Co. Ltd (Japan), SHI Cryogenics Group (Japan), HEROSE GMBH (Germany), Wessington Cryogenics (U.K.), Cryo Pur (France), INOXCVA (INOX India Pvt Ltd) (India), Sulzer (Switzerland), and Others |

| Growth Drivers: | Growing LNG Demand Will Accelerate Market Development |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Cryogenic Equipment Market Dynamics

Growing LNG Demand Will Accelerate Market Development

The cryogenic equipment market offers substantial growth opportunities due to expanding demand across healthcare, energy, and food industries. In healthcare, rising biobanking and cryosurgery applications drive the need for ultra-low temperature storage. The energy sector, particularly with the growing liquefied natural gas (LNG) market, sees increased reliance on cryogenic tanks and pumps for safe storage and transport. Emerging markets in Asia-Pacific show strong growth potential due to investments in medical infrastructure and energy projects. Additionally, advancements in material science are enabling more efficient, durable, and cost-effective cryogenic equipment, opening doors for adoption in smaller industries. Environmental regulations, promoting LNG as a cleaner fuel alternative, further bolster demand. These factors make the market ripe for innovation and expansion, with investment and R&D providing strategic growth avenues.

Restraints & Challenges

The cryogenic equipment market faces challenges primarily from high production costs, stringent regulatory requirements, and technical complexities. Manufacturing cryogenic equipment demands premium materials like stainless steel and aluminum, which withstand extremely low temperatures but drive up costs, impacting profitability. Strict regulations across industries, particularly in healthcare and energy, require rigorous testing and certification to ensure safety, adding further expenses and extending development timelines. Technical challenges also arise from handling ultra-cold substances like LNG, liquid nitrogen, and oxygen, which require precision engineering to prevent leaks, corrosion, and insulation breakdown. Maintenance costs are high, as cryogenic equipment needs regular servicing to retain efficiency, especially in harsh operating environments. Additionally, fluctuating raw material prices and the limited availability of skilled labor make production and market expansion difficult for manufacturers.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Cryogenic Equipment Market from 2023 to 2033. The region’s established LNG industry fuels demand for cryogenic storage and transport systems, given LNG’s role as a cleaner energy alternative. Additionally, North America's focus on food preservation and cold chain logistics drives demand for cryogenic freezing and cooling solutions. Leading companies are investing in advanced, eco-friendly equipment, aligning with strict environmental regulations. The United States and Canada also see ongoing R&D initiatives, supported by government funding, which aim to enhance cryogenic technology efficiency and safety, securing North America’s prominent position in this market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Key contributors include rising LNG demand, as countries like China, India, and Japan shift toward cleaner energy sources. This shift accelerates investments in cryogenic storage and transport infrastructure. In healthcare, the increase in medical infrastructure and biobanking needs bolsters demand for cryogenic storage solutions for biological materials and vaccines. The food industry’s growth in the region also fuels the adoption of cryogenic freezing for preservation. Additionally, Asia-Pacific’s focus on technology development and cost-effective manufacturing is driving competitive pricing and innovation in cryogenic equipment. With government support and growing local manufacturing, the region is expected to maintain a high growth rate, attracting global players for investment and partnerships.

Segmentation Analysis

Insights by Product

The tank segment accounted for the largest market share over the forecast period 2023 to 2033. The tank segment in the cryogenic equipment market is experiencing substantial growth due to its crucial role in storing and transporting cryogenic gases like LNG, nitrogen, and oxygen at ultra-low temperatures. Demand for cryogenic tanks is fueled by expanding applications in healthcare for biobanking and cryotherapy, as well as in the energy sector, where LNG is increasingly used as a cleaner fuel alternative. Technological advancements have improved tank insulation and materials, boosting efficiency and safety, which further encourages adoption. The growth of industrial gas applications, including metal processing and electronics, also supports tank demand. Key markets like Asia-Pacific and North America are seeing increased investments in LNG infrastructure, healthcare facilities, and food processing, positioning tanks as a vital component in the cryogenic equipment industry’s expansion.

Insights by Cryogen Type

The LNG segment accounted for the largest market share over the forecast period 2023 to 2033. The LNG (liquefied natural gas) segment is a major growth driver in the cryogenic equipment market, fueled by the global shift towards cleaner energy sources. As natural gas emits less CO2 than coal or oil, it’s increasingly favored for power generation, especially in Asia-Pacific and North America. This shift boosts demand for cryogenic equipment, specifically storage tanks, pumps, and vaporizers, essential for maintaining LNG at extremely low temperatures. Expanding LNG infrastructure projects, including terminals, transport vessels, and storage facilities, are key factors accelerating growth. Furthermore, technological advancements in LNG handling and storage efficiency contribute to safer, more cost-effective operations. Supportive policies promoting LNG as a sustainable fuel alternative, particularly in China, India, and Japan, are also bolstering the segment's expansion, offering substantial growth opportunities for the cryogenic equipment market.

Insights by End User

The chemical & petrochemical segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by increased demand for industrial gases such as nitrogen, oxygen, and argon. These gases are essential in various chemical processes, including cooling, purging, and maintaining inert atmospheres, which require cryogenic storage and handling. Rising production in regions like Asia-Pacific, along with expansions in petrochemical facilities, heightens the need for efficient cryogenic tanks, vaporizers, and piping systems. Additionally, stringent environmental regulations encourage the use of cleaner processes, indirectly boosting demand for cryogenic equipment that supports emission reduction and energy efficiency. Technological advancements in cryogenic systems for gas separation and liquefaction further improve operational reliability, supporting the segment's growth. With increasing global investments in chemical production, the demand for cryogenic equipment in this sector is poised to rise.

Recent Market Developments

- On June 2021, TECO 2030 has signed a Memorandum of Understanding with Chart Industries, Inc. to collaborate on developing technological solutions aimed at capturing carbon dioxide (CO2) emissions from ships and storing it in liquid form.

Competitive Landscape

Major players in the market

- Chart Industries, Inc. (U.S.)

- Cryofab, Inc. (U.S.)

- Linde (Germany)

- Nikkisso Cryoquip (U.S.)

- Nikkiso Co. Ltd (Japan)

- SHI Cryogenics Group (Japan)

- HEROSE GMBH (Germany)

- Wessington Cryogenics (U.K.)

- Cryo Pur (France)

- INOXCVA (INOX India Pvt Ltd) (India)

- Sulzer (Switzerland)

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Cryogenic Equipment Market, Product Analysis

- Tank

- Valve

- Vaporizer

- Pump

- Actuator

- Bayonet Connection

- Others

Cryogenic Equipment Market, Cryogen Type Analysis

- Nitrogen

- Oxygen

- Argon

- Liquefied Natural Gas

- Hydrogen

- Helium

- Others

Cryogenic Equipment Market, End Use Analysis

- Oil & Gas

- Metallurgy

- Power Generation

- Chemical & Petrochemical

- Marine

- Others

Cryogenic Equipment Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Cryogenic Equipment Market?The global Cryogenic Equipment Market is expected to grow from USD 25.8 billion in 2023 to USD 43.2 billion by 2033, at a CAGR of 5.29% during the forecast period 2023-2033.

-

2. Who are the key market players of the Cryogenic Equipment Market?Some of the key market players of the market are Chart Industries, Inc. (U.S.), Cryofab, Inc. (U.S.), Linde (Germany), Nikkisso Cryoquip (U.S.), Nikkiso Co. Ltd (Japan), SHI Cryogenics Group (Japan), HEROSE GMBH (Germany), Wessington Cryogenics (U.K.), Cryo Pur (France), INOXCVA (INOX India Pvt Ltd) (India), and Sulzer (Switzerland).

-

3. Which segment holds the largest market share?The LNG segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Cryogenic Equipment Market?North America dominates the Cryogenic Equipment Market and has the highest market share.

Need help to buy this report?