Global Cystatin C Assay Market Size, Share, and COVID-19 Impact Analysis, By Product (Kits, Reagents, Analyzers), By Sample Type (Blood, Urine), By Application (Diagnostics, Research), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Cystatin C Assay Market Insights Forecasts to 2033

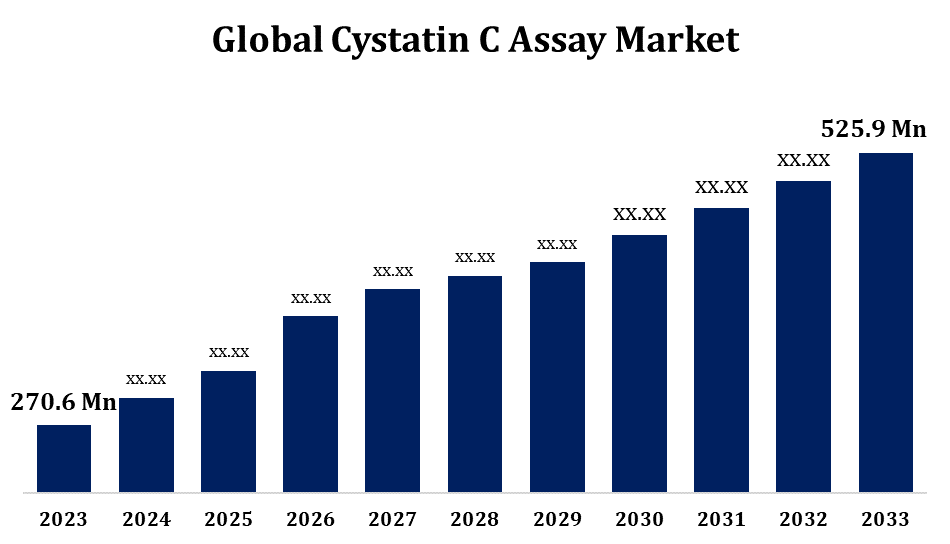

- The Cystatin C Assay Market Size was valued at USD 270.6 Million in 2023.

- The Market Size is Growing at a CAGR of 6.87% from 2023 to 2033

- The Worldwide Cystatin C Assay Market Size is Expected to reach USD 525.9 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Cystatin C Assay Market is Expected to reach USD 525.9 Million by 2033, at a CAGR of 6.87% during the forecast period 2023 to 2033.

The cystatin C assay market is poised for substantial growth driven by the increasing prevalence of kidney diseases, particularly chronic kidney disease (CKD) and acute kidney injury (AKI), along with the advantages cystatin C offers over traditional creatinine tests, such as higher accuracy regardless of muscle mass variations. Technological advancements and the growing adoption of point-of-care testing (POCT) are enhancing the efficiency and accessibility of these assays. Despite challenges like high costs and regulatory hurdles, the market outlook remains positive, driven by an aging population, increased healthcare access, and the integration of personalized medicine approaches. Efforts to raise awareness and manage costs will be crucial for broader adoption and market expansion.

Cystatin C Assay Market Value Chain Analysis

The value chain analysis of the cystatin C assay market encompasses several key stages, beginning with raw material procurement and moving through production, distribution, and end-use application. Raw materials, primarily reagents and biological materials, are sourced from specialized suppliers and are crucial for the manufacturing of high-quality cystatin C assays. The production phase involves the development of assay kits and instruments, incorporating advanced technologies to ensure accuracy and reliability. At the end-use application stage, cystatin C assays are utilized for diagnosing and monitoring kidney function in patients, with an increasing emphasis on personalized medicine and point-of-care testing. Throughout the value chain, regulatory compliance, cost management, and technological advancements are critical factors influencing the market dynamics and ensuring the delivery of effective diagnostic solutions to healthcare providers and patients.

Cystatin C Assay Market Opportunity Analysis

The cystatin C assay market presents significant growth opportunities driven by various factors. One of the primary opportunities lies in the increasing prevalence of chronic kidney disease (CKD) and acute kidney injury (AKI) globally, which necessitates more reliable diagnostic tools for early detection and management. The aging population further amplifies this need, as older adults are more prone to kidney-related issues. Technological advancements in diagnostic testing, including the development of high-throughput and point-of-care testing (POCT) devices, offer substantial potential for market expansion. These innovations enable faster, more accurate, and convenient testing, enhancing patient care and clinical outcomes.

Global Cystatin C Assay Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 270.6 million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.87% |

| 2033 Value Projection: | USD 525.9 million |

| No. of Pages: | 280 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Sample Type, By Application, By Region |

| Companies covered:: | Abbott (U.S.), Roche Diagnostics Limited (Switzerland), Siemens Healthcare GmbH (Germany), Thermo Fisher Scientific Inc. (U.S.), Randox Laboratories Ltd. (U.K.), DiaSys Diagnostic Systems GmbH (Germany), Bio-Techne (U.S.), Gentian Diagnostics ASA (Norway), Getein Biotech, Inc. (China), Agilent Technologies, Inc. (U.S.), Abcam plc. (U.K.), Sino Biological, Inc. (China), Eurolyser Diagnostica GmbH (Austria), and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Cystatin C Assay Market Dynamics

Rising adoption of point of care testing

The increasing adoption of point-of-care testing (POCT) in the cystatin C assay market is a significant trend driving market growth. One of the primary drivers of POCT adoption in the cystatin C assay market is the rising prevalence of kidney diseases, which requires regular and reliable monitoring. Traditional laboratory tests often involve longer processing times, which can delay diagnosis and treatment. POCT addresses this issue by delivering immediate results, allowing healthcare providers to make quicker clinical decisions and initiate appropriate interventions. Furthermore, the growing emphasis on personalized medicine and patient-centric care has fueled the demand for POCT. Personalized treatment plans require precise and timely diagnostic information, which POCT can provide.

Restraints & Challenges

Cystatin C assays are generally more expensive than traditional creatinine tests. The high cost can be a barrier to widespread adoption, particularly in low- and middle-income countries where healthcare budgets are limited. There is a lack of awareness among healthcare providers and patients about the advantages of cystatin C over creatinine for kidney function assessment. Many clinicians still rely on creatinine due to familiarity and established practice, which can slow the transition to cystatin C testing. Navigating the complex regulatory landscape for diagnostic assays can be challenging. Obtaining necessary approvals from regulatory bodies like the FDA or EMA requires significant time and resources, which can delay product launches and market entry.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Cystatin C Assay Market from 2023 to 2033. This region's dominance is driven by a combination of advanced healthcare infrastructure, high healthcare expenditure, and increasing awareness of chronic kidney diseases (CKD) and acute kidney injuries (AKI). The presence of well-established healthcare facilities equipped with the latest diagnostic technologies supports the adoption of advanced assays. Higher healthcare expenditure allows for the adoption of newer and more expensive diagnostic tests, such as cystatin C assays. The shift towards point-of-care testing is a significant trend, driven by the need for rapid and accurate diagnostics. POCT devices for cystatin C assays offer convenience and quick results, aiding in timely clinical decision-making.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The cystatin C assay market in the Asia-Pacific region is experiencing significant growth, driven by a combination of factors including rising healthcare awareness, increasing prevalence of chronic kidney diseases (CKD), and improving healthcare infrastructure. Economic growth in countries like China and India is leading to increased healthcare spending, allowing for the adoption of more advanced and costly diagnostic tests. The demographic shift towards an aging population in many Asia-Pacific countries increases the prevalence of age-related kidney diseases, driving the need for accurate kidney function diagnostics. Increasing interest in personalized healthcare solutions emphasizes the need for precise biomarkers like cystatin C to tailor treatment plans for kidney disease patients.

Segmentation Analysis

Insights by Product

The kits segment accounted for the largest market share over the forecast period 2023 to 2033. The growing incidence of chronic kidney disease (CKD) and acute kidney injury (AKI) globally boosts the demand for diagnostic tests, including cystatin C assay kits. Innovations in assay technologies have led to the development of more sensitive, specific, and easy-to-use kits. These advancements improve the reliability and efficiency of cystatin C measurements. The adoption of POCT is a significant driver for the kits segment. POCT requires compact, reliable, and easy-to-use kits that can provide rapid results, making cystatin C assay kits ideal for these applications.

Insights by Sample Type

The blood samples segment is dominating the market with the largest market share over the forecast period 2023 to 2033. Blood samples provide a more accurate and reliable measurement of cystatin C levels, which is less influenced by factors such as muscle mass, making it a preferred choice for assessing kidney function. With the rising incidence of chronic kidney disease (CKD) and acute kidney injury (AKI), there is a greater need for precise diagnostic tools like blood-based cystatin C assays. Blood-based cystatin C assays are critical for the early diagnosis and monitoring of kidney diseases, enabling timely intervention and better patient outcomes. Increasing awareness about the importance of early detection and regular monitoring of kidney function drives the adoption of blood-based cystatin C assays.

Insights by Application

The diagnostics segment is dominating the market with the largest market share over the forecast period 2023 to 2033. The growing incidence of chronic kidney disease (CKD) and acute kidney injury (AKI) globally is fueling the demand for reliable diagnostic tools, including cystatin C assays, in both clinical diagnostics and research applications. The increasing emphasis on personalized medicine has spurred the demand for precise biomarkers like cystatin C, which can provide valuable insights into individual patient profiles, aiding in personalized treatment strategies and improving patient outcomes. Rising healthcare expenditure worldwide, coupled with investments in research infrastructure, supports the adoption of advanced diagnostic tools and fosters collaboration between diagnostic companies and research institutions.

Recent Market Developments

- In March 2022, Gentian, a major player in the cystatin C test market, stated that its Cystatin C and GCAL assays have received IVDR (In-Vitro Diagnostic Regulation) certification from TüV SÜD.

Competitive Landscape

Major players in the market

- Abbott (U.S.)

- Roche Diagnostics Limited (Switzerland)

- Siemens Healthcare GmbH (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Randox Laboratories Ltd. (U.K.)

- DiaSys Diagnostic Systems GmbH (Germany)

- Bio-Techne (U.S.)

- Gentian Diagnostics ASA (Norway)

- Getein Biotech, Inc. (China)

- Agilent Technologies, Inc. (U.S.)

- Abcam plc. (U.K.)

- Sino Biological, Inc. (China)

- Eurolyser Diagnostica GmbH (Austria)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Cystatin C Assay Market, Product Analysis

- Kits

- Reagents

- Analyzers

Cystatin C Assay Market, Sample Type Analysis

- Blood

- Urine

Cystatin C Assay Market, Application Analysis

- Diagnostics

- Research

Cystatin C Assay Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Cystatin C Assay Market?The global Cystatin C Assay Market is expected to grow from USD 270.6 million in 2023 to USD 525.9 million by 2033, at a CAGR of 6.87% during the forecast period 2023-2033.

-

2. Who are the key market players of the Cystatin C Assay Market?Some of the key market players of the market are Abbott (U.S.), Roche Diagnostics Limited (Switzerland), Siemens Healthcare GmbH (Germany), Thermo Fisher Scientific Inc. (U.S.), Randox Laboratories Ltd. (U.K.), DiaSys Diagnostic Systems GmbH (Germany), Bio-Techne (U.S.), Gentian Diagnostics ASA (Norway), Getein Biotech, Inc. (China), Agilent Technologies, Inc. (U.S.), Abcam plc. (U.K.), Sino Biological, Inc. (China), Eurolyser Diagnostica GmbH (Austria).

-

3. Which segment holds the largest market share?The blood segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Cystatin C Assay Market?North America is dominating the Cystatin C Assay Market with the highest market share.

Need help to buy this report?