Global Cyber Insurance Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, and Services), By Insurance Type (Standalone, and Packaged), By End-user (Healthcare, Retail, BFSI, IT and Solution, Manufacturing, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Cyber Insurance Market Insights Forecasts to 2033

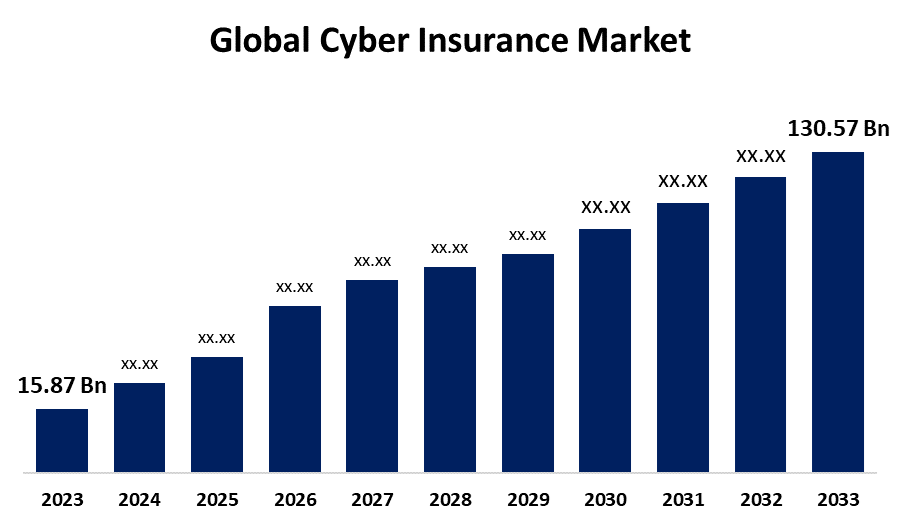

- The Global Cyber Insurance Market Size was Valued at USD 15.87 Billion in 2023

- The Market Size is Growing at a CAGR of 23.46% from 2023 to 2033

- The Worldwide Cyber Insurance Market Size is Expected to Reach USD 130.57 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Cyber Insurance Market Size is Anticipated to Exceed USD 130.57 Billion by 2033, Growing at a CAGR of 23.46% from 2023 to 2033.

Market Overview

Cyber insurance is a specific insurance product that covers the financial risks of cybersecurity threats. Cyber insurance protects against various crimes, including ransom, data loss, hacking, theft, disruption of service, and other online crimes. Administrations are more liable to electronic warfare and data breaches as the number of electronic devices utilized to store data rises. The market is perceiving vigorous growth, which can be credited to the growing number of cyber threats and regulatory pressures. In addition, the rising consciousness among the multitudes about the destructive impact of cyber risks globally is offering a favorable cyber insurance market outlook. Growth in the implementation of cyber insurance products owing to the growth in implications of cyber-attacks on public security, economic wealth, and government cyber security has led to noteworthy growth in the cyber insurance market in recent years. The custom of cyber insurance solutions aids businesses in diminishing the risk of cyber threats, such as data breaking and cyberattacks. These solutions protect administrations from the costs of Internet-based attacks that affect information governance, IT infrastructure, and information policies. This attack is regularly not covered by traditional insurance products or commercial liability policies. The increasing cybersecurity risks and data breach activities are allowing businesses to implement cyber insurance policies. Furthermore, small and medium enterprises are also being targeted by cyber attackers. This factor is anticipated to increase the adoption of new cyber insurance products by small businesses. As digital transformation develops, the extended utilization of digital technologies and evolving tech raises the vulnerability to cyber threats. Cybersecurity insurance supports organizations in managing and reducing these risks.

Report Coverage

This research report categorizes the market for the global cyber insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global cyber insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global cyber insurance market.

Global Cyber Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 15.87 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 23.46% |

| 2033 Value Projection: | USD 130.57 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component, By Insurance Type, By End-user and By Region |

| Companies covered:: | Chubb, Travelers Indemnity Company, American International Group, Inc., AXA XL, Beazley Group, CNA Financial Corporation, AXIS Capital Holdings Limited, BCS Financial Corporation, Zurich Insurance, The Hanover Insurance, Inc., Arthur J. Gallagher & Co., Allianz SE, Berkshire Hathaway Inc., Munich Re Group and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing incidents of cybersecurity threats and data breaches epitomize one of the crucial factors growing the demand for cyber insurance. Moreover, the beginning of advanced technologies is reflected in the increasing complexity of cyber threats as hackers are using more erudite systems, making conventional security measures less operative. This is encouraging businesses to pursue comprehensive protection through cyber insurance. Instead, the increasing admiration of remote work modules is creating new susceptibilities in cyber security and pouring the demand for cyber insurance to protect against potential breaches. Additionally, the growing customer reliance on the booming e-commerce industry to handle huge amounts of complex consumer data is pouring the demand for cyber insurance. Furthermore, governments of several countries are striking stringent data protection regulations, which is pushing industries to implement cyber insurance to ensure compliance and manage legal risks. Additionally, the growing implementation of insurance policies by the healthcare and finance sectors to meet acquiescence standards and protect sensitive data is positively prompting the market. Apart from this, governing bodies are daunting heavier fines and retribution for data breaking, making cyber insurance a critical tool for financial protection. Furthermore, the growing consciousness among customers about the advantages offered by cyber insurance policies is encouraging them to invest more in cyber insurance to maintain client trust and determine responsibility.

Restraining Factors

For insurers, the accrual of cyber risk offerings is a special difficulty. A sole cyber calamity might concurrently affect numerous policyholders, making noteworthy risk magnification. A huge ransomware beating that aims at a precise industry, for instance, can result in a huge number of claims from affected policyholders. To daze this exertion, insurers must cautiously control their risk exposure and confirm they have sufficient insurance to protect against potentially disastrous events. There is an absence of consistency in cyber insurance policy forms, policies, and cost structures. Cyber risks are frequently tough to quantify, and assessing potential losses can be intricate. This can lead to ambiguity in indorsing and pricing cyber insurance policies. As the market increases and more insurers arrive, rivalry can put pressure on pricing. In some cases, insurers might underprice policies to increase market share, potentially leading to derisory coverage.

Market Segmentation

The global cyber insurance market share is classified into component, insurance type, and end-user.

- The solution segment is expected to hold the largest share of the global cyber insurance market during the forecast period.

Based on the component, the global cyber insurance market is divided into solutions and services. Among these, the solution segment is anticipated to hold the largest share of the global cyber insurance market during the forecast period. This is attributed to the solutions component comprises insurance plans calculated to deal with the financial significance of cyber threats and crimes. These policies protect several circumstances, from first-party policies that cover policyholders from their direct losses to third-party policies that take care of obligations ensuing from cyber-attacks and other occurrences of the loss of personal data. These insurance selections can better gauge the company's cyber risk or threat scope. The increase in cyber-attacks, assaults on privacy, and the influences of the global rampant were all factors that contributed to the sharp growth in data breaches. Thus, numerous administrations and industries practice solutions to maintain corporate cyber security measures.

- The standalone segment is expected to hold the largest share of the global cyber insurance market during the forecast period.

Based on the insurance type, the global cyber insurance market is divided into standalone, and packaged. Among these, the standalone segment is expected to hold the largest share of the global cyber insurance market during the forecast period. This is attributed to the standalone insurance supports business enterprises in mitigating the hazard of silent exposures. As standalone policies decrease the threat of silent exposures and fortify the market, various cyber insurance companies are undergoing a modification in policy consumers from authorization to standalone insurance policies. These policies often offer liability coverage for losses ensuing from data breaches. Business enterprises can also get financial reimbursement for their legal and investment costs and the damage produced when they file a standard policy claim connected to a cyber event. These plans also offer cover for any direct damages brought on by phishing, social engineering scams, cyber fraud, spoofing, and phishing, as well as any legal compulsions that organizations might have to third parties.

- The BFSI segment is expected to hold the largest share of the global cyber insurance market during the forecast period.

Based on the end-user, the global cyber insurance market is divided into healthcare, retail, BFSI, IT and solution, manufacturing, and others. Among these, the BFSI segment is expected to hold the largest share of the global cyber insurance market during the forecast period. This is attributed to the massive customer base that the sector aids and the delicate financial data at risk, the BFSI industry is one of the perilous infrastructure categories that regularly exploit data breaks and cyber-attacks. Since the financial industry has a highly striking functioning model with unexpected risks and the plus of comparatively low risk and detectability, cybercriminals are enhancing an extensive variety of criminal cyber-attacks to petrify it. The threat situation for these attacks comprises trojans, ATMs, ransomware, data breaches, institutional invasion, data thefts, financial breaches, and other threats, growing the demand for cyber security insurance in the BFSI sector.

Regional Segment Analysis of the Global Cyber Insurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global cyber insurance market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global cyber insurance market over the predicted timeframe. North America is reported for the largest market share as it is home to a noteworthy number of huge companies and technology corporations, which are the main targets for cyber attacks. Furthermore, compliance demands, such as those directed by the New York Department of Financial Services and the California Consumer Privacy Act, inspire industries to invest in cyber insurance as a part of their inclusive risk management strategy. Apart from this, the values of consciousness and education around cybersecurity risks in North America endorse empathy and acknowledgment of the necessity for protection. Additionally, technological improvement and investment in cybersecurity research in North America make a dynamic environment where insurance products can constantly adapt to emerging threats and trends.

Asia Pacific is expected to grow at the fastest pace in the global cyber insurance market during the forecast period. This is attributed to growing ransom attacks and risks in the region. Countries with the maximum rise in cyberattacks in the Asia Pacific are Japan, Singapore, Indonesia, and Malaysia. Furthermore, governments, comprises Japan, India, South Korea, and China are advancing in insurance to reduce the effects of cybercrimes. Cyber insurance solutions are gaining adhesion in Asia Pacific owing to swiftly increasing connectivity. The fast-tracking digital transformation exposes an organization and makes it susceptible to cyber exploitation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global cyber insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chubb

- Travelers Indemnity Company

- American International Group, Inc.

- AXA XL

- Beazley Group

- CNA Financial Corporation

- AXIS Capital Holdings Limited

- BCS Financial Corporation

- Zurich Insurance

- The Hanover Insurance, Inc.

- Arthur J. Gallagher & Co.

- Allianz SE

- Berkshire Hathaway Inc.

- Munich Re Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, Saiber Innovation Technologies arrived at a corporation with CYMAR Management Ltd., a cyber-insurance specialist, to satisfy the cyber insurance demands of the maritime & logistics sector in the U.A.E. and aid protect this sector from cyber-attacks.

- In February 2023, Cowbell, a cyber-insurance provider arrived at a corporation with Millennial Shift Technologies to provide Cowbell’s cyber insurance programs called Cowbell Prime 100 and 250 to contact Millennial Shift's e-trading broker platform, mFactor, for improved processes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global cyber insurance market based on the below-mentioned segments:

Global Cyber Insurance Market, By Component

- Solution

- Services

Global Cyber Insurance Market, By Insurance Type

- Standalone

- Packaged

Global Cyber Insurance Market, By End-user

- Healthcare

- Retail

- BFSI

- IT and Solution

- Manufacturing

- Others

Global Cyber Insurance Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?