Global Cylinder Deactivation System Market Size, Share, and COVID-19 Impact Analysis, By Component (Valve Solenoid, Engine Control Units, Electronic Throttle Control), By Actuation Method (Overhead Camshaft Design, Pushrod Design), By End Use (Passengers Cars, Light Commercial Vehicles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Cylinder Deactivation System Market Size Insights Forecasts to 2033

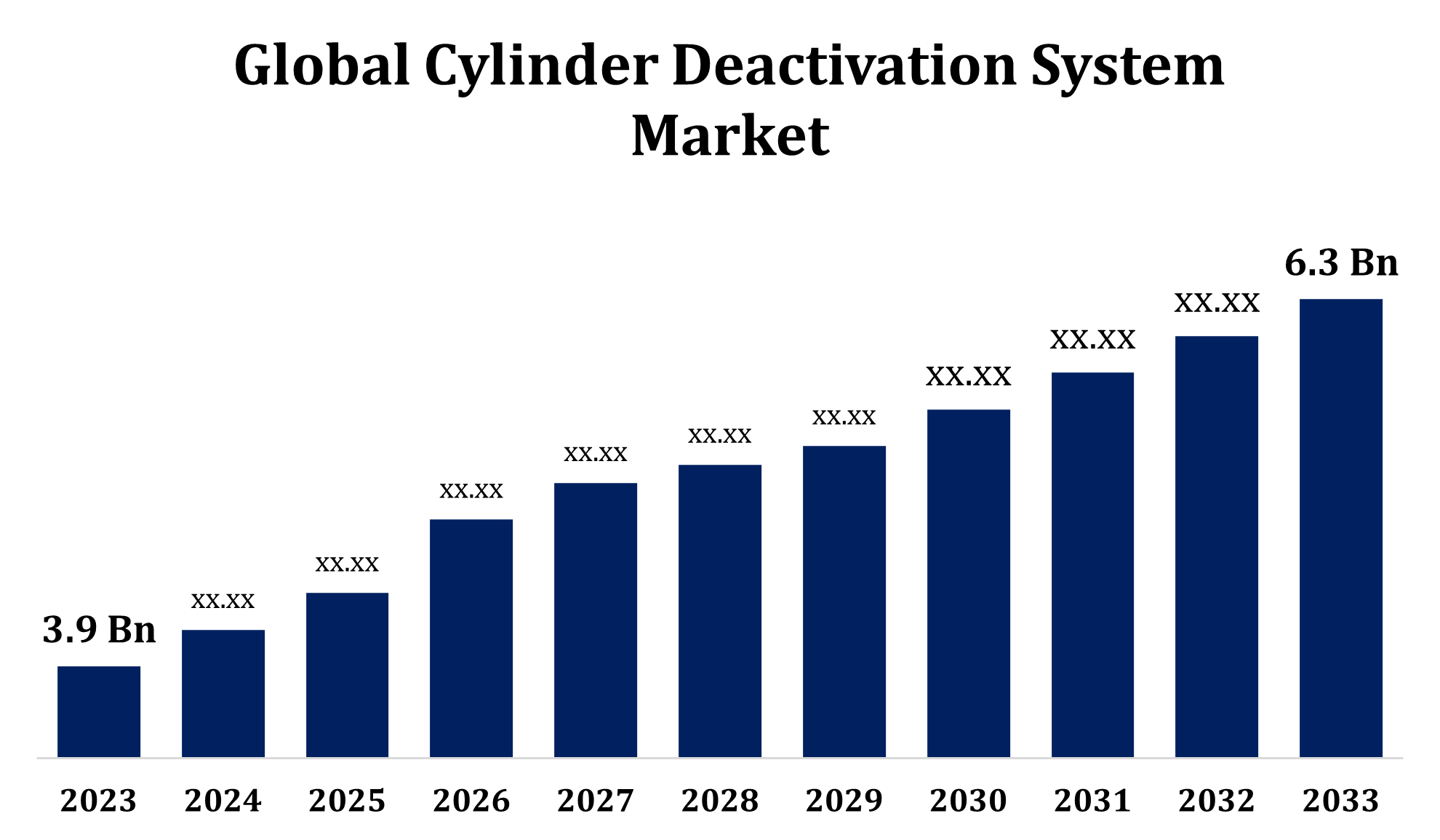

- The Global Cylinder Deactivation System Market Size was valued at USD 3.9 Billion in 2023.

- The Market is Growing at a CAGR of 4.91% from 2023 to 2033.

- The Worldwide Cylinder Deactivation System Market Size is Expected to reach USD 6.3 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Cylinder Deactivation System Market Size is Expected to reach USD 6.3 Billion by 2033, at a CAGR of 4.91% during the forecast period 2023 to 2033.

The Global Cylinder Deactivation System (CDS) market is experiencing significant growth, driven by increasing demand for fuel efficiency and stringent emission regulations globally. CDS technology enhances engine efficiency by deactivating select cylinders when full power is not required, reducing fuel consumption and emissions. Automakers are integrating these systems to comply with environmental standards while maintaining vehicle performance. Key players in the market are focusing on advanced technologies and partnerships to expand their offerings. Rising consumer awareness of sustainability and the growing adoption of hybrid and electric vehicles are also influencing market dynamics. However, the high cost of implementation and maintenance may pose challenges. Geographically, North America and Europe lead the market due to established automotive industries and supportive regulatory frameworks, with Asia-Pacific showing substantial potential for future growth.

Cylinder Deactivation System Market Value Chain Analysis

The value chain of the Cylinder Deactivation System (CDS) market encompasses multiple stages, from raw material suppliers to end users. It begins with the procurement of essential components, such as actuators, valve lifters, and control modules, supplied by specialized manufacturers. These components are then integrated into engines by automakers, often in collaboration with Tier 1 suppliers that provide advanced engineering and assembly expertise. Research and development play a crucial role, focusing on improving efficiency and reducing system costs. Regulatory bodies influence the value chain by enforcing emission norms, driving innovation in CDS technologies. The aftermarket segment also contributes, with services like maintenance and replacement. Ultimately, the end users—automotive consumers—benefit from improved fuel efficiency, aligning with environmental sustainability goals while reducing operational costs.

Cylinder Deactivation System Market Opportunity Analysis

The Cylinder Deactivation System (CDS) market offers significant growth opportunities driven by the rising focus on fuel efficiency and compliance with stringent emission standards. As governments worldwide tighten environmental regulations, automakers are adopting CDS to meet these requirements cost-effectively without compromising vehicle performance. Emerging markets, particularly in Asia-Pacific and Latin America, present untapped potential due to expanding automotive production and increasing environmental awareness. The integration of CDS with hybrid powertrains and advanced driver-assistance systems (ADAS) is another promising avenue, catering to the demand for eco-friendly and technologically advanced vehicles. Furthermore, advancements in electronic control systems and the shift toward lightweight engine components open doors for innovation in CDS design and performance. Addressing cost barriers and raising consumer awareness will further accelerate market adoption, offering long-term growth prospects.

Global Cylinder Deactivation System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.9 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.91% |

| 023 – 2033 Value Projection: | USD 6.3 Billion |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Component, By Actuation Method, By End Use, By Regional Analysis |

| Companies covered:: | Nissan Motor Company, Delphi Technologies, Eaton Corporation, BorgWarner Inc, Magna International Inc, Daimler AG, Toyota Motor Corporation, Ford Motor Company, Continental AG, Hyundai Mobis, Volkswagen AG, General Motors Company, Porsche AG, Mitsubishi Motors Corporation, AVL List GmbH, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Cylinder Deactivation System Market Dynamics

Growing Demand for Vehicles with Enhanced Fuel Efficiency

The growing demand for vehicles with enhanced fuel efficiency is a key driver for the Cylinder Deactivation System (CDS) market. With increasing environmental concerns and rising fuel costs, consumers and automakers are prioritizing technologies that optimize fuel consumption. CDS addresses this need by selectively deactivating engine cylinders during low-load conditions, significantly improving efficiency without compromising performance. Regulatory pressures to reduce greenhouse gas emissions further amplify the adoption of CDS, as it enables automakers to meet stringent standards cost-effectively. This trend is particularly prominent in developed regions like North America and Europe, while emerging markets in Asia-Pacific are witnessing a surge in adoption due to rising consumer awareness and vehicle production. As automakers strive for greener solutions, the CDS market is poised for sustained growth, driven by its fuel-saving potential.

Restraints & Challenges

High implementation costs remain a significant barrier, as the advanced components and integration processes increase the overall cost of vehicles. This can limit adoption, especially in price-sensitive markets. Additionally, the complexity of CDS technology requires skilled maintenance and repair, posing challenges for widespread aftermarket support. Compatibility issues with smaller and high-performance engines also restrict the system's application across diverse vehicle segments. The growing shift toward electric vehicles (EVs), which bypass the need for internal combustion engine optimizations like CDS, further threatens market growth. Consumer awareness and acceptance of CDS technology remain low in certain regions, necessitating education efforts. Addressing these challenges is crucial for the long-term success and expansion of the CDS market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Cylinder Deactivation System Market from 2023 to 2033. North America is a leading region in the Cylinder Deactivation System (CDS) market, driven by its established automotive industry and stringent fuel efficiency and emission regulations. The Corporate Average Fuel Economy (CAFE) standards and other environmental policies have encouraged automakers in the region to adopt CDS technology as a cost-effective solution to meet these requirements. High consumer demand for fuel-efficient vehicles, coupled with rising environmental awareness, further propels market growth. Key automakers and Tier 1 suppliers in the U.S. and Canada are investing heavily in research and development to enhance CDS technology, making it more efficient and compatible with modern engines. Additionally, the region’s robust aftermarket service infrastructure supports maintenance needs, ensuring long-term adoption. North America’s leadership in innovation and regulatory frameworks positions it as a critical player in the global CDS market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Rapid urbanization and economic growth in countries like China, India, and Japan have led to a surge in automotive demand, prompting manufacturers to adopt fuel-efficient technologies like CDS. Governments across the region are enforcing stricter emission standards, further driving the integration of CDS in new vehicle models. The growing awareness among consumers regarding fuel efficiency and environmental sustainability is also contributing to the market's expansion. As automakers and suppliers invest in R&D and localization strategies, Asia-Pacific is poised to emerge as a dynamic and lucrative market for CDS technology.

Segmentation Analysis

Insights by Component

The electronic control unit segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is due to its critical role in managing system functionality. ECUs enable precise control of cylinder activation and deactivation, optimizing engine performance and fuel efficiency. The growing demand for advanced, fuel-efficient technologies in compliance with stringent emission norms drives innovation and adoption of high-performance ECUs. Integration with advanced sensors and real-time monitoring capabilities further enhances their efficiency and appeal. Automakers are increasingly incorporating sophisticated ECUs in vehicles to meet regulatory standards and consumer expectations for enhanced driving experiences. Moreover, advancements in automotive electronics, including miniaturization and improved processing power, are making ECUs more cost-effective and reliable, fueling their adoption across diverse vehicle segments globally.

Insights by Actuation Method

The overhead camshaft design segment accounted for the largest market share over the forecast period 2023 to 2033. OHC designs facilitate efficient cylinder deactivation by providing precise valve timing and reduced engine friction, enhancing fuel efficiency and reducing emissions. This design's compatibility with modern high-performance engines makes it a preferred choice for automakers aiming to integrate CDS technology. The rising adoption of lightweight and compact engine components further boosts the demand for OHC designs, as they support engine downsizing without compromising performance. Additionally, advancements in materials and manufacturing processes have improved the durability and cost-effectiveness of OHC systems. With increasing regulatory pressure to meet emission standards, the OHC segment is expected to play a pivotal role in driving the growth of the CDS market.

Insights by End Use

The passenger car segment accounted for the largest market share over the forecast period 2023 to 2033. As the demand for fuel-efficient vehicles continues to rise, CDS technology, which deactivates cylinders under low-load conditions, offers a cost-effective solution for reducing fuel consumption and CO2 emissions without compromising performance. The increasing adoption of hybrid and gasoline-powered passenger vehicles further supports CDS integration. Consumers' growing focus on sustainability and lower operational costs is encouraging automakers to equip more passenger car models with CDS. Additionally, advancements in engine technology and regulatory pressure are accelerating the adoption of this system in mainstream vehicles. The passenger car segment is expected to lead the market in the coming years, driven by these factors.

Recent Market Developments

- In May 2023, a research study found that both open-loop and closed-loop cylinder deactivation system strategies can enhance catalyst performance and contribute to reduced emissions in internal combustion engines.

Competitive Landscape

Major players in the market

- Nissan Motor Company

- Delphi Technologies

- Eaton Corporation

- BorgWarner Inc

- Magna International Inc

- Daimler AG

- Toyota Motor Corporation

- Ford Motor Company

- Continental AG

- Hyundai Mobis

- Volkswagen AG

- General Motors Company

- Porsche AG

- Mitsubishi Motors Corporation

- AVL List GmbH

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Cylinder Deactivation System Market, Component Analysis

- Valve Solenoid

- Engine Control Units

- Electronic Throttle Control

Cylinder Deactivation System Market, Actuation Type Analysis

- Overhead Camshaft Design

- Pushrod Design

Cylinder Deactivation System Market, End Use Analysis

- Passengers Cars

- Light Commercial Vehicles

Cylinder Deactivation System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Cylinder Deactivation System Market?The global Cylinder Deactivation System Market is expected to grow from USD 3.9 billion in 2023 to USD 6.3 billion by 2033, at a CAGR of 4.91% during the forecast period 2023-2033.

-

2.Who are the key market players of the Cylinder Deactivation System Market?Some of the key market players of the market are Nissan Motor Company, Delphi Technologies, Eaton Corporation, BorgWarner Inc, Magna International Inc, Daimler AG, Toyota Motor Corporation, Ford Motor Company, Continental AG, Hyundai Mobis, Volkswagen AG, General Motors Company, Porsche AG, Mitsubishi Motors Corporation, AVL List GmbH.

-

3.Which segment holds the largest market share?The passenger car segment holds the largest market share and is going to continue its dominance.

-

4.Which region dominates the Cylinder Deactivation System Market?North America dominates the Cylinder Deactivation System Market and has the highest market share.

Need help to buy this report?