Global Cyanoacrylate Adhesives Market Size, Share, and COVID-19 Impact Analysis, By Technology (Reactive and UV Cured Adhesives), By End Use (Aerospace, Automotive, Building & Construction, Healthcare, Woodworking, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Cyanoacrylate Adhesives Market Insights Forecasts to 2033

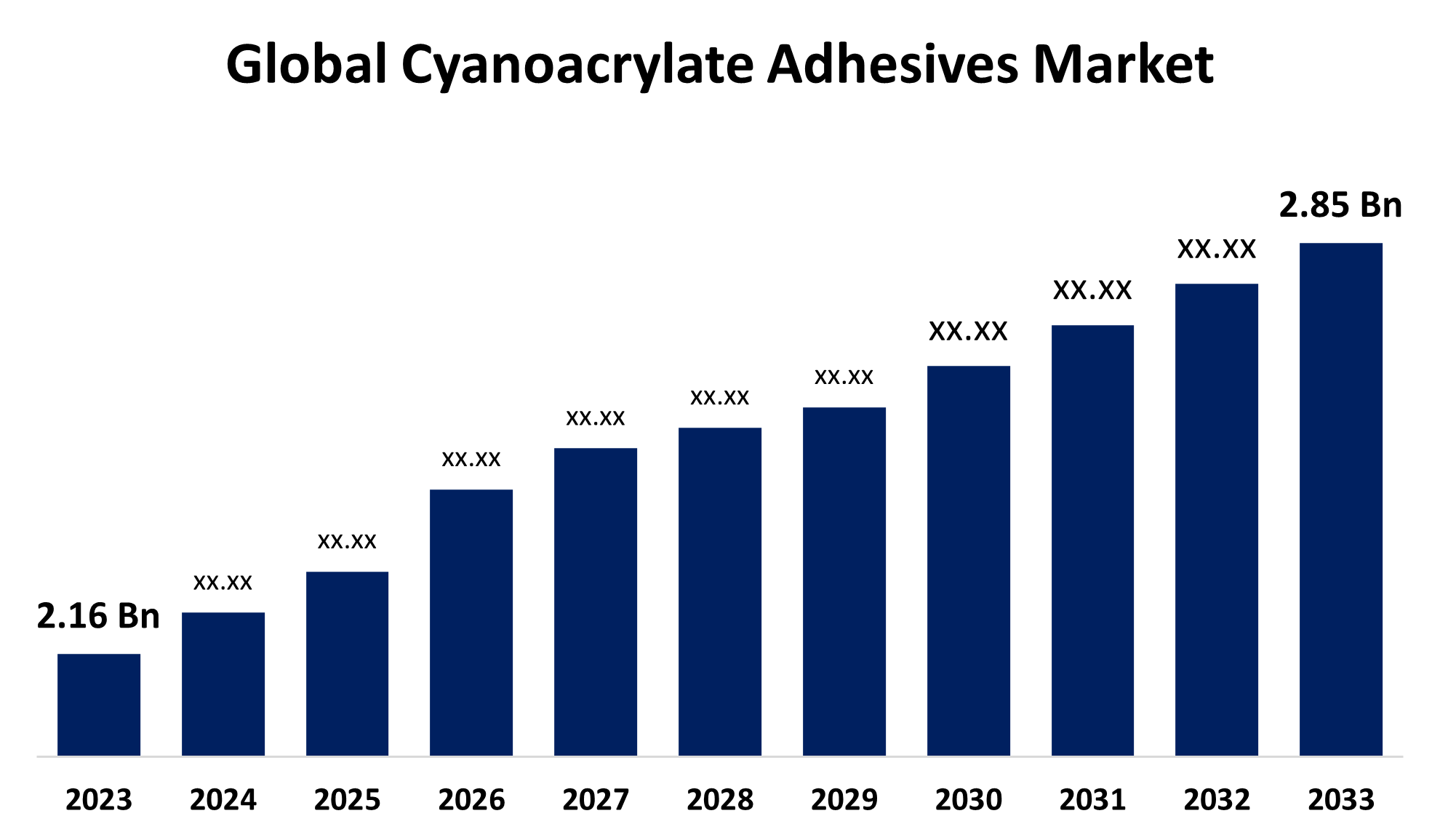

- The Global Cyanoacrylate Adhesives Market Size was Estimated at USD 2.16 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 2.81% from 2023 to 2033

- The Worldwide Cyanoacrylate Adhesives Market Size is Expected to Reach USD 2.85 Billion by 2033

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Cyanoacrylate Adhesives Market Size is anticipated to exceed USD 2.85 Billion by 2033, growing at a CAGR of 2.81% from 2023 to 2033. The introduction of new and efficient cyanoacrylate adhesives and rising demand across various sectors such as transportation, medical, electronics, and woodworking are bolstering the cyanoacrylate adhesives market growth.

Market Overview

The cyanoacrylate adhesives market refers to the industry of adhesives that cure quickly to form strong bonds. Cyanoacrylates are a family of strong fast-acting adhesives, derived from ethyl cyanoacrylate and related esters. They have industrial, medical, and household applications. Super glue, power glue, and quick glue are some general names for cyanoacrylate adhesives. "CA" is a frequently used acronym for industrial-grade cyanoacrylate. The market for cyanoacrylate adhesives is expanding as a result of the growing number of construction and infrastructure projects as well as the growing need for adhesive solutions that cure quickly. Cyanoacrylate adhesives are used in a variety of sectors and industries because they cure quickly and provide strong bindings. New and very effective cyanoacrylate adhesives have been introduced as a result of formulation improvements. The adoption of cyanoacrylate adhesives in the medical and electronic industries owing to their quick bonding and high strength is offering a market growth opportunity.

Report Coverage

This research report categorizes the cyanoacrylate adhesives market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cyanoacrylate adhesives market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cyanoacrylate adhesives market.

Global Cyanoacrylate Adhesives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.16 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.81% |

| 2033 Value Projection: | USD 2.85 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Technology, By End Use, By Region |

| Companies covered:: | H.B. Fuller Company, 3M, Sika AG, Arkema Group, Huntsman International LLC, Toagosei Co. Ltd., Aica Kogyo Co. Ltd., Henkel AG & Co. KGaA, Pidilite Industries Ltd., Illinois Tool Works Inc., Parker-Hannifin Corporation, Astral Ltd., Hubei Huitian New Materials Co. Ltd, NANPAO RESINS CHEMICAL GROUP, Soudal Holding N.V., Franklin International, and other major players |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

In the automotive industry, the use of cyanoacrylate adhesives for bonding applications in the manufacturing of lightweight and efficient materials is propelling the cyanoacrylate adhesives market. Cyanoacrylate adhesives are employed in the assembly of engine parts, body interiors, and electric car batteries. Further, government policies and standards supporting EV production are propelling the cyanoacrylate adhesives market. The upsurging research and development activities for introducing advanced formulations with enhanced performance as well as increasing emphasis on creating low-odor and low-blooming formulations of cyanoacrylate adhesives are augmenting the market growth.

Restraining Factors

The limited shelf life and stability issues associated with cyanoacrylate are challenging the cyanoacrylate adhesives market

Market Segmentation

The cyanoacrylate adhesives market share is classified into technology and end use.

- The reactive segment dominated the market accounting for a revenue share of 79.75% in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the cyanoacrylate adhesives market is classified into reactive and UV cured adhesives. Among these, the reactive segment dominated the market accounting for a revenue share of 79.75% in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Owing to their exceptional capacity to react with moisture and quickly polymerize to create strong connections, reactive cyanoacrylate adhesives are very well-liked. The adhesive's adhering qualities, cure speed, thermal stability, and resistance to humidity can all be enhanced by these additions.

- The healthcare segment dominated the market with the largest revenue share of 29.51% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the end use, the cyanoacrylate adhesives market is classified into aerospace, automotive, building & construction, healthcare, woodworking, and others. Among these, the healthcare segment dominated the market with the largest revenue share of 29.51% in 2023 and is expected to grow at a significant CAGR during the forecast period. Cyanoacrylate adhesives are used in diverse areas of healthcare such as surgery, medical device manufacturing, and wound closure. The widespread application of cyanoacrylate adhesives owing to their biocompatible nature and their ability to form robust bonds with biological tissues is driving the market expansion.

Regional Segment Analysis of the Cyanoacrylate Adhesives Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

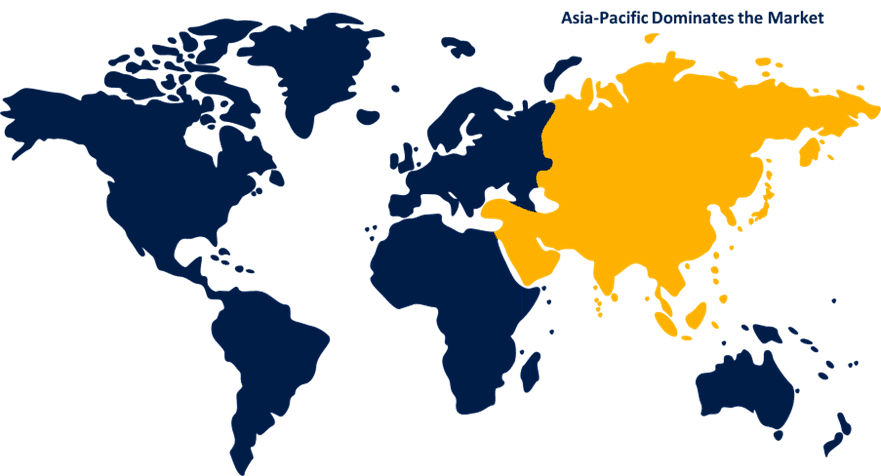

Asia Pacific is anticipated to hold the largest share of the cyanoacrylate adhesives market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the cyanoacrylate adhesives market over the predicted timeframe. The expanding automotive, electronics, and medical sectors are responsible for driving the cyanoacrylate adhesives market. The increasing need for strong bonding and rapid-curing adhesive solutions is driving the cyanoacrylate adhesives market. Further, the technological advancements in adhesive formulations and application methods are propelling the market growth.

North America is expected to grow at the fastest CAGR growth of the cyanoacrylate adhesives market during the forecast period. The increasing cyanoacrylate adhesives demand from electronics and furniture industries in the region are propelling the market. The crucial role of cyanoacrylate adhesives in the manufacturing sector for bonding a variety of materials such as metals, plastics, rubber, and ceramics is contributing to driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the cyanoacrylate adhesives market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- H.B. Fuller Company

- 3M

- Sika AG

- Arkema Group

- Huntsman International LLC

- Toagosei Co. Ltd.

- Aica Kogyo Co. Ltd.

- Henkel AG & Co. KGaA

- Pidilite Industries Ltd.

- Illinois Tool Works Inc.

- Parker-Hannifin Corporation

- Astral Ltd.

- Hubei Huitian New Materials Co. Ltd

- NANPAO RESINS CHEMICAL GROUP

- Soudal Holding N.V.

- Franklin International

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, H.B. Fuller Company, the biggest pureplay adhesives company in the world, announced that it has acquired ND Industries Inc., a leading provider of specialty adhesives and fastener locking and sealing solutions serving customers in the automotive, electronics, aerospace, and other industries.

- In May 2024, A new 90,000-square-foot expansion at 3M's facility in Valley, Nebraska, would increase the plant's manufacturing capacity and add new jobs to the community. The $67 million investment includes new production lines, equipment and a warehouse, and would help 3M more quickly meet customer demand for the company's personal safety products. The expansion of the plant is expected to create about 40 new jobs.

- In February 2024, Henkel introduced two next-generation medical grade, cyanoacrylates-based instant adhesives that offer improved safety and performance. The new products are formulated without CMR (Carcinogenic, Mutagenic, or Reproductively hazardous) ingredients and are designed to offer increased strength during and after heat cycling.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the cyanoacrylate adhesives market based on the below-mentioned segments:

Global Cyanoacrylate Adhesives Market, By Technology

- Reactive

- UV Cured Adhesives

Global Cyanoacrylate Adhesives Market, By End Use

- Aerospace

- Automotive

- Building & Construction

- Healthcare

- Woodworking

- Others

Global Cyanoacrylate Adhesives Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the cyanoacrylate adhesives market over the forecast period?The cyanoacrylate adhesives market is projected to expand at a CAGR of 2.81% during the forecast period.

-

What is the market size of the cyanoacrylate adhesives market?The Cyanoacrylate Adhesives Market Size is Expected to Grow from USD 2.16 Billion in 2023 to USD 2.85 Billion by 2033, at a CAGR of 2.81% during the forecast period 2023-2033.

-

Which region holds the largest share of the cyanoacrylate adhesives market?Asia Pacific is anticipated to hold the largest share of the cyanoacrylate adhesives market over the predicted timeframe.

Need help to buy this report?