Global Crypto Asset Management Market Size, Share, and COVID-19 Impact Analysis, By Solution (Custodian Solutions and Wallet Management), By Application (Web-Based and Mobile), By Deployment Mode (Cloud and On-Premises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Crypto Asset Management Market Insights Forecasts to 2033

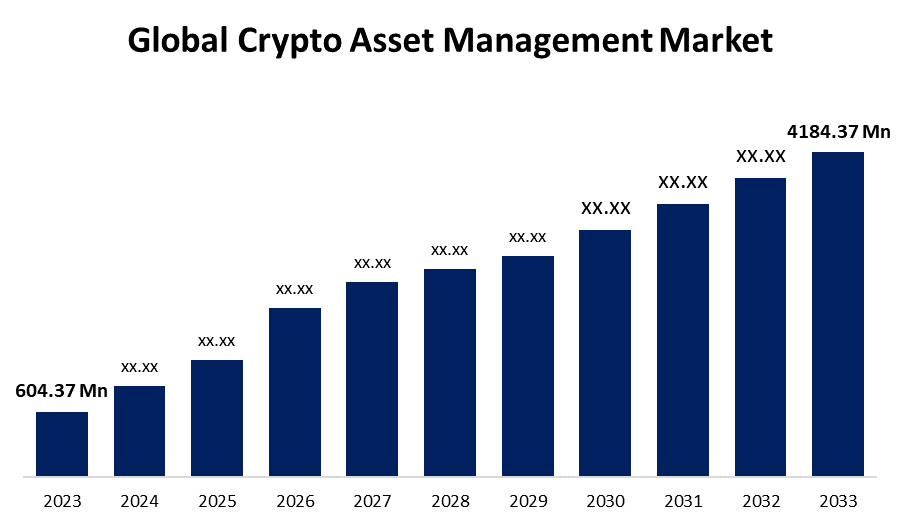

- The Global Crypto Asset Management Market Size was Valued at USD 604.37 Million in 2023

- The Market Size is Growing at a CAGR of 21.35% from 2023 to 2033

- The Worldwide Crypto Asset Management Market Size is Expected to Reach USD 4184.37 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Crypto Asset Management Market Size is Anticipated to Exceed USD 4184.37 Million by 2033, Growing at a CAGR of 21.35% from 2023 to 2033.

Market Overview

A crypto asset management platform is specialized software designed to streamline the processes involved in buying, trading, and keeping bitcoins. With the aid of crypto asset management, users may manage several cryptocurrency assets on a single platform. As more individuals invest in many accounts and wallets, there is an increasing demand for consolidated portfolio management solutions. It is projected that this would lead to a rise in the need for crypto asset management services and solutions. The asset management system is being used by both new and experienced investors to learn about the constantly changing virtual currency market. Globally, cryptocurrency users are growing increasingly interested in the answer.

The market is rife with financial risk, much like this. To lessen and manage these substantial risks, consumers are turning to cryptocurrency asset management tools. Furthermore, as society becomes more globalized, there is a noticeable increase in the desire for internet traction. This has a favorable impact on the adoption of crypto-asset management, which benefits investors by generating significant opportunities. The rise in emerging economies and the development of investment options are driving the use of bitcoin asset management solutions.

Report Coverage

This research report categorizes the market for the global crypto asset management market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global crypto asset management market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global crypto asset management market.

Global Crypto Asset Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 604.37 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 21.35% |

| 2033 Value Projection: | USD 4184.37 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 211 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Solution, By Application, By Deployment Mode and By Region |

| Companies covered:: | Coinbase Gemini Trust Company Crypto Finance Group Vo1t Ltd, Bakkt BitGo Ledger SAS METACO ICONOMI Limited Exodus Movement Xapo Holdings Limited Paxos Trust Company Amberdata Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global cryptocurrency market is expanding quickly as a result of blockchain's introduction. For digital assets and cryptocurrencies, blockchain has the potential to offer extremely high security. Users don't need authorization from central authorities to approve transactions when they use blockchain technology. Voting, smart contracts, and fund exchange are a few of the main applications of blockchain. In every industry, blockchain has a wide range of applications. To put it briefly, blockchain is a peer-to-peer network's decentralized digital ledger that records and tracks transactional data. Due to they were the initial use case for blockchain technology, cryptocurrencies have fundamentally altered how companies approach digital assets. The concept of using blockchain technology to transport and store digital assets, including cryptocurrencies, throughout the internet ecosystem is being investigated by financial institutions. Globally crypto asset management solutions will become increasingly in demand due to the availability of blockchain technology, which is driving the expansion of cryptocurrencies. Financial stakeholders must use crypto asset management solutions due to enterprises' increasing use of cryptocurrencies.

Restraining Factors

The main obstacles to the widespread usage of cryptocurrencies are a lack of knowledge about their applications and a lack of technical expertise in transaction processing. The majority of vertical-end consumers are unaware of the advantages of cryptocurrencies and are also not familiar with how they operate. Due to its decentralized nature and ambiguous regulatory status, this limits the amount of money that businesses can invest in cryptocurrencies. Since cryptocurrency is not yet widely used by investors, the general public, or business owners, its promise to revolutionize transaction procedures is still unrealized. Cryptographic algorithms are used by a large network of separate computers to process cryptocurrency. Therefore, to investigate the advantages of cryptocurrency in use cases, a solid technical understanding of the relevant technology is essential.

Market Segmentation

The global crypto asset management market share is segmented into solution, application, and deployment mode.

- The custodian solutions segment dominates the market with the largest market share through the forecast period.

Based on the solution, the global crypto asset management market is segmented into custodian solutions and wallet management. Among these, the custodian solutions segment dominates the market with the largest market share through the forecast period. With their ability to manage digital assets and offer safe storage on behalf of investors, custodian solutions are vital to the market. Due to cryptocurrencies becoming more valuable and advanced, investors need trustworthy custodial services with strong security features like multi-signature authentication and offline storage. To meet the growing need for safe storage and institutional-grade custodial services, well-known custodians and financial institutions are tapping on their experience in traditional asset custody to enter the global crypto asset management market.

- The mobile segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the application, the global crypto asset management market is segmented into web-based and mobile. Among these, the mobile segment is anticipated to grow at the fastest CAGR growth through the forecast period. Mobile applications have grown in popularity among Bitcoin investors due to the increasing use of smartphones and the ease they provide. Users can access their digital assets anytime, anywhere by using mobile-based crypto asset management apps, which let them monitor portfolios, make transactions, and manage their investments. The popularity of mobile applications among investors, together with their push notifications, easy-to-use interfaces, and availability of real-time market data, contribute to the dominance of this particular market segment.

- The on-premises segment accounted for the largest revenue share through the forecast period.

Based on the deployment mode, the global crypto asset management market is segmented into cloud and on-premises. Among these, the on-premises segment accounted for the largest revenue share through the forecast period. Due to its ability to install software on an organization's own IT infrastructure and its increased security over cloud deployment, the on-premise deployment technique is commonly regarded as beneficial in large companies. Platform and standalone versions of crypto asset management solutions are offered, and they are typically installed in end-user locations. The gear, software, data, maintenance, and support that the solution providers offer are all completely under their control. Locally, on the end-user's property, all operational tasks are carried out, such as setup, configuration, maintenance, and solution deployment.

Regional Segment Analysis of the Global Crypto Asset Management Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global crypto asset management market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global crypto asset management market over the predicted timeframe. Several factors, including the emergence of new sectors and the economy's expansion, are to blame for this. The market potential in the region is being driven by the introduction and early adoption of the solution. Additionally, several well-known companies in the region provide specialized solutions for every industry segment. Furthermore, a high number of cloud crypto solution providers in the US and Canada are anticipated to open up profitable chances for the market.

Asia Pacific is expected to grow at the fastest CAGR growth of the global crypto asset management market during the forecast period. Asia Pacific is becoming a hub for the creation and acceptance of cryptocurrencies. Nations like Singapore, South Korea, China, Japan, and others have demonstrated a keen interest in cryptocurrencies and have embraced blockchain technology early on. The area is highly technologically advanced and has a sizable population, making it an ideal place for the cryptocurrency asset management business to expand. Additionally, the proliferation of cryptocurrency exchanges and startups in the Asia Pacific area, along with the growing involvement of Asian institutional investors, are driving the market's expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global crypto asset management market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Coinbase

- Gemini Trust Company

- Crypto Finance Group

- Vo1t Ltd, Bakkt

- BitGo

- Ledger SAS

- METACO

- ICONOMI Limited

- Exodus Movement

- Xapo Holdings Limited

- Paxos Trust Company

- Amberdata

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2021, Gemini Trust Company, LLC unveiled Gemini Fund Solutions, a comprehensive suite of Bitcoin fund services for fund managers. The system offers clearing, custody, trade execution, and other capital markets services on a single platform.

- In May 2020, BitGo, Inc. launched BitGo Prime, a new cryptocurrency trading platform, to the institutional trading community. Cryptocurrencies will be supported by conventional trading platforms, such as hedge funds, fiduciaries, asset managers, and fund managers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global crypto asset management market based on the below-mentioned segments:

Global Crypto Asset Management Market, By Solution

- Custodian Solutions

- Wallet Management

Global Crypto Asset Management Market, By Application

- Web-Based

- Mobile

Global Crypto Asset Management Market, By Deployment Mode

- Cloud

- On-Premises

Global Crypto Asset Management Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Coinbase, Gemini Trust Company, Crypto Finance Group, Vo1t Ltd, Bakkt, BitGo, Ledger SAS, METACO, ICONOMI Limited, Exodus Movement, Xapo Holdings Limited, Paxos Trust Company, Amberdata, and Others.

-

2. What is the size of the global crypto asset management market?The Global Crypto Asset Management Market Size is Expected to Grow from USD 604.37 Million in 2023 to USD 4184.37 Million by 2033, at a CAGR of 21.35% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global crypto asset management market over the predicted timeframe.

-

1. Which are the key companies that are currently operating within the market?Coinbase, Gemini Trust Company, Crypto Finance Group, Vo1t Ltd, Bakkt, BitGo, Ledger SAS, METACO, ICONOMI Limited, Exodus Movement, Xapo Holdings Limited, Paxos Trust Company, Amberdata, and Others.

-

2. What is the size of the global crypto asset management market?The Global Crypto Asset Management Market Size is Expected to Grow from USD 604.37 Million in 2023 to USD 4184.37 Million by 2033, at a CAGR of 21.35% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global crypto asset management market over the predicted timeframe.

Need help to buy this report?