Global Cryptocurrency Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, and Software), By Type (Bitcoin (BTC), Litecoin, Ether, Ripple, Ether Classic, and Others), By End-Use (Trading, E-Commerce And Retail, Peer-To-Peer Payment, and Remittance), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Cryptocurrency Market Insights Forecasts to 2033

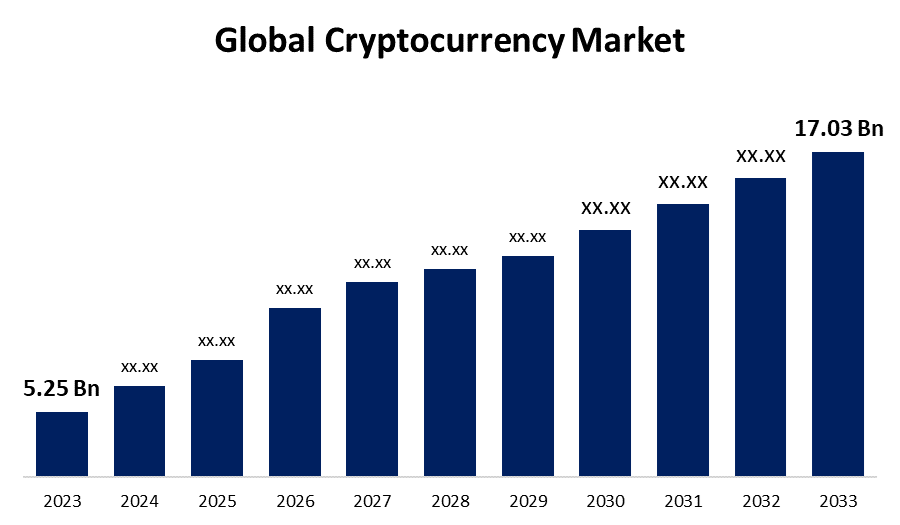

- The Global Cryptocurrency Market Size was Valued at USD 5.25 Billion in 2023

- The Market Size is Growing at a CAGR of 12.49% from 2023 to 2033

- The Worldwide Cryptocurrency Market Size is Expected to Reach USD 17.03 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Cryptocurrency Market Size is Anticipated to Exceed USD 17.03 Billion by 2033, Growing at a CAGR of 12.49% from 2023 to 2033.

Market Overview

Cryptocurrency, also termed virtual currency, occurs digitally and has no governing authority. Cryptocurrency customs distributed ledger technology such as blockchain to authorize transactions. The growing implementation of distributed ledger technology is estimated to drive the cryptocurrency market development during the forecast period. Furthermore, the growing number of clients of cryptocurrencies for cross-border settlements are predicted to boost market growth owing to the reduction in customer fees and exchange charges. The main factor pouring the market's growth is the development of distributed ledger technology and increasing digital investments in venture capital. Emerging countries have started utilizing digital currency as a financial exchange medium. The growing admiration of digital assets like Bitcoin and Litecoin is expected to propel market growth in the upcoming years. Moreover, digital currency is also frequently used with the incorporation of blockchain technology to achieve regionalization and controlled effective transactions. Blockchain technology delivers regionalized, fast, transparent, secure, and reliable transactions. With these benefits of blockchain and digital currency, companies are investing in cryptocurrency and cooperating with other companies to provide efficient and quality services to the operators. The admiration of virtual or digital currencies such as bitcoins, litecoins, ethers, and many more are anticipated to determine the market in the upcoming years. Individuals from advanced countries are expected to implement the easy and flexible transactional technique provided by digital currency. This admiration of virtual currency as a replacement medium controlled the central bank to support digital currency. The central bank patented Central Bank Digital Currency (CBDC) activity requirements for digital currency projects across numerous advanced countries. For instance, the Bank of Thailand and Central Bank of Uruguay are smearing the toolkit to their CBDC estimation process; the Eastern Caribbean Central Bank and People’s Bank of China also sustain CBDC for implementing digital cash as an exchange medium. Numerous companies, such as Facebook, Inc., are increasing their business by providing digital money.

Report Coverage

This research report categorizes the market for the global cryptocurrency market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global cryptocurrency market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global cryptocurrency market.

Global Cryptocurrency Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.25 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 12.49% |

| 2033 Value Projection: | USD 17.03 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Type, By End-Use, By Region |

| Companies covered:: | Advanced Micro Devices, Inc., Binance, Bit Fury Group Limited, Bit Go, Inc., Bit Main Technologies Holding Company, Intel Corporation, NVIDIA Corporation, Ripple, Xapo Holdings Limited, Xilinx, Inc., Ledger SAS, Ethereum Foundation, Coinbase, Alchemist, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The development of the cryptocurrency market is suggestively driven by the growing demand for transparency and efficiency in financial payment systems. This growing requirement aligns with the increasing internet saturation across various global regions. Moreover, the development of technology companies' contribution to accessible trading platforms through smartphones and computers has become a prominent trend in recent years. The growth in the public interest concerning cryptocurrency is a key driver of the market. Individuals are becoming conscious of using cryptocurrencies which leads to their development by growing the users that's contributive market growth. The industries and the market players are also contributing towards its development by implementing cryptocurrencies into their payment system which is increasing the market. It delivers quicker transactions and lower transaction fees, which raises the customs. This serves to determine market growth. For customers, cryptocurrencies provide cheaper and faster peer-to-peer payment options than those delivered by traditional money services businesses, without the need to provide personal details. While cryptocurrencies continue to increase some acceptance as a payment option, price instability and the opportunity for academic investments boost customers not to use cryptocurrency to purchase goods and services but rather to trade it.

Restraining Factors

One of the substantial restraints opposing the cryptocurrency market is the lack of regulations governing the formation and valuation of these digital assets. This regulatory void consents certain users to manipulate the value of cryptocurrencies, targeting individuals with inadequate knowledge about these assets. This manipulation frequently leads to misleading strategies that induce inexperienced investors, resulting in financial losses within the market. The absence of oversight or standardized regulations creates an environment where the value of cryptocurrencies can be exaggeratedly inflated or deflated, posing a risk to individuals who are not experienced in the complications of this market, eventually affecting their investments adversely.

Market Segmentation

The global cryptocurrency market share is classified into component, type, and end-use.

- The hardware segment is expected to hold the largest share of the global cryptocurrency market during the forecast period.

Based on the components, the global cryptocurrency market is divided into hardware and software. Among these, the hardware segment is expected to hold the largest share of the global cryptocurrency market during the forecast period. This is attributed to the hardware segment is again classified based on platform forms such as graphical processing unit (GPU), field programmable gate array (FPGA), application-specific integrated circuit (ASIC), and others. The hardware segment includes hardware implemented for crypto mining and exchange such as Bitmain Antminer S9i, Halong Mining DragonMint T1, Pangolin Whatsminer M3X, and Avalon6, among others. ASIC mining hardware is anticipated to hold the largest share mostly owing to its high performance and high muddle rate while mining a specific coin

- The bitcoin (BTC) segment is expected to hold the largest share of the global cryptocurrency market during the forecast period.

Based on the type, the global cryptocurrency market is divided into bitcoin (BTC), litecoin, ether, ripple, ether classic, and others. Among these, the bitcoin (BTC) segment is expected to hold the largest share of the global cryptocurrency market during the forecast period. This is attributed to the bitcoin is a highly accepted digital currency in the market. Bitcoin is a virtual currency functioning as a decentralized alternative payment method. The arrival of Bitcoin Exchange Traded Funds (ETFs) is estimated to raise the volume of global bitcoin trades during the forecast period. For instance, in May 2022, Purpose Bitcoin ETF in Canada observed the biggest inflow of USD 207 million.

- The trading segment is expected to hold the largest share of the global cryptocurrency market during the forecast period.

Based on the end-use, the global cryptocurrency market is divided into trading, e-commerce and retail, peer-to-peer payment, and remittance. Among these, the trading segment is expected to hold the largest share of the global cryptocurrency market during the forecast period. This is attributed to the trading in cryptocurrencies allows operators to buy, sell, and examine asset balances and get deposit addresses. Numerous browser technology providers are focusing on forming alliances with blockchain technology firms to allow their clients to trade cryptocurrency easily. For instance, in March 2020, Brave Software, Inc., a browser technology company, arrived into a corporation with Binance, a blockchain technology company, to allow its operators to seamlessly trade cryptocurrency assets through Binance. Such factors divine well for the development of the segment.

Regional Segment Analysis of the Global Cryptocurrency Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global cryptocurrency market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global cryptocurrency market over the predicted timeframe. The governance is attributable to the acceptance of cryptocurrencies in countries such as South Korea, Japan, and India. Moreover, the presence of cryptocurrency mining companies such as Ebang International Holdings, Inc., Bitmain Technologies Limited., Canaan, Inc. and others are anticipated to support the market growth in the region. Furthermore, leading players in the region are entering into corporations to address the competitive market. For instance, in February 2020, Canaan Inc., a China-based crypto mining hardware manufacturer amalgamated with Northern Data AG, a blockchain infrastructure firm, to pool and organize their technological and operational resources.

North America is expected to grow at the fastest pace in the global cryptocurrency market during the forecast period. This is attributed to the use of cryptocurrencies in NFTs in the region and the increasing acceptance of cryptocurrencies as a kind of value storage is pouring the regional market's growth. Moreover, the region is perceiving substantial investments in companies evolving blockchain technology and radical solutions for cryptocurrency mining systems that have higher confusion rates and better power efficiency. For instance, In February 2022, Intel Corporation was introduced to contribute to the expansion of blockchain technology with a roadmap of energy-efficient accelerators. The company detailed that its blockchain accelerator chip will ship later in the year. Argo Blockchain, Block & Grid Infrastructure is among their first clients for this upcoming product.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global cryptocurrency market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Advanced Micro Devices, Inc.

- Binance

- Bit Fury Group Limited

- Bit Go, Inc.

- Bit Main Technologies Holding Company

- Intel Corporation

- NVIDIA Corporation

- Ripple

- Xapo Holdings Limited

- Xilinx, Inc.

- Ledger SAS

- Ethereum Foundation

- Coinbase

- Alchemist

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2023, Bitfinex Securities Ltd. secured USD 5.2 million in USDT by using its tokenized bond ALT2612. The fundraising initiative was made possible through the assistance of ALTERNATIVE, a securitization fund based in Luxembourg, and accomplished by Mikro Kapita, a renowned microfinancing company.

- In October 2023, Quantstamp, a prominent player in web3 security, revealed DeFi Protection, an innovative security solution that reimburses users for their DeFi losses. DeFi Protection is a cutting-edge product that thoroughly inspects the security of smart contracts, promptly informs users about potential risks, and confirms round-the-clock assistance from skilled security auditors. Significantly, this remarkable offering comprises a guarantee program that promises to reimburse DeFi Protection customs for any financial setbacks resulting from a lapse in Quantstamp's security services.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global cryptocurrency market based on the below-mentioned segments:

Global Cryptocurrency Market, By Component

- Hardware

- Software

Global Cryptocurrency Market, By Type

- Bitcoin (BTC)

- Litecoin

- Ether

- Ripple

- Ether Classic

- Others

Global Cryptocurrency Market, By End-Use

- Trading

- E-Commerce And Retail

- Peer-To-Peer Payment

- Remittance

Global Cryptocurrency Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- The rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?Advanced Micro Devices, Inc., Binance, Bit fury Group Limited, Bit Go, Inc., Bit Main Technologies Holding Company, Intel Corporation, NVIDIA Corporation, Ripple, Xapo Holdings Limited, Xilinx, Inc., Ledger SAS, Ethereum Foundation, Coinbase, Alcheminer, and others.

-

2.What is the size of the global cryptocurrency market?The Global Cryptocurrency Market is expected to grow from USD 5.25 Billion in 2023 to USD 17.03 Billion by 2033, at a CAGR of 12.49% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global cryptocurrency market over the predicted timeframe.

Need help to buy this report?