Global Cyber Warfare Market Size, By Application (Defense, Government, Aerospace, Homeland, Corporate), By Region, And Segment Forecasts, By Geographic Scope And Forecasts to 2033

Industry: Aerospace & DefenseGlobal Cyber Warfare Market Insights Forecasts to 2033

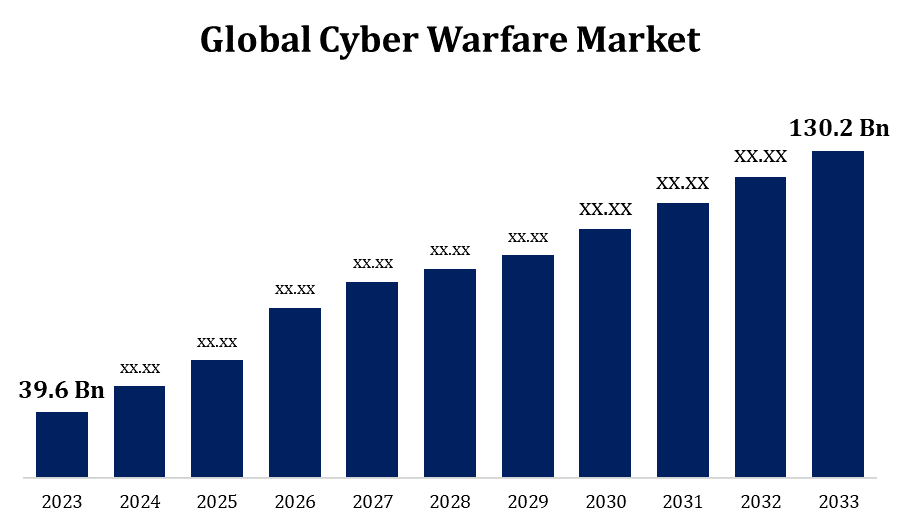

- The Global Cyber Warfare Market Size was valued at USD 39.6 Billion in 2023.

- The Market is Growing at a CAGR of 12.64% from 2023 to 2033

- The Worldwide Cyber Warfare Market Size is Expected to reach USD 130.2 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Cyber Warfare Market Size is Expected to reach USD 130.2 Billion by 2033, at a CAGR of 12.64% during the forecast period 2023 to 2033.

A major factor in the market's growth for cyber warfare has been the frequency and sophistication of cyberattacks, as well as the growing understanding of cybersecurity's important role in maintaining both national security and economic stability. The market has also grown as a result of factors like the rise of cloud computing, the proliferation of linked devices (IoT), and the digitalization of industries. Threat actors are continually developing new strategies and technology, which drives innovation and investment in cybersecurity defences, making the cyber warfare market dynamic and ever-evolving. The fact that governments all over the world are making cybersecurity a national priority also contributes to the market's expansion.

Cyber Warfare Market Value Chain Analysis

Research on threat intelligence, vulnerability analysis, and the creation of new security tools and protocols are examples of R&D efforts. The development of novel cybersecurity technologies, such as hardware, software, and algorithms, is a part of this stage. Following their development, new cybersecurity technologies undergo testing and refinement to guarantee their dependability and efficacy. Developing user interfaces, integrating new technologies, and performance optimisation are all possible steps in the product development process. Distribution methods for cybersecurity solutions include distributors, value-added resellers (VARs), direct sales, and online marketplaces. Cybersecurity solutions must be implemented and incorporated into the client's IT system after acquisition. Cybersecurity solutions must be constantly checked for threats and performance problems after they are deployed. Cybersecurity products eventually have to be discarded or replaced when their useful lives are up. Data deletion and appropriate hardware component disposal or recycling are crucial factors to take into account.

Cyber Warfare Market Opportunity Analysis

Strong cybersecurity solutions are in high demand due to the rise in cyberattacks that target companies, governments, and private citizens. Tools for threat identification, incident response, encryption, and secure communication are included in this. Technological innovations like blockchain, quantum cryptography, machine learning, and artificial intelligence (AI) open up new possibilities for cyber defence. Businesses who put money into R&D to use these technologies for cybersecurity stand to benefit from a competitive advantage. The expansion of cloud-based services and Internet of Things (IoT) devices increases the attack surface for cyber attacks. Novel cybersecurity offers can benefit from the increased demand for cybersecurity solutions designed to safeguard cloud infrastructures and IoT ecosystems.

Global Cyber Warfare Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 39.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.64% |

| 2033 Value Projection: | USD 130.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Intel Corporation, BAE Systems, L3Harris Technologies, Inc., General Dynamics Corporation, Airbus, DXC Technology Company, RTX, IBM, Booz Allen Hamilton Inc., Cisco Systems, Inc., and other key vendors. |

| Growth Drivers: | Modernizing government IT infrastructure to propel the market growth |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Cyber Warfare Market Dynamics

Modernizing government IT infrastructure to propel the market growth

Governments frequently set aside substantial sums of money for updating their IT infrastructure, which includes spending on cybersecurity. Governments are a major factor in the growth of the cyber warfare market since they are driving up demand for cybersecurity services and products as they modernise their systems to counter cyber threats and safeguard vital infrastructure. Modernization initiatives incorporate cybersecurity into the development lifecycle of IT systems and applications, giving security a higher priority through design principles. Government organisations now have more chances for cybersecurity providers to offer security evaluations, secure development tools, and advisory services due to the trend towards proactive security measures. Because of their inherent weaknesses, old software, and out-of-support hardware, legacy IT systems can provide serious cybersecurity threats. The goal of modernization projects is to replace or improve outdated systems with more robust and secure options, which increases the need for cybersecurity products.

Restraints & Challenges

The sophistication of cyber threats is on the rise, as adversaries are utilising sophisticated tactics like supply chain attacks, ransomware-as-a-service, and zero-day exploits. It takes constant innovation and investment in cybersecurity procedures and technologies to stay up with the ever-evolving threats. Professionals with expertise in cybersecurity, such as analysts, engineers, and incident responders, are in short supply worldwide. Organisations are unable to effectively detect, respond to, and mitigate cyber risks due to a shortage of competent workers. It will take coordinated initiatives in workforce development, education, and training to close the cybersecurity skills gap. A lot of businesses, especially small and medium-sized businesses (SMEs), don't know about cybersecurity best practices and hazards. Furthermore, there can be a lack of knowledge about the possible effects of cyberthreats on the finances, reputation, and day-to-day operations of businesses.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Cyber Warfare Market from 2023 to 2033. The majority of cybersecurity spending in North America is contributed by the private sector, which includes sectors like banking, healthcare, technology, energy, and defence. To defend sensitive data, intellectual property, and vital business operations from cyber threats, organisations invest in cybersecurity solutions. IoT devices, cloud computing, and digital transformation programmes are all becoming more and more popular, which is raising demand for cybersecurity goods and services. The global market for cyber insurance is dominated by North America, where insurance companies offer plans to reduce monetary losses brought on by ransomware attacks, data breaches, and other cyber catastrophes. The market for cyber warfare is expanding as a result of the increased incentives provided by the expanding cyber insurance industry to businesses for cybersecurity risk management and resilience planning.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Significant digital transformation is taking place in several Asia-Pacific nations across a number of industries, including government, industry, healthcare, and finance. Adoption of mobile technologies, cloud computing, IoT devices, and online services increases the attack surface for cyber threats and calls for strong cybersecurity measures to safeguard sensitive data and digital assets. Because the economies in the Asia-Pacific area are among the fastest-growing in the world, there have been large expenditures made in cybersecurity to protect digital infrastructure, intellectual property, and economic interests. To reduce cyber threats and ensure business continuity, companies in industries including banking, e-commerce, telecommunications, and healthcare are investing in cybersecurity services and solutions.

Segmentation Analysis

Insights by Application

The defence segment accounted for the largest market share over the forecast period 2023 to 2033. Cybercriminals, hacktivists, nation-state actors, and insider threats are among the constant and changing cyberthreats that defence organisations must contend with. Strong cybersecurity defences and proactive threat mitigation techniques are essential in light of cyberattacks that target defence infrastructure, such as military networks, communication systems, weapon systems, and command-and-control centres. Global defence agencies are allocating resources towards the enhancement of military capabilities, encompassing cyber warfare capabilities, in order to sustain a competitive advantage in the digital arena. To successfully identify, discourage, and counteract cyber threats, this calls for the development and application of sophisticated cyberweapons, as well as offensive and defensive cyberoperations and cyberintelligence capabilities. To maintain operational resilience and mission success, cybersecurity is being more and more incorporated into defence operations in the air, space, sea, and land domains.

Recent Market Developments

- In October 2023, Booz Allen Hamilton Inc. has enhanced its security offerings and broadened its service portfolio to introduce artificial intelligence (AI) solutions to government agencies.

- In April 2023, a cybersecurity and cyber intelligence platform was launched by Thales, a French IT corporation, in partnership with eleven cybersecurity-focused organisations and businesses in France.

Competitive Landscape

Major players in the market

- Intel Corporation

- BAE Systems

- L3Harris Technologies, Inc.

- General Dynamics Corporation

- Airbus

- DXC Technology Company

- RTX

- IBM

- Booz Allen Hamilton Inc.

- Cisco Systems, Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Cyber Warfare Market, Application Analysis

- Defense

- Government

- Aerospace

- Homeland

- Corporate

Cyber Warfare Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Cyber Warfare Market?The global Cyber Warfare Market is expected to grow from USD 39.6 billion in 2023 to USD 130.2 billion by 2033, at a CAGR of 12.64% during the forecast period 2023-2033.

-

2. Who are the key market players of the Cyber Warfare Market?Some of the key market players of the market are Intel Corporation, BAE Systems, L3Harris Technologies, Inc., General Dynamics Corporation, Airbus, DXC Technology Company, RTX, IBM, Booz Allen Hamilton Inc., Cisco Systems, Inc., others.

-

3. Which segment holds the largest market share?The defence segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Cyber Warfare Market?North America is dominating the Cyber Warfare Market with the highest market share.

Need help to buy this report?