Global CV Depot Charging Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (ELCV, eMCV, eHCV, and eBusus), By Charger Type (AC Chargers and DC Chargers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal CV Depot Charging Market Insights Forecasts to 2033

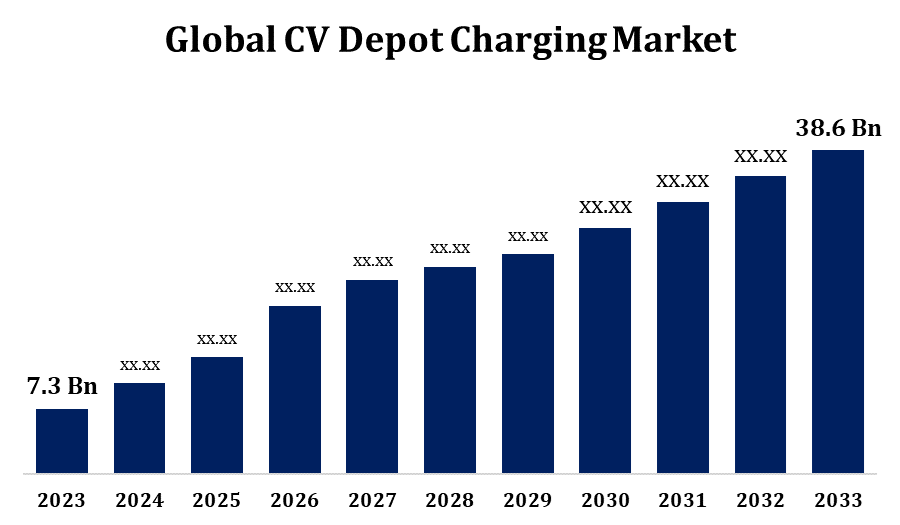

- The Global CV Depot Charging Market Size was valued at USD 7.3 Billion in 2023.

- The Market is Growing at a CAGR of 18.12% from 2023 to 2033.

- The Worldwide CV Depot Charging Market Size is Expected to reach USD 38.6 Billion By 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global CV Depot Charging Market Size is Expected to reach USD 38.6 Billion By 2033, at a CAGR of 18.12% during the forecast period 2023 to 2033.

The CV (Commercial Vehicle) depot charging market is growing rapidly, driven by the global shift toward electrification to meet sustainability goals and regulatory mandates. This market focuses on providing infrastructure solutions for charging electric commercial fleets such as trucks, buses, and delivery vans at centralized depots. Key drivers include the rising adoption of electric vehicles (EVs) in logistics, advancements in fast-charging technologies, and government incentives promoting green energy. Challenges include high initial infrastructure costs, grid capacity limitations, and the need for seamless fleet management solutions. Market players are investing in scalable charging stations, energy storage systems, and software platforms for efficient scheduling and cost management. With increasing fleet electrification, this market is poised to expand significantly, shaping the future of green transportation logistics.

CV Depot Charging Market Value Chain Analysis

The CV depot charging market value chain encompasses multiple interconnected stages, each playing a crucial role in delivering efficient charging solutions for electric commercial fleets. At the core are charging hardware manufacturers, producing EV chargers and ancillary equipment. Energy providers supply electricity, often integrating renewable energy sources to power the chargers. Infrastructure developers design and build charging depots, ensuring compliance with regulatory standards and optimizing energy distribution. Software solution providers offer fleet management and charging optimization platforms, enabling real-time monitoring and scheduling. Fleet operators are the end-users, relying on these solutions to manage charging needs efficiently. Additionally, policy makers and regulators influence the ecosystem by establishing incentives, standards, and grid management protocols. Collaboration across these stakeholders drives the market’s growth, efficiency, and sustainability.

CV Depot Charging Market Opportunity Analysis

The CV depot charging market presents significant opportunities as the global transition to electric commercial vehicles accelerates. Fleet operators are increasingly adopting electrification to meet emissions regulations and reduce operational costs, creating demand for robust depot charging infrastructure. Innovations in ultra-fast charging, energy storage solutions, and renewable energy integration are opening new avenues for growth. Emerging markets, where urbanization and e-commerce drive logistics, offer untapped potential for charging infrastructure development. Strategic partnerships between technology providers, fleet operators, and energy companies can address challenges like grid capacity and cost optimization. Additionally, government incentives and public-private collaborations are fostering investment in this sector. As fleet electrification expands, opportunities for scalable, intelligent charging systems are expected to grow, shaping a sustainable and profitable future for market players.

Global CV Depot Charging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.3 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 18.12% |

| 2033 Value Projection: | USD 38.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 243 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Vehicle Type, By Charger Type, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | ABB (Switzerland), Blink (US), Bosch (Germany), bp pulse (UK), ChargePoint (US), EVgo (US), Heliox (Netherlands), Kempower (Finland), Shell Recharge (US), Siemens (Germany), Wallbox (Spain), and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

CV Depot Charging Market Dynamics

Electric commercial vehicles are increasingly being adopted for public transportation

The adoption of electric commercial vehicles (e-CVs) in public transportation is a significant driver of growth in the CV depot charging market. As governments and municipalities prioritize reducing emissions and enhancing sustainability, e-CVs like electric buses and shuttles are replacing traditional diesel-powered vehicles. This shift demands scalable, reliable charging infrastructure at depots to support fleet operations efficiently. Advances in fast-charging technology and energy management systems further bolster the market, enabling quick turnaround times and optimized energy use. Public transit operators are also leveraging incentives and subsidies for fleet electrification, accelerating infrastructure development. With increasing urbanization and the need for cleaner transportation solutions, the deployment of e-CVs in public transportation is set to expand, creating robust opportunities for growth in the CV depot charging ecosystem.

Restraints & Challenges

The CV depot charging market faces several challenges as it scales to meet the growing demand for electric commercial vehicles (e-CVs). High upfront costs for setting up depot charging infrastructure, including chargers, energy storage, and grid upgrades, pose significant financial barriers. Grid capacity limitations and the need for enhanced grid stability can hinder large-scale deployment, particularly in regions with outdated power networks. Ensuring compatibility across diverse vehicle types and charging standards further complicates implementation. Additionally, the long charging times of some systems can disrupt fleet operations without proper scheduling and optimization. Limited access to renewable energy sources at depots and concerns over the environmental impact of electricity generation add to sustainability challenges. Addressing these issues through technological innovation and policy support is crucial for market growth and efficiency.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the CV Depot Charging Market from 2023 to 2033. The CV depot charging market in North America is experiencing significant growth, driven by increasing adoption of electric commercial vehicles (e-CVs) across industries such as logistics, public transportation, and delivery services. The region’s strong regulatory framework, including emissions reduction mandates and government incentives, supports fleet electrification and infrastructure development. Key players are investing in advanced charging technologies like ultra-fast chargers and energy management systems to cater to the growing demand. Challenges such as grid capacity and high initial costs are being addressed through public-private collaborations and utility investments. The U.S. and Canada are leading in deployment, focusing on integrating renewable energy sources and building scalable depot solutions. North America’s market is poised for robust expansion as fleet operators embrace electrification for sustainability and cost-efficiency.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The CV depot charging market in Asia-Pacific is rapidly expanding, fueled by the region's growing adoption of electric commercial vehicles (e-CVs) to address rising urbanization, air pollution, and sustainability goals. China, Japan, and India are leading this transition, driven by government policies, subsidies, and ambitious net-zero emission targets. Asia-Pacific benefits from significant investments in infrastructure development, including high-capacity charging stations and integration with renewable energy sources. However, challenges such as grid reliability, high setup costs, and varying charging standards persist. The logistics and public transportation sectors are primary drivers of demand, with electric buses and delivery fleets leading fleet electrification. As e-commerce and urban transport continue to grow, the region presents immense opportunities for scalable and cost-effective depot charging solutions.

Segmentation Analysis

Insights by Vehicle Type

The ELCV segment accounted for the largest market share over the forecast period 2023 to 2033. The Electric Light Commercial Vehicle (eLCV) segment is emerging as a key growth driver in the CV depot charging market. As industries prioritize sustainability and cost efficiency, eLCVs are being increasingly adopted for urban deliveries, last-mile logistics, and small-scale freight operations. Their rising demand is fueled by stricter emission regulations, government incentives, and the expansion of e-commerce. To support this transition, depot charging infrastructure tailored for eLCVs is gaining momentum, emphasizing fast-charging capabilities and efficient fleet management systems. The eLCV segment is poised for robust growth, creating significant opportunities for charging technology providers to develop scalable, flexible, and cost-effective solutions tailored to smaller commercial fleets.

Insights by Charger Type

The AC charger segment accounted for the largest market share over the forecast period 2023 to 2033. The AC charger segment is experiencing steady growth in the CV depot charging market, driven by its cost-effectiveness and suitability for overnight charging at commercial vehicle depots. AC chargers, although slower compared to DC fast chargers, offer a more affordable and reliable solution for fleets with predictable schedules, especially for light commercial vehicles and smaller fleets. As more companies seek to electrify their fleets while managing costs, AC chargers are becoming increasingly popular due to their lower installation and maintenance expenses. The growth of e-commerce and urban logistics, combined with the need for sustainable transportation solutions, is further boosting the demand for AC charging infrastructure. Additionally, advancements in smart charging technology and energy management are optimizing AC charger performance, contributing to the overall expansion of this segment in the CV depot charging market.

Recent Market Developments

- In 2023, Siemens acquired Heliox, a provider of depot and fleet solutions, as well as fast charging solutions for e-buses and e-trucks.

Competitive Landscape

Major players in the market

- ABB (Switzerland)

- Blink (US)

- Bosch (Germany)

- bp pulse (UK)

- ChargePoint (US)

- EVgo (US)

- Heliox (Netherlands)

- Kempower (Finland)

- Shell Recharge (US)

- Siemens (Germany)

- Wallbox (Spain)

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

CV Depot Charging Market, Vehicle Type Analysis

- ELCV

- eMCV

- eHCV

- eBusus

CV Depot Charging Market, Charger Type Analysis

- AC Chargers

- DC Chargers

CV Depot Charging Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the CV Depot Charging Market?The global CV Depot Charging Market is expected to grow from USD 7.3 billion in 2023 to USD 38.6 billion by 2033, at a CAGR of 18.12% during the forecast period 2023-2033.

-

2. Who are the key market players of the CV Depot Charging Market?Some of the key market players of the market are ABB (Switzerland), Blink (US), Bosch (Germany), bp pulse (UK), ChargePoint (US), EVgo (US), Heliox (Netherlands), Kempower (Finland), Shell Recharge (US), Siemens (Germany), Wallbox (Spain) and others.

-

3. Which segment holds the largest market share?The AC chargers segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the CV Depot Charging Market?North America dominates the CV Depot Charging Market and has the highest market share.

Need help to buy this report?