Global Cryptocurrency Payment Apps Market Size, Share, and COVID-19 Impact Analysis By Cryptocurrency Type (Bitcoin, Ethereum, Litecoin, DAI, Ripple and Others), By Payment Type (In-store Payment and Online Payment), By Operating System (Android, IOS, and Others) By End User (Individuals and Businesses) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) Analysis and Forecast 2021 - 2030

Industry: Banking & FinancialCryptocurrency Payment Apps Market Insights Forecasts to 2030

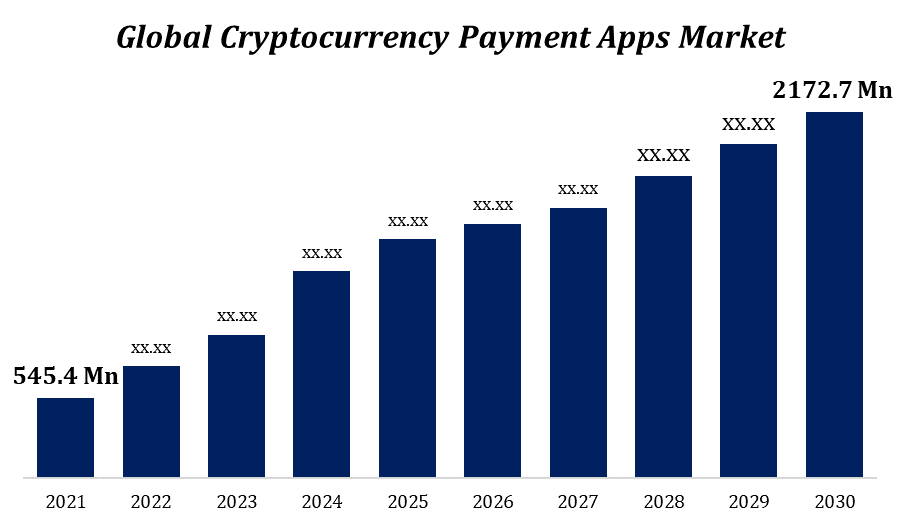

- The Cryptocurrency Payment Apps Market was valued at USD 545.4 million in 2021.

- The market is growing at a CAGR of 16.6% from 2021 to 2030

- The Cryptocurrency Payment Apps Market is expected to reach 2172.7 million by 2030

- The Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Cryptocurrency Payment Apps Market is expected to reach 2172.7 million by 2030, at a CAGR of 16.6% during the forecast period 2021 to 2030. The industry is growing as a result of the existence of numerous illustrious businesses in the region. Additionally, it is projected that the willingness of some market players to accept bitcoin payments outright would increase the possibility for regional growth. For instance, in April 2022, Strike announced a partnership with online retailer Shopify to enable Bitcoin payments using the Lightning Network. The association seeks to simplify transactions while safeguarding bitcoin for businesses by quickly converting bitcoin payments into US dollars.

Market Overview

Virtual currency is also another term for the cryptocurrency payment apps market. It is a currency that solely exists digitally and lacks a central issuing or governing body. Blockchain Type is used to verify the transactions. Blockchain is a decentralized Type that tracks and manages transactions across numerous computers. Additionally, it is a peer-to-peer system that enables users to send and receive payments from anywhere in the world and does not rely on banks to authenticate transactions. Due to the increased need for software performance upgrades and solutions to make financial transactions more efficient, the hardware sector gained a significant portion of the cryptocurrency market. However, over the forecast period for the cryptocurrency market, the software segment is anticipated to develop at the fastest rate since it makes it easier to handle the enormous amount of data being generated for insightful insights and better decisions. Asia-Pacific dominated the cryptocurrency market by region in 2020, and it is anticipated that it will continue to do so throughout the forecast period. Because more Bitcoin exchanges are popping up around Asia, the cryptocurrency market is becoming more mature and competitive. As the government promotes using the bitcoin Type to improve transparency and combat fraud in its financial sector, Chinese banks are employing blockchain expertise. The bitcoin market in the area is growing due to these causes. Examining the worldwide cryptocurrency market's growth potential, challenges, and trends is the main emphasis of the paper. The study offers Porter's five forces analysis to comprehend the effects of numerous elements on the global cryptocurrency industry, including the bargaining power of suppliers, the competitive intensity of competitors, the threat of new entrants, the threat of substitutes, and the bargaining power of buyers. However, the lack of skilled workforce restraints the market’s growth over the forecast period. Increasing R&D activities in cryptocurrency Type companies globally provide growth opportunities for the market’s growth over the forecast period.

Report Coverage

This research report categorizes the cryptocurrency payment app market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cryptocurrency payment apps market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each cryptocurrency payment apps market sub-segments.

Global Cryptocurrency Payment Apps Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 545.4 million |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 16.6% |

| 2030 Value Projection: | USD 2172.7 million |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 160 |

| Segments covered: | By Cryptocurrency Type, By Payment Type, By Operating System, By End User, By Region, COVID-19 Impact Analysis |

| Companies covered:: | BitPay, Coinomi, Paytomat, Aprione OÜ, SecuX Technology, Inc, Circle Internet, Financial Limited, Binance, CoinJar UK Limited., Crptopay Ltd. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Segmentation Analysis

- In 2021, the bitcoin segment dominated the market with the largest market share of 33.0%and market revenue of 179.9 million.

Based on the Cryptocurrency segment, the cryptocurrency payment apps market is categorized into Bitcoin, Ethereum, Litecoin, DAI, Ripple, and Others. In 2021, the bitcoin segment dominated the market with the largest market share of 33.0% and market revenue of 179.9 million. The growth of this segment can be attributed to the increasing adoption of Bitcoin applications due to the proof-of-work process supported by the decentralized bitcoin network's users; it ensures the uncompromised security of the payment systems. Volunteers are required to sign hashes that employ cryptography to verify transactions over the bitcoin network in order for the blockchain-based currency to function. Due to the method's guarantee that transactions are often irreversible, bitcoin offers great data security, fueling the segment's expansion.

- In 2021, the In-store payment segment accounted for the largest share of the market, with 67.0% and a market revenue of 365.4 million.

Based on Payment the market is categorized into In-store Payment and Online payment. In 2021, the In-store segment accounted for the largest share of the market, with 67.0% and a market revenue of 365.4 million. Because of digitalization and the acceptance of contactless payments, there is a growing need for digital payment methods. Retailers can accept payments by installing a QR code or NFC terminal in the POS, and cryptocurrency payment apps offer a platform for cryptocurrency transactions. Additionally, transaction costs on bitcoin payment applications are predicted to be lower than on traditional payment platforms, enticing more users to choose them.

- In 2021, the Android segment accounted for the largest share of the market, with 56.0% and market revenue of 305.4 million.

Based on the Operating system, the market is categorized into Android, IOS, and Others. In 2021, the Android segment accounted for the largest share of the market, with 56.0% and a market revenue of 305.4 million. The prevalence is highlighted by the accessibility and affordability of smartphones with Android operating systems. As a result, market participants are increasingly willing to create platforms for operating systems based on Android.

- In 2021, the businesses segment accounted for the largest share of the market, with 66.0% and market revenue of 359.9 million.

Based on End Users, the market is categorized into Individuals and Businesses. In 2021, the Businesses segment accounted for the largest share of the market, with 66.0% and a market revenue of 359.9 million. Due to the increased size of cryptocurrency transactions completed using cryptocurrency payment apps, the dominance is explained. For instance, the American automaker Tesla declared in January 2022 that it would accept payments made in cryptocurrencies like bitcoin. Tesla is a high-end electric vehicle maker, and each transaction costs significantly more than the average person makes in a year.

Regional Segment Analysis of the cryptocurrency payment apps market

Get more details on this report -

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

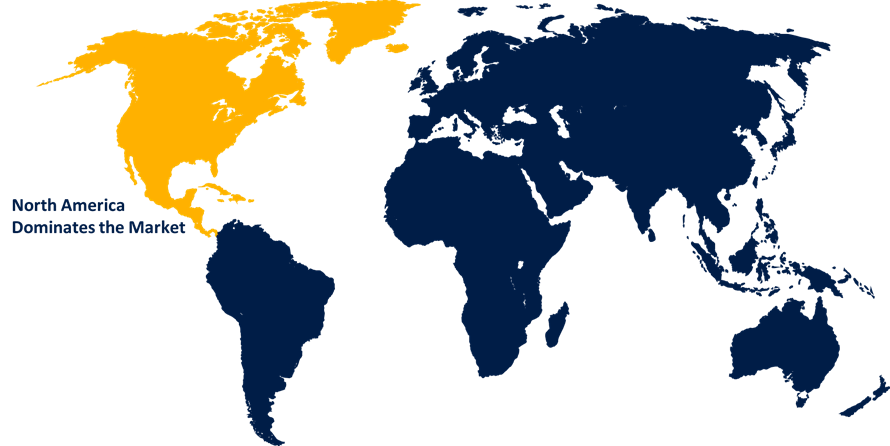

Among all regions, North America emerged as the largest market for the cryptocurrency payment apps market, with a market share of around 32.0% and 545.4 million of the market revenue in 2021.

- In 2021, North America emerged as the largest market for the Cryptocurrency Payment Apps Market, with a market share of around 31.11% and 545.4 million in market revenue. North America is expected to be the largest market for self-supervised learning. This is mostly due to prominent market players in the regions, such as U.S.-based Meta, Google, and Microsoft. Furthermore, the presence of specialists in the region's cryptocurrency payment apps market also propels the market's growth. Most of the countries in the North American region have developed cryptocurrency-type infrastructure, which adds impetus to the growth of the cryptocurrency payment apps market in the region.

- The Asia-Pacific market is expected to grow at the fastest CAGR between 2021 and 2030, owing to the increasing demand for increasing government initiatives in Artificial Intelligence solutions in several countries of the Asia-Pacific region. Furthermore, there is rapid growth in the technological sector in several countries of the Asia Pacific, such as India, China, Japan, etc., which propel the market’s growth in the region. In addition, the increasing awareness about the benefits of the cryptocurrency payment apps market among consumers in the region is expected to propel the market’s growth during the forecast period.

Competitive Landscape

The report offers the appropriate analysis of the key organizations/companies involved within the cryptocurrency payment apps market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- BitPay

- Coinomi

- Paytomat

- Aprione OÜ

- SecuX Technology, Inc

- Circle Internet

- Financial Limited

- Binance

- CoinJar UK Limited.

- Crptopay Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Recent Developments:

- In March 2022, the launch of its cryptocurrency payments gateway will allow businesses to accept Bitcoin and other cryptocurrencies as payment.

- In January 2022, Data2vec, a Cryptocurrency Payment Apps system for text, vision, and speech, was unveiled by Meta AI in January 2022. The method fared better than earlier speech and Ethereum techniques.

- In July 2021, Algorithmia Inc., a U.S.-based Machine Learning Operations (MLOps) software platform, was purchased by DataRobot, Inc. The platform, which was developed to meet the needs of IT operations specialists, enables businesses to handle the generation of complicated models in huge volumes safely and effectively. With this acquisition, DataRobot, Inc. hopes to offer customers a platform for using any machine learning model.

- In February 2022, Neudesic, a U.S.-based cloud services consultancy, was purchased by IBM. IBM made a financial investment in IBM's hybrid cloud and AI strategy. Data analytics, data engineering, and deep Azure cloud experience are all added by Neudesic. With this acquisition, IBM wants to increase its cloud service expertise and capabilities to better serve the client's needs.

Market Segment

This study forecasts global, regional, and country revenue from 2019 to 2030. Spherical Insights has segmented the Cryptocurrency Payment Apps Market based on the below-mentioned segments:

Global Cryptocurrency Payment Apps Market, By Type

- Bitcoin

- Ethereum

- Litecoin

- DAI

- Ripple

- Others

Global Cryptocurrency Payment Apps Market, By Payment

- In-store Payment

- Online payment

Global Cryptocurrency Payment Apps Market, By Operating System

- Android

- iOS

- Others

Global Cryptocurrency Payment Apps Market, By End Users

- Individuals

- Businesses

Global Cryptocurrency Payment Apps Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?